Posted August 21, 2025

By Enrique Abeyta

My #1 Piece of Advice After 30 Years of Investing

My full-time career on Wall Street began almost exactly three decades ago this week.

After graduating from the Wharton School in the summer of 1995, I took a few weeks off before starting full-time at Lehman Brothers.

My fascination with stocks began half a decade earlier, which was one of the reasons I chose to go to Wharton in the first place.

I joined Lehman and spent the next two years there before they fired my boss. With his departure, I decided to move over to what Wall Street calls “the buyside.”

This simply refers to the people who manage money and buy stocks.

Through building connections, I earned a seat with a 25-year-old money management firm called Atalanta Sosnoff.

It was a great opportunity, as they managed almost $3 billion in assets with only four investment professionals.

They also managed a hedge fund founded in 1960, making it one of the oldest hedge funds out there.

Within two years at the firm, I became a full-time money manager — managing $200 million at the ripe old age of 27!

I thought about my journey earlier this week when I was writing a note about why most money managers fail to beat the indices.

This brought me to the question of what I would tell my younger self as I was beginning my multi-decade career managing money.

The answer was simple…

Aim for BIG Returns and Buy GROWTH

As I explained in my note earlier this week, the reason most money managers fail is that they don’t focus on the biggest returns. (You can read my full article here.)

It may sound safer to avoid the high-risk, high-reward trades and aim for more modest returns. But think about it this way…

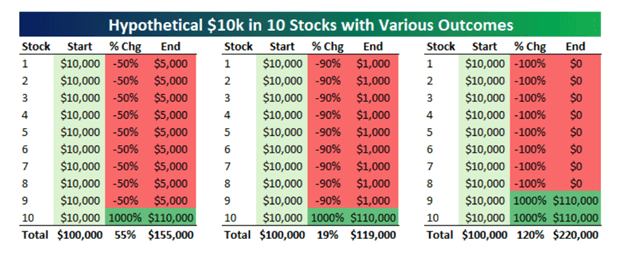

If you have a portfolio of 10 stocks and 90% of them get cut in half — but one goes up tenfold — then you have +55% return on the overall portfolio.

If 90% of them go down 90%, you still get a +19% return.

If you have two 10-baggers and the other eight go to $0? That is more than doubling your capital.

Below is a chart that shows how a few big winners can make a huge difference in your portfolio.

Now the idea of finding 10-baggers seems like common sense. Finding them, however, can be a little more difficult.

That brings me to the second part of my advice to my younger self: buy growth.

What do I mean by that? It’s simple.

If you can find a company that is earning $1 in earnings per share (EPS) and that company is going to eventually earn $10, then that stock is going to go up — and by a lot.

It may go up soon, or it may go up later. It may go up less than 10 times, or it may go up more than 10 times.

In all scenarios, though, it is going higher.

Now, it is not always about EPS. Some companies are measured by cash flow, and others by revenue or subscribers.

Regardless of the metric, if you find companies that can grow their operations by tenfold, twentyfold, or even a hundredfold, then you have a huge winner.

Talk to most investors and they will tell you there are dozens of variables that influence a stock’s price.

This is true. When you are looking for the biggest returns, though, there’s only one: growing the economic value creation of the company.

Focus on identifying the companies growing their results in a massive fashion, and you will find the biggest returns.

That’s what I would tell myself 30 years ago at the start of my investing career.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Labor Is Capitalism: A Tribute to Work

Posted September 01, 2025

By Enrique Abeyta

The Alt Energy Bet That’s Already Lost

Posted August 31, 2025

By Chris Cimorelli

Biotech Bombshell 💣

Posted August 29, 2025

By Greg Guenthner

Julian Roberston and the Discipline That Built Billions

Posted August 28, 2025

By Enrique Abeyta

Ditch Nvidia Tomorrow Night

Posted August 26, 2025

By Ian Culley