Posted December 16, 2024

By Enrique Abeyta

The GameStop Gambit

Successful trading is all about finding asymmetric risk/reward setups.

That simply means a situation where your potential gain from an investment is far greater than your potential loss.

One of the most intriguing asymmetric bets in the market right now is GameStop (GME).

Now, I know what you’re probably thinking…

The meme stock king… that GameStop? Could any self-respecting trader seriously consider buying GME?

The answer is absolutely YES.

I’ll tell you why in just a moment. But before I do, allow me to share an important trading lesson.

Trade Stocks, Not Companies

As a trader, it’s important to remember that stocks are not companies. What do I mean by that?

Well, if you listen to “smart” money, they’ll tell you that you own a piece of a company when you buy a share of stock. And this is technically true.

They’ll also tell you that the value of a stock should be the discounted value of the future cash flows.

We don’t need to dissect that whole statement for our purposes today. But basically, it means a stock should be worth the pile of cash it will throw off in the future.

Now, 99% of professional financial advisors, economists, academics, and media pundits will say this is gospel truth. It isn’t.

It’s actually a concept that can lose you a lot of money and keep you from some of the best opportunities.

I guarantee the ONE trader out of 100 who will tell you differently is the most successful you will ever meet.

These are the kind of traders that successfully manage billions of dollars — traders like me.

The truth that the “smart” money doesn’t want you to know (or doesn’t understand themselves) is that a stock is worth whatever anyone is willing to pay.

My favorite example is the e-commerce giant Amazon.com (AMZN).

The stock has gone from $0.075 per share at the IPO to a recent high of over $230. That’s a 306,566% return if you want help with the math.

In that time, Amazon has never returned a single cent of the cash it has generated to investors. It bought back a little bit of stock, but never once paid a dividend.

If the value of the company is the value of the cash flows, when (if ever) do we get to see these actual cash flows?

The reality is that unless a stock gets bought out or goes bankrupt, the value is simply what the market is willing to pay for it.

The “smart” money doesn’t want you to know this, because it means you stop paying them fees and do it yourself.

Once you understand this, you’ll become a much more successful trader.

This realization is like unplugging from the Matrix. Think of me as your Morpheus, showing you what’s really happening with stocks.

Now let’s get back to GameStop…

An Asymmetric Opportunity

I don’t have the space to cover the longer history of GameStop as a meme stock. But let’s go back to earlier this year.

In May, the internet influencer Roaring Kitty sent GME stock soaring once again after returning to the scene. Here’s the stock chart.

You can see that the stock went nuts after this happened.

What’s most interesting is that GameStop CEO Ryan Cohen took advantage of the situation and issued a ton of stock.

The company used a novel strategy called an at-the-market offering to issue more than 120 million shares, raising over $4 billion of cash in the last six months.

When the company reported results last week, it reported over $4.6 billion of cash or cash equivalents on the balance sheet.

That’s balanced against basically no debt (under $20 million) and is a little bit more than $10 per share.

GameStop’s results were bad. Sales for its legacy video game retail business were down over 30% year-over-year.

You’d think the company must be hemorrhaging money as a result, right? Well, it actually reported a net income of $17 million during the most recent quarter.

The $33 million loss from its retail operations was offset by $55 million of interest income on its huge pile of cash.

Over the last several years, the company has done a great job of cutting costs and reducing its cash burn.

It burned only $27 million last year while producing almost $100 million of cash in the last two quarters.

I’m sure GameStop wishes its core business was profitable. But it isn’t going out of business anytime soon.

Now, this is where it gets really interesting…

When you buy GME shares today, you’re basically buying an option on what its savvy CEO will do with the cash in the future.

Of course, that option isn’t free. The cash pile is worth $10 per share and you pay $30 per share. It’s a $20 per share (or $8 billion) premium. That’s a LOT!

Do I think it’s the right amount? I don’t know, but I don’t think it matters.

But it is the right price in the sense that there are millions of shares transacting at these levels right now. Remember one of my favorite sayings: PRICE = TRUTH.

I think that Ryan Cohen will do something with the cash sooner rather than later. I also think he will do something that will benefit the stock.

He’s the largest shareholder with over 36 million common shares and more exposure with his compensation.

Here’s one idea…

A Rocketship to the Moon

What if he went out and bought Bitcoin?

He doesn’t have to use all of the cash. But he could easily spend $1-2 billion and still have plenty of ammo to do other stuff.

I think the stock would fly if he did this and could see $60 again as it did in May.

And what if he took advantage of that opportunity again and issued more stock, or did a convertible bond like Michael Saylor has successfully done at MicroStrategy (MSTR)?

The stock would go ballistic!

Does any of this create real economic value? That remains to be seen.

But MSTR is sitting on a massive gain on the Bitcoin it bought over the years, so it has created real value.

Is it sustainable? Does it fit the “smart” money’s academic models? Maybe not.

But remember, we aren’t here to sit for a financial exam. We’re here to identify great risk/reward opportunities and MAKE MONEY!

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Silver's Swan Dive Is Just the Beginning

Posted February 02, 2026

By Enrique Abeyta

Lightning Round: Trump’s Fed Pick, the Silver Crash, and More

Posted January 30, 2026

By Greg Guenthner

Forget the Noise, You're Not Bullish Enough

Posted January 29, 2026

By Enrique Abeyta

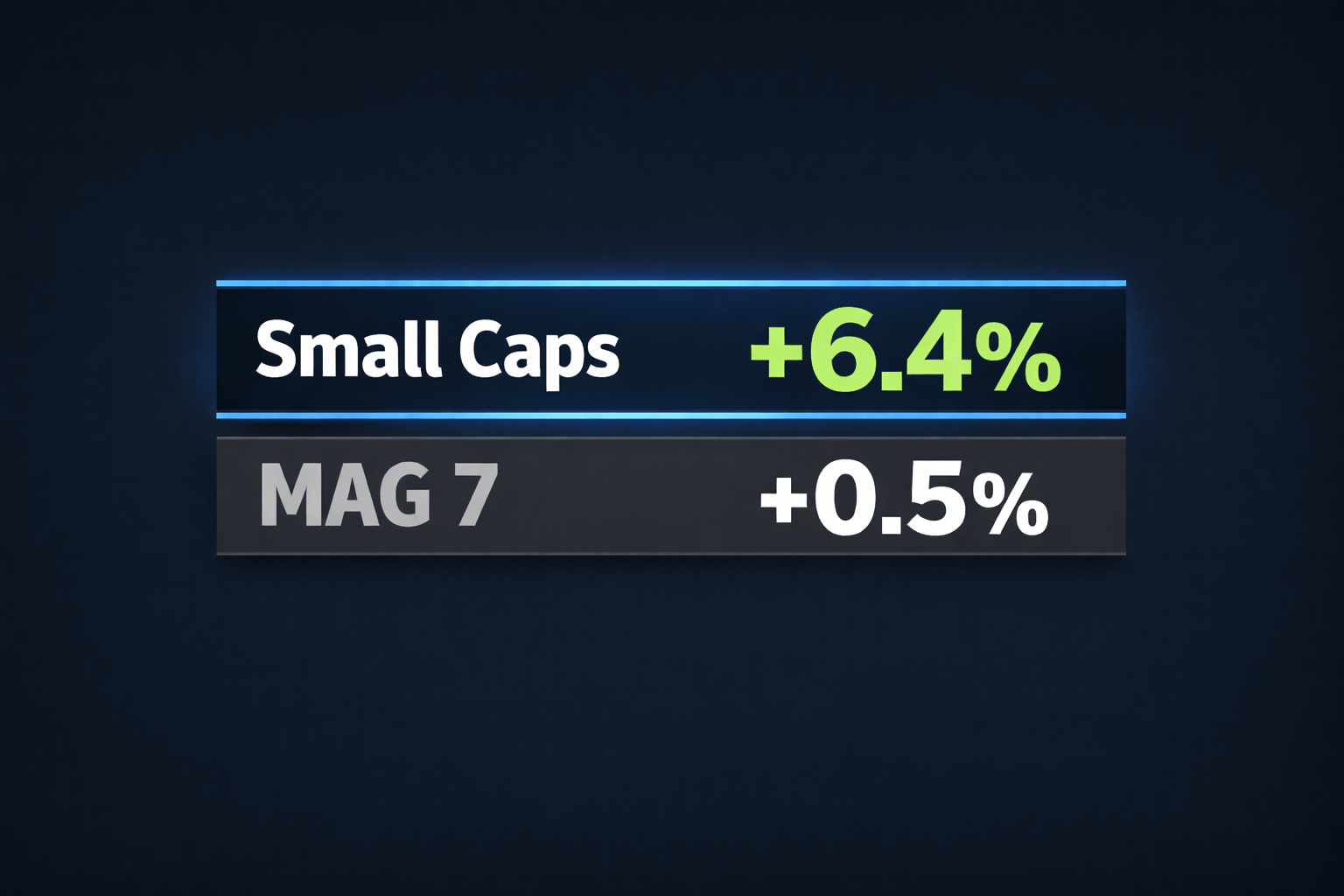

Small Caps Are Back, Baby!

Posted January 23, 2026

By Greg Guenthner

Greenland, Carry Trades, and Lazy CNBC Takes

Posted January 22, 2026

By Enrique Abeyta