Posted March 31, 2025

By Enrique Abeyta

We Nailed GameStop’s Bitcoin Bet

In recent years, “virtue signaling” has become popular in the political sphere.

It refers to outwardly showing one’s commitment to a cause or idea to indicate political leanings.

It is often said disparagingly and implies that the people don’t believe in the cause or that it doesn’t make sense.

Unfortunately, as investors and traders, we’re confronted with a similar crock of BS every day.

And no, I’m not talking about investors cheering on Tesla’s stock crashing to express their beef with Elon Musk…

I’m talking about the financial pundits who missed a stock’s quick jump last week — just because they didn’t take the company seriously.

Let me explain…

“Smart Money” Can Be Dead Wrong

The “smart” money and financial media posture all the time around how you are supposed to invest your money.

The crazy thing about the financial talking heads is that they actually believe what they are saying, despite often being dead wrong.

Remember, their goal isn’t to make you money. Their goal is to get you to give them your money so they can make money off you.

Let’s just say we take a different approach.

One of the biggest ways they cost investors money is by quickly dismissing stocks that are going up.

They don’t dismiss all stocks that go up. Just the ones that go up for reasons they don’t approve of or (more aptly) understand.

This has been the case with the stocks termed the “meme stocks” and especially with the most famous of these companies — GameStop (GME).

I am sure you have heard a lot about GameStop over the past several years and heard it dismissed by the “smart” money.

The quick version is that it is a retailer that was founded four decades ago that focuses on selling software and video games.

Over the years, it expanded to over 6,000 locations globally. But in the last decade, like many retailers, it has seen a big decline in its business.

The decline in the business led to a big decline in the stock. And by 2019, the stock was ridiculously cheap, trading at a very low multiple of earnings. It was basically left for dead.

That attracted the attention of several successful investors. One of those was an entrepreneur named Ryan Cohen who had founded the online pet retailer Chewy.

Cohen went out and bought hundreds of millions of dollars of stock and got involved directly. He was eventually appointed Chairman and CEO and took control of the company.

In 2021, the situation got a little crazy. Remember, this was the time when the markets were soaring and full of speculation in penny stocks, crypto and NFTs.

In January of that year, the stock took off on the back of a rabid group of investors on the social app Reddit, which sent the stock soaring.

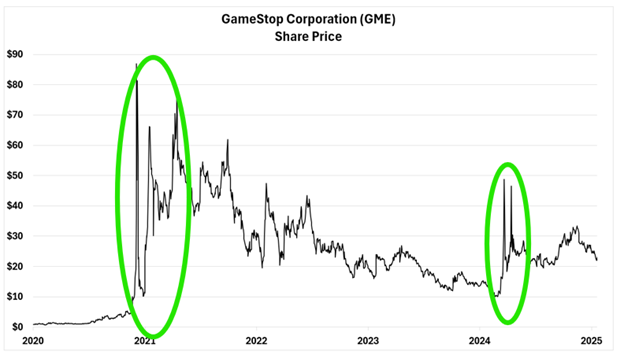

Here is a chart of what has happened with the stock in the last few years with that period circled.

Again, I am sure you have heard a lot about this story and everything that has happened. It’s fascinating, but what interests me most is what has happened in the last year.

A little less than a year ago, the Reddit crowd got involved again and sent the stock soaring higher once more. That is the second green circle on the chart.

When the stock went higher this time, Cohen was ready and issued a ton of shares.

The “smart” money would argue this is a bad thing. And they are not wrong — most of the time.

In this case, though, Cohen took advantage of the situation.

He had spent the last few years cutting costs and stemming the cash flow bleed in the company. He also had accumulated a huge cash pile of almost $1 billion.

Cohen saw the huge valuation of his stock and quickly issued millions of new shares. So many shares that he was able to raise another $3 billion in cash.

The “smart” money dismissed this move. They didn’t even pay attention.

They looked at the stock soaring again on hype and loudly proclaimed that it was a scam and that investors would lose all their money.

The problem is they simply did not do the work.

By smartly issuing shares, Cohen was now sitting on over $4 billion in cash with no debt. On a company that was now generating a small amount of cash.

Cohen now had almost a $1 billion investment of his OWN money in the stock and at some point, Cohen was going to make another move.

I covered this late last year here at Truth & Trends, alerting our readers to a great risk/reward setup. And just last week, the catalyst we were waiting for finally kicked off.

Quick Profits on a Meme Stock

Just under two weeks ago, I sent an alert to subscribers of my trading service The Maverick, recommending to buy shares of GameStop before their next earnings call.

The idea was that Cohen would likely announce on the earnings call that he was going to begin buying Bitcoin with all that cash.

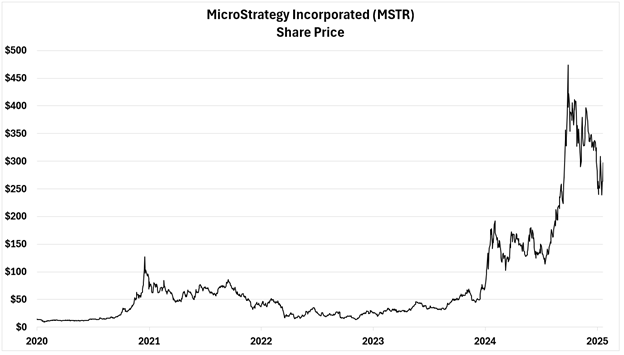

This is the same strategy that sent the shares of MicroStrategy soaring more than 2,000% in the last few years. Here is that chart.

I said the “smart” money would dismiss the move. They don’t believe in the value of Bitcoin either; it doesn’t fit their “value” narrative.

And while they may (or may not) be right, the stock could STILL soar on the announcement. Well, here is what happened.

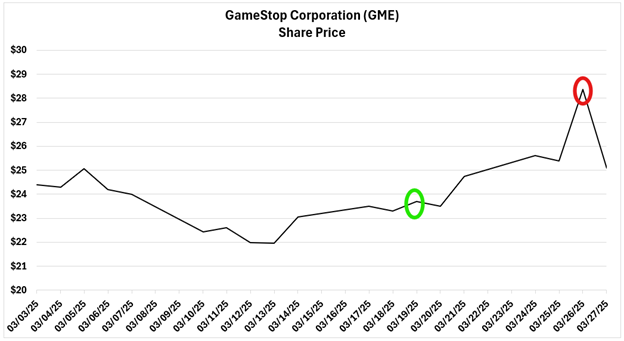

On the chart, we circled where we told our subscribers to both buy and sell the stock.

You see, as soon as the announcement was made, the stock did indeed go higher. (Notice the market anticipated the move a week earlier.)

Investors who followed our advice made more than a 26% gain on the stock in just five trading days!

By not paying attention to the conventional narrative and doing the real work, I identified a high probability (and very profitable) trading opportunity for our readers.

Remember, the “smart” money is trying to make money off of you. But my job is to make money FOR you!

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

A Crude Awakening: History Says Buy Stocks

Posted March 09, 2026

By Enrique Abeyta

Fade the End of the World

Posted March 06, 2026

By Greg Guenthner

The Dark Side of the Tape

Posted March 04, 2026

By Nick Riso

The Iran War: What’s Next for Stocks, Oil and More

Posted March 02, 2026

By Enrique Abeyta

It’s Not Just You, This Market Is Mind-Melting

Posted February 27, 2026

By Greg Guenthner