Posted December 09, 2024

By Enrique Abeyta

$1,000,000 Bitcoin Sound Impossible? Think Again…

Bitcoin did the “unthinkable” last week — smashing through the $100,000 mark and shattering expectations for what was possible in 2024.

If you’ve been following me and my colleague James Altucher, you know we saw it coming before the rest of the crowd.

But the real question now isn’t about dwelling on the past or dissecting how we got here.

It’s what you do right now.

If you’re holding Bitcoin, do you cash out? Double down on your position? Or if you’ve been sitting on the sidelines, is now the time to jump in?

But the biggest question is this: After surging over 130% this year, can Bitcoin climb even higher in 2025?

Let’s start by diving into what my favorite strength indicator says about Bitcoin’s next move — and get to a strategy you can use right now to take part in this historic moment.

Applying My Favorite Technical Analysis Indicator

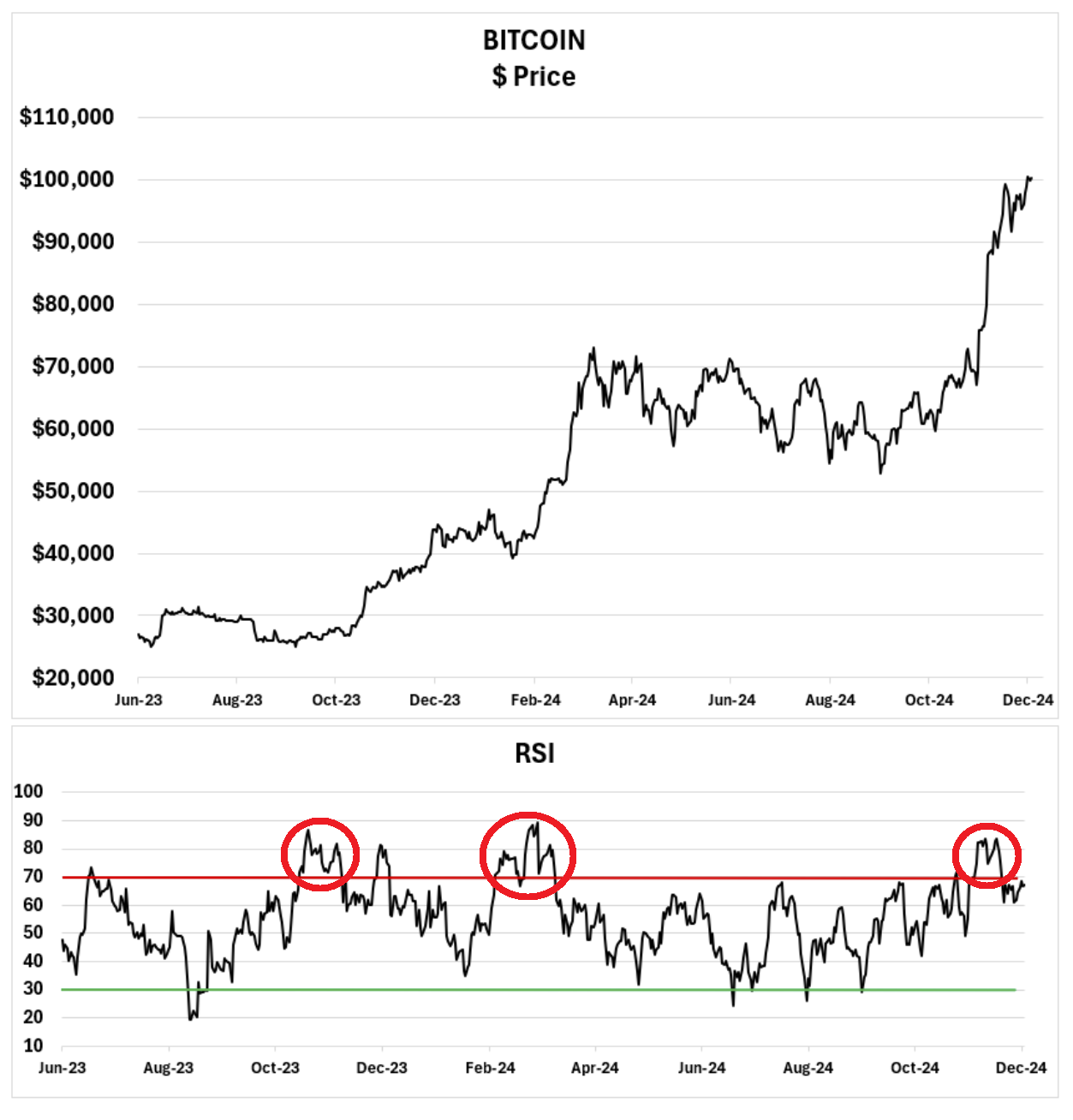

Here is a two-year chart of the price of Bitcoin along with my favorite technical analysis signal — the relative strength index or “RSI.”

RSI is a technical signal I often use to determine whether a security is overbought or oversold.

A security is considered to be overbought when the RSI is above 70. It is considered to be oversold when the RSI is below 30.

How do we use this signal to make money?

Typically, securities that are overbought have a high probability of NOT going higher in the short term (the next 10 to 90 days). On average, the returns for the security over these periods are also muted.

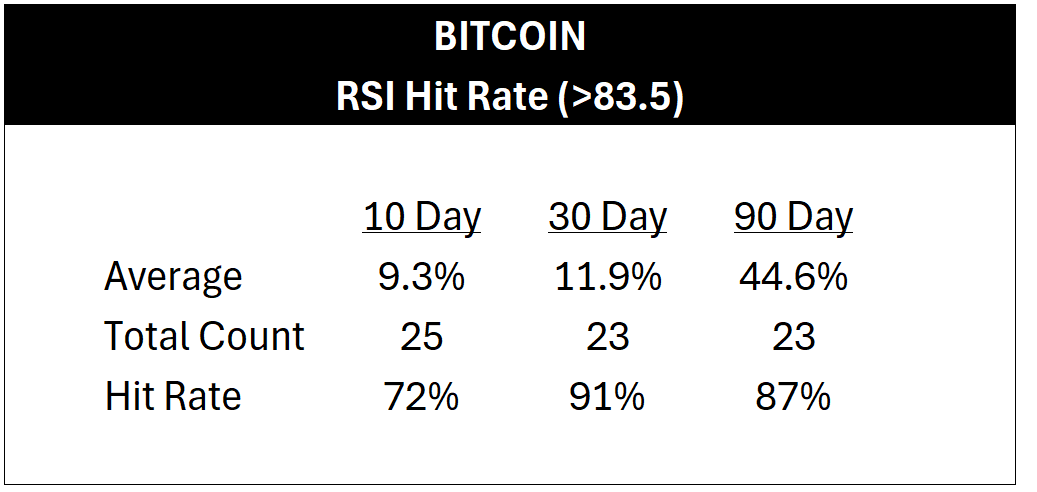

Bitcoin recently breached an 83.5 reading on RSI. Here is a table showing how the stock has performed in the 10, 30, and 90 days after it has gone through that level over the last decade…

Wow — this is some incredible data!

I have run this data analysis literally thousands of times over the last 10 years and can’t recall a single time I ever saw results like these.

Over the last 10 years, if you bought Bitcoin after it breached this “overbought” RSI level of 83.5, it’s up the vast majority of the time in the near term.

Not only that, but it’s up 45% on average over a 90-day period.

Again, wow! I have never seen anything like this before…

One of the core drivers of our successful trading strategies is to avoid overbought stocks and buy oversold ones. This isn’t driven by opinions — it is driven by the data.

Here the data is telling us something VERY different and we want to respect it.

So, my answer to what to do with Bitcoin right now is to OWN IT.

If you owned it before, keep what you own. If you do not own it now — buy some.

This is where it gets interesting, and we discussed trading entry strategies in last week’s Top Trades Live.

As much as I respect the power of the historical data on Bitcoin, you have to have a smart strategy to buy it.

Even with the powerful data, it is down 10% of the time.

When Bitcoin moves, it also moves a LOT. No one wants to buy a full position and then quickly be tagged with a double-digit loss.

Also, while statistically past performance IS the best predictor of future performance, I think that the current Bitcoin overbought/oversold results evolve over time. The reason it works is based on human nature, and that will assert itself eventually.

Utilize This Key Strategy

This is where my version of “dollar-cost averaging” in trading is useful.

Dollar-cost averaging is a trading or investing strategy where you buy consistently in equal amounts.

For long-term investing, you might buy $100 of stock every month for many years. This makes sure you are participating in the stock but also will smooth out any volatility. It is an awesome strategy for investing and compounding.

I have my own version for trading — essentially the same strategy but over a shorter period of time.

If you don’t own Bitcoin today, I recommend buying a fraction of what you think you would want to have owned in a “full” position when it was at $75,000 a month ago.

Let’s say you would have been willing to own a $10,000 position at that point. Then go out today and buy a $3,500 or $5,000 position. This is 35% to 50% of your desired “full” position.

This puts you in a position to win no matter what happens.

If the historical data plays out like it has before, you make some nice returns on the position you now hold. You identified a high probability bet and took advantage of it.

If Bitcoin trades off in the next few days, however, from these levels go out and buy the rest of what you would own every time it trades down 10% from where you bought it.

Say another $1,500-$2,000 at the $90, $80, and $70 levels.

This puts you in a position where you are still playing the high probability bet identified by the historical RSI data but have a much bigger position and better prices.

Although you have lost some money in the short term, you are setting yourself up for a much bigger win.

What if Bitcoin KEEPS going down?

Well, I would not recommend this strategy if I didn’t love Bitcoin for the future.

James and I both have been huge fans and continue to be optimistic. Both our teams think Bitcoin could trade as high as $250,000 in the near year or two.

Though personally, I think Bitcoin can go MUCH higher than $250,000. Guess where it would trade if it had roughly the same market capitalization as gold?

$1,000,000!

Sound impossible? Well, so did Bitcoin $100,000 earlier this year.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

50-Year Storm Hits the Dow…

Posted December 20, 2024

By Greg Guenthner

Yesterday’s Selloff Triggered a Rare Setup

Posted December 19, 2024

By Enrique Abeyta

This Swiss Athletic Stock Could Shoot 20% Higher - Within 2 Weeks

Posted December 17, 2024

By Greg Guenthner

The GameStop Gambit

Posted December 16, 2024

By Enrique Abeyta

‘Tis the Season for a Snapback

Posted December 13, 2024

By Greg Guenthner