Posted March 28, 2025

By Greg Guenthner

The Next Trillion-Dollar Whale

“What’s the one stock everyone will wish they bought today five years from now?”

It’s a great question — and deceptively challenging to answer.

Think about it: Not very long ago, Exxon was the biggest company in the stock market. Bigger than Apple, Microsoft, and Google.

Creative destruction is real!

That’s why my publisher, Matt Insley, posed this question to me the other day.

Without hesitation, I gave him a point-blank answer. That’s how confident I am about one innovative company.

But I’m getting ahead of myself…

In my neck of the woods, we typically focus on short-term trading.

We follow momentum, leverage technical analysis, and stick to trades that last anywhere from a few days to just a couple of weeks. In these cases, fundamentals like sales, profits, and earnings hardly ever matter much.

If there’s a breakout, there’s a breakout. We’re in, then we’re out.

Today, we’re shifting gears.

We have to discuss a longer-term opportunity because the noise surrounding this company has become impossible to ignore.

By holding off on this discussion any longer, you might miss out on significant returns that are right in front of us, ripe for the picking.

We’ve mentioned this stock several times before, but never quite in this way.

The company’s making waves in massive, multi-billion-dollar markets — crypto, options trading, prediction markets, sports betting… you name it, they’re probably there.

It’s disrupting traditional financial landscapes, opening opportunities far beyond just trading stocks.

Which is why I believe the stock will more than double by the end of the year. I also think it could be the first fintech among all major banks and institutions to reach a trillion-dollar market cap.

Going forward, we'll be closely following each development, each move, and every innovation the company rolls out. You’ll receive regular updates right here at Truth & Trends.

Bottom line, this is the strongest long-term conviction I’ve had on any stock in almost 10 years.

Let’s dig into the details.

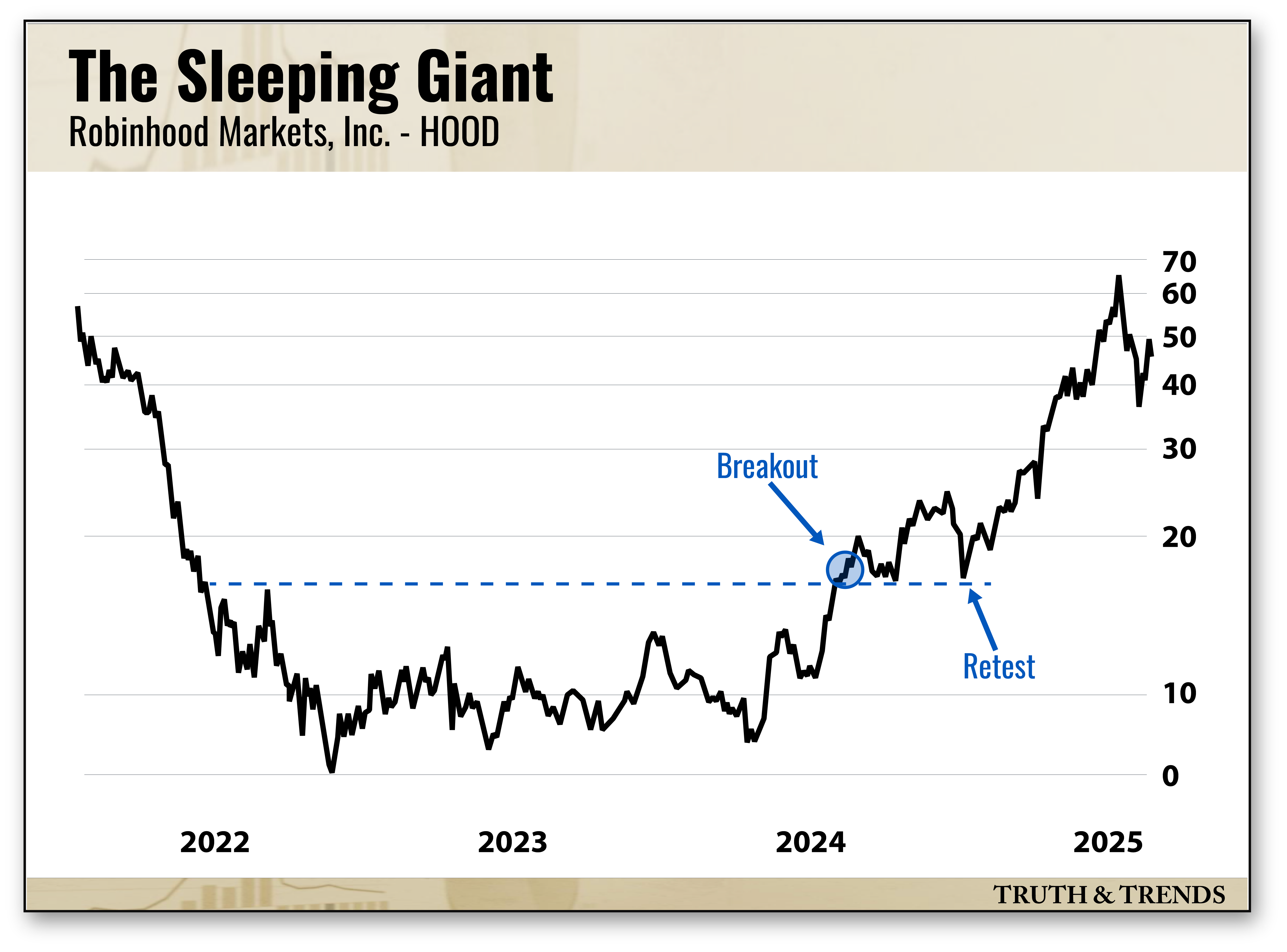

Robinhood: The Sleeping Giant

I’m not just a trader. Like most investors, I also have long-term accounts where I make concentrated bets on high-conviction plays.

Yes, I do have some broader technical requirements for these stocks (I like charts that go UP consistently over time). But I also want to be involved in companies that I believe have a better-than-average shot at becoming future market leaders.

Robinhood Markets Inc. (HOOD) is one of those companies.

HOOD is a sleeping giant. Not only do I think the stock could rally toward $100 by the end of this year — it’s also the type of play that has that magic mix of growth and disruption that could propel it to market royalty.

I began to build my HOOD position in late 2022 when the stock was still trading in the $10 range.

It wasn’t a perfect entry. The stock was still building its base as the post-COVID bear market dragged into the third quarter. HOOD was hit especially hard because it was one of the later IPOs of the era, launching in mid-2021.

The stock quickly cooled following some rabid buying during its first week on the market. And it was one of the first stocks speculators jettisoned when the market started to soften in the fourth quarter. By the time the dust cleared the next year, HOOD had fallen as much as 90% off its IPO highs.

As the bear market ebbed, HOOD spent 2023 building its big base. Then came the initial breakout the next year. HOOD surged above $16 one year ago, then retested this base breakout level over the summer.

Since then, the stock has been on an absolute tear, exploding as much as 300% off those August lows.

A True One-Stop Shop

My reasons for buying were simple enough. I felt that HOOD was overlooked (and hated!) due to the trading platform’s surge in popularity during the COVID trading bubble. Most serious investors looked at HOOD as a gambling site for young men who wanted to “yolo” GameStop options while the world was shut down.

But the Robinhood platform is evolving.

Yes, there’s gambling! Robinhood has recently opened up to sports betting and predictions markets. But it’s also maturing as an incredible one-stop shop for everything markets.

First, you have Robinhood Gold. This is a program for paid subscribers that offers some very competitive perks, including deposit bonuses and a 5% yield on cash.

The company also launched a gold credit card with no annual or late fees — with plans to expand into banking, including high-yield savings accounts.

Then, there’s Robinhood’s foray into 24-hour trading on major stocks and ETFs. It has also launched a crypto wallet with plans to expand into DeFi. And a new trading interface for phone and desktop? Yep, it’s got that, too.

Robinhood’s laundry list of new features is growing so fast that I’m having trouble keeping up. That’s one of the reasons I finally opened an account this week. I’ve been using ThinkorSwim (Now owned by Schwab) for more than a decade.

Will Robinhood convince me to jump ship?

Will I migrate my crypto holdings from Coinbase?

What about my savings accounts?

Is JP Morgan management worried that Robinhood is coming for its customers?

We’ll see!

If you’re a Robinhood user, drop me a line and tell me what you think.

Is HOOD the market’s next amazing success story? Or am I taking crazy pills?

Let me know your thoughts. I’ll keep you posted on the journey.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Lightning Round: Trump’s Fed Pick, the Silver Crash, and More

Posted January 30, 2026

By Greg Guenthner

Forget the Noise, You're Not Bullish Enough

Posted January 29, 2026

By Enrique Abeyta

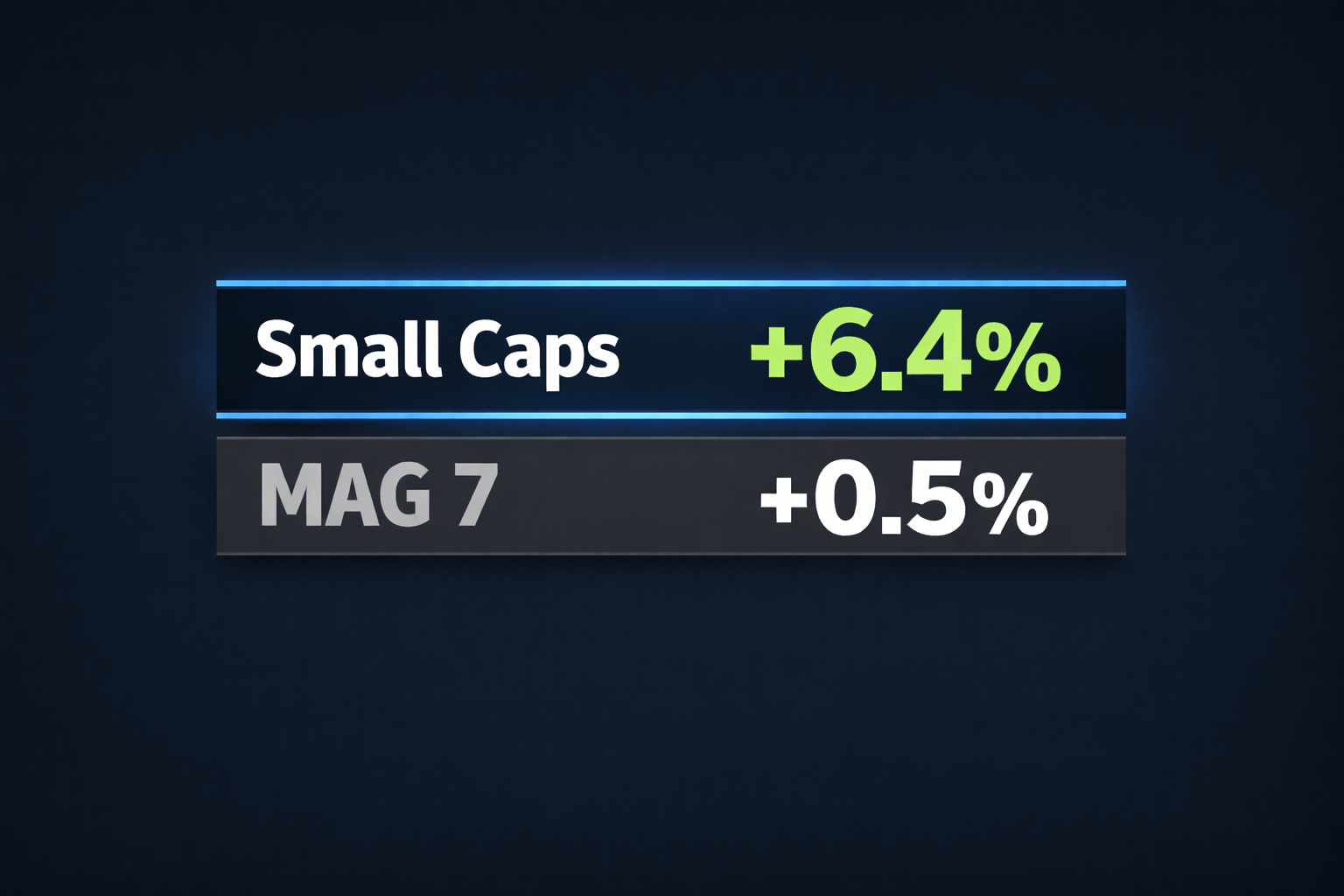

Small Caps Are Back, Baby!

Posted January 23, 2026

By Greg Guenthner

Greenland, Carry Trades, and Lazy CNBC Takes

Posted January 22, 2026

By Enrique Abeyta

“TACO” Out… “Big MAC” In

Posted January 19, 2026

By Enrique Abeyta