Posted May 01, 2025

By Enrique Abeyta

Trump's $800 Billion Gift to China

The relationship between the United States and China is entering a decisive new phase — one that could reshape the global order.

For decades, Washington tolerated China’s rise, betting that trade and diplomacy would moderate Beijing’s ambitions. That bet has failed.

Now under Trump, the U.S. is shifting course by imposing tariffs, rallying allies, and labeling China the top threat to global stability.

But the real test won’t come through trade; it will come through Taiwan, an island off of China’s coast with a GDP of roughly $800 billion.

Taiwan’s fate may soon force a historic decision: escalate toward military conflict, or negotiate a peaceful resolution.

And if the Trump administration chooses the latter, it could echo a moment from recent history — the 1997 handover of Hong Kong.

This would be a move that trades one inevitable loss for long-term stability and redefines the rules of engagement with China.

The Hong Kong Blueprint

To understand where this might be headed, let’s look at the last time a major global power negotiated a peaceful transfer of a prized territory to China.

That was the 1997 handover of Hong Kong.

Hong Kong was established as a colony of the British Empire back in 1841 after the First Opium War. The British sealed a 99-year lease to occupy the territory 50 years later.

The Flag of British Hong Kong

Over the next century, Hong Kong operated as an autonomous region and a member of the British Commonwealth.

It still had strong economic ties with China but was managed completely as a British colony.

After the Chinese Communist Revolution and the establishment of the People’s Republic of China, this relationship became more contentious.

The Chinese did not appreciate having a key area controlled by the British. Over the second half of the 20th century, they began to put significant pressure on the United Kingdom.

They wanted more control over the future of Hong Kong and pushed to hand over the territory before the expiry of the lease.

Eventually, diplomatic negotiations resulted in the 1984 Sino-British Joint Declaration.

In this agreement, the British agreed to hand over Hong Kong in 1997, and China would guarantee Hong Kong’s economic and political system for the following 50 years.

Going into the handover, there was considerable economic and political volatility. Over half a million Hong Kong citizens left and migrated to Canada and other parts of the Commonwealth.

Eventually, though, the handover took place and was relatively non-eventful.

There was no real disruption to Hong Kong’s economy, the domestic stock market, or the publicly listed companies based in Hong Kong.

While it was not necessarily “everything as usual” after the handover, there was minimal disruption from an economic perspective.

Some 20 years later, China would become much more aggressive in asserting its political power over Hong Kong.

Although Hong Kong’s political system was supposed to persist for 50 years, the PRC began to take over aggressively roughly a decade ago.

This led to large protests, suppression of the press and security actions to quell the discontent. Eventually, China stomped it out and has now mostly eliminated any major political dissent.

Now, I personally don’t approve of this action. But want to know what was not disrupted during this process? Hong Kong’s economy.

While it lost some prominence over the decades as mainland China emerged, the Hong Kong economy and financial markets continued to operate soundly.

I believe the handover of Hong Kong in 1997 sets up a road map for what the Trump administration will likely do with Taiwan.

Realpolitik in the Pacific

While the United States does not have governance over Taiwan, there is no doubt that Taiwan’s independence has continued as a result of the implied protection of the United States.

Over the last 15 years, however, the Chinese have spent massive resources preparing to take over Taiwan through military force.

Right now, it’s just not feasible for the U.S. to defend Taiwan… not without incredible cost to both the U.S. and the entire world.

What could happen — and will, in my opinion — is that the United States could help negotiate a peaceful handover of Taiwan, a situation similar to Hong Kong.

This isn’t backing down to China; it’s a strategic redirection.

Rather than lose a war over Taiwan, the U.S. could use diplomacy to secure peace, protect markets, and reassert control over the terms of global power.

In this scenario, the Chinese are satisfied that they are able to reacquire this key province without significantly disrupting the global economy.

There is no doubt that the Taiwanese will be unhappy. But like the citizens of Hong Kong, they have an impossible choice.

There is no possibility they could fight off China, so their only option is to make the best deal possible.

I think that this outcome will eventually be wrapped into the global reset of relationships between the United States and China.

What right now is a hot economic war could turn out to be a strong and lasting military peace.

Most analysts think war over Taiwan is either inevitable or unthinkable.

Few are considering the third option: a peaceful handover, orchestrated by the very administration that’s taking the hardest line against China.

That might sound like surrender. But in reality, it would be the boldest diplomatic move in decades…

One that avoids global war, resets U.S.-China relations, and secures long-term economic stability.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Silver's Swan Dive Is Just the Beginning

Posted February 02, 2026

By Enrique Abeyta

Lightning Round: Trump’s Fed Pick, the Silver Crash, and More

Posted January 30, 2026

By Greg Guenthner

Forget the Noise, You're Not Bullish Enough

Posted January 29, 2026

By Enrique Abeyta

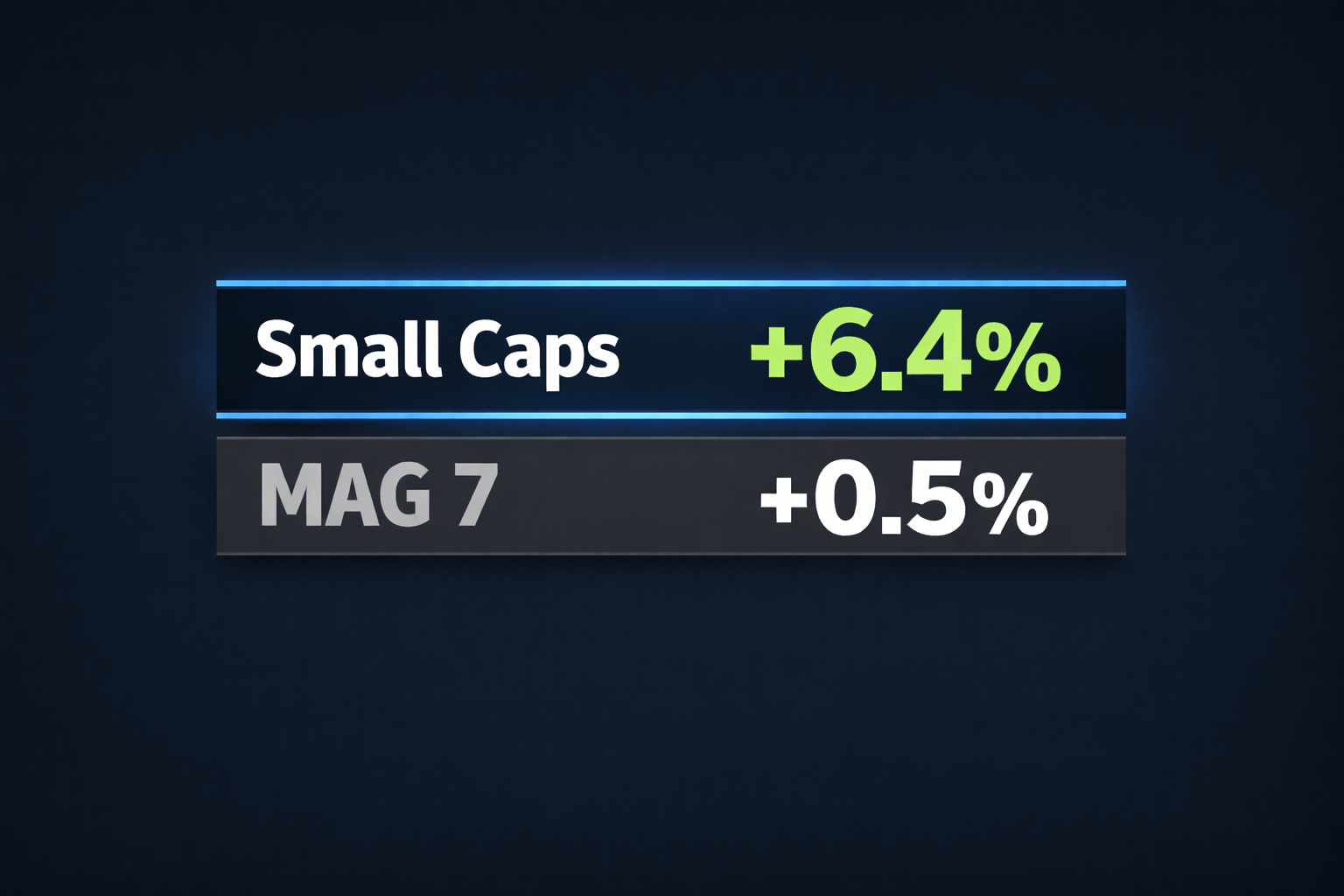

Small Caps Are Back, Baby!

Posted January 23, 2026

By Greg Guenthner

Greenland, Carry Trades, and Lazy CNBC Takes

Posted January 22, 2026

By Enrique Abeyta