Posted November 22, 2024

By Greg Guenthner

The Race Is On!

Market watchers are feeling a bit more confident heading into the weekend now that several key assets have shot higher off support.

Crypto is mooning…

Small-caps are rallying after closing the post-election gap…

And tech stocks have stabilized now that the last of the major earnings events has passed.

The runway is now clear for the year-end melt-up we’ve eagerly anticipated. These are the market conditions we live for! If a good ol’ fashioned melt-up rally doesn’t get your blood pumping, maybe you should ditch trading and take up base jumping.

With our fingers firmly resting on the “buy” button, let’s take a quick minute to dive into the charts and trends turning heads this week…

Finally, No More Earnings Drama!

Investors have been positively obsessed with Nvidia Corp. (NVDA) stock this year.

The best and brightest chip stock delivered first-half 2024 gains of more than 150%, capturing the imagination of most AI-obsessed investors. Consensus opinion was clear: if you aren’t involved in NVDA, then what are you even doing with your portfolio?

But the stock cooled during the summer months, and only recently snuck back toward its all-time highs. This is where it came to rest ahead of this week’s earnings announcement, offering plenty of fodder for financial gossip and speculators hoping for some serious volatility.

Unfortunately for these speculators, they didn’t get quite the reaction they were hoping for – higher or lower. While NVDA beat top and bottom line estimates, it wasn’t enough to whip the bulls into a fresh buying frenzy. Nor did it embolden the bears to tear the stock to shreds.

Instead, NVDA shares bounced around in a red-to-green-to-red range on Thursday. So much for that big earnings move…

But longer-term investors have nothing to worry about. NVDA remains near the top of its range following a retest of its summer highs earlier this week:

I wouldn’t bet against the big dog here!

With market conditions likely remaining favorable through December, NVDA will likely continue to post new highs heading into 2025.

A Golden Dip-Buying Opportunity

Who wants to buy gold when bitcoin is hitting 99K?

I get it…

Bitcoin is hot. And gold is not. But I don’t view them as the same trade.

Remember, gold was the first to print new all-time highs in 2020 and in 2024. Plus, gold prices have fallen as bitcoin soars. Instead of getting caught up in the noise, I prefer to trade what's in front of me.

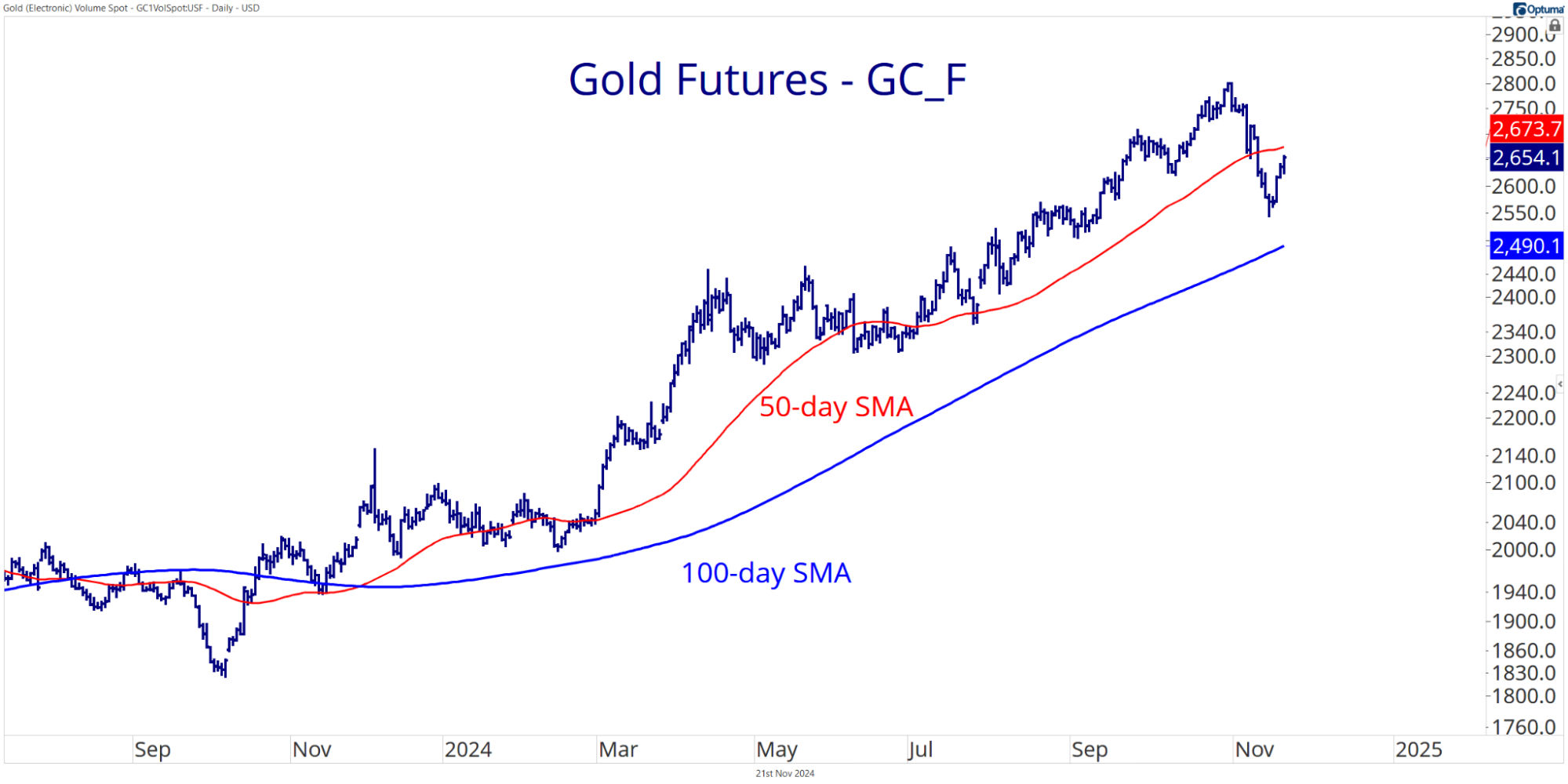

Check out the chart of gold:

Last month, Enrique made the case for NOT buying gold. As you can imagine, it wasn’t the most popular take. But momentum, price, and positioning were telling him the uptrend was due for a pause.

It turned out to be the right call.

Fast forward to today, and gold is posting a dip-buying bounce between the 50- and 100-day simple moving averages (just as Enrique pointed out in Top Trades earlier this month).

In fact, it’s only the second time this year that gold has traded down near its 100-day average. The first was back in early February, right before it broke out to new all-time highs…

The Widowmaker Turns Heads

Shiny rocks aren’t the only commodities alluring investors.

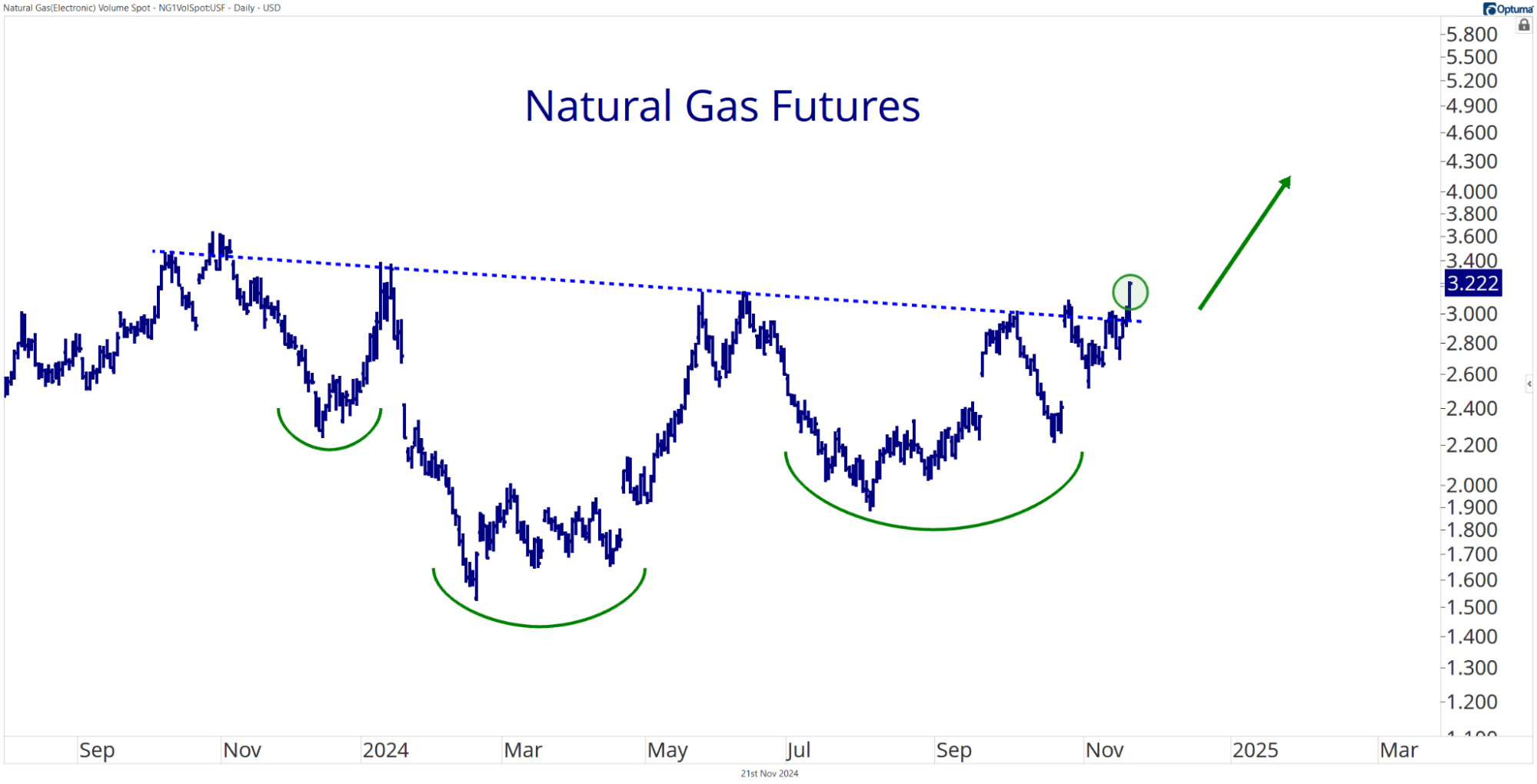

After going nowhere for more than a year, buyers are driving natural gas futures to fresh 12-month highs:

Natty gas posted a 9% gain mid-week and tacked on almost 5% yesterday.

Of course, pulling profits from this market is challenging to say the least. (That’s why traders fondly refer to it as the widowmaker.)

The natty gas trade had everything going for it earlier this fall: strong seasonal tailwinds, cyclical lows, and a well-defined risk level. The only thing missing was a rally.

I dipped our toes in the US Natural Gas Fund ETF (UNG), managing to escape with little more than a few bumps and bruises. Two months later, the widowmaker is at it again, enticing would-be buyers with quick returns.

My bias remains higher as long as natty holds above the June highs.

But remember, always tread lightly when trading natural gas…

That’s it for today!

Thanks for reading. If you have any questions, feedback, or topics you want covered in future issues, you know the drill…

Drop me a line at AskGreg@paradigmpressgroup.com and let me know!

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

I'm Buying Stocks Hand Over Fist

Posted December 23, 2024

By Enrique Abeyta

50-Year Storm Hits the Dow…

Posted December 20, 2024

By Greg Guenthner

Yesterday’s Selloff Triggered a Rare Setup

Posted December 19, 2024

By Enrique Abeyta

This Swiss Athletic Stock Could Shoot 20% Higher - Within 2 Weeks

Posted December 17, 2024

By Greg Guenthner

The GameStop Gambit

Posted December 16, 2024

By Enrique Abeyta