Posted February 09, 2026

By Enrique Abeyta

This Feels Like 1999… NOT 2000

Every market pullback eventually triggers the same question...

Is this the top?

That old familiar fear is back again after last week’s selloff in AI and software stocks.

Investors are increasingly worried that today’s market looks a lot like the peak that preceded the dot-com crash of 2000.

It’s a reasonable concern. But I couldn’t disagree more with that idea.

When you strip away the fear and compare today’s conditions to those in early 2000, it’s clear the market is NOT at a top like the one before the dot-com collapse.

The market is behaving very differently today, and many of the signals that defined that era are notably absent.

Here are three core differences between then and now that explain why the AI bubble isn’t bursting yet.

The Market Is Not Acting Like a Blow-Off Top

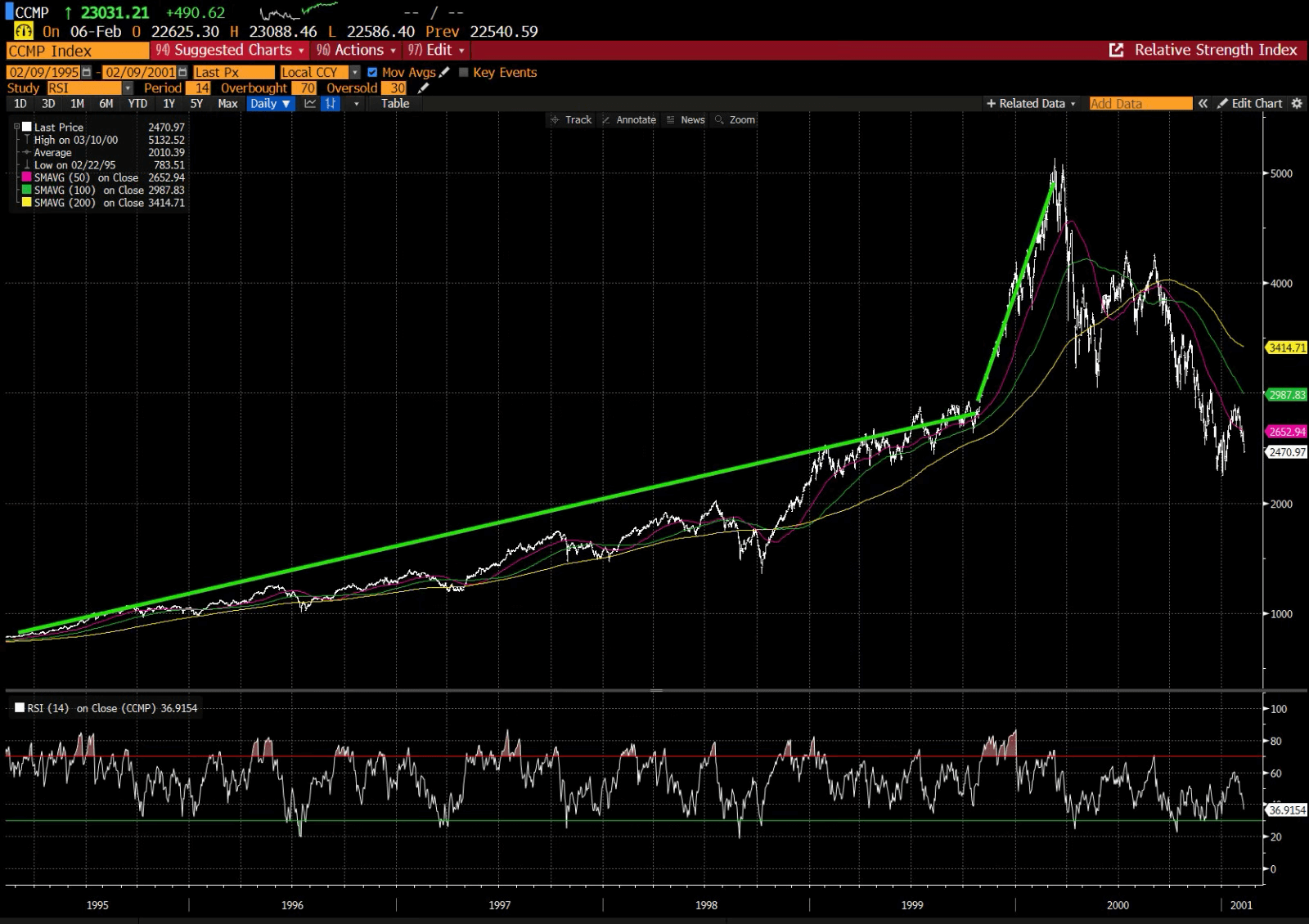

In early 2000, the Nasdaq didn’t just rise — it went parabolic. From November 1999 through March 2000, the index surged roughly 80% in just a few months.

That kind of vertical move is the hallmark of a true blow-off top. Price stopped reflecting fundamentals and began reflecting speculation alone.

As a quick refresher, here’s what the index looked like leading up to the dot-com crash.

We haven’t seen anything like that spike in the Nasdaq. Today, the opposite is happening.

The Nasdaq has been largely flat since mid-year, and many of the world's most valuable companies have already undergone meaningful corrections on their own.

This matters more than most people realize.

Blow-off tops don’t happen in markets that are correcting internally. They happen when everything rises together, relentlessly, regardless of earnings, growth, or balance sheet strength.

Moreover, while today’s headline valuations in a handful of popular stocks appear elevated, median valuations across the broader market are not egregious.

That is a critical distinction.

In the late 1990s, valuation excess was widespread. Companies with no profits, no clear business models, and often no meaningful revenue were commanding enormous market capitalizations.

Today, much of the market has already corrected excesses before they become systemic.

We've seen the largest stocks in the world by valuation pull back, reset expectations, and absorb selling pressure without triggering broader instability.

That self-correction is not a sign of fragility. It’s a sign of health.

The Fed Is Not Slamming the Brakes

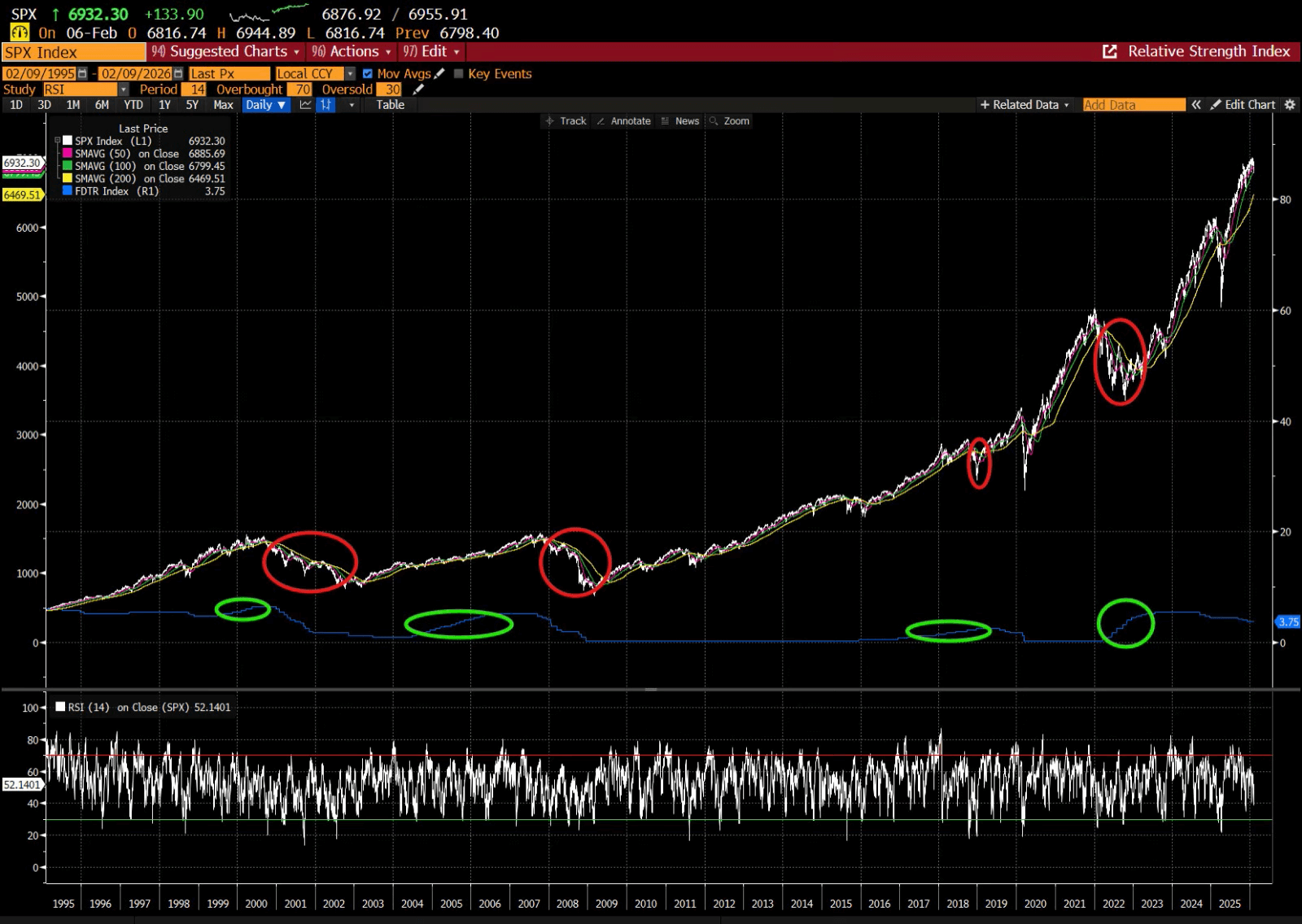

One of the most underappreciated drivers of major market tops is the Federal Reserve.

Historically, severe market crashes tend to follow periods where the Fed is aggressively raising rates, tightening financial conditions, and deliberately slowing economic activity.

That was exactly the setup in 2000. The Fed was hiking rates into a speculative frenzy, draining liquidity just as valuations peaked. The result was inevitable.

In the chart below, the green circles highlight rate increases while the red circles highlight the subsequent market declines. The 1999–2000 era is the first timeframe highlighted.

Today, the setup is completely different. The Federal Reserve is no longer tightening. It’s in a cutting cycle — or at the very least, preparing to be.

With President Trump’s newly nominated Fed Chair, it is widely understood that the bias will be toward rate reductions rather than hikes.

We don’t know exactly how much the new Chair will be able to cut rates, or how quickly those cuts will arrive. But direction matters more than precision.

Markets typically do not experience catastrophic tops when monetary policy is easing.

Liquidity acts as a cushion. It supports risk assets, absorbs shocks, and extends cycles longer than many expect.

The idea that we are on the verge of a 2000-style collapse while rates are being reduced underscores how much emotion, not history, is driving the comparison.

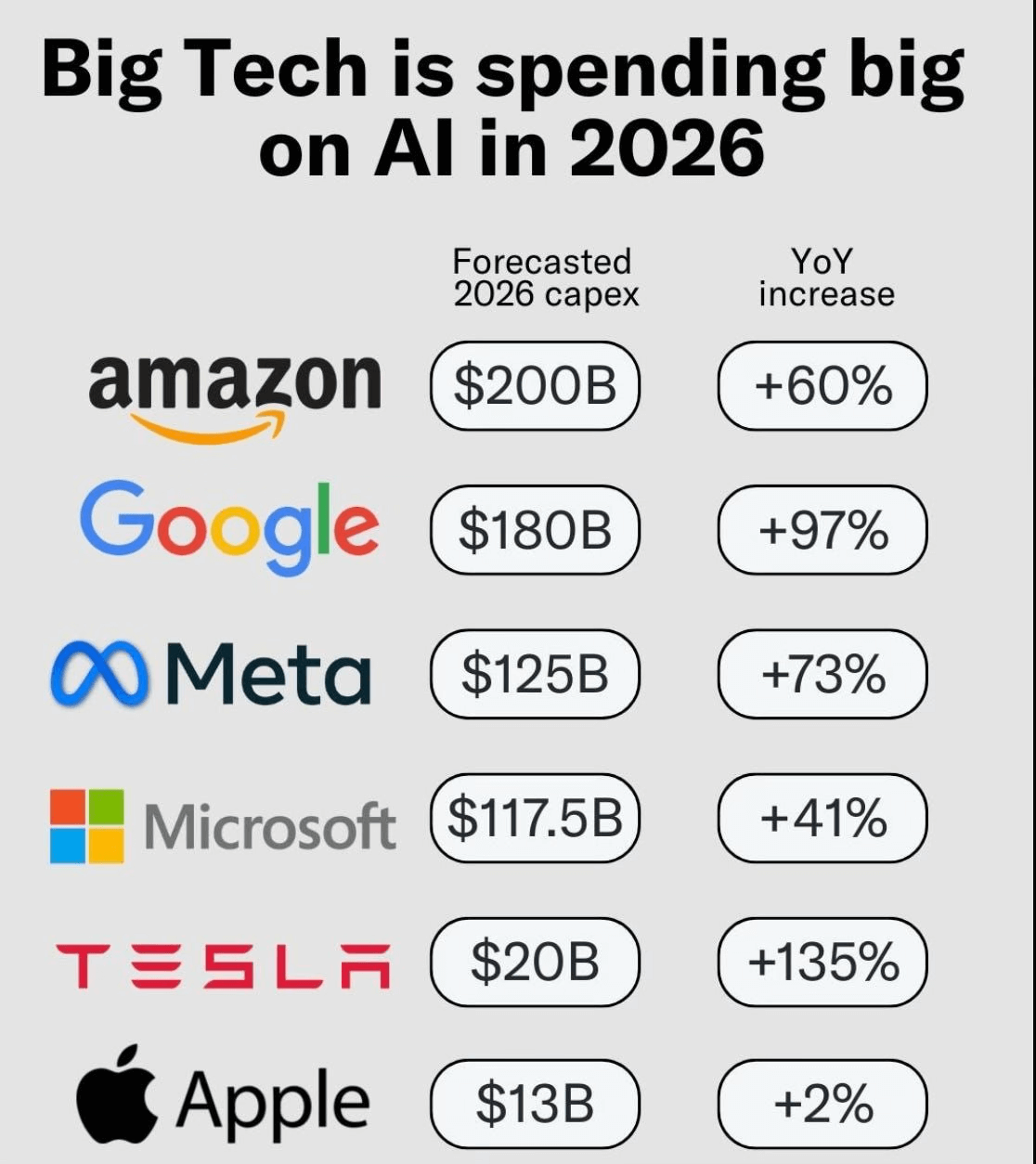

Today’s Big Spenders Can Actually Afford It

The third difference is perhaps the most important. The financial quality of the companies doing the spending.

During the Internet 1.0 era, many companies building digital infrastructure could not afford what they were attempting to build.

They were burning cash at staggering rates and financing growth almost entirely through debt issuance and equity dilution. When capital markets closed, those business models collapsed overnight.

Fast-forward to 2026, and the picture could not be more different.

The companies committing the largest capital expenditures today are among the healthiest and most profitable enterprises on the planet.

The major technology leaders funding AI infrastructure are generating massive free cash flow, posting strong margins, and operating with fortress-like balance sheets.

This is not speculative spending born of desperation. It is a strategic investment backed by real earnings power.

That distinction alone makes comparisons to 2000 deeply flawed.

Why I’m More Bullish Than I’ve Been in Years

Against this backdrop, I feel more bullish than I’ve been in years.

Much of the policy uncertainty that rattled markets in 2025 has already played out. Core fiscal initiatives like tariffs have been implemented or clearly outlined. Leadership changes at the Fed have been telegraphed.

There simply shouldn’t be many more market-shaking surprises of the magnitude we saw last year.

Even recent volatility supports this view.

The selloff triggered by concerns surrounding Anthropic’s latest Claude releases increasingly looks like this year’s version of last year’s DeepSeek moment: sharp, unsettling, but ultimately temporary.

The market has already begun to stabilize, and while a rapid V-shaped recovery is never guaranteed, the underlying trend remains intact.

Could the market churn sideways for several weeks? Absolutely.

Consolidation after strong moves is normal and healthy. But directionally, the evidence points higher.

This environment feels far more like 1999 than 2000.

In 1999, there was still significant upside left before excess reached truly dangerous levels.

Momentum was strong, capital was available, and the speculative fever had not yet reached its peak.

The actual top didn’’t arrive until months later. And when it did, it was unmistakable.

There will be no confusion about it when a real market-wide melt-up begins.

Valuations will detach from reality across the board. Price action will turn vertical. Participation will become indiscriminate.

We are simply not seeing those conditions today.

So When Will the AI Bubble Actually Burst?

That just leaves the question of when the AI bubble will inevitably burst, as all of them do.

One plausible scenario is a global escalation in AI capital expenditures.

At present, U.S. hyperscalers are leading the charge. But it’s unlikely that China, the Middle East, Europe, and other major players will sit idle while the next dominant technology platform is built.

If global competition sparks an exponential AI investment arms race, that could ignite the kind of parabolic climb that historically marks the final stage of a cycle.

But again, we’re not there yet. Not even close.

For now, the market is doing exactly what a healthy market should do. It is correcting excess, digesting gains, and climbing a wall of worry.

That is not the behavior of a market on the brink of collapse. It is the behavior of a market preparing for its next leg higher.

The bubble will burst someday. But today is not that day.

And until the signs become obvious — and trust me, they will — this remains a market focused not on fear, but on opportunity.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Bad Vibes Everywhere

Posted February 06, 2026

By Greg Guenthner

The Momentum Trade Cuts Both Ways (Silver Edition)

Posted February 05, 2026

By Enrique Abeyta

The Silver Implosion in Slow Motion

Posted February 04, 2026

By Nick Riso

Silver's Swan Dive Is Just the Beginning

Posted February 02, 2026

By Enrique Abeyta

Lightning Round: Trump’s Fed Pick, the Silver Crash, and More

Posted January 30, 2026

By Greg Guenthner