Posted June 26, 2025

By Enrique Abeyta

Ken Griffin Is Full of Sh*t

Ken Griffin is one of the richest men in the world.

He’s the Founder and CEO of Citadel LLC, one of the most successful hedge funds in history.

Recent purchases of his include…

$45 million for a dinosaur skeleton…

$43 million for a first edition of the U.S. Constitution…

And half a BILLION dollars for just two pieces of art in 2016!

Griffin was recently interviewed by Bloomberg and shared his best advice on how regular folks can make solid returns.

His advice?

You can’t. Don’t even try.

Griffin says that retail investors should rely on “professional investors” to manage most of their money.

He is dead wrong. With the right combination of hard work, knowledge and discipline, anyone can succeed as an investor.

Let’s talk about it.

The Numbers Don’t Lie

As for Griffin, apparently being smart and super rich doesn’t make you good at math.

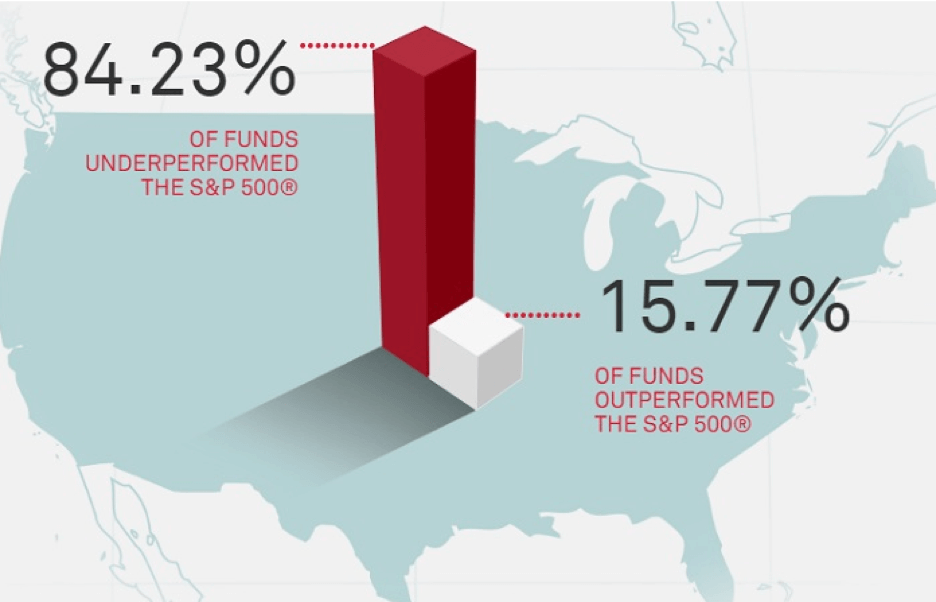

Here is a good graphic showing how the professionals actually perform compared to the broad market.

Source: ETF Trends

This analysis is over a five-year period. The numbers over a 15-year period are even worse, with a little bit over 5% of funds outperforming.

Griffin would probably argue that hedge funds do better. But the facts don’t back him up there either.

Not only have the hedge fund indices — even his vaunted Citadel — underperformed the S&P 500 heavily over time!

Griffin’s returns aren’t amazing. He makes his real money not his returns, but on the amount of assets he has under management.

Keep in mind, you have to jump through a ton of hoops and pay massive fees to get the “privilege” of investing with him and his billionaire pals.

Here is what he said:

“It’s very important to understand that your likelihood of beating the pros as a novice investor is low. It’d be like asking me to go out there and play football on an NFL team. One of the mistakes that investors will make early in life is they don’t take a step back and think about the fact that there are thousands and thousands of people for whom picking stocks is a full-time job. Now, this doesn’t mean that retail investors aren’t successful, but I think that retail investors need to always keep in mind that for a significant portion of their portfolio, they should probably entrust it to professional investors for whom this is a full-time job.”

Part of this is true. Factually, professional investors spend a lot more time than retail investors on stocks.

The data appears to support the idea that it doesn’t matter, as the vast majority of both underperform the stock market indices.

Why then should you pay those hefty fees to these professionals? You shouldn’t!

Instead, you should empower yourself through intelligent research, finding great resources and a disciplined process.

You Are Not Doomed to Fail

An analogy I like to use is the restaurant business.

You don’t need a degree or training to open a restaurant. The market is huge, and anyone with a little bit of capital can start one.

The data shows, however, that the vast majority of restaurants fail.

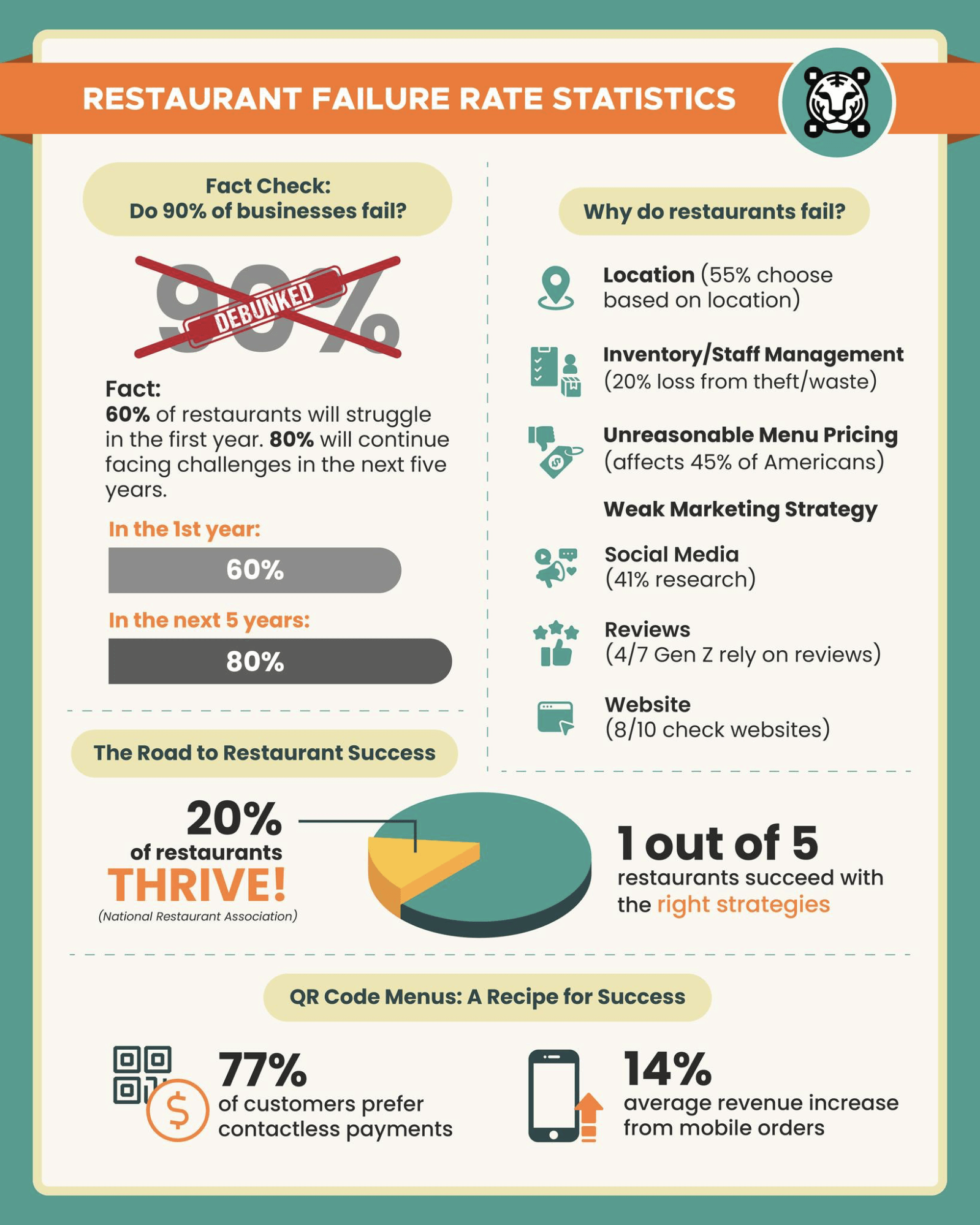

The myth is that 90% fail in the first year, which isn’t exactly true. Here is a good graphic showing the actual numbers.

Source: Menu Tiger

Interestingly, the number of restaurants that succeed is about the same as the number of investors who consistently outperform the stock market.

You could make a similar graphic for investing. The short list of items on the “why investors fail” list would be:

- Lack of trading discipline

- Valuing narrative over price

- Ignoring technical analysis

- Too much emphasis on valuation

- Not enough selectivity

- Over-diversification

For anyone willing to do the work — learning a great process, finding great resources and remaining disciplined — great rewards await in investing.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

The Kill Switch: How a Hidden Algorithm Is Blowing Up Boring Stocks

Posted February 16, 2026

By Enrique Abeyta

Snapback Trade Watchlist: HOOD, SHOP, TOST

Posted February 13, 2026

By Greg Guenthner

Play Ball! 3 Investing Rules From the Baseball Diamond

Posted February 12, 2026

By Enrique Abeyta

This Feels Like 1999… NOT 2000

Posted February 09, 2026

By Enrique Abeyta

Bad Vibes Everywhere

Posted February 06, 2026

By Greg Guenthner