Posted August 18, 2025

By Enrique Abeyta

Why “Smart” Money Managers Fail at Investing

I recently had the great honor of participating in a virtual investor conference hosted by my old friend George Noble.

There were 18 presentations in total from money managers with centuries of combined experience.

Many of them are friends of mine and include some of the most experienced people in the business.

My presentation was on the challenges that will emerge for Nvidia, which I have shared with you here before.

After the conference, I asked an analyst I work with to take notes on the rest of the presentations.

Specifically, I asked him to flag stocks with the potential to at least triple, or even rise 5–10x.

He went through each of the presentations and found that almost NONE of them named stocks with that kind of upside.

This perfectly captures a larger problem with professional money management. Let’s talk about it…

The Fatal Flaw Keeping the Pros Down

As surprising as it may sound, professional investors don’t necessarily aim for the big winners.

Some of that has to do with the fact that many of them — including me and George — have a background in short-selling.

And with short selling, you can only make a 100% return on your money. Sure, you can use options, but this is tricky.

Going back to the conference, there were about a dozen presentations left after you take out the ones that presented shorts.

Out of those, only two or three featured the kind of massive upside I asked my analyst to look for.

This is a great example of what I see as a structural problem in professional money management.

You may recall a note I sent you a few months ago about the legendary hedge fund manager Ken Griffin, who warned regular folks that they shouldn’t try to beat the markets on their own.

(If you missed it, you can read the full note here.)

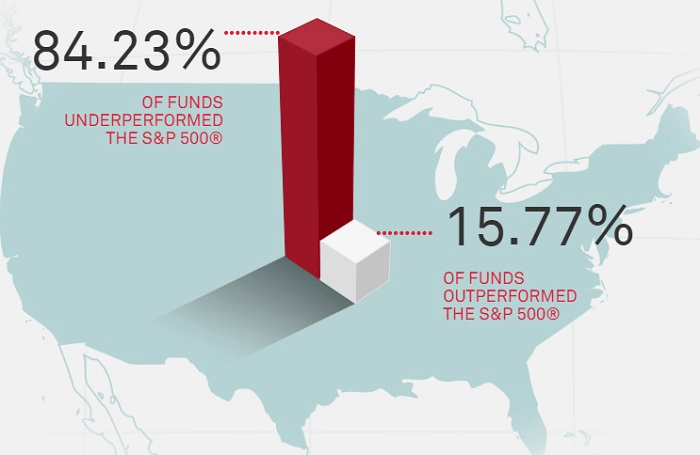

While Griffin says you should put your money with professionals, I pointed out that 85% of professional money managers fail to beat the indices.

Source: ETF Trends

If you are not beating the stock market indices as a professional money manager, then why bother?

In that case, it would be much better for an investor to save the fees and buy an ETF, for example.

One of the biggest problems behind this huge failure amongst money managers is that they don’t set their sights high enough.

It seems obvious that finding a stock that can go up 10 times is better than finding one that can go up by 50%. But there are many reasons why managers don’t make that their primary focus.

First, many of them think these stocks are too volatile. They are not wrong, but the overall goal is the returns.

Even adjusting for volatility, portfolios powered by stocks that go up a lot are more powerful for investors.

Second, most stocks with this kind of upside are already well-known.

These companies have been identified by investors and don’t fit the “smart money” view of finding undiscovered gems.

To that, I would say that undiscovered may sound smart — but finding 10-baggers sounds successful.

Third, most money managers are simply bad at trading and even simple math. They are taught that if a stock has doubled, then they have missed the opportunity.

Well, if the opportunity is to make 150%, then I suppose this is true. But if you are looking for companies with huge upside, then a double is only the beginning.

Every stock that has ever gone up five- or tenfold first had to double. It is simply math.

Your Edge Over the Wall Street Pros

It is my view that most money managers are more concerned about sounding smart than focusing on the returns. This is a massive mistake.

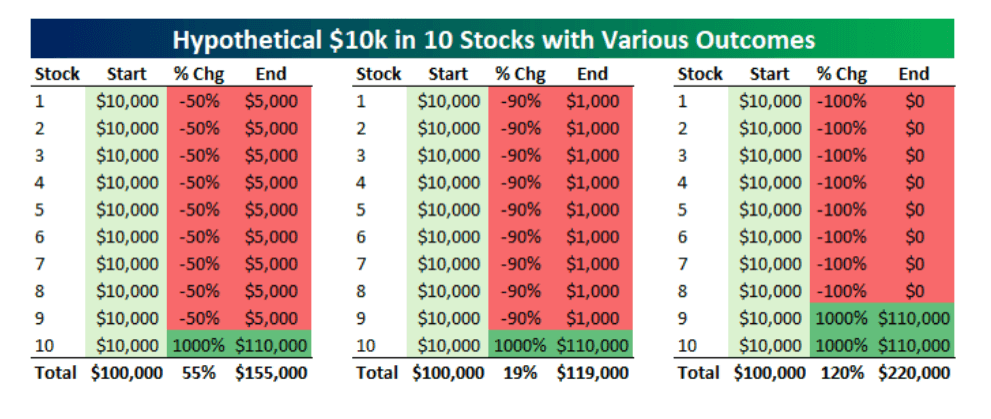

Here is a table showing the impact a 10-bagger can have on your portfolio.

If you have a portfolio of 10 stocks and 90% of them get cut in half — but one goes up tenfold — then you have +55% return on the overall portfolio.

If 90% of them go down 90%, you STILL get a +19% return.

If you have two 10-baggers and the other eight go to $0? That is more than doubling your capital.

This is the power of big winners.

The good news is that while professional money managers have biases that prevent them from identifying these types of stocks… you don’t have that problem.

You only work for yourself. And the best measure of “smart” is how much you can grow your portfolio.

One or two 10x winners can do more for your portfolio than a dozen “safe” bets.

That’s the simple math professional investors keep ignoring — and your biggest advantage as an individual investor.

Focus on the big winners, and investment success will follow.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

The Dark Side of the Tape

Posted March 04, 2026

By Nick Riso

The Iran War: What’s Next for Stocks, Oil and More

Posted March 02, 2026

By Enrique Abeyta

It’s Not Just You, This Market Is Mind-Melting

Posted February 27, 2026

By Greg Guenthner

Israel, India and Iran: The Calm Before the Strike

Posted February 26, 2026

By Enrique Abeyta

Tariff Tantrum Redux

Posted February 23, 2026

By Enrique Abeyta