Posted November 06, 2025

By Enrique Abeyta

Wisdom of a FinTwit Oracle

My life has changed significantly after I left my career on Wall Street to become a writer.

I didn't spend much time thinking about my investment philosophy when I managed money full-time.

My strategy was well-defined, and I refined it over many years. But I didn’t have much time to gather wisdom from new sources.

That isn't to say that I thought I knew it all.

It’s that the learning process was driven more by the day-to-day operations. I looked at the data and evolved my investment process accordingly.

A real pleasure of writing is a return to active learning. Part of that process is being introduced to great thinkers I was previously unfamiliar with.

One of them is an author named Ed Borgato.

Ed began his career as a 19-year-old at Lehman Brothers and went on to become a broker and investment advisor before launching his hedge funds.

During that entire time, he also wrote a daily investment journal in which he chronicled his observations. (I wish I had done the same!)

He began posting these thoughts as an early Twitter adopter and a FinTwit community stalwart.

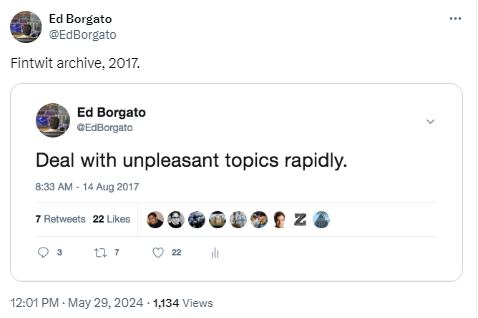

Ed has some great insights and still posts them from time to time, although he mostly shares ones from the past.

Here are some of my favorites.

This is one of my absolute favorites. The debate about "value" versus "growth" is one of the most useless in the financial media. (And that’s saying something!)

Don't worry about value or growth. Focus on finding great companies at good prices, buy them, and then hold on for the long run.

This one made me chuckle.

But seriously, our goal as investors should be finding businesses that are so good that the government will eventually come after them for their success.

If you buy these companies, you will crush the broad market.

This is an integral part of my “plan the trade, trade the plan” ethos. You must have a plan and be able to adapt it as the environment changes.

It all starts with being prepared before you go into the trade. Preparation is the key to winning.

One of my favorite sayings in technical analysis is “price is truth.”

You can never truly know why a stock is doing what it is doing. But you do know what it’s doing via the price.

Figure out a strategy that deals with the truth of price instead of trying to manufacture reasons for a stock movement.

This is an excellent insight for trading, investing, and life.

One key to success is to take whatever you least want to deal with and deal with that first.

It’s also great advice in relationships. Take the topic you do not want to talk about and start by talking about that first.

This one could be my mission statement.

I believe that most of what you hear from Old Wall Street is not helpful and exists only to justify their fees.

Anyone can become a good (or even great) investor if they do the work and find mentors.

And it’s my privilege to offer you that mentorship here.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Hyper-Caffeinated Sticker Shock

Posted November 16, 2025

By Ian Culley

An UP-date on the Melt-DOWN

Posted November 14, 2025

By Greg Guenthner

7 Final Lessons From Buffett’s Farewell

Posted November 13, 2025

By Enrique Abeyta

Warren Buffett, Signing Off One Last Time

Posted November 10, 2025

By Enrique Abeyta

Give Gold a Rest (and Trade This Miner Instead)

Posted November 04, 2025

By Ian Culley