Posted July 14, 2025

By Enrique Abeyta

The Secret to My 77% Win Rate

People sometimes ask me whether I’m a value investor or a growth investor.

The truth? I’m neither.

Instead, I like to say that I’m a “make money” investor.

I don’t stick to any single style or philosophy. I don’t spend hours trying to predict the Fed’s next move or model out every earnings report.

I focus on the strategies that can generate real, repeatable profits across any and all time frames.

That approach is part of the reason I’ve earned the nickname “The Maverick” around Paradigm Press.

It’s also why my trading service of the same name has racked up an impressive 77% win rate in our stock portfolio.

Today, I want to share two simple concepts that have been essential to that success. These will change how you think about trading and transform your results.

Even the Best Traders Lose Sometimes

The first concept you need to understand as a trader is probability.

One of the hardest aspects of trading is taking a loss. We all want a sure thing, especially with our hard-earned money.

As humans, we are biologically programmed to feel the pain of a loss stronger than the pleasure of a gain. Our bodies react as much as eight times more to losing money than to winning.

This makes dealing with a loss difficult for anyone. But you have to remember that losses aren’t just possible — they’re unavoidable.

As a trader, you need to know that there is a probability of both winning and losing when you go into any trade.

As I mentioned earlier, my trading service The Maverick has a win rate of around 77%. That means we lose money on nearly a quarter of our trades. That’s fairly often.

Once you understand that losses are inevitable, they become less meaningful. Losing money is simply part of the trading process.

In other words, you can’t win 77% of the time without also losing 23% of the time.

Even with strategies that have higher loss rates, accepting losing as a part of winning will be a key to your future success.

Small Bets Can Beat Big Swings

The second concept is incrementalism. Even if you’re just buying one stock, look at it as multiple steps rather than a single investment.

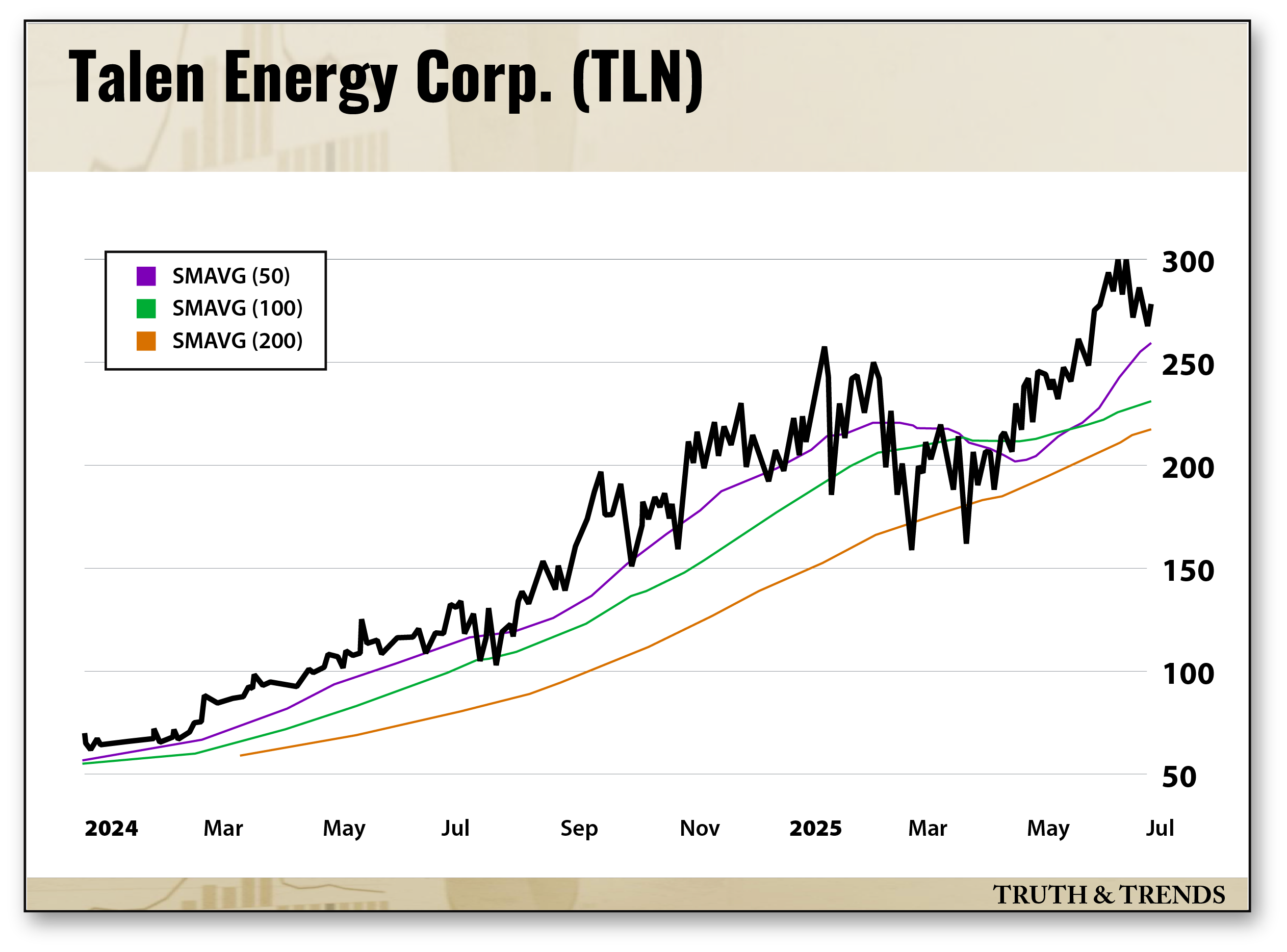

Let’s use a real example to demonstrate this idea. Below is the chart for one of my favorite stocks, Talen Energy Corp. (TLN).

I like the stock as a long-term investment and think it could eventually double from its current price. So we have traded temporary pullbacks a few times this year.

In January, we bought the stock after a sharp drop and sold our position for a gain of 22.15% in just nine days.

A few weeks later, the stock sold off again. So we issued another buy alert and ended up closing that second trade for a 7.57% gain.

On average, we target gains in the high single digits over a holding period of around 60 days..

High single digits may not sound like much. But when you compound that over a year, you are looking at 30% to 50% annualized returns.

This same concept of thinking incrementally applies to long-term investing, too. Let’s say you were willing to take a 10% position in the stock.

Start by buying 3.5% today. If the stock pulls back to the moving averages, you can buy more to make it a larger position.

With TLN and the hypothetical 10% position, I would buy another 1.5% at the 50-day moving average. Then I would buy another 2.5% at both the 100-day and 200-day moving averages.

Is the stock going to trade at those moving averages? Nobody can say for sure.

But employing this strategy means that if it trades higher and doesn’t touch those moving averages, then you have made money on your initial 3.5% position.

If it pulls back and then trades higher, even better. You have built a larger position with a better price.

And finally, if the stock pulls back to the 200-day moving average, you can be excited to build a large position at an attractive price instead of being despondent about near-term losses.

Using an incremental approach, you put yourself in a win-win situation when the future is unknown.

These two strategies — accepting losses and thinking incrementally — may sound simple. But they’re at the heart of consistent trading success.

Use them, refine them, and you’ll put yourself in the top tier of disciplined investors.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

2026: The Leaders, the Laggards, and a Wild Card

Posted January 05, 2026

By Enrique Abeyta

Optimism Wins: A Fresh Mindset for 2026

Posted January 01, 2026

By Enrique Abeyta

War, Media Game of Thrones, and a Shocking Assassination

Posted December 29, 2025

By Enrique Abeyta

Will We Get a Santa Claus Rally… or Coal?

Posted December 25, 2025

By Enrique Abeyta

This $5 Stock TRIPLED After I Told You About It

Posted December 23, 2025

By Ian Culley