Posted May 20, 2025

By Ian Culley

You Just Ticked The Top

We’ve all been there before…

You watch a hot stock take flight as market conditions turn bullish. A couple of names on your watch list start to bubble higher.

But you hesitate.

You sit on your hands, hoping for a better price or confirmation that the rallies will stick.

A week goes by. Then two.

The hottest stocks are now screaming higher as they leave the station. And that pullback you wanted? Well, it ain’t happening…

Finally, you wake up one morning and your favorite names gap higher, again. You begin to lose your resolve.

The fear of missing out hits. You can’t help yourself! Instead of following your plan and waiting for that elusive pullback, you pull the trigger…

You just ticked the top.

Of course, this is precisely when the market starts to run out of steam. You ignored your trading rules and chased some of the most overbought plays on your screen. Now, you’re sitting on losses and hoping (and praying!) that your trades turn around before you’re stopped out.

It happens to the best of us. Our emotions play tricks on us, leaving behind poor entries, broken trades, and excruciating losses.

But it doesn’t have to be this way…

Today, I’ll run through three of the hottest stocks on the market. These are the names you wish you bought at the lows last month that have now extended into extreme overbought territory.

To be clear, I believe all three will print new all-time highs by the end of the year. But you’re throwing your good, hard-earned money away buying at today’s prices.

Here’s why…

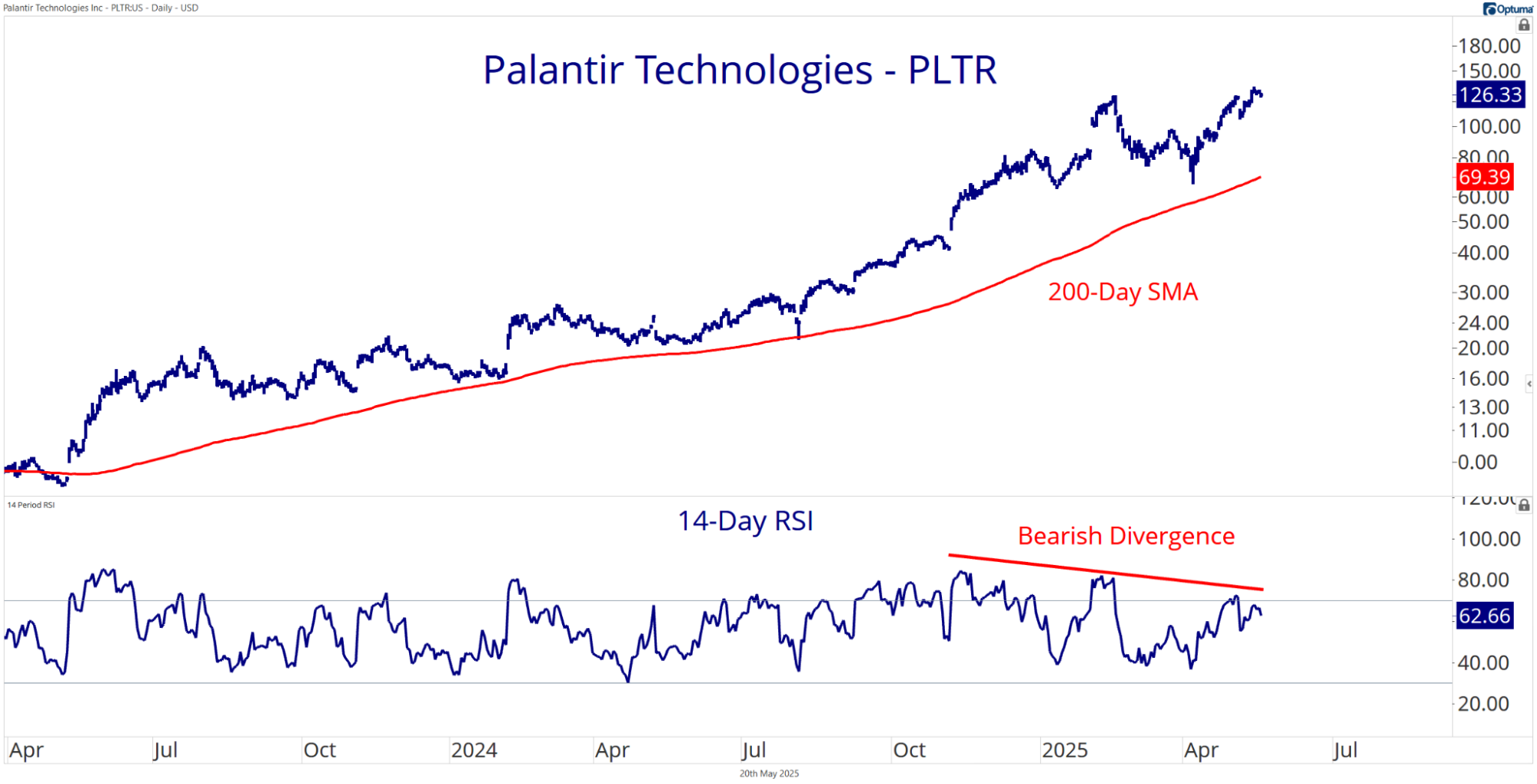

PLTR Loses Steam

According to the recent earnings call, Palantir Technologies (PLTR) expects unlimited growth, forever.

Of course, I’m exaggerating. But Palantir’s price-to-earnings ratio is around 550.

It’s also trading almost 100% above its 200-day moving average (shown in red) – the hallmark of an extended rally…

When PLTR reached a similar distance above its long-term average in July 2023, it proceeded to chip sideways for nine months. It’s also gone relatively nowhere since it ran a whopping 167% above the 200-day a couple months ago.

If you chased after Palantir shares as it was peaking mid-February, you would have been saddled with a -47% drawdown seven weeks later. Not fun.

We want to avoid catastrophic losses like that.

But here’s the crux of trading PLTR: You can’t escape the volatility.

It rips and roars while it rallies and craters as buyers lose steam – a perfect stock for a buy-the-dip and sell-the-rip strategy.

Since it’s up more than 90% in roughly six weeks and is struggling to hold above its February high, PLTR is a no-touch from the long side.

If anything, it might be time to sell the rip.

The 14-day RSI in the lower pane highlights a bearish momentum divergence. (This is when a momentum indicator diverges from price.)

In this case, the RSI has registered a series of lower highs while price has posted a run of higher highs. Each new high in price was met with a lower high in momentum, suggesting buyers need a well-deserved break.

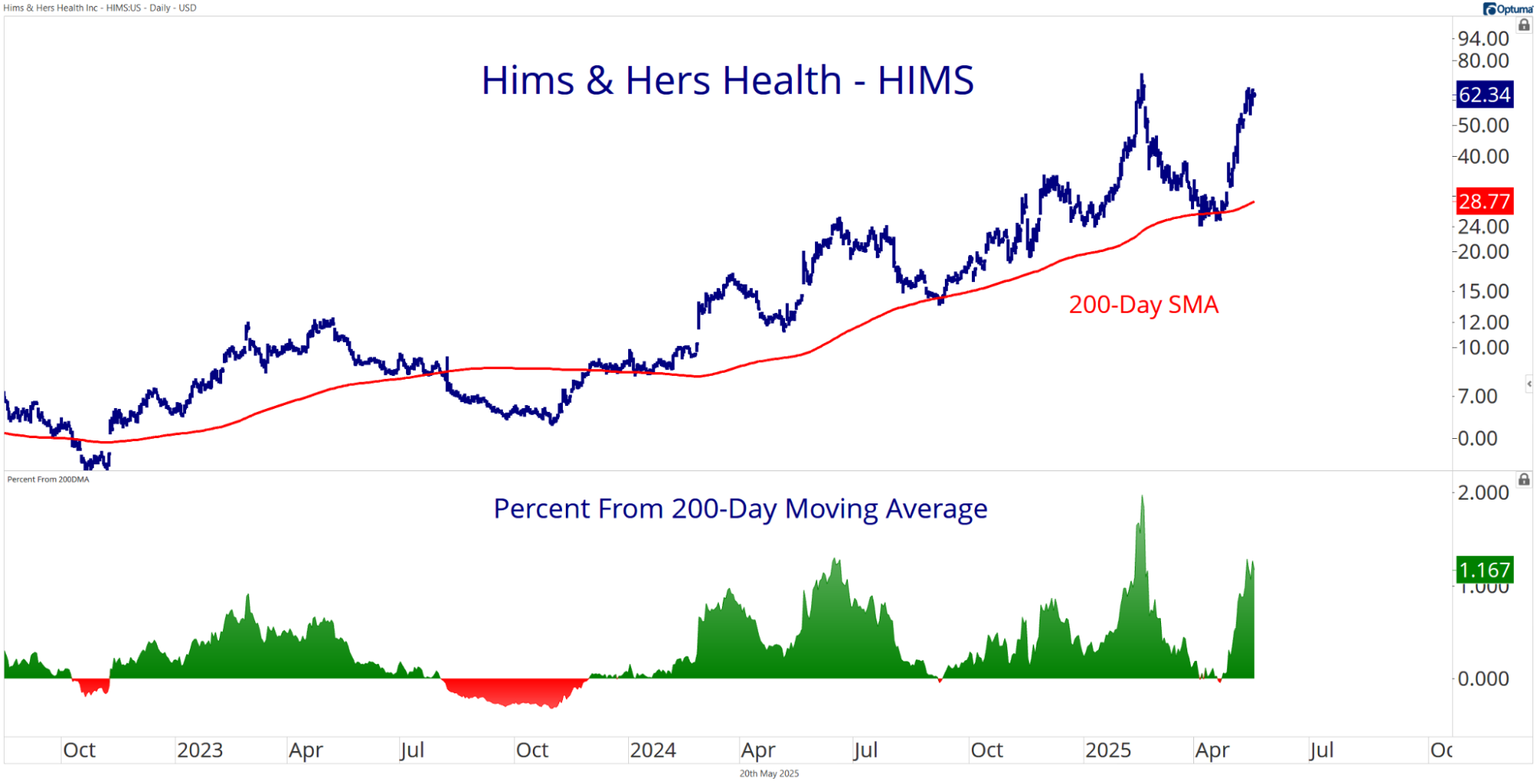

HIMS Extends Toward All-Time Highs

You’ve likely heard of Hims & Hers Health, Inc. (HIMS). If you haven’t, it’s a telehealth platform based out of (you guessed it!) San Francisco, CA.

HIMS is notorious for pushing penis pills in the fight against erectile dysfunction.

However, I was surprised to learn it also provides mental health and dermatology care. And from the looks of the chart, we’re not dealing with a one-trick pony…

HIMS is ripping. It’s trading well above its long-term average – a distance that coincides with peak price levels (depicted in the lower pane). Throw in February’s highs, and Hims & Hers needs to Netflix and chill.

For the record, I like trading this stock.

I like the volatility. I like the chart. And I like the ticker symbol – HIMS.

But I preferred to buy this name at thirty bucks when it bounced off the 200-day moving average. That was three weeks ago.

The stock is now up more than 100% from its April low and is running into its former all-time highs, leaving savvy buyers little to like.

ONON Hits the Wall

When it comes to footwear stocks, it’s ONON or nothing!

I don't own a pair, but I see them everywhere – on the streets, at the gym, and on my coffee table!

The Swiss athletic shoe brand ON Holdings (ONON) has developed a spray-on running shoe technology called LightSpray. As the name implies, these shoes are light. Plus, they’re laceless, which reduces chafing when you’re out on a 26.2-mile stroll.

ONON cruised from a low of $34.59 last month to $60.42 last Friday.

Meanwhile, Nike (NKE) shares are trading approximately 65% below their 2021 all-time high.

When it’s time to buy footwear stocks, you better believe I’ll buy On Holdings before Nike.

But it’s not time to buy either one.

For starters, ONON is running into a shelf of former highs dating back to its 2021 peak. Sellers will likely show up at these former highs in numbers.

I believe buyers will ultimately win, driving ONON to new highs. However, price must consolidate first.

ONON needs time for the intermediate trend (blue line) to catch up and overtake the longer-term trend (red line).

Notice that the price meanders sideways when the blue line is below the red line and trends upward when the blue line is above the red line.

Why not wait for the blue line to cross back above the red? The stock isn’t going anywhere.

At the end of the day, it’s all about managing risk so you can sleep at night. These red-hot stocks will move lower, consolidate, and set back up again. ONON, HIMS, and PLTR will provide stellar buy setups in the future.

No need to chase these rallies while they’re on fumes. The market will reward your patience.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

![[Breakout Confirmed] This 10x Trade Is Taking Off](http://images.ctfassets.net/vha3zb1lo47k/5SZCYl7OZbRTZpXv6ItiqQ/fcc3fb7ac31039e02a1e4ef1ff161ca5/ttr-issue-07-01-25-img-post-2.jpg)

[Breakout Confirmed] This 10x Trade Is Taking Off

Posted July 01, 2025

By Ian Culley

Elon Musk Changed My Life Forever

Posted June 30, 2025

By Enrique Abeyta

How I Build MONSTER Positions

Posted June 27, 2025

By Greg Guenthner

Ken Griffin Is Full of Sh*t

Posted June 26, 2025

By Enrique Abeyta

The “Wall of Worry” Climb Is Over

Posted June 24, 2025

By Ian Culley