Posted August 25, 2025

By Enrique Abeyta

The Tiger's Advice That Still Rings True

When I began my career on Wall Street, there weren't as many hedge funds as there are today.

While a few small ones existed here and there, the industry was dominated by a select few names.

Ken Griffin's Citadel dominated the convertible arbitrage side. Steve Cohen of SAC Capital Advisors already had a reputation as a legendary trader.

On the macro-investing side, George Soros was the 800-pound gorilla famous for taking on the Bank of England and being partially responsible for the collapse of the British pound.

On the equity side, though, one name stood apart...

Steeped in history — and a bit of Southern twang — this fund and the funds it eventually spun off would become the single largest center of equity hedge-fund excellence.

I'm talking about Julian Robertson's Tiger Management.

An Investment Framework for the Ages

Robertson was a former U.S. Navy officer from North Carolina who began his career as a stockbroker at the seminal brokerage firm Kidder, Peabody & Co.

He eventually became the head of the firm's asset-management business, but he left in 1980 to start Tiger with just $8 million in capital.

By 1996, the year I started my career in the hedge-fund business, Tiger was managing more than $7 billion in assets and was potentially larger than all of its equity peers combined.

My introduction to Tiger was around this time, as several of my salespeople also covered it or some of its descendant funds, known as "Tiger Cubs."

In fact, my first hedge-fund job was in the same building as Tiger Management (101 Park Avenue in New York City), but we were about 20 floors below Tiger, in both altitude and assets under management ("AUM").

I also went on to become one of the founding members of a Tiger "Grand Cub" called Falcon Edge Capital, which my team and I eventually grew to more than $3 billion in AUM.

Throughout those years, I was always incredibly impressed with the thorough research conducted by the Tiger funds.

While my personal investing is as much focused on the stock as the company fundamentals, it's critical to understand the drivers of how investors are going to react to those fundamentals.

The Tiger funds not only put together a well-defined process, but — almost uniquely — they also focused on those drivers rather than the fundamentals alone.

Don't just figure out what you and others know, but also what you know that others do not know. Develop a "variant perception" to understand how and why a stock might perform differently than the consensus.

They also focused on something they refer to as "value added research" ("VAR"). This goes beyond just reading reports and talking to analysts and management. It includes "boots-on-the-ground research" — visiting manufacturing plants, customers, competitors, etc. — and conducting interviews to verify knowledge and develop that variant perception.

I'm extremely proud to call myself an alumnus of this lineage. And in my five years at Falcon Edge, I learned as much about company analysis as I had in the previous 15 years combined.

So today, I'll share the famed Tiger Investment Framework.

To be honest, I don't know who originally put this together, but it was likely created in the late 1990s. The managing partner of a major Tiger Cub gave it to me in the early 2000s. And now, I'm sharing it with you.

Even though the list is almost 20 years old, it still applies. I encourage you to read the list and incorporate it into your process for long-term investing.

The Tiger Investment Framework

Industry Study

- Is this a good business?

- What are the key success factors to superior performance in this industry? (VAR)

- Define the market opportunity. How do competitive products address this opportunity?

- What are the barriers to entry ("moats")? (VAR)

- What is the relative power of: (VAR)

- Customers

- Suppliers

- Competitors

- Regulators

- Who controls industry pricing? Does the company/sector have any pricing power?

- How (and how much) can a good company differentiate itself from a bad one in this industry?

- Do you understand this business? Test yourself and describe it to a 10-year-old.

Business Model (VAR)

- What is the selling model: Razor/blades? Services? One-off contracts?

- What are the economics of the base business unit? How does it stack up against competitors?

- Why is the company good (or bad) at what it does? Can the company sustain it?

- Is this company growing by acquisition? How sustainable is that?

- Be able to easily describe the entire sales process – from order to fulfillment.

Management (VAR)

- What is the executives' background, and what do their former colleagues, investors, and classmates say about them? Have they been successful in the past? (Very important)

- How is management compensated? Are its interests aligned with shareholders?

- Has management been good at allocating capital?

- Are management members buying or selling stock? How much as a percentage of their holdings, and why?

Company/Cultural Issues (VAR)

- Is this a great company? Is it built to last? What could change this assessment?

- Can you imagine holding stock in this company for 20 years?

- If you had access to unlimited capital, how would you feel about your chances of successfully competing against this company?

- Compare to a weak competitor in the same industry. What is the difference and why?

Financial Measures First Step: Check against all the accounting shenanigans in Howard Schilit's book Financial Shenanigans: How to Detect Accounting Gimmicks and Fraud in Financial Reports.

- What is the company's capital structure, and how does it compare to its peers?

- What are the trends in inventory turns, days payable/receivable, and working capital?

- What are the company's coverage ratios on interest payments?

Cash Flow

- What are the company's capital requirements and cash flow characteristics?

- How is the company choosing to invest its capital? Capital expenditures? Buybacks? Acquisitions?

- Does the company need to access the capital markets? How soon/often?

Earnings/Profitability

- Regarding the company's sales model, how visible are earnings quarter to quarter, and year to year?

- Is this a fixed or variable cost business? How much cost leverage?

- Do earnings grow as a function of unit sales growth, price increases, or margin improvement? How sustainable is this growth?

Valuation

- Looking forward, what is the company's valuation in terms of:

- Market value/earnings

- Enterprise value ("EV")/earnings before interest, taxes, depreciation, and amortization ("EBITDA")

- Free cash flow ("FCF") yield (after-tax FCF/market value)

- Market value/sales

- What are the company's growth rates in terms of earnings, EBITDA, and FCF?

- What are consensus earnings estimates versus your own expectations?

- What are the key leverage points in our own and the Street's earnings models? What has to go right, and where is the most chance for surprise?

- Are the company's accounting policies conservative and in line with its peers?

Risks

- What are the big unknowns? How much can the company control/influence these risks?

- What could cause this investment to be a total disaster? How bad could it be?

Other (Timeline/Timing Issues)

- What are the catalysts (triggers) for the company's proper valuation to be realized?

- What good news and what bad news will affect the company in the coming year?

- Who owns the stock? Momentum funds? Big mutual funds? Hedge funds?

- How difficult is it to build a significant position (float, volume)?

- Draw a timeline of expected events and dates. What might go wrong and when?

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Palmer Luckey, America's Secret Weapon in Flip-Flops

Posted October 27, 2025

By Enrique Abeyta

$MEME - Animal Spirits Run Wild

Posted October 24, 2025

By Greg Guenthner

Gold: The New Meme Stock

Posted October 23, 2025

By Enrique Abeyta

Beware the “Backdoor Correction”

Posted October 21, 2025

By Ian Culley

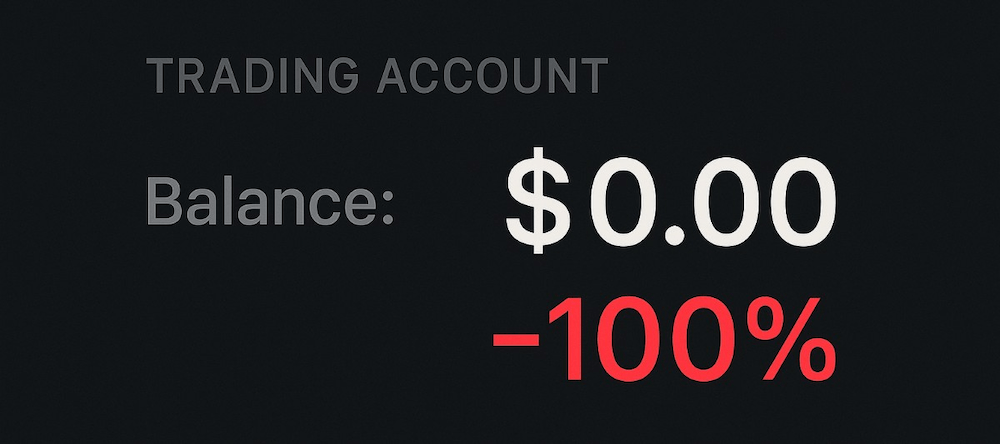

The Leverage Trap: A Painful Lesson in Risk

Posted October 17, 2025

By Greg Guenthner