Posted February 18, 2026

By Nick Riso

The S&P 500 Lies

If you just glance at the financial news, you’ll see some concerns about software and AI.

Otherwise, the stock market looks boring right now, almost like nothing is happening. But that’s not true.

Under the surface, the market is experiencing significant internal disruption and dislocation.

We aren’t observing a tranquil or balanced market environment. We’re observing an increasingly misleading navigational instrument.

The S&P 500 index has ceased functioning as an accurate measurement tool.

And if you continue relying upon it to guide your investment allocation decisions, you are essentially operating without reliable informational guidance.

Here’s the story…

The Soldiers Stopped Following the Generals

For the last two years, beating the market was “easy.” You bought the Mag 7 — Apple, Microsoft, Nvidia, the usual suspects — and you made money.

When they went up, the market went up. When they took a breather, the market took a breather. They were the generals, and the rest of the market just followed orders.

That era is increasingly coming to an end.

If we look at the data, we see something remarkable. There is a version of the S&P 500 most investors have never heard of called the equal-weight index.

The regular S&P 500 weights companies by their market capitalization. The bigger you are, the more you matter. But the equal-weight version treats every stock exactly the same.

That means Apple gets one vote. A regional bank gets one vote. Nvidia gets one vote. And so does a tire company. It’s a democracy instead of an oligarchy.

The regular S&P 500? Essentially flat year-to-date, only up about 0.56% so far. The equal-weight S&P 500? Up 5.36%.

This could signal a changing of the guard, or as Enrique has said in the past, major dispersion in the Mag 7 this year.

The average company — the regional bank in Columbus, the energy driller in Houston, the industrial manufacturer producing ball bearings in Milwaukee — is having a genuinely strong year.

These companies are making money, hiring people, and expanding operations. But you cannot see any of this activity in the headline number.

That’s because the headline number remains stuck in place, held down by the weight of a few massive technology stocks that are simply taking a pause.

The scoreboard is frozen while the game is still being played, and the players are still scoring. But if you are only watching the S&P 500, you would never know it.

Why the Index Is Stuck

The answer is simple: concentration.

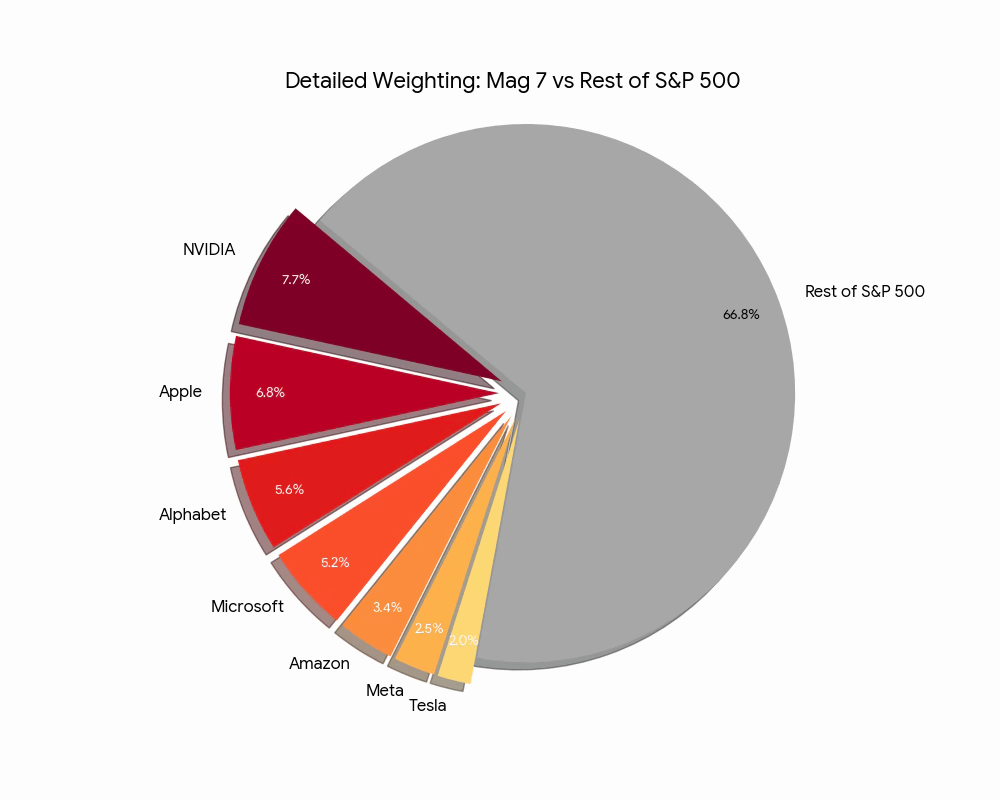

The Mag 7 now makes up 31% of the entire S&P 500. Nearly a third of the index and only seven companies. When those seven stocks sit still, the index sits still, even if the other 493 are ripping.

Think about that dynamic for a moment. Apple, by itself, has a market capitalization of $3.9 trillion, larger than entire economic sectors.

When Apple takes a nap — and we aren’t talking about a crash here, just a natural pause after two consecutive years of extraordinary appreciation — it exerts downward pressure on the entire index average.

Banks can be rallying 10%. Energy stocks can be surging 8%. Regional industrials can be breaking out to new highs.

But none of it matters to the headline number, because Apple represents such an enormous portion of the index that its stillness drowns out everyone else’s movement.

This is not how the S&P 500 was originally designed to function.

When Standard & Poor’s created this index, the intention was to provide investors with a representative snapshot of American corporate performance.

The index was supposed to reflect the aggregate health and trajectory of the broader business economy.

But somewhere along the evolutionary path of the last several decades, the methodology transformed into something resembling a popularity contest.

And the most popular participants grew to such disproportionate size that they fundamentally distorted the underlying mathematical framework.

You can measure the drag. The average stock is up 5.36%. The index is up 0.56%. That 4.8% difference? That is pure dead weight from the top.

The real market is already having a breakout year. But the math of market-cap weighting hides it from you.

The Nvidia Problem

Within that top-heavy group, Nvidia is the specific problem right now. At over 7% of the index, it has become what traders call a “liquidity black hole.”

Here’s how the mechanism works…

The options market surrounding Nvidia has become extraordinarily crowded with activity. Billions of dollars in derivatives bets are being placed every single day.

Market makers — the specialized firms that facilitate these trades and provide liquidity — are required to hedge their exposure by buying and selling the underlying stock itself.

When this hedging activity reaches a massive scale, it creates a self-reinforcing feedback loop that effectively pins the stock price within a narrow trading range.

The stock becomes trapped, unable to move freely even when fundamental factors would normally drive significant price movement.

So now we have a zombie index. Nvidia goes down 2%. The rest of the market goes up 1%.

Result? The S&P 500 does nothing. It just sits there, giving you no useful information about what is actually happening underneath.

This is a math and derivatives problem, not a market problem.

Let’s Zoom Out

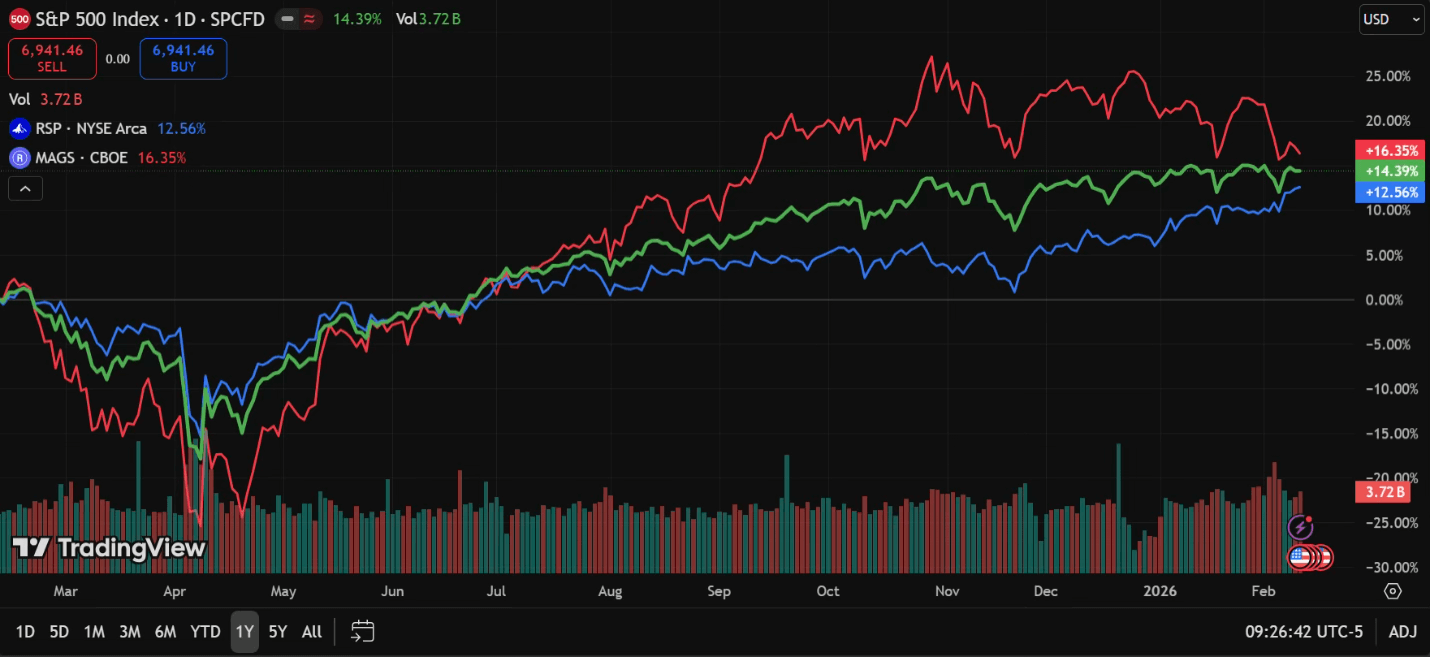

Over the past couple of years, the Mag 7 has crushed everything.

They’ve posted a 16.35% gain since 2024 and left the average stock in the dust. If you owned those seven names, you felt like a genius.

But the chart is changing. Take a look at the major divergence beginning last July.

And you can see the Mag 7 (the red line) begins to flatten in October. Not crashing, just catching their breath.

Now look at the green line. No coincidence that it’s also just slowly grinding higher in that same period.

And while they rest, the boring stocks are catching up fast. The blue line — stuff that got ignored for two years like banks, energy, and industrials — is finally getting its turn.

This is mean reversion manifesting in real time. It represents one of the fundamental principles of market behavior: nothing sustains exponential appreciation indefinitely.

The securities that experienced the most dramatic price appreciation are now consolidating their gains.

Meanwhile, the securities that significantly underperformed during the previous rally are experiencing accelerated momentum.

The pattern is neither dramatic nor catastrophic. It simply reflects the natural cyclical rhythm of financial markets reasserting equilibrium after a period of extreme concentration.

But if you are only watching the S&P 500, you cannot see this shift. All you see is a line only slowly grinding higher. And that doesn’t tell us much.

What This Means for You

The market is confused, not weak.

The headline number is being held hostage by a handful of giant tech stocks that are taking a well-earned breather.

The rest of the market — the actual market, the 493 other companies — is now waking up and moving higher.

It sounds bizarre, but the S&P is misleading. It shows us more what day traders and the Mag 7 are doing, not a ton other than that.

In short, the generals are tired. But the soldiers are marching.

And if you want to know where this market is actually going, you need to start watching the troops, not the commanders.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

The Kill Switch: How a Hidden Algorithm Is Blowing Up Boring Stocks

Posted February 16, 2026

By Enrique Abeyta

Snapback Trade Watchlist: HOOD, SHOP, TOST

Posted February 13, 2026

By Greg Guenthner

Play Ball! 3 Investing Rules From the Baseball Diamond

Posted February 12, 2026

By Enrique Abeyta

This Feels Like 1999… NOT 2000

Posted February 09, 2026

By Enrique Abeyta

Bad Vibes Everywhere

Posted February 06, 2026

By Greg Guenthner