Posted June 17, 2025

By Ian Culley

The Regime Shift No One’s Watching

The most important regime shift for markets has nothing to do with Trump, Iran, or Israel…

And everything to do with rising interest rates.

Don’t get me wrong. All of the above will affect the markets.

But in the long term, a force is already reckoning itself as a major market-mover in the years ahead.

Undoubtedly, as I type this, the Middle East chaos has reached a fever pitch.

Trump gave the G7 Summit the old “Irish goodbye,” slipping out the back as Macron muttered something about Palestine.

Geopolitical tensions threaten a wider conflict. And Trump's wagging finger at Iran raises legitimate questions of a regime shift in U.S. foreign policy.

Gold and crude oil will almost certainly capture the headlines amid the rampant fear. You’re already seeing it.

But rising global yields carried the market this far. And whether WWIII just broke out or not, they will drive the market for the next three to five years, maybe longer.

Gold and silver mining stocks are showing you what to expect and what’s possible for other commodity-related shares — rip-roaring rallies.

Let's take a look at oil following last week’s shock, review what the recent action means for the coming quarters, and break down one energy stock that could buoy your portfolio amid the turbulent conditions.

The Snapback

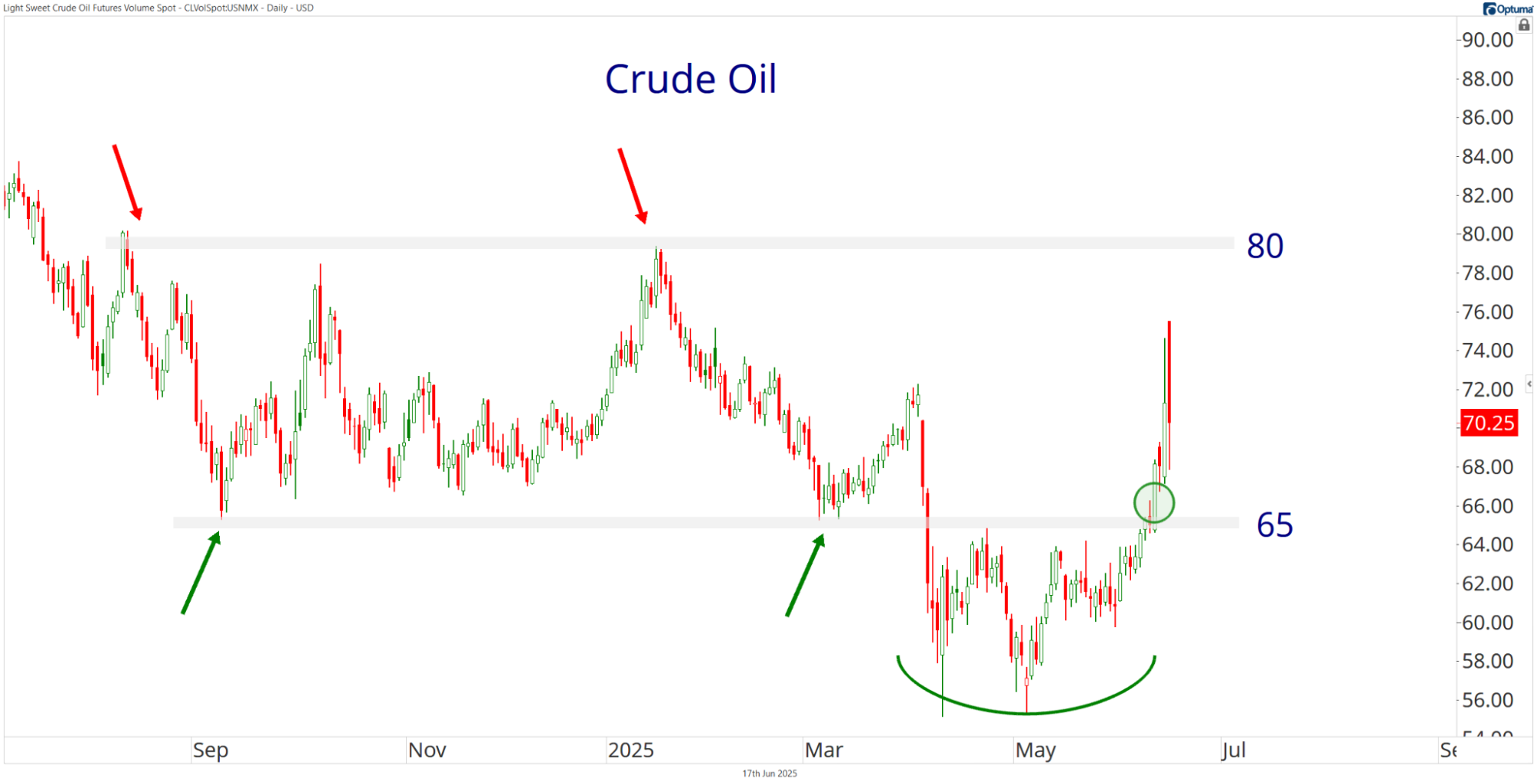

After a slight detour to a new four-year low, black gold broke back into its multi-year range.

It might not sound all that bullish, but energy bulls haven’t had this much to talk about since crude’s second-half rally in 2023.

Here’s a closer look at the past 10 months for reference.

The key takeaway: Risks have flipped sideways to higher now that crude is trading above the September ‘24 and March lows from earlier this year (green arrows). It’s a significant departure from the past two months and a good reason to get involved.

Unfortunately, the volatility is making crude a difficult trade. (It often does.)

Crude has been trading in a $10 range since last Friday. One day it’s up 7.26%. The next day, it’s down 1.66% only to rebound the following day.

Luckily, you don't have to trade crude oil. You have the option of buying and selling energy companies. And when it comes to oil and gas shares, you can’t go wrong with Exxon Mobil (XOM).

Exxon is an industry bellwether. It touts a 13% gain since May 30 with plenty of upside potential. Plus, last month’s low offers an excellent level to trade against for the more conservative trader.

But with rising rates, a burgeoning commodity rally, and sticky inflation, I think we can be a bit more adventurous than Exxon Mobil.

A New High

Regardless of sector or industry group, the key to choosing the best stocks hinges on relative strength.

You want to find names that are not only outperforming the broader market but are also outpacing their peers. This next stock checks both boxes…

Check out the $10 billion explorer and producer, Range Resources (RRC).

RRC is up 40% off its April low, outperforming the overall market and the energy sector. (You can see in the lower pane that RRC has risen relative to the Energy Sector ETF (XLE) since last fall.)

Range Resources provides a prime example of the relative strength I look for when buying a stock. I also like new highs…

Today, RRC broke out of a five-month bullish consolidation to a new eight-year high. If it’s trading above $42, the path of least resistance points up and to the right. A 30-40% gain by year-end marks a reasonable target.

To be clear: Buying RRC or any other energy stock is not betting on catastrophe.

No doubt, crude oil prices will soar due to geopolitical fallout (especially in the Middle East). However, crude and oil & gas companies will continue to benefit from elevated yields.

Oil stocks are flashing buy signals in the same vein as metal and mining stocks. It’s time to bust out the commodity supercycle playbook and settle into the new rising rate regime.

Stay tuned, I’ll have more energy names for you as the trend develops.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Elon Musk Changed My Life Forever

Posted June 30, 2025

By Enrique Abeyta

How I Build MONSTER Positions

Posted June 27, 2025

By Greg Guenthner

Ken Griffin Is Full of Sh*t

Posted June 26, 2025

By Enrique Abeyta

The “Wall of Worry” Climb Is Over

Posted June 24, 2025

By Ian Culley

GME: A Warren Buffett Kind of Stock

Posted June 23, 2025

By Enrique Abeyta