Posted December 24, 2025

By Nick Riso

The Unbearable Lightness of Silver

I

Let me tell you about something that happened Monday afternoon that should make your blood boil.

At exactly 3:15 p.m. — 45 minutes before the market closed — someone with very deep pockets made a move that perfectly captures what's really happening in the silver market right now.

They took $9.6 million worth of profitable bets on silver and cashed them out.

Good for them, right? They made money. Except here's the twist…

In the same breath, they took $5.1 million of that cash and immediately placed new bets at higher prices. They pocketed $4.5 million and kept playing.

Now, if you're thinking "so what, people trade all day long," you're missing the point. Because in the 45 minutes after this trade, the price of silver jumped 1.2%.

Not because a mine collapsed. Not because China announced they're hoarding metal.

But because this one trade — this one repositioning of paper bets — forced a chain reaction that moved the entire global silver market.

Let me say that again slowly…

One trader moving paper around changed the price of a physical metal that's been mined out of the earth for 5,000 years.

That's classic casino behavior. And the house is dealer algorithms with unlimited buying power.

I'm going to show you exactly how this works, why it explains the spectacular rally you've been watching, and why the whole thing is probably going to end very badly.

But first, you need to understand what happened on December 22, because that day gave us the clearest picture yet of the machinery that's been installed underneath your silver investment.

II

December 22 wasn't special because something unusual happened. It was special because the usual thing happened at such a massive scale that the numbers are impossible to ignore.

According to official data from the Chicago Board Options Exchange (CBOE) where most options trading happens, 192,652 options contracts on SLV changed hands that day.

Now, SLV is the ticker symbol for the iShares Silver Trust, the big ETF that most regular people use to invest in silver without actually storing bars in their basement.

Each options contract represents 100 shares of SLV. So we're talking about exposure to millions and millions of ounces of silver.

But here's the thing that should make you sit up straight: Those 192,652 contracts weren't normal options. They were what Wall Street calls "0DTE" (zero days to expiry) options. They were purchased that morning and expired that same day at 4:00 p.m..

Think about that. People were making bets on where silver would be in six hours. Not six months. Not six weeks. Six hours.

This is what silver has become. A metal that took millions of years to form in the earth's crust, that's mined with heavy machinery and refined in smelters, that goes into solar panels and phones and medical equipment... and it's being treated like a slot machine by traders who don't even want to hold the position overnight.

Those 192,652 contracts represented roughly 20% of the entire options market activity that day. One-fifth of all the betting on silver was concentrated in a six-hour window.

You know what that tells me? This isn't investing anymore. This is gambling. High-speed, high-stakes gambling.

And the really disturbing part is that this gambling — not the supply shortage you keep reading about — is what's been driving the price for months.

III

Let me explain the trick, because once you see it, you can't unsee it.

For most of silver's history, options had one expiration date per month. Usually the third Friday. You'd place your bet, wait a few weeks, and see what happened. It was slow. Methodical. Kind of boring, honestly.

Then in late 2024, the exchanges made a change. They added Monday and Wednesday expirations for major ETFs like SLV. On the surface, it sounded reasonable. "More flexibility for investors," they said. "Better liquidity," they promised.

What they actually did was turn a monthly chess game into a three-times-per-week roulette wheel.

Suddenly, traders didn't have to wait a month to see if their bet paid off. They could bet on Monday, collect on Monday afternoon, then bet again on Wednesday.

It's the same psychological trick that makes slot machines addictive — fast feedback loops, quick wins, constant action.

And just like that, silver became the hottest game in the casino.

But here's where it gets really twisted. When all these traders started making huge short-term bets, they created a problem for the big banks that sell them those bets.

Those banks (the "market makers") don't actually want to gamble on silver. They just want to collect fees for providing the casino. So they have to protect themselves.

Here's how: When they sell you a call option (a bet that silver goes up), they're mathematically on the other side of your bet. If silver rises, they lose money. They don't want that. So their computers automatically buy silver futures to balance it out. The fancier term for this is "delta hedging," and the rate at which they have to buy is called "gamma."

Now, in the old monthly system, this hedging happened gradually. A little buying here, a little there, spread out over 30 days. No big deal.

But with Monday-Wednesday-Friday expirations and massive 0DTE volume, the buying happens in violent 48-hour bursts. And here's the really crazy part…

The buying itself pushes the price up. Which attracts more gamblers. Who place more bets. Which forces more buying. Which pushes the price higher. Which attracts even more gamblers.

It's a feedback loop. A tornado. A runaway train. Pick your metaphor. The point is, once it gets going, it feeds itself until the music stops.

IV

Let's go back to that 3:15 p.m. trade, because now you'll understand why it mattered.

This trader — probably a hedge fund, maybe a prop trading desk, doesn't really matter who — had $9.6 million in call options that were already winning. Silver was up. They were making money. Normal people would cash out and celebrate.

But they didn't just cash out. They took $5.1 million of their winnings and immediately bought new call options at a higher strike price.

Why would they do this?

Because they understood the machine. They knew that by "rolling up" their position — moving from lower strikes to higher strikes — they would force the market makers' computers to recalculate everything. Those algorithms would suddenly realize they weren't hedged properly anymore. They'd gone from being protected at $47 to being exposed at $57.

And when a computer realizes it's exposed, it doesn't think. It doesn't hesitate. It just buys. Fast.

That's exactly what happened. In the final 45 minutes of trading, silver jumped 1.2% as the computers scrambled to cover their new exposure before the 4:00 p.m. deadline.

The trader pocketed $4.5 million in cash and forced the price higher without ever touching a single ounce of physical silver. They played the machine like a piano.

V

Now let me show you the number that proves this whole thing is a squeeze, not a genuine supply-driven rally.

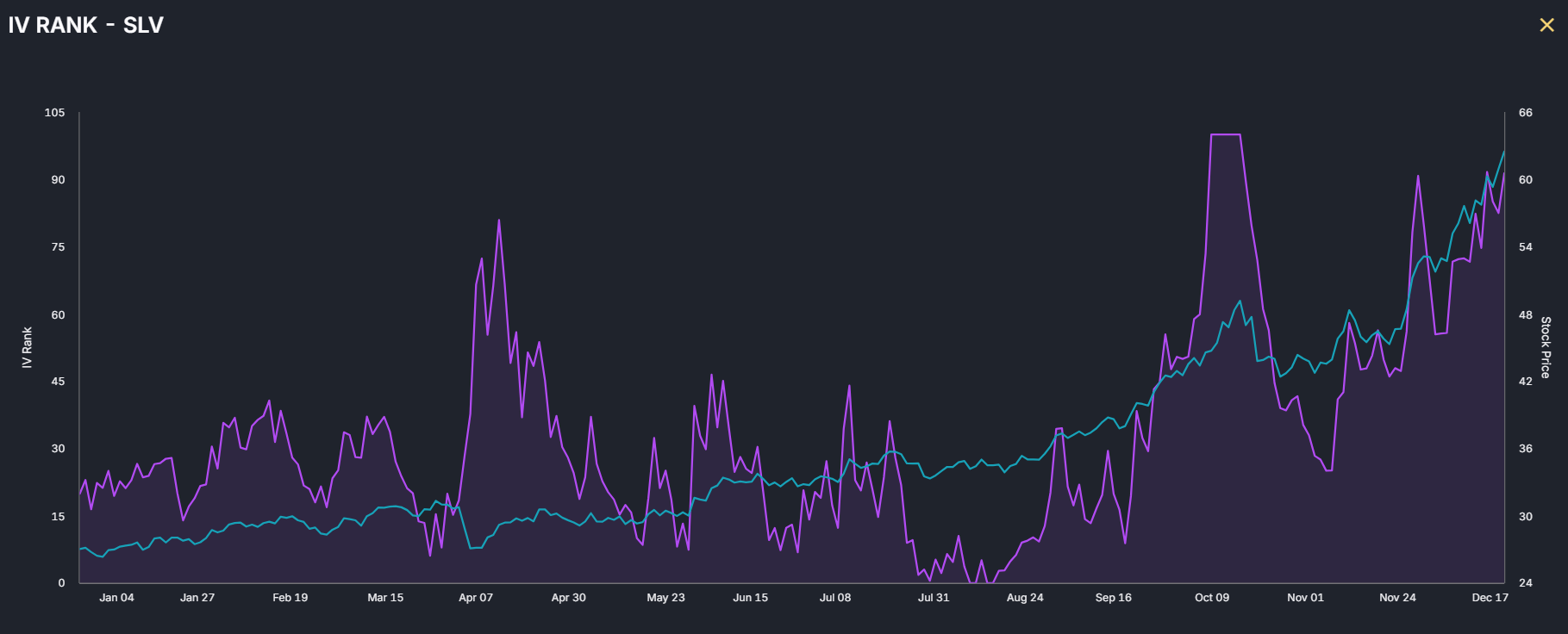

It's called Implied Volatility, and right now it's sitting at the 91st percentile.

Let me translate that into English: Implied Volatility measures how much panic is priced into the options market. When it's at the 91st percentile, that means it's higher than it's been on 91 out of every 100 trading days in history.

Here's why that's weird — and disturbing.

Normally, when the price of something goes up because people want it, volatility goes down. People feel confident. The panic subsides. Options get cheaper because nobody's worried about big moves.

That's what happened during the gold rally in 2020, during the oil rally in 2022, during basically every healthy bull market in history. Price up, volatility down. It's the natural order of things.

But right now, silver is rocketing to multi-decade highs while volatility is exploding.

Price is panicking upward. And the options market is panicking about the price. Both are happening at the same time.

That's not what a supply shortage looks like. That's what a squeeze looks like. That's what happens when market makers know they're trapped in a mechanical buying loop and they're terrified it could reverse just as violently as it began.

Think about it: If this rally was really about solar panels and industrial demand and mines running out of silver, why would the options market be pricing in maximum panic? Industrial users don't panic. They plan. They sign long-term contracts. They quietly buy what they need.

The panic is coming from the dealers. The banks. The market makers who are stuck in the machine and know that one bad day — one sudden shift in sentiment — could force them to unwind all this buying just as fast as they were forced to buy it.

VI

Now we need to talk about the number that should genuinely scare you.

300 to 1.

That's the estimated ratio of paper silver to physical silver in the global market.

Let me paint you a picture of what this means. Imagine there's a parking garage with 300 parking spaces. The owner sells 300 parking passes — one for each space. Makes sense, right?

But then the owner realizes most people don't use their parking space every day. Some use it once a week. Some once a month. So the owner gets greedy and sells 90,000 parking passes for those same 300 spaces.

For years, this has worked fine. Most people just like having a parking pass. They trade the pass with other people. "I'll sell you my pass for $50." "I'll buy it for $45." Nobody actually tries to park.

Until one day, everyone shows up at the same time.

That's the silver market. For every ounce of actual silver sitting in a vault, there are roughly 300 paper claims — futures contracts, options, ETF shares, unallocated accounts, certificates — floating around in the financial system.

For decades, this wasn't a problem. The 300 people holding claims were happy to just trade the claims back and forth. They didn't want the actual metal. They just wanted to bet on the price.

But now we're in the fifth consecutive year of physical supply deficits. The mines are producing 117 million fewer ounces this year than the world is consuming. That's not speculation — that's data from the Silver Institute, the industry's official tracking organization.

Real companies need real silver. Apple needs it for phones. Tesla needs it for electronics. Solar panel manufacturers are consuming it at record rates — demand from solar alone has gone from 110 million ounces in 2022 to 180 million ounces last year.

And all of that real demand is competing with a financial system that's trading 300 paper claims for every ounce of actual metal.

Meanwhile, the 0DTE gambling machine is churning billions of dollars through the market every Monday, Wednesday, and Friday, creating price swings that have nothing to do with whether anyone is actually buying or selling metal.

VII

Let me make sure you understand how serious this supply situation is, because it's real and it matters — even though it's not what's driving the current price action.

Five years. Five consecutive years where the world consumed more silver than the mines produced.

- Year one: Deficit of 194 million ounces

- Year two: Deficit of 237 million ounces

- Year three: Deficit of 142 million ounces

- Year four: Deficit of 200 million ounces

- Year five (this year): Deficit of 117 million ounces

Add it all up, and we're short roughly 890 million ounces over five years. That's more than an entire year of global mine production. Gone. Consumed. Turned into solar panels, electronics, and medical devices that are never giving that silver back.

Under normal circumstances — under the basic laws of supply and demand that you learned in high school — that should have sent prices to the moon years ago.

But it didn't. For most of that time, silver actually fell. It peaked at $30 in early 2021, then dropped to $21 by late 2023. Down 30% while the shortage was getting worse.

Why? Because the 300-to-1 paper market was in control. The real physical shortage didn't matter as long as everyone was content to trade paper tickets.

Then something changed in late 2024. Silver started rallying. Hard. Fast. Violently.

Did the supply shortage suddenly get worse in November 2024? No.

Did solar demand suddenly spike? No.

Did a major mine collapse? No.

What happened in November 2024 is that the exchanges introduced Monday-Wednesday expirations and the 0DTE casino opened for business.

Suddenly, for the first time in years, something had enough force to override the paper market's control. Not the physical shortage — that had been building for years without moving the price. The gamma squeeze. The mechanical buying forced by the 0DTE machine.

That's what you're watching right now. The physical shortage is the kindling that's been piling up for five years. But the 0DTE machine is the match.

VIII

Here's what keeps me up at night about this whole situation. The current structure requires continuous new speculative money to keep the machine running.

As long as traders keep piling into 0DTE options on Monday and Wednesday and Friday, the dealers stay trapped in forced-buy mode. The feedback loop keeps churning. The price keeps climbing.

But the moment that speculative interest fades — and it will fade, because momentum traders are like locusts, they swarm and then they move on — everything reverses.

The same mechanical hedging that forced dealers to buy will force them to sell. The same algorithms that were programmed to chase the price up will be programmed to chase it down. The feedback loop that sent silver vertical will send it off a cliff.

And here's the really scary part: The 300-to-1 ratio means there's almost no physical metal available to absorb that kind of selling pressure.

Let me give you an example of how fast this can unravel.

In 2022, natural gas rallied from $3 to $10 on completely legitimate supply concerns. There really was a shortage. Europe was scrambling for energy after the Russian supply cuts. The fundamentals were rock solid.

Then in early 2023, the speculative positioning got too crowded. Momentum traders started taking profits. The forced unwinding began. Natural gas didn't drift back down to $5 or $6. It crashed to $2. Below where it started. The technical overwhelmed the fundamental so completely that the price ended up disconnected from reality in the opposite direction.

The same thing is going to happen to silver.

Not because the supply shortage isn't real; it is. Not because solar demand is fake; it's not. But because the price you see on the screen right now is being set by a mechanical squeeze, not by industrial users competing for scarce metal.

And when squeezes break, they don't ease gently back to equilibrium. They explode.

IX

If you're still skeptical, let me show you one more piece of evidence that this rally is artificial.

If silver was really rallying because of a supply shortage — because industrial users were desperately competing for limited metal — you'd expect to see certain things happening in the physical market.

First, you'd expect delivery requests on COMEX futures to be surging. When there's a real shortage, people don't want paper promises, they want metal. They "stand for delivery" — they force the other side to give them actual silver bars.

Second, you'd expect ETF inventories to be growing. If investors believed in the shortage story, they'd be buying SLV shares, which forces the fund to buy physical silver to back those shares.

Let's check the data.

Delivery requests ARE up about 220% compared to last year. On the surface, that supports the shortage narrative.

But here's the weird part: Of all the delivery requests in December, 60% of them were "rolled" or cash-settled instead of actually delivered. That means 60% of the people who supposedly wanted physical silver accepted cash instead.

That's not how shortages work. When you desperately need metal, you don't accept cash. You take the metal.

And the ETF data is even more damning. SLV inventories are DOWN 6.2% since October. Not up. Down. Investors are selling, not buying, even as the price goes vertical.

In a real supply-driven rally, investment vehicles accumulate metal. People rush to buy exposure because they believe the shortage will get worse. They want to own the thing that's becoming scarce.

That's not happening. The paper price is detaching from physical flows entirely. The price is going up, but nobody's actually accumulating metal. They're just trading paper back and forth faster and faster, while the algorithms force-buy futures to stay hedged.

That's the signature of a technical squeeze, not a fundamental shortage.

X

So where does this leave you?

You've been watching the silver rally. You've been reading all the articles about the supply shortage, solar demand, and the mines running out. And all of that is true. It's real. The physical fundamentals are probably the best they've been in decades.

But the price you're seeing — $63, $65, $70, wherever it is when you're reading this — that price is not being set by the fundamentals.

It's being set by the Monday-Wednesday-Friday 0DTE casino. By the gamma squeeze. By the mechanical forced-buying of dealers who are trapped in their own hedging algorithms.

The December 22 data makes this undeniable. 192,652 contracts traded in six hours. $15 million repositioned by a single whale. 1.2% price move in 45 minutes. Implied volatility at the 91st percentile while prices hit multi-decade highs.

None of that is normal. None of that is healthy. None of that is sustainable.

And the 300-to-1 ratio means that when this breaks — when the 0DTE traders lose interest and move on to the next hot trade — the unwinding is going to be spectacular.

The physical shortage is real. But the price is fake. And the fake price is going to collapse long before the real shortage gets resolved.

The supermarket shelf is empty. There really are only five loaves of bread left. But nobody's looking at the shelf. They're all staring at a TV screen in the corner that's showing a computer program selling infinite virtual bread tickets at falling prices.

Eventually, someone's going to get hungry enough to look away from the screen. They're going to walk over to the shelf. They're going to reach for actual bread.

And that's when everyone will realize that 300 people are holding tickets, but there are only five loaves.

The question you need to ask yourself is this: When that moment comes, are you holding real bread, or are you holding a ticket to a TV show?

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

“BTSD” — The Powell Probe Trade

Posted January 12, 2026

By Enrique Abeyta

Revealed: The New Momentum Trades for 2026

Posted January 09, 2026

By Greg Guenthner

5 Healthy Investing Habits to Start Today

Posted January 08, 2026

By Enrique Abeyta

2026: The Leaders, the Laggards, and a Wild Card

Posted January 05, 2026

By Enrique Abeyta

Optimism Wins: A Fresh Mindset for 2026

Posted January 01, 2026

By Enrique Abeyta