Posted December 23, 2025

By Ian Culley

This $5 Stock TRIPLED After I Told You About It

In early April, I shared with you one of my favorite stocks for 2025.

After tracking this stock for nearly two years, it was finally poised to make its move.

I was prepared to pounce, and I encouraged you to do the same.

I’m glad I did. This stock has exceeded all expectations so far and is up 236% since I wrote to you about it in April.

And it could still triple in value before the current cycle ends.

So let’s review how the trade has progressed and what it means looking ahead to 2026.

But first, hang with me for a moment while I recap why I was chomping at the bit to buy this stock in the first place.

My Favorite Stock for the Commodity Supercycle

The stock I’m referring to is Sibanye Stillwater (SBSW).

It’s a South African-based company that produces and recycles various metals, including platinum, palladium, rhodium, iridium, ruthenium, nickel, chrome, copper, and cobalt.

I wanted to own this stock for these main reasons:

- Gold screamed to record highs

- Palladium stopped falling at a critical inflection point

- Momentum flipped to the upside

All three supported one highly probable outcome: colossal gains for precious metals.

Here’s what I had to say about my favorite platinum miner in the spring…

“Lithium, nickel, and zinc are critical components in the batteries that will charge tomorrow’s technology. Plus, the world will need these minerals and metals to rebuild Ukraine, Los Angeles, and the United States’ failing power grid.

Perhaps best of all, SBSW has stopped falling just above its 2020 trough…

Investors have put in the floor as the stock triggers the same buy signal as Palldium. I want to start building a position now.

It all comes down to minimizing regret. I’d rather begin nibbling on SBSW while it continues to churn below six bucks, then lift my head twelve months from now with nothing to show as it’s trading at eight or ten dollars with increasing upside potential.

I wouldn’t be surprised if SBSW rips through its record highs to $30 or even $50 before the commodity bull run ends.”

I still believe the commodity bull run has another five to ten years before calling it quits.

It’s been a while since I last wrote to you about SBSW, so let’s check out the more recent price action.

Well, That Was Fast!

Silver, platinum, and palladium have gone vertical in recent months, and subsequently, so has Sibanye Stillwater.

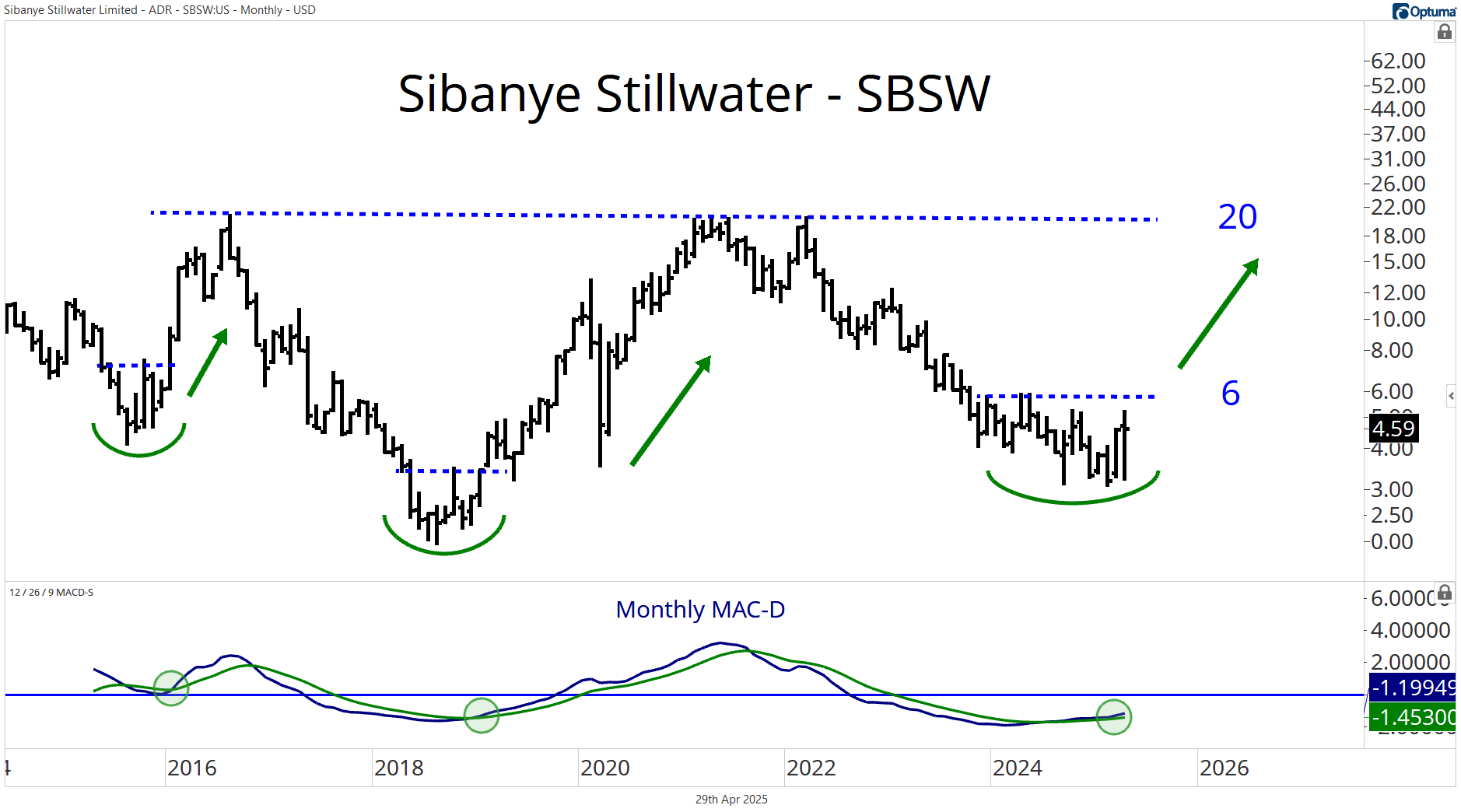

Check out the SBSW chart from earlier this year.

Price had carved out a tradeable low below $6. And perhaps most importantly, gold broke out to record highs.

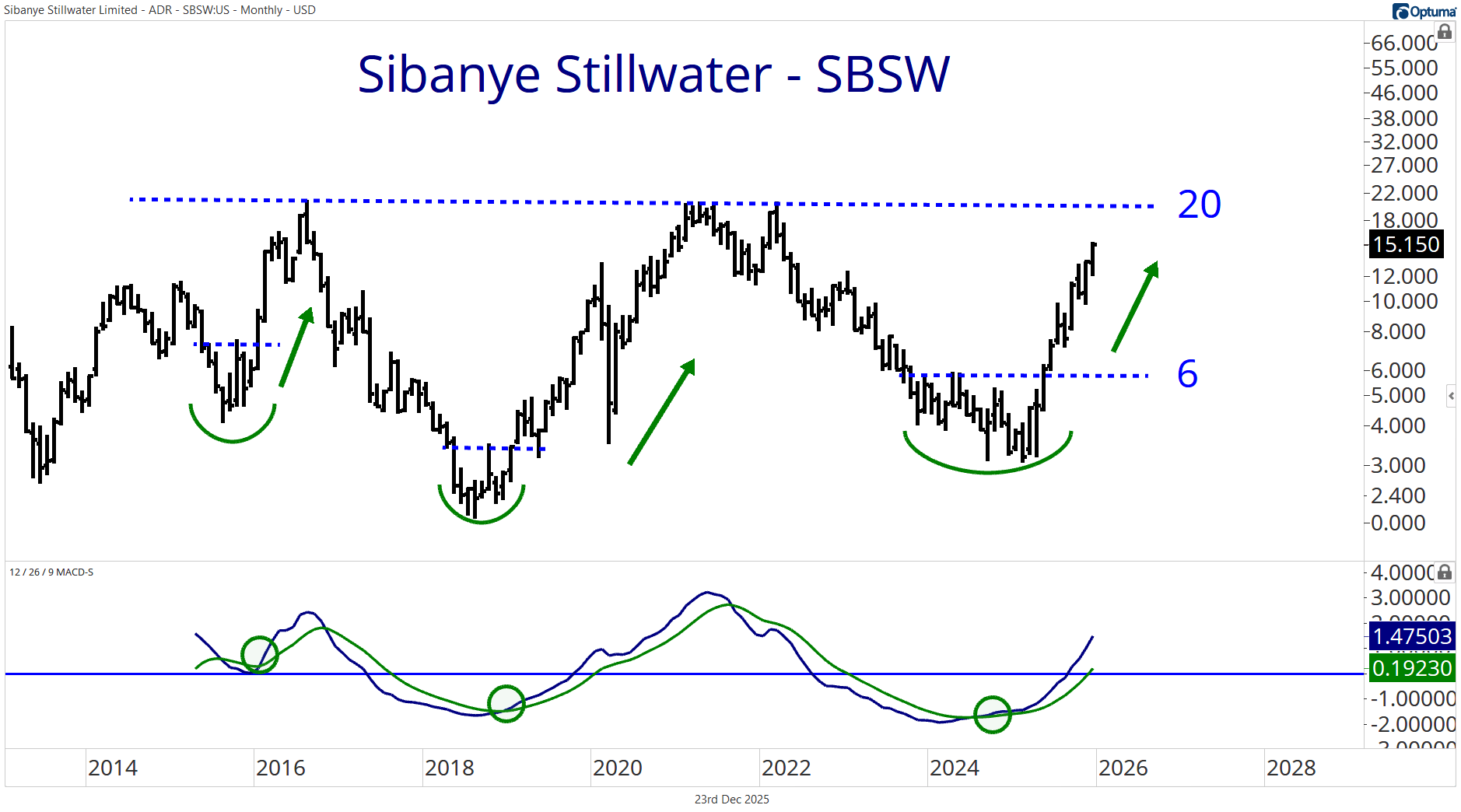

Fittingly, here’s how we find Sibanye Stillwater shares today.

Well, that was fast!

SBSW has rallied from $4.50 to $15 over the past eight months.

In fact, the South African platinum miner outpaced your favorite speculative-tech trades, gaining roughly 350% year-to-date.

The vertical precious metal and subsequent SBSW rallies are why I wanted to avoid missing this trade at all costs, even if it meant buying before the breakout.

If you missed it, the market will offer you another chance. A dip buying opportunity will more than likely present itself at some point before the commodity supercycle ends.

When it does, I’ll be sure to let you know in case you’d like to join me.

Takeaways for the New Year

The metals and mining rally has flabbergasted investors, but you’re not witnessing anything new.

Commodity supercycles follow a similar pattern. Gold leads the way, and then the rest of the commodity space catches up to the leader.

You’re witnessing the chase right now.

Silver gained 3.5% today, while palladium gained 7.50%, and platinum gained 10%. In comparison, gold rose 1%.

The commodity boom is spreading. Aluminum, tin, copper, lithium, cobalt, uranium… You name it!

If you dig it out of the ground, it’s probably launching into a rip-roaring bull run. And if it’s not rallying now (I’m looking at you crude oil), it will be soon.

I don’t want to get ahead of myself, so let’s table oil and gas stocks until after Christmas.

For now, simply entertain the idea of including commodity stocks at the top of your watchlist in 2026.

Spoiler alert: Energy is my favorite sector for Q1. Alright, alright, I’ll stop!

I appreciate you hanging with me all the way to the bottom of the page. Thanks for reading, and may joy and gratitude fill your heart this holiday.

Merry Christmas. And as always…

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

“BTSD” — The Powell Probe Trade

Posted January 12, 2026

By Enrique Abeyta

Revealed: The New Momentum Trades for 2026

Posted January 09, 2026

By Greg Guenthner

5 Healthy Investing Habits to Start Today

Posted January 08, 2026

By Enrique Abeyta

2026: The Leaders, the Laggards, and a Wild Card

Posted January 05, 2026

By Enrique Abeyta

Optimism Wins: A Fresh Mindset for 2026

Posted January 01, 2026

By Enrique Abeyta