Posted December 13, 2024

By Greg Guenthner

‘Tis the Season for a Snapback

There’s something for everyone in this melt-up market.

Bitcoin is back on track, sneaking back above $100K.

Mega-caps are catching higher, helped by the hype surrounding Google’s breakthrough quantum chip.

And a quick momentum reset earlier this week set up some choice bounces in the more speculative trades.

With so many choice setups in this market, it’s difficult to stick to just one.

To kick things off, let’s first look at one stock that’s making an incredible comeback heading into the holidays.

The Perfect Holiday Snapback Trade

Big base breakouts are popping in this market, along with some familiar consumer names. That’s why I just put on a new trade that offers both.

Yeti Holdings (YETI) was a hot stock once upon a time. But it was destroyed during the last bear market, losing nearly 75% of its value by late 2022.

Since then, the stock has been basing out, carving out a wide range below $40 for more than two years now.

The stock is still well below its December 2023 highs. I’m betting it could run here after breaking out to levels not seen in nearly 10 months.

It could get back into the $50 range in a hurry if the herd jumps on this trade. Just look at this clean breakout over horizontal resistance.

‘Tis the season for snapback trades!

To be clear, I don’t know if Yeti coolers and tumblers are necessarily making a resurgence this holiday season. I’m simply playing the price action of a beaten-down stock that’s quickly coming back into favor.

Yeti is just the type of stock that can run higher in this environment as speculators pick up every familiar ticker they can find heading into the holidays.

Wake Up! Your Morning Coffee Just Hit New Highs

Have you noticed the empty supermarket shelves at the back of the store where you normally find the eggs?

It turns out the bird flu is decimating chickens in the U.S., resulting in a dwindling egg supply that’s left shoppers with high prices and few (if any) choices.

But eggs aren’t the only breakfast table item hitting our pocketbooks…

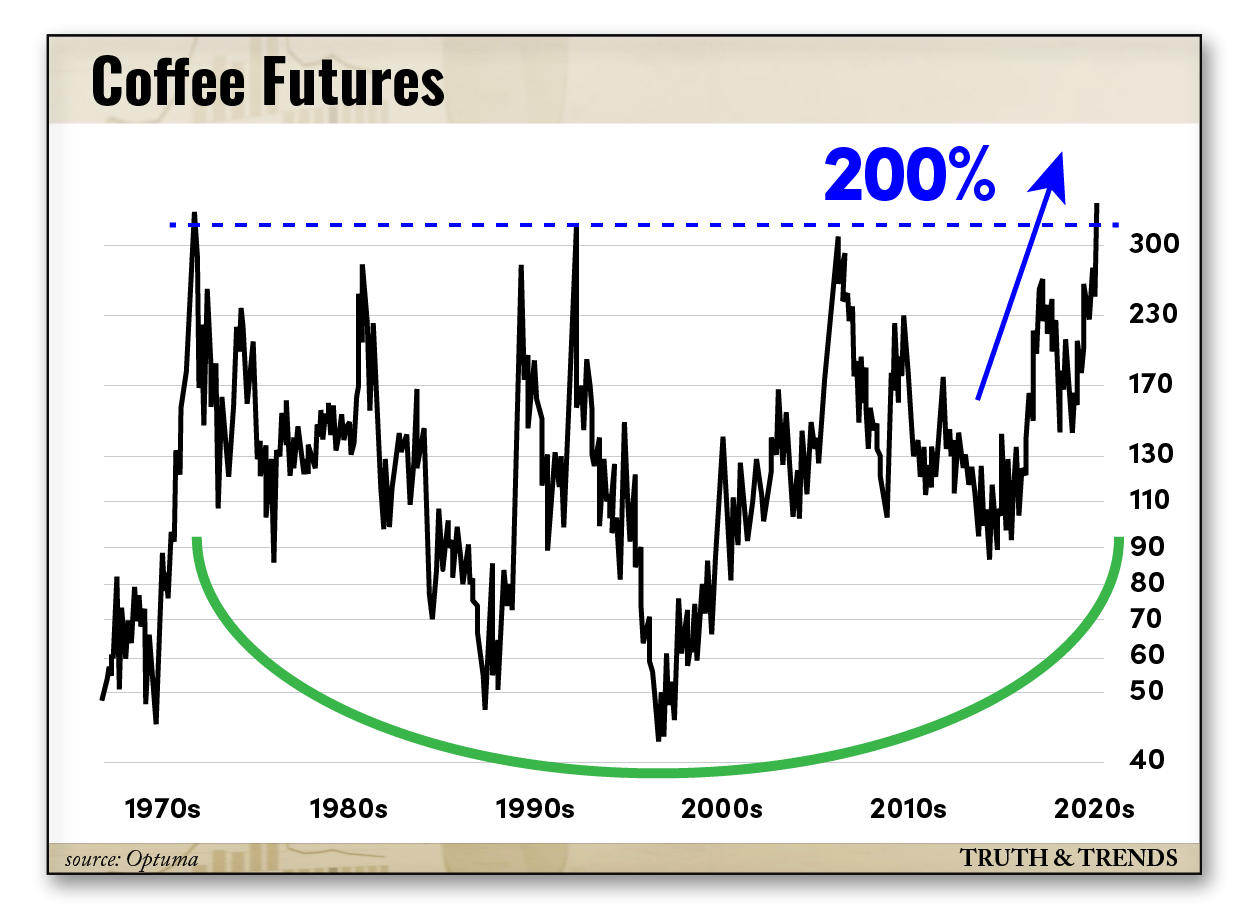

Orange juice futures are squeezing to their highest price on record, and coffee is eclipsing its former all-time set in 1977.

No wonder I haven’t been able to get Dunkin coffee on sale at Costco!

Coffee futures have risen over 200% in the past 12 months, and they will climb much further if they follow cocoa’s lead.

Last year, cocoa futures gained roughly 150% after slicing through its 1979 record high — almost 450% off the 2022 lows.

Whether you’re reviewing the chart of coffee or picking up a few basic items at the grocery store, it’s clear: Inflation is sticky.

Perhaps the economic factors driving higher prices are beyond our reach as we’re forced to pay up every time we reach the register.

But you can ease some of that sticker shock by participating in these rallies, even if you don’t directly trade commodities…

How to Hedge Your Breakfast Bill

Besides precious metals and oil and gas names, the market has made it difficult to trade commodities through stocks.

In fact, many commodity ETFs were closed within the past few years just as these historic bull runs kicked into gear.

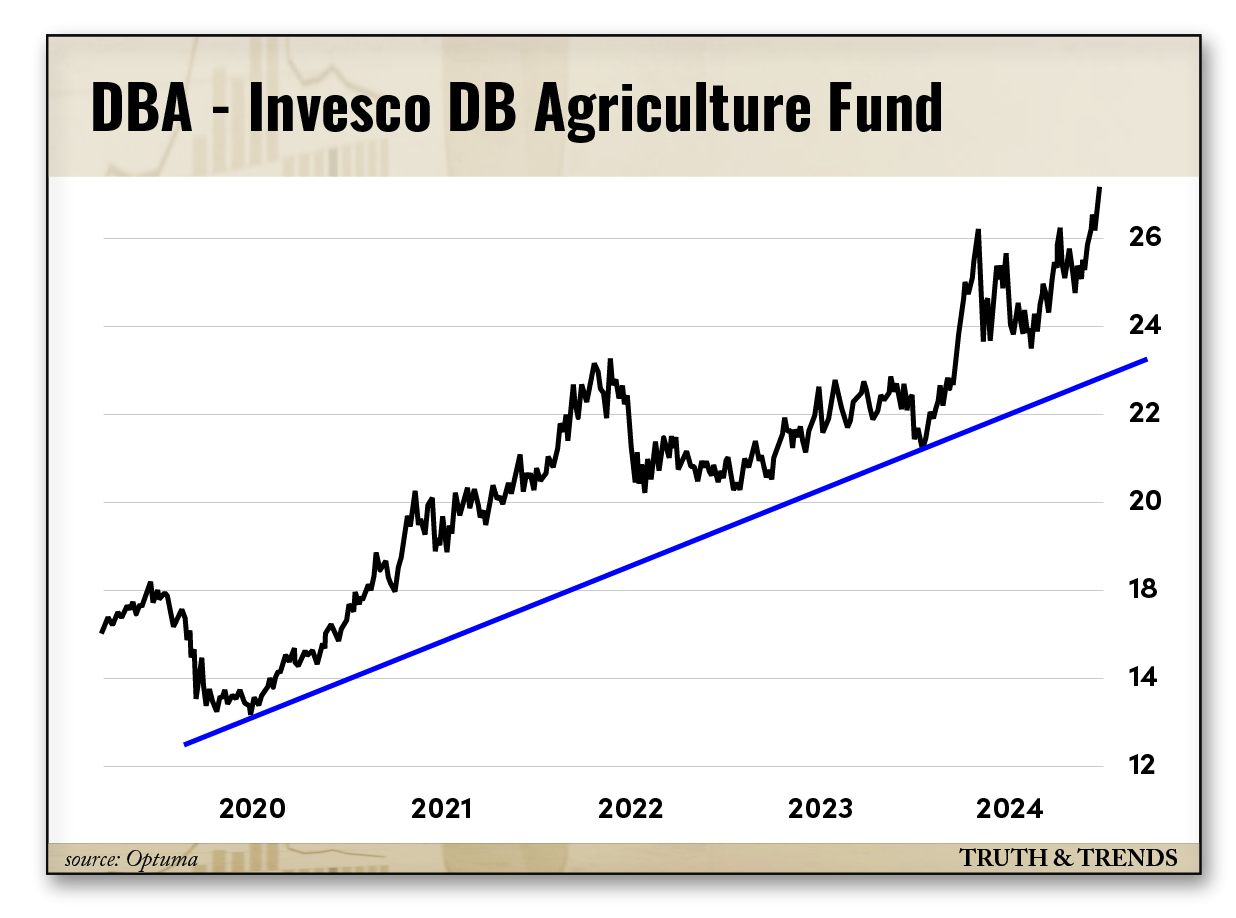

Luckily, coffee and cocoa futures are two of the top holdings in the Invesco DB Agriculture ETF (DBA). Plus, it’s posting fresh decade highs.

DBA presents a picture-perfect uptrend off the 2022 bottom and the closest thing to a pure play on Coffee and Cocoa.

If today’s agriculture rallies mimic the 1970s bull runs, coffee is just beginning to percolate, and cocoa will likely see another 400%+ markup.

Meanwhile, cattle futures are inching closer to new all-time highs.

So, while mega-caps track higher and speculative growth rebounds off the momentum reset, consider adding DBA to your melt-up watchlist.

Chances are it’s in the early stages of a decade-plus advance.

That’ll do it for today!

Thanks for reading. If you have any topics you want covered in future issues, questions, or feedback...

Be sure to drop me a line at AskGreg@paradigmpressgroup.com and let me know.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

I'm Buying Stocks Hand Over Fist

Posted December 23, 2024

By Enrique Abeyta

50-Year Storm Hits the Dow…

Posted December 20, 2024

By Greg Guenthner

Yesterday’s Selloff Triggered a Rare Setup

Posted December 19, 2024

By Enrique Abeyta

This Swiss Athletic Stock Could Shoot 20% Higher - Within 2 Weeks

Posted December 17, 2024

By Greg Guenthner

Murder in Manhattan

Posted December 12, 2024

By Enrique Abeyta