Posted March 25, 2025

By Greg Guenthner

TSLA Leaves Hate Sellers in the Dust

It’s time to get aggressive.

The markets just endured four straight weeks of steady selling. Investors watched the strongest stocks cough up their hard-fought post-election gains.

And the bulls are running scared from a political news spiral that’s dredging up more than its fair share of economic concerns.

Investors are beyond frustrated.

They have no idea what to make of the aggressive, ever-changing tariff policies and “government efficiency” developments coming out of Washington.

The fear has been palpable for weeks, no doubt convincing more than a few market watchers to sell and go away until conditions improve.

But for tactical traders, now is not the time to run and hide.

You should be buying!

Late last week, we discussed the “bad news bounce” that helped to stabilize the market. Now, we're watching stocks extend their gains to begin the new trading week.

Today, I’ll show you how to get tactical in order to take advantage of the bounce. (Here’s a hint: You’ll want to focus on some of the hardest-hit names during this bearish news cycle.)

We’ll also discuss what areas of the market should command your focus as stocks recover — and what we can expect in the coming weeks.

It’s time to play for a bigger rally!

The Stock Everyone Loves to Hate

Some stocks were hit harder than others over the past five weeks.

Notably, many of the strongest-performing names since early November sustained the biggest drawdowns.

Crypto-adjacent stocks, tech runners, and the Magnificent Seven mega-caps took more than their fair share of the damage as sellers sprinted for the exits.

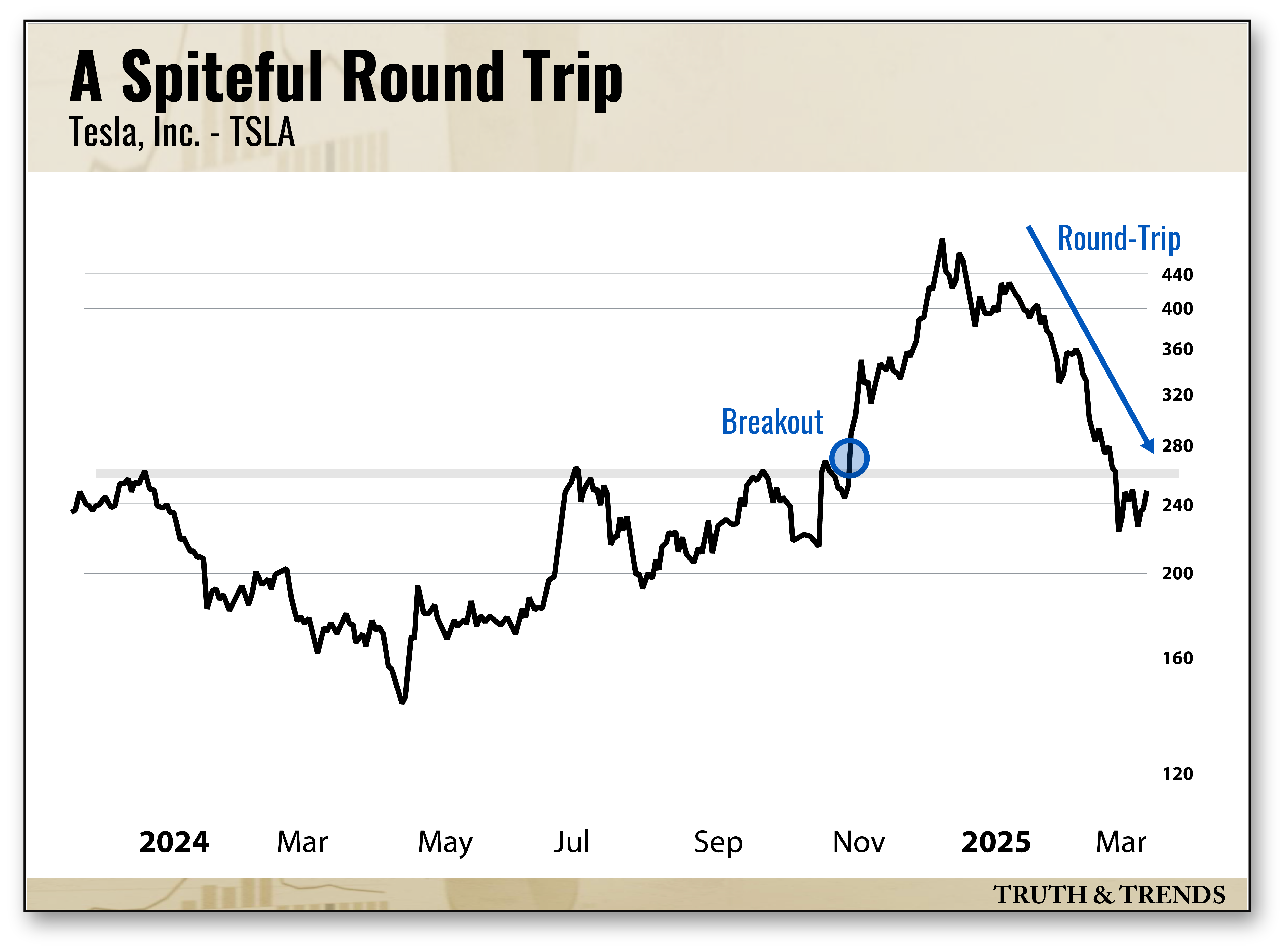

Tesla (TSLA) is the perfect example. Shares broke out above the critical $270 level immediately after the election, soaring more than 80% over the next month to fresh all-time highs.

But the news quickly turned against Elon and his flagship public company. The stock suddenly topped out in December, giving back all its post-election gains into the Q1 broad market pullback.

You couldn’t avoid the anti-Tesla sentiment — it was everywhere. Protestors of Elon’s Department of Government Efficiency took to the streets, with some even vandalizing Teslas and setting fires to dealerships.

Former VP candidate Tim Walz also took a public jab at Elon, pulling out his phone to mock TSLA’s sinking share price at a rally last week.

Enrique and I discussed this spite-selling phenomenon on Top Trades last week just as TSLA was beginning to level out after hitting deeply oversold conditions.

Don’t get me wrong; there are plenty of legitimate fundamental concerns about TSLA. But when the selling becomes completely detached from reality, it’s a good idea to lean hard in the opposite direction.

That’s exactly what’s happening with TSLA right now.

The stock started to rally late last week, posting a three-day winning streak culminating with Friday’s 5% gain. Buyers turned up the heat to begin the new trading week, sending TSLA higher by nearly 12% during yesterday’s tariff relief rally.

Sentiment had clearly become too stretched. With no one left to sell, Tesla shares are now back above $270 and in a prime position to extend higher.

The stock that no one wanted to own just a week ago was Monday’s strongest-performing component in the S&P 500 and Nasdaq 100.

Stay Tactical to Win Big!

TSLA isn’t the only beaten-down stock beginning to rally this week.

Former high-fliers like PLTR, HOOD, and APP are posting impressive moves. Semiconductors are attempting to play catch-up. And the Mag 7 names are back on the leaderboard.

I know conditions aren’t perfect. You might even have some serious reservations about this young rally.

But here’s the thing… We don’t need the stock market to rush back to all-time highs to make money on this rally.

To be clear, I’m not saying a complete recovery couldn’t happen. Just know that relief rallies can also be powerful money-making opportunities!

Instead of hiding under a rock, you should be actively looking to buy these beaten-down names this week as they start to run.

Shut out the negative news. We can worry about how far this rally will extend when the time comes. Right now, there’s an opportunity to get tactical and play these oversold bounces.

A quick screen of the best performers to start the week reveals plenty of software companies, chip stocks, and other household names that are ready to launch.

Don’t let them pass you by.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

The Next Trillion-Dollar Whale

Posted March 28, 2025

By Greg Guenthner

One Company’s Secret to 47,535% Returns

Posted March 24, 2025

By Enrique Abeyta

How to Trade the “Bad News Bounce”

Posted March 21, 2025

By Greg Guenthner

Ready…Aim…FIRE!

Posted March 20, 2025

By Enrique Abeyta

Breakout Alert: Energy Is Heating Up Fast

Posted March 18, 2025

By Greg Guenthner