Posted October 30, 2025

By Enrique Abeyta

Trade Earnings “Noise” for Quick, Double-Digit Profits

It’s the best time of the year for traders — earnings season.

Companies are reporting third-quarter earnings results, and this will continue for the next few weeks.

The dynamic of earnings season has evolved somewhat in my 25+ year investing career.

When I first started on Wall Street, investors could make great returns by figuring out which companies would beat analyst expectations.

And when these companies posted strong results, their stocks would often rally sharply.

But over time, it became harder to figure out what those expectations really were and how stocks would respond to them.

A company could strongly beat earnings estimates but trade down sharply afterward.

Gradually, the act of playing earnings season by identifying earnings beats became impossible.

Sure, investors could figure out which companies would beat, but the stock’s reaction was completely unpredictable.

As a result, I developed another strategy — perhaps an even better one — with the funds I managed.

My Approach to Trading Earnings Season

Our trading portfolios began to focus on having relatively neutral strategies going into earnings season. The short-term moves became too difficult to predict, so we wanted low exposure.

The opportunity, though, was to shift the focus from predicting to reacting.

Inevitably, we would see several great companies get clobbered in the aftermath of an earnings announcement — despite reporting strong results.

The reasons would vary. It could be about decelerating growth, some area of margins, or conservative guidance, among other things.

But the real reason was likely that investors using a simple lens on the markets were crowding into companies they thought would post great earnings results.

They would drive the share price up leading up to the announcement, anticipating a big pop in the stock... which wouldn't happen, because everyone had already bought them.

These folks would panic and drive the stock price down rapidly.

Here is an example of how we took advantage of this in our trading service The Maverick during the last earnings season.

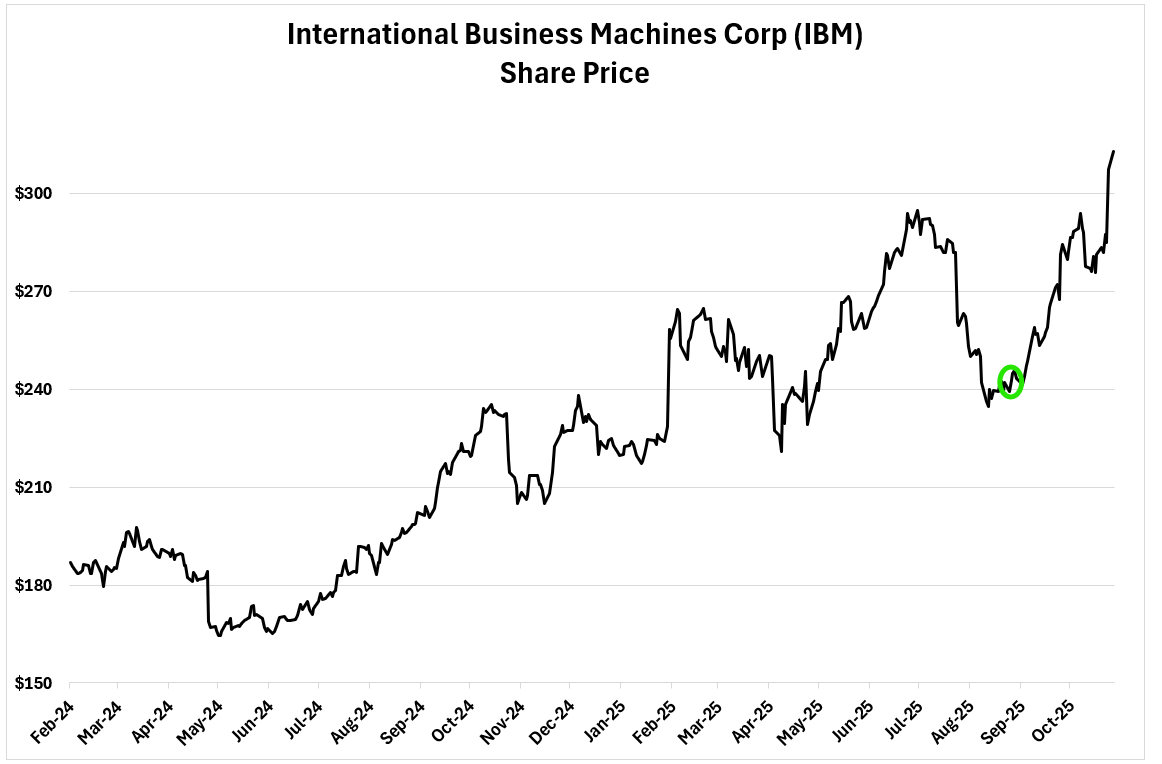

Here’s the chart of International Business Machines Corp. (IBM).

The company reported second-quarter earnings in early August and beat expectations for both revenue and earnings per share (EPS).

Despite these strong results, many investors had even higher expectations.

I looked at how the company had been performing and thought that they would continue to beat results.

After the shares stabilized, I recommended IBM to our readers. And they made a quick double-digit return in less than one month!

These are the kinds of opportunities that can emerge during earnings season.

For high-volatility growth stocks that are up a lot going into earnings, it's not unusual to see them collapse by 5%, 10%, or even 25%.

And this creates some outstanding opportunities.

As we move through the heart of earnings season, I encourage you to take advantage of this volatility.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

![[VIDEO] The Year-End Rally Is Back On!](http://images.ctfassets.net/vha3zb1lo47k/4mfoBVvX4hSw8BLbDAjPP7/c13db091bfeef2a493bcfd0f1e73df14/ttr-issue-12-05-25-img-post.jpg)

[VIDEO] The Year-End Rally Is Back On!

Posted December 05, 2025

By Greg Guenthner

The Truth About Stock Market “Voodoo”

Posted December 04, 2025

By Enrique Abeyta

Breakout Alert: Copper Coils for a Monster Move

Posted December 02, 2025

By Ian Culley

Time for a Reality Check

Posted December 01, 2025

By Enrique Abeyta

Thankful for the Greatest Game on Earth

Posted November 27, 2025

By Enrique Abeyta