Posted June 23, 2025

By Enrique Abeyta

GME: A Warren Buffett Kind of Stock

Warren Buffett, the Oracle of Omaha, built his legendary fortune on a simple, often-misunderstood principle: value investing.

In essence, it means buying a stock for less than it's truly worth. Think of it like this: finding a dollar bill on the street and only paying fifty cents for it.

Back when Buffett started over 60 years ago, these opportunities were far more common.

You could uncover overlooked companies, snap up their shares for a fraction of their assets, and patiently wait for the market to catch up, leading to massive gains. Buffett mastered the art of identifying these hidden gems.

Value investing is often perceived as, well, boring.

It's about deep analysis, patience, and avoiding the flashy, speculative plays that dominate headlines. It's the antithesis of excitement.

But what if the most un-boring, headline-grabbing, wildly speculative stock of the last few years is quietly transforming into a classic value opportunity?

What if GameStop (GME), the ultimate meme stock, the one Buffett wouldn't typically touch with a 10-foot pole, is lining up to be one of those situations right now?

Yes, that GameStop.

If you can look past the hype, the short squeezes, and the internet folklore, you might just find that GME is one of the most overlooked value propositions in the market today.

Allow me to explain how a supposed speculative circus might actually be a disciplined investor's quiet delight.

When Meme Stocks Become Value Plays

Most investors know GameStop as a video game retailer. The company operates over 3,000 retail outlets in a half dozen countries, mostly in the U.S., Canada, and Australia.

That business made about $3.7 billion in revenue in the last 12 months, running at roughly a breakeven profit. Those sales, however, were down more than 25% year-over-year.

Looking at similar businesses, GameStop should be worth somewhere between $500 million and $1 billion. But the stock currently has a market cap of almost $12 billion.

Why is that?

The short version is that the company is being valued for its current CEO and its massive cash holdings. (For more details, check out our previous GME coverage here.)

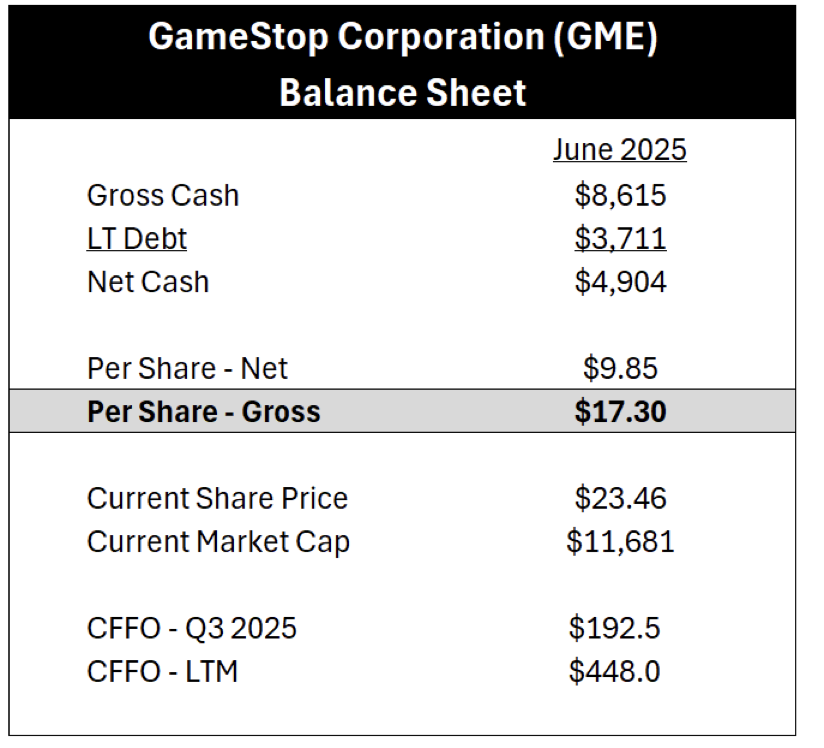

For now, let’s focus on the cash holdings. Here is a table breaking down various financial metrics for GameStop.

As of the company’s most recent earnings, it had $6.4 billion of cash and cash equivalents. This included $500 million in bitcoin, which they recently purchased.

The company also recently announced that it was going to raise $1.7 billion more in cash via a convertible bond offering.

All you need to know about this is that the company eventually raised $2.25 billion, bringing its cash holdings to $8.6 billion (as seen on the table above).

GameStop has been active over the past several years, issuing both equity and convertible debt.

Last year, it took advantage of the meme stock influencer Roaring Kitty’s return and issued almost $4 billion in new stock.

Then, in March, the company took advantage of the strength in the stock to issue $1.3 billion of convertible debt.

Note that these debt issuances are not maturing until 2030 and 2032, respectively, and both carry an interest rate of 0%.

That means that the company has five years before it must pay any of it back and no real carrying cost.

The stock sold off to just over $22 per share, giving the company an almost $12 billion market capitalization that I mentioned earlier.

If we believe the decline of GameStop’s retail business can be managed, then an investor right now is paying a roughly 35% premium to the company’s gross cash on its balance sheet.

That’s not a bad premium, especially when you consider the possibility (if not probability) that investors get excited about GameStop again sometime soon.

Buy Low, Sell High

Critics may argue that we should be looking at the cash net of the debt. But I would counter that none of the debt is due for half a decade.

They would also argue that GameStop is a terrible business. I say that doesn’t matter; the company is generating strong cash flow from its business and interest income on its cash.

I’m sure there are a dozen other criticisms, but this is exactly why the opportunity exists.

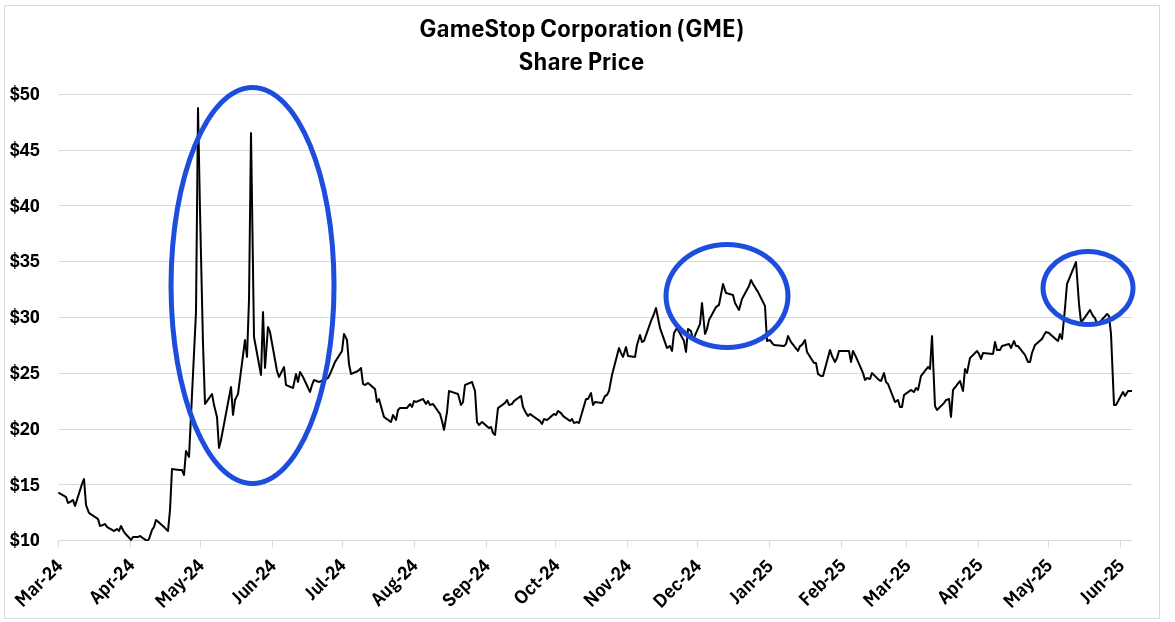

Now, look at the stock’s performance over the last 18 months. I have circled when the stock traded above $30 a share on the chart below.

As you can see, the stock sold off recently. But I think it’s unlikely to trade much lower or stay down for long.

At the very least, it’s unlikely to go below $17.65 per share (the value of the company’s cash).

However, I do think there is a high likelihood that shares will be trading higher than where they are today in the next 18 months.

If you can own the stock near its cash value before the market gets excited again, the payoff could be substantial.

That’s not a meme trade. That’s value investing, plain and simple.

While Buffett probably won’t be buying shares of GameStop anytime soon, that doesn’t mean you should let the opportunity pass you by.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Elon Musk Changed My Life Forever

Posted June 30, 2025

By Enrique Abeyta

How I Build MONSTER Positions

Posted June 27, 2025

By Greg Guenthner

Ken Griffin Is Full of Sh*t

Posted June 26, 2025

By Enrique Abeyta

Juneteenth: A Commitment to American Optimism

Posted June 19, 2025

By Enrique Abeyta

The Regime Shift No One’s Watching

Posted June 17, 2025

By Ian Culley