Posted December 17, 2024

By Greg Guenthner

This Swiss Athletic Stock Could Shoot 20% Higher - Within 2 Weeks

I was ready. The charts were set, the trends looked familiar, and the market seemed primed to deliver a 2021-style melt-up.

But something’s off.

Highs aren’t sticking. Trades aren’t extending. And my watchlist? Shrinking faster than holiday shopping budgets.

Sure, AI stocks, quantum computing plays, and even flying car fantasies are grabbing headlines. Cathie Wood’s ARK Innovation ETF (ARKK) is roaring back, chasing levels we haven’t seen in two years.

Yet beneath the surface, some components, like CRISPR Therapeutics (CRSP), are still stuck in the mud. The broad snapback hasn’t shown up — at least not yet.

But here’s the thing: melt-ups don’t announce themselves. The best trades? They take off when you’re second-guessing everything.

And I’ve got one stock in my sights. It’s quietly bouncing off a key level — its 2021 highs — while showing the kind of strength melt-up winners are made of.

This company might not get the flashy AI headlines, but its Swiss precision has made it a favorite among traders watching for a breakout.

Time is running out for 2024. Miss this move, and it will be your biggest regret into the New Year.

Here’s why this trade could deliver a 20% run — fast…

So far, the stock market has kept tight to its seasonal schedule this year.

The averages began to advance after Labor Day, following the late-summer volatility spurred by the Japanese yen unwind.

Small-caps outperformed their large-cap peers during November (their strongest month of the year). In fact, the Russell 2000 recorded one of its most impressive Novembers on record, posting a 10.69% gain.

Even the challenging first half of December fits the historical norm…

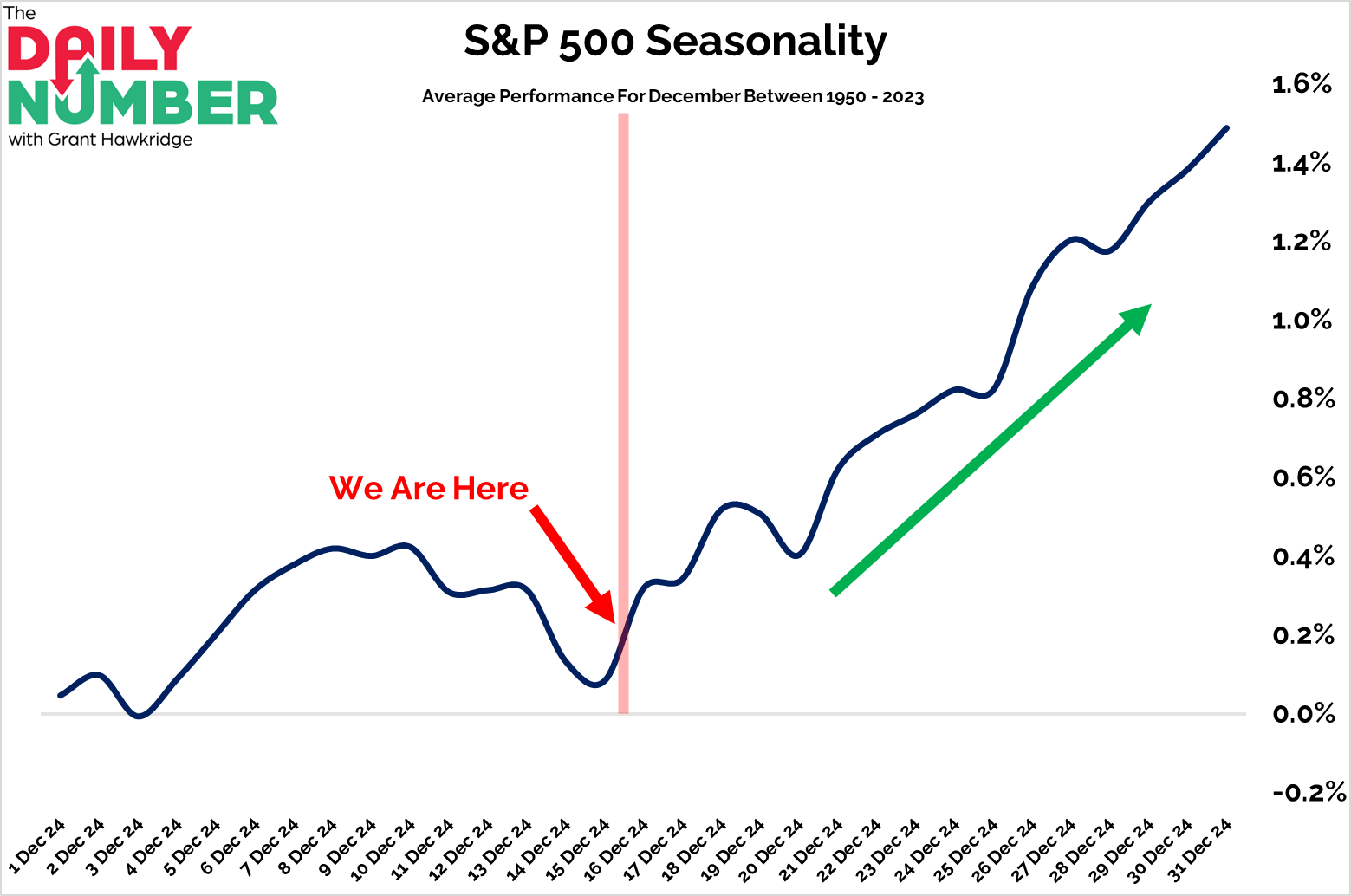

Check out the S&P 500 December seasonality chart shared by our friend Grant Hawkridge from The Daily Number…

The dark blue line represents the average December return for the U.S. benchmark going all the way back to 1950.

Notice the first couple of weeks tend to meander while the bullish trend kicks into gear mid-month – right where we are today.

It would seem last week’s momentum reset was right on time.

Stock Traders Almanac author Jeffery Hirsch explains, “Around early November, small stocks begin to wake up and in mid-December, they take off.”

His observation puts the recent selling pressure into perspective, echoing the S&P 500 seasonality chart above.

So if last week’s shakeout threw you for a loop, don’t sweat it! The first half of December tends to throw a few punches.

Perhaps we can attribute December’s slow start to money managers cutting losers for tax purposes while bolstering their yearend performance.

Either way, seasonal tailwinds favor the boldest of the bulls.

One Stock That Can Run Up Your P&L

Before I outline one of my favorite trades heading into year-end…

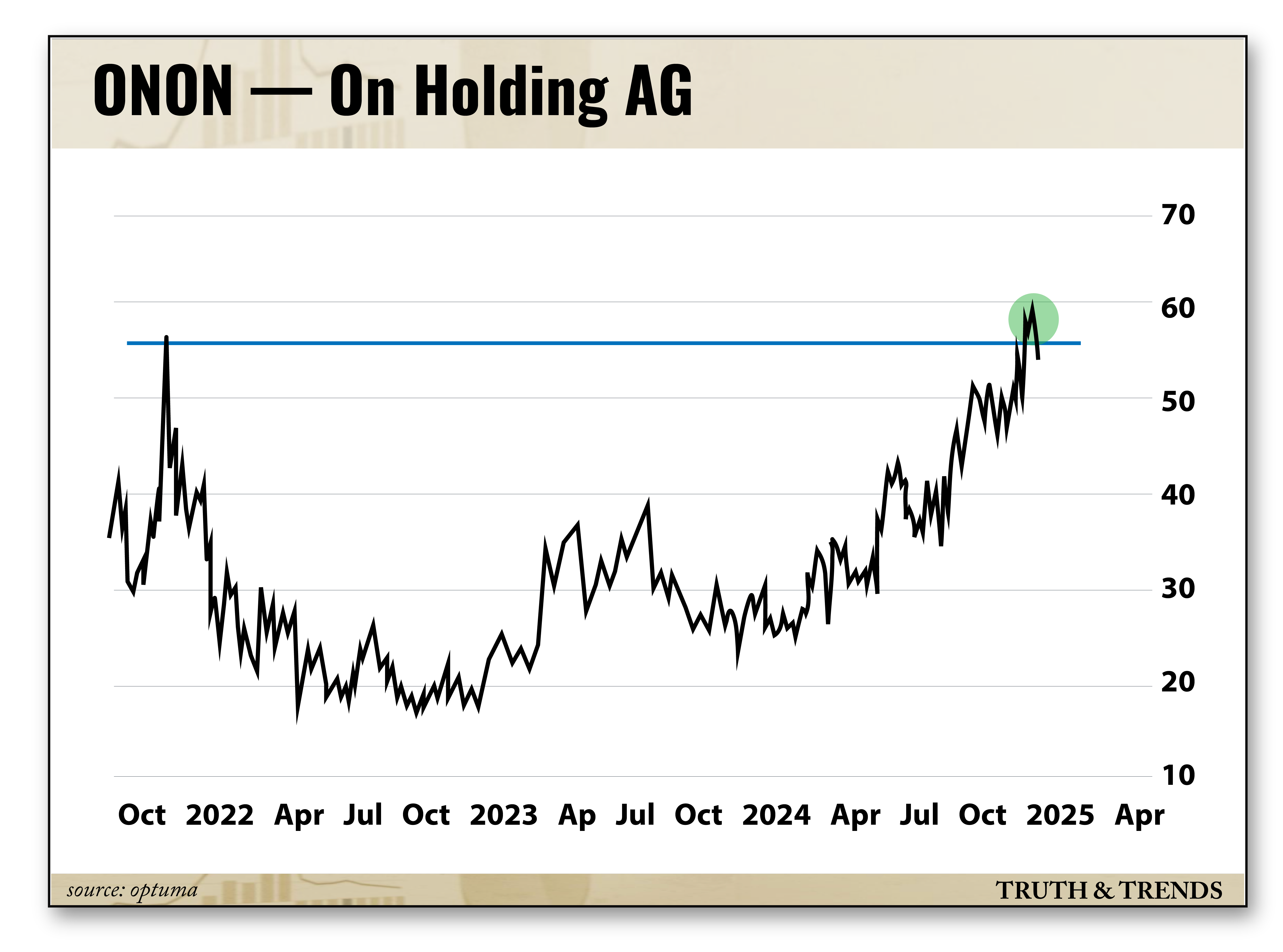

Full disclosure, The Trading Desk took an options position for this stock last month. At the time, it was breaking above its 2021 post-IPO peak to register a new all-time high despite reporting a slight earnings miss.

The market’s disregard for the company's lackluster performance made the stock an excellent candidate for a melt-up rally. (Remember, we trade stocks, not companies.)

I’m talking about On Holdings (ONON), a popular athletic shoe company selling Swiss-engineered running shoes and athletic wear…

To be clear, our ONON position has yet to produce outsized returns. But it’s poised to rip…

First, I like when and where ONON recently stopped falling. It bounced along with December seasonality right at its post-IPO peak (the same peak that marked the end of the 2021 melt-up).

Those former highs represent our line in the sand. Let’s give it a little wriggle room and call it $54.50. As long as that level holds, I’m targeting a 20%-plus gain through the holiday season.

On the flip side, ONON is someone else’s problem if it slips below those former highs.

Melt-up conditions might feel lukewarm at the moment, but that’s normal for this time of year. Seasonal tailwinds start picking up mid-month.

Remember, now is the time to be aggressive. We see these market conditions once a year.

Your greatest risk during the next three weeks is not taking on enough risk.

I made that mistake during the last melt-up, and it only led to regret.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Bad Vibes Everywhere

Posted February 06, 2026

By Greg Guenthner

The Momentum Trade Cuts Both Ways (Silver Edition)

Posted February 05, 2026

By Enrique Abeyta

The Silver Implosion in Slow Motion

Posted February 04, 2026

By Nick Riso

Silver's Swan Dive Is Just the Beginning

Posted February 02, 2026

By Enrique Abeyta

Lightning Round: Trump’s Fed Pick, the Silver Crash, and More

Posted January 30, 2026

By Greg Guenthner