Posted September 04, 2025

By Enrique Abeyta

The Next Five Days Could CRUSH Stocks

I have been cautious about the trajectory of the stock market for a while now.

But it has nothing to do with Trump, the economy, or corporate earnings.

Instead, it’s based on the technical position of the stock market. Quite simply, it had run too far, too fast.

Now, two catalysts coming in the next five days could send the major indices tumbling 5%–10%.

This sell-off will be especially bad for popular stocks like Nvidia Corp. (NVDA), Palantir Technologies Inc. (PLTR), and Robinhood Markets Inc. (HOOD).

It’s important that you prepare for what could be an extremely dangerous few days.

So here is what I think will happen — and how to protect yourself if the market finally cracks.

This Market Screams “Correction”

When the market goes up this quickly and reaches the levels of “overbought” that we see now, it typically corrects in the coming months.

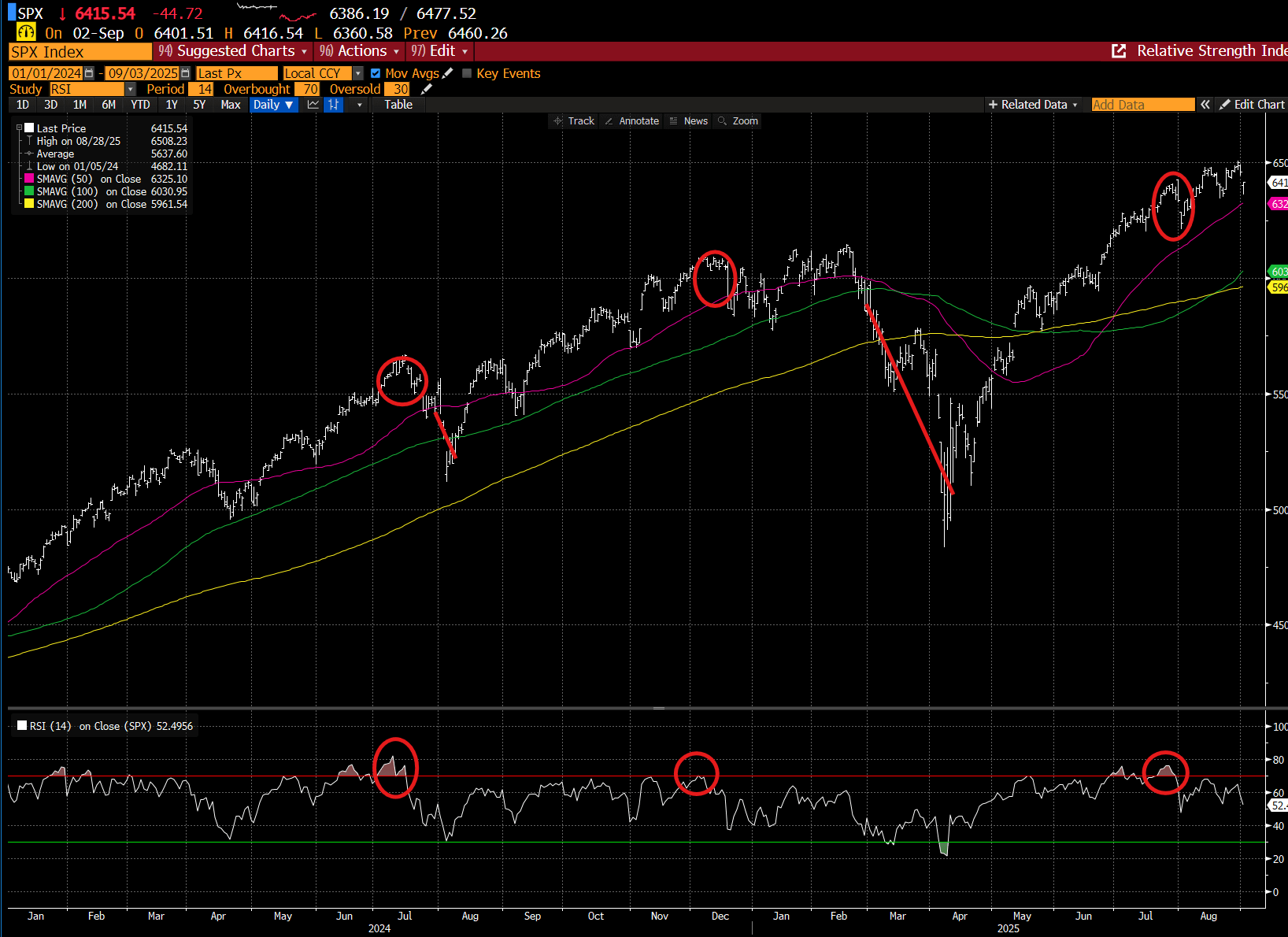

Here is a chart of the price of the S&P 500 along with my favorite technical indicator, the relative strength index (RSI).

On the chart, I have noted the last two times the S&P 500 was this extended from the 50-day moving average and the RSI above 70.

The market saw a steep sell-off both times within three months.

In July 2024, it was -8.5% in one month. In late November 2024, the sell-off took three months to develop. But then the S&P 500 plummeted -21%.

The S&P 500 hit these same “overbought” levels here about a month ago. We don’t know what this coming sell-off will look like, but it could resemble the one from this time last year.

Another group of important technical indicators also recently flashed sell signals. I highlighted these signals in a note on August 4. (You can read it here.)

To summarize, they have to do with the big sell-off that happened at the start of August.

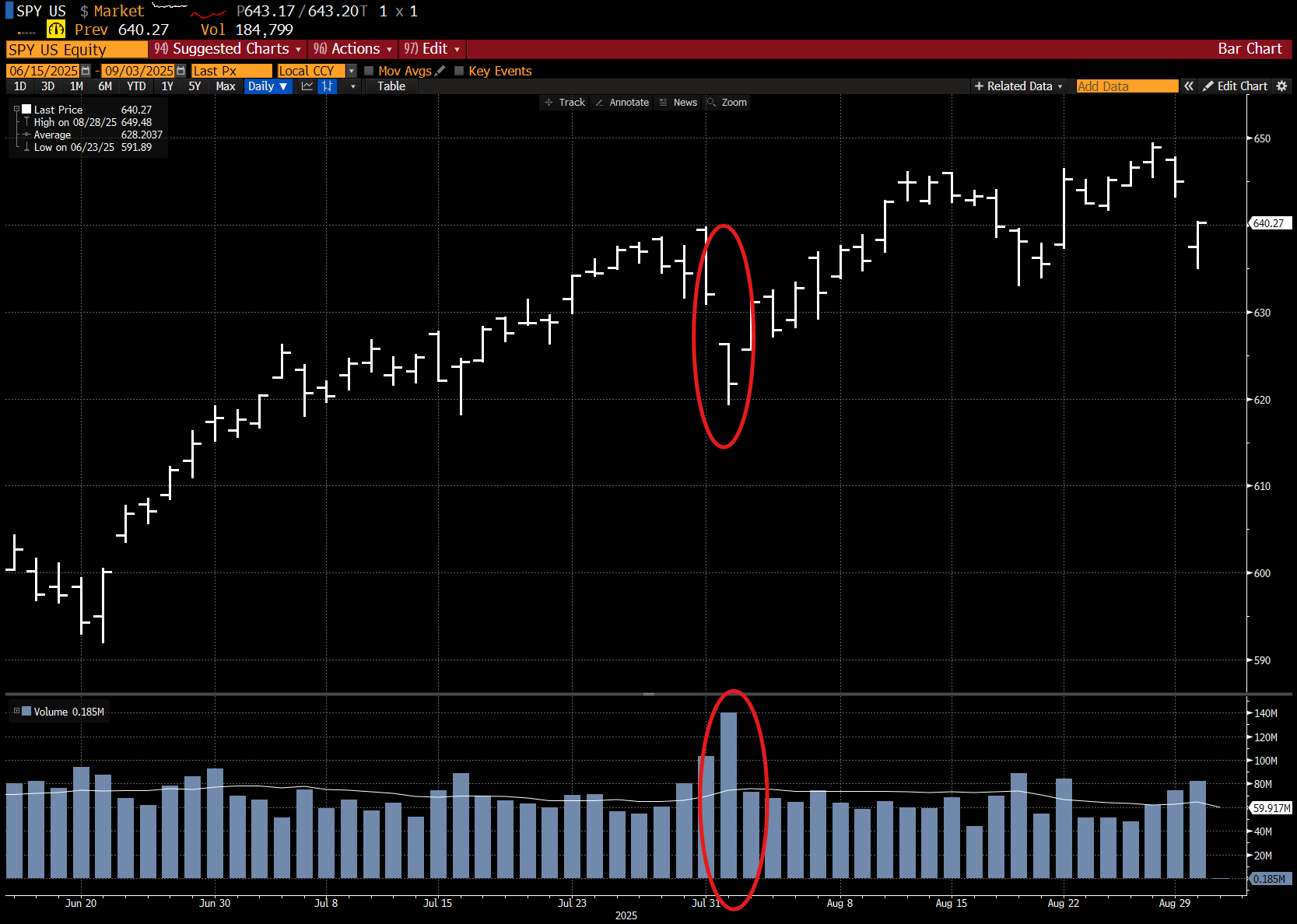

Here is a short-term chart of the major S&P 500 ETF (SPY) over the last three months.

I have circled the sell-off that took place on August 1, along with the big spike in volume in the SPY ETF.

This sell-off was of interest because of its magnitude and breadth coming off a new stock market high and a period of low volatility.

When the stock market sells off strongly after a recent high and breaches the 20-day moving average, it has been a bad omen over the next few weeks.

And when a long streak without a 1% move (positive or negative) in the S&P 500 is broken by a down 1% day, it also bodes poorly over the next few months.

That sell-off was a 90% down day, where 90% of the volume on the New York Stock Exchange was down — another bad omen in the short term, especially coming off recent highs.

This nasty day was also coming into the worst seasonal period of the year.

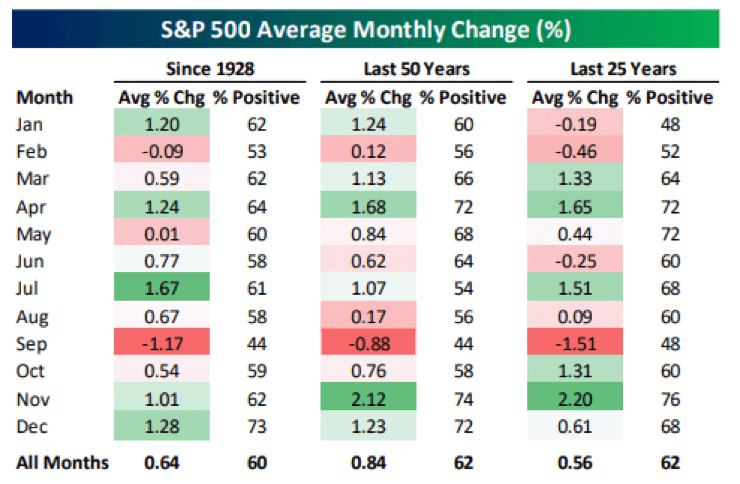

Here is a table from Bespoke Investment Group showing the average monthly change in the S&P 500 over the last century.

One observation should be clear from this data: September is a BAD month for the stock market.

On average, it is down the majority of the time (more than -1%) and it has been worse in the last 25 years. Looking at the data, it is by far the worst month of the year.

Now, everything I have said so far was true back at the start of August. Yet the stock market continued to grind to new highs.

What is different now that has us so concerned?

Two Catalysts That Could Crack the Market

The first catalyst that could send the market lower is the Bureau of Labor Statistics (BLS) August jobs report, which comes out tomorrow.

Remember what happened with the last jobs report a month ago?

Not only did the July Payrolls come in far below the estimates at just 73k, but we also saw big negative revisions to the previous months.

May was revised down by -125k to just +19k. And June was revised down by -133k to just +14k.

Wow! Those are almost -90% revisions just a few months later.

This is what knocked the stock market down so hard on that big sell-off. I think there is a real risk that we see a similar situation this upcoming Friday.

And there is another catalyst — potentially even scarier— coming up next week.

Each year, the BLS releases the CES Preliminary Benchmark Announcement. This is where they do an initial assessment of potential revisions for the data for the current year.

It comes out on September 9 this year, next Tuesday.

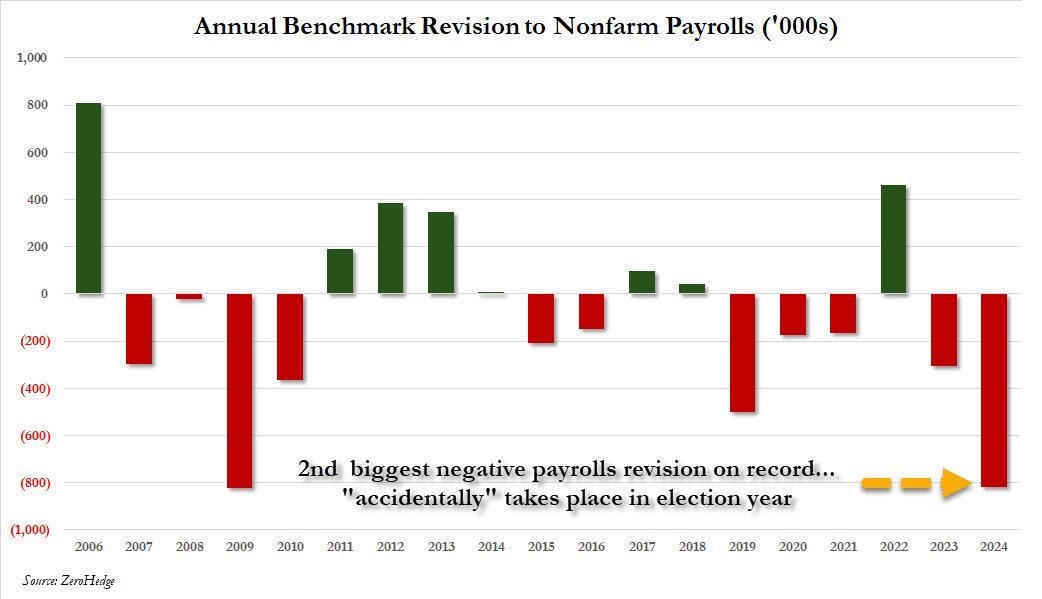

Last year, the BLS came out with massive negative revisions. They took a remarkable -818k out of the previously reported payroll numbers.

Here is a chart showing this in a historical perspective.

ZeroHedge, the great independent financial news and commentary website that put this analysis together, ascribes some political bias in these numbers.

That may be. But what we do know is that we do NOT want to own an overbought (but flailing) stock market heading into the worst seasonal period of the year…

Especially with these two potential major negative catalysts in front of us.

As an investor, what should you do?

Three Steps to Take Right Now

First, take profits. If you have big gains in trading positions, book your profits and sit tight, especially if the stocks are still overbought.

The stocks I mentioned earlier, Nvidia, Palantir and Robinhood, are all great examples.

They have pulled back in the last few weeks but are still way above their 100-day moving averages.

If this pullback looks like previous ones, they are likely to visit that moving average. This is a ride you don’t want to take.

Second, be patient. “Buy the dip” has been an awesome strategy these last few years, and it will be here.

Just wait for the dip to become a real one before diving in. You want to see a sell-off of at least -5% in the S&P 500 and -10% in the Nasdaq.

And finally, make a plan and stick to it.

If you know volatility is coming, you can prepare whatever is best for your portfolio. When the volatility hits, stick with that plan.

Sell-offs in bull markets are inevitable. The key is turning them into an opportunity instead of a failure.

If you have been riding the rally, this is the moment to protect your gains and prepare to buy when the real opportunity arrives.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Hyper-Caffeinated Sticker Shock

Posted November 16, 2025

By Ian Culley

An UP-date on the Melt-DOWN

Posted November 14, 2025

By Greg Guenthner

7 Final Lessons From Buffett’s Farewell

Posted November 13, 2025

By Enrique Abeyta

Warren Buffett, Signing Off One Last Time

Posted November 10, 2025

By Enrique Abeyta

3 Beaten-Down Charts Ready to Bounce

Posted November 07, 2025

By Greg Guenthner