Posted January 14, 2025

By Greg Guenthner

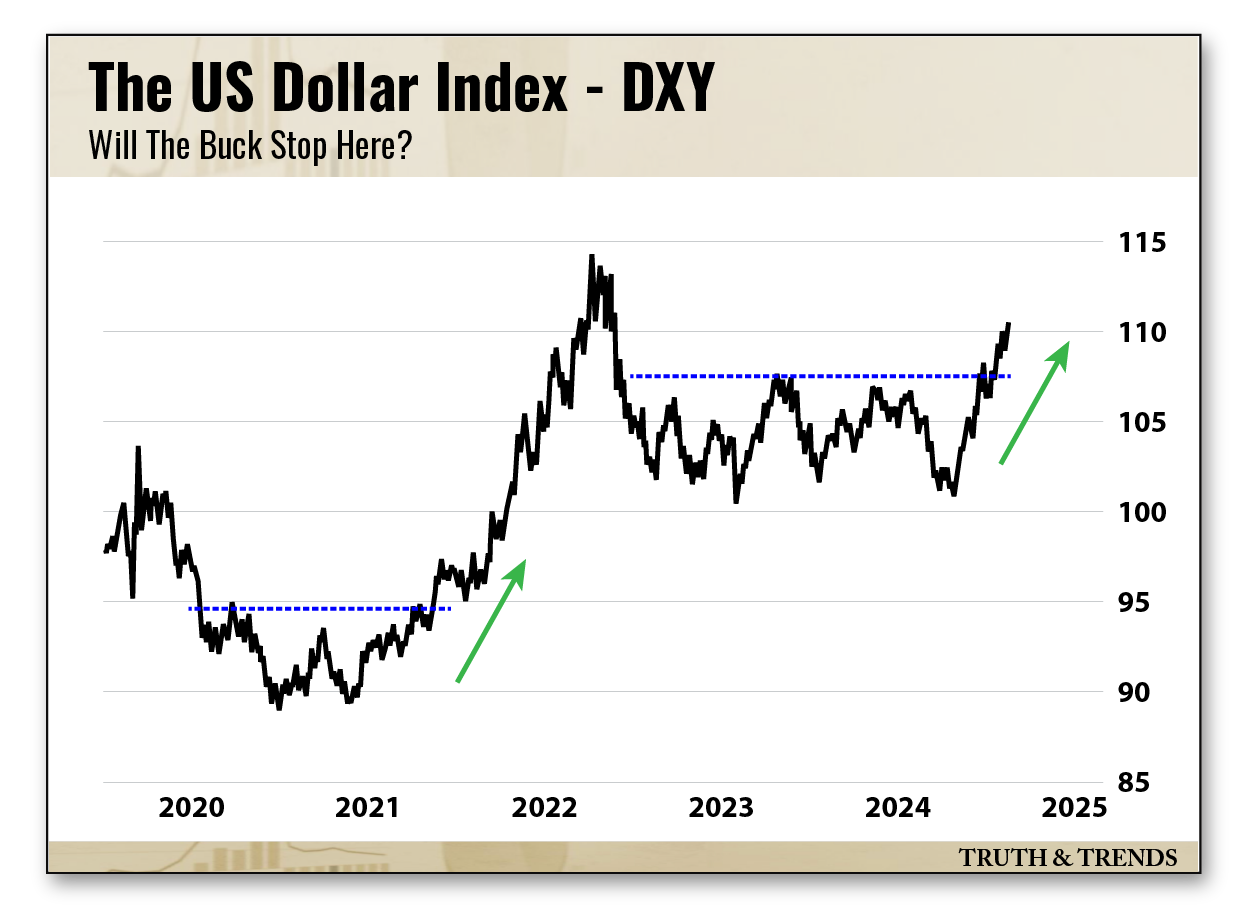

Will The Buck Stop Here?

Unless you’ve been hiding under a rock for the past month, you know the stock market is in a precarious spot right now.

So we’re going to need to watch our step.

The big question in moments like the one we’re in now is whether the decline has gone far enough to wash out the exuberance and reset sentiment.

Everywhere we look, we see stocks and sectors at do-or-die levels. If they catch and bounce, we’ll get more relief. If not, more pain. Simple as that.

One of the most difficult mental hurdles during corrective action like this involves turning off your emotions.

If you can remain objective when everyone else starts worrying or panicking, you stand a much better chance of staying ahead of the market’s biggest moves.

Of course, the best way to keep your mind right is to stick to the facts. Pay attention to the charts and relationships that will likely have the most impact on prices going forward.

And don’t take your eyes off the U.S. dollar.

What’s Next for Stocks, According to the Dollar

I don’t trade currencies, so I usually don’t give the King Dollar much airtime. However, a strong dollar tends to weigh heavily on risk assets (especially stocks and shiny rocks).

That’s why last fall, the U.S. Dollar Index (DXY) grabbed my full attention. The index ripped almost 2% on Nov. 6.

Perhaps a couple of percentage points doesn’t seem like much, but it's a big move for a currency. Significant single-day moves such as this occur at inflection points in the underlying trend. (This applies to all assets, not just the dollar.)

In fact, the last time the buck posted a similar daily return was during the Sept. 2022 blowoff top. But since DXY was meandering toward the upper bounds of a year-plus range, I couldn’t help but think this could be the beginning of another sustained uptrend for the dollar.

Sure enough, DXY broke out three weeks later…

Fast forward to today, and the U.S. Dollar Index challenges a 110-handle. Interest rates rise worldwide, and the market melt-up grows cold.

Last Friday, the major averages all slipped more than 1.5%, while the small-cap Russell 2000 lost 2.2% and appeared to break down out of a bear flag, testing its 200-day moving average on Monday morning.

Crypto is also taking a hit following an uneventful weekend. I’m seeing broad drops across the board amongst the small coins, while Bitcoin briefly broke below $90K for the first time since mid-November.

If you've been trading stocks, you’ve probably bled money for the past six weeks (I know have). That’s why I’m laser-focused on the dollar.

I can’t predict if the buck will stop here. I don’t have a crystal ball.

But if it continues to rally toward the 2022 highs at approximately 114, I imagine recent selling pressure will become a more pronounced selloff.

Remember, we never witnessed a 10% correction in the S&P 500 last year. It’s due!

That doesn’t mean we won’t find stocks to buy. Instead, there will be fewer choices, many of them energy names.

On the flip side, you’ll have plenty of options if the King Dollar cools off and begins to track toward 107.

In this scenario, speculative growth names and the major averages are likely rebounding following a much-needed momentum reset.

That’s it for today!

Thanks for reading. If you have any questions, feedback, or topics you want covered in future issues, you know the drill…

Drop me a line at AskGreg@paradigmpressgroup.com and let me know!

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Losing Right > Winning Wrong

Posted December 15, 2025

By Enrique Abeyta

2026: Year of the Trader

Posted December 12, 2025

By Greg Guenthner

Meet Mr. Bubbleology, the Next Fed Chair

Posted December 11, 2025

By Enrique Abeyta

Melt-Up Trifecta: 3 Sectors to Buy Now

Posted December 09, 2025

By Ian Culley

"In the End, We Win”

Posted December 08, 2025

By Enrique Abeyta

![[VIDEO] The Year-End Rally Is Back On!](http://images.ctfassets.net/vha3zb1lo47k/4mfoBVvX4hSw8BLbDAjPP7/c13db091bfeef2a493bcfd0f1e73df14/ttr-issue-12-05-25-img-post.jpg)