Posted August 26, 2025

By Ian Culley

Ditch Nvidia Tomorrow Night

Pundits, market makers, and traders are on the edge of their seats.

Even passive investors are biting their nails…

Nvidia is casting its long shadow across the market once again as everyone awaits the $4 trillion chipmaking leviathan’s earnings call on Wednesday evening.

Most expect the King of the Semiconductors to exceed expectations. But will beating the number be enough?

Poor results or even a less-than-stellar report will likely push NVDA shares lower. And since it’s one of the seven largest stocks in the S&P 500 — which account for a third of the U.S. benchmark’s weighting — the S&P 500 will likely fall with it.

I understand the worry from the buy-and-hold crowd. But active investors and traders, NVDA isn’t the market. Neither are GOOG, AAPL, or AMZN.

Far greater market forces are impacting today’s market, and they’re coming from the most unlikely places.

Instead of hanging on every word of Nvidia’s call tomorrow night, you need to turn your attention toward this small mobile payment company.

But first, you must consider the stock market’s recent surge…

The Broad Rally

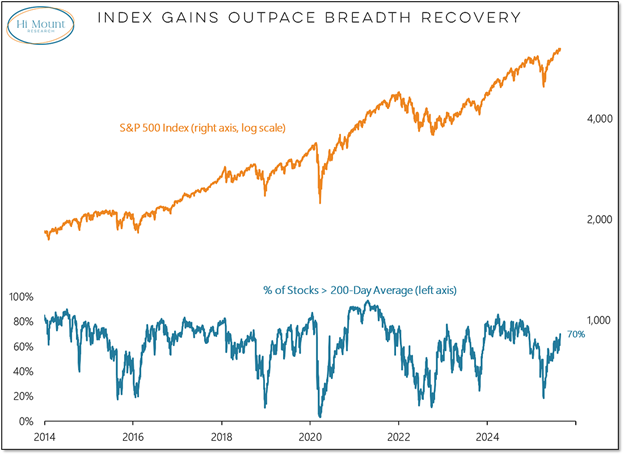

Stocks soared last Friday, but you might have missed the extent of the rally if you solely followed the large-cap indexes.

Willie Delwiche of High Mount Research pointed out that beneath the surface, more S&P 500 stocks finished above their long-term averages last Friday than at any other point this year (blue line in lower pane).

Broad rallies like this are a hallmark of a healthy bull market, and they tend to come in clusters.

The impressive breadth thrust marked an NYSE triple-double as 90% of NYSE listings advanced, along with 90% of NYSE volume for the third time this year (the 27th since 1950).

Grant Hawkridge ran the numbers, and the forward returns following past signals are astounding.

One month out, returns average a little more than 3%. Not the greatest, so I anticipate more seasonal chop as we head into Q4.

However, stepping out an additional five months, the S&P 500 has risen roughly 15% with an 88% hit rate. The data gets even better 12 months later.

The S&P averages a 22% return one year after a 90/90 breadth thrust an eye-popping 92% of the time.

I have no desire to fight those numbers. At the same time, the large-cap averages may need to settle or even pull back over the next two or three months.

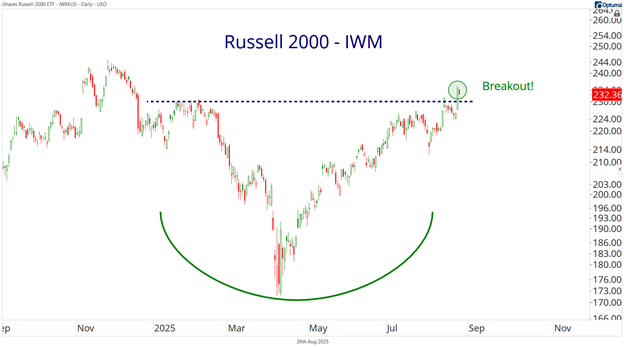

Meanwhile, IWM finally broke out of an eight-month base to register a new year-to-date high.

Last week’s new highs shouldn’t come as a shock, as a rotation down the cap scale is taking place.

Tiny gold stocks, South African platinum miners, and Emerging Markets are outperforming Nvidia this year.

So instead of hanging on Jensen Huang’s every word tomorrow night, tune into what this company has to say the following night…

The Thursday Night Call

You could argue that Affirm Holdings’s (AFRM) digital merchant commerce business and $25 billion market capitalization render it insignificant compared to Nvidia. I agree wholeheartedly.

No one would notice if Affirm filed for bankruptcy, and its stock price dropped to zero (except for its shareholders). The broader market wouldn’t bat an eye.

To be clear, I consider the disparity between NVDA and AFRM of utmost importance when assessing the SPY allocation in my retirement account. But that’s not what we’re doing here.

We’re looking for a solid double by year's end, and AFRM has a far better chance of reaching that goal than any mega-cap name.

Check out the daily AFRM chart, which resembles the small-cap index, IWM.

If smallcaps continue to rally, it's only a matter of time until AFRM breaks through its March highs.

When it comes to Affirm’s earnings call, I must confess: My depth of fundamental analysis only goes so far as the ticker. (Does it catch my eye? And if so, do I like it?)

Occasionally, I beat the mean streets to channel check what I see in the charts, though rarely beyond the necessity of gathering food. Both are highly subjective.

I prefer to simply track Affirm’s earnings call reaction via its share price, rather than fretting over company operations and cash flow.

That said, you’ve likely encountered an AFRM device (or one of its rivals) if you’ve dined out lately.

Affirm provides point-of-sale technology, the type of mobile device that punctuates an enjoyable evening by demanding payment.

They’re everywhere. But at the end of the day, I don’t care what Affirm does or how it impacts my life. All I care about is whether AFRM is rallying toward $150.

I believe it will once it clears its March high.

We’re in a healthy bull market. More stocks are catching higher than lower, and the smaller names are outpacing their larger peers.

I suggest you proceed accordingly.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Labor Is Capitalism: A Tribute to Work

Posted September 01, 2025

By Enrique Abeyta

The Alt Energy Bet That’s Already Lost

Posted August 31, 2025

By Chris Cimorelli

Biotech Bombshell 💣

Posted August 29, 2025

By Greg Guenthner

The Tiger's Advice That Still Rings True

Posted August 25, 2025

By Enrique Abeyta

Name That Chart

Posted August 24, 2025

By Ian Culley