Posted February 05, 2026

By Enrique Abeyta

The Momentum Trade Cuts Both Ways (Silver Edition)

Silver has a dedicated following of long-term investors who truly believe in the precious metal.

These investors own silver because they see rising demand and limited supply sending it higher in the long run.

They’re incredibly patient and hold through long periods of boredom. And their returns are measured in years, not weeks.

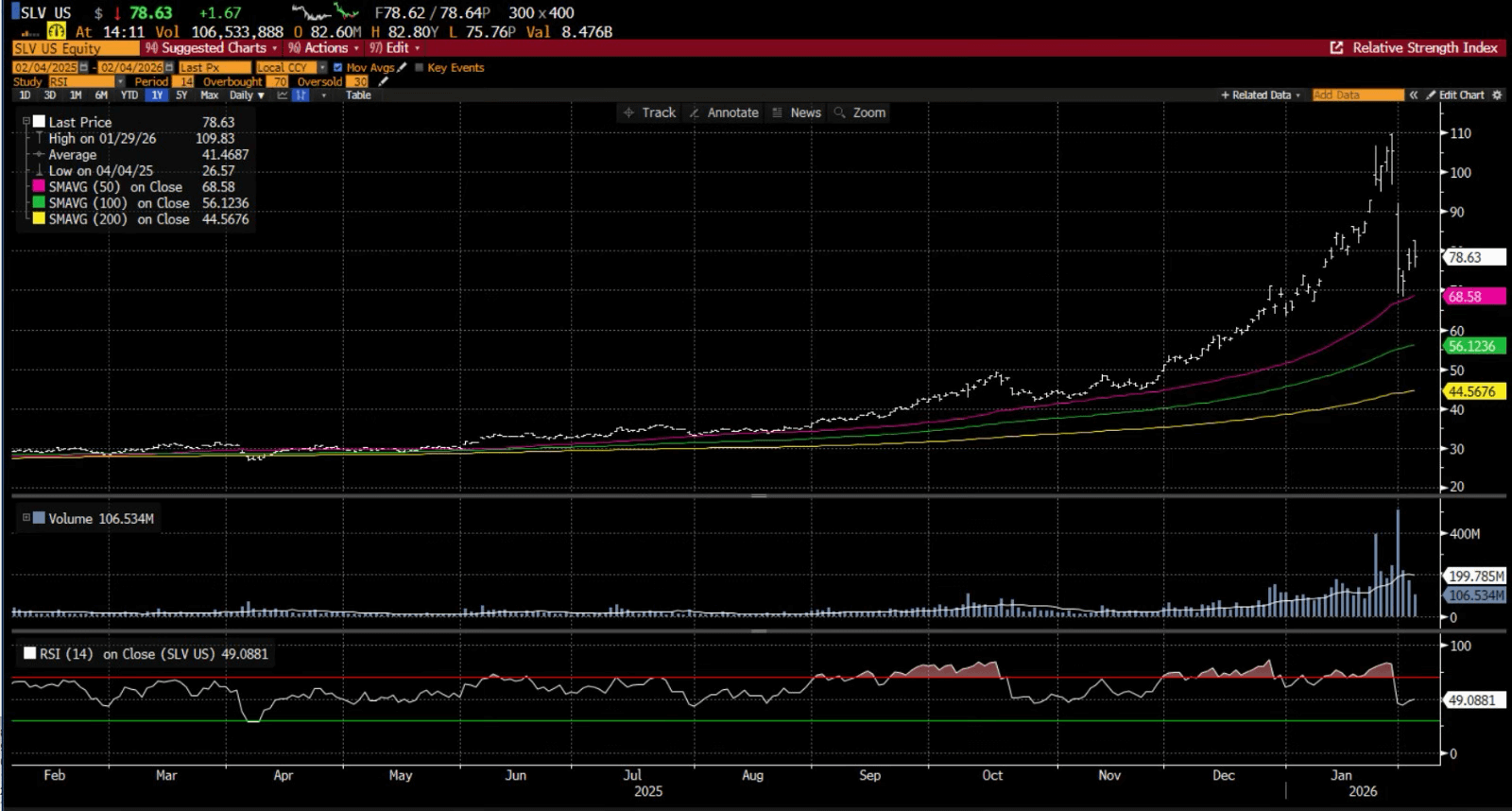

That’s why silver’s meteoric rise over the past few months felt so validating.

After years of waiting, it looked like their investment thesis was finally playing out. But here's the thing...

That parabolic rally had less to do with slow-moving fundamentals and more to do with momentum.

Yes, there are real, structural arguments supporting higher silver prices.

Global demand tied to electrification, solar power, and industrial usage has increased…

Supply growth has been constrained by years of underinvestment in mining…

Central bank behavior, currency debasement fears, and geopolitical uncertainty have added fuel to the fire.

But assets don’t move the way silver just did on fundamentals alone. Moves like that require something else.

They require momentum investors.

When Momentum Investors Arrive on the Scene

Momentum investors are a very different breed from the long-term silver holder.

Traditional silver investors tend to think in terms of intrinsic value, macro cycles, and long-term preservation of purchasing power.

Momentum investors think in terms of trend strength, velocity, and crowd behavior.

They’re not buying silver because they've studied Mexico's mining output or China's industrial demand projections. They’re buying because the price is going up.

Momentum investors are only interested in assets with a compelling story that are already moving higher — preferably fast.

And once momentum investors arrive, even assets known for their steady price action like silver can start to move unpredictably.

The reason momentum investing can feel almost magical on the way up is that it feeds on itself.

Rising prices attract new buyers. New buyers push prices higher. And higher prices validate the narrative and draw in even more capital.

Throw in coverage on financial news stations or social media, and what usually takes years to accomplish can happen in weeks or months.

Doubling or tripling returns in a short window is common during one of these phases.

That’s the upside of momentum, and it’s why so many investors chase it. But momentum is a double-edged sword.

The same mechanism that drives prices higher can work in reverse just as quickly.

Momentum investors are not known for their loyalty to an asset’s story or long-term thesis. They only care about the price action.

When the price stops going up, their reason for being in the trade disappears.

And unlike traditional investors, they don’t wait for confirmation from fundamentals. They respond first and ask questions later.

This is exactly what the silver market just experienced.

Last week’s sharp selloff left many investors scrambling for explanations.

Some blamed manipulation. Others blamed shadowy institutions or sudden changes in physical supply.

But the simplest explanation is often the correct one. Momentum stalled, and so momentum investors started leaving.

What Happens After the Momentum Is Gone

Broadly speaking, there are two groups of momentum investors.

The first group enters early, rides the trend aggressively, and is hyper-sensitive to any sign that the narrative or price action is breaking.

These investors are usually the first to exit. They simply sell and move on to the next opportunity.

That initial wave of selling is often what causes the first sharp break lower, like the one silver just experienced.

The second group behaves a little differently. They don’t immediately panic at the first pullback.

Instead, they wait to see whether momentum reasserts itself and hope for consolidation or a brief pause before the next leg higher.

Momentum assets rarely move sideways for long, because sideways action is the market’s way of bleeding off enthusiasm.

If the asset fails to regain upward momentum, impatience sets in. If price dips again, this second group will exit as well.

When that happens, a second leg lower often follows.

This is why momentum-driven assets tend to move in sharp bursts rather than smooth waves.

Calm consolidation, which long-term investors often interpret as healthy, can actually be dangerous in a momentum context.

For momentum investors, stalling is a warning.

If this sounds theoretical, I can promise you that it isn’t. We’ve seen this exact pattern play out recently in other markets.

Here’s one example…

A Case Study in Commodity Collapse

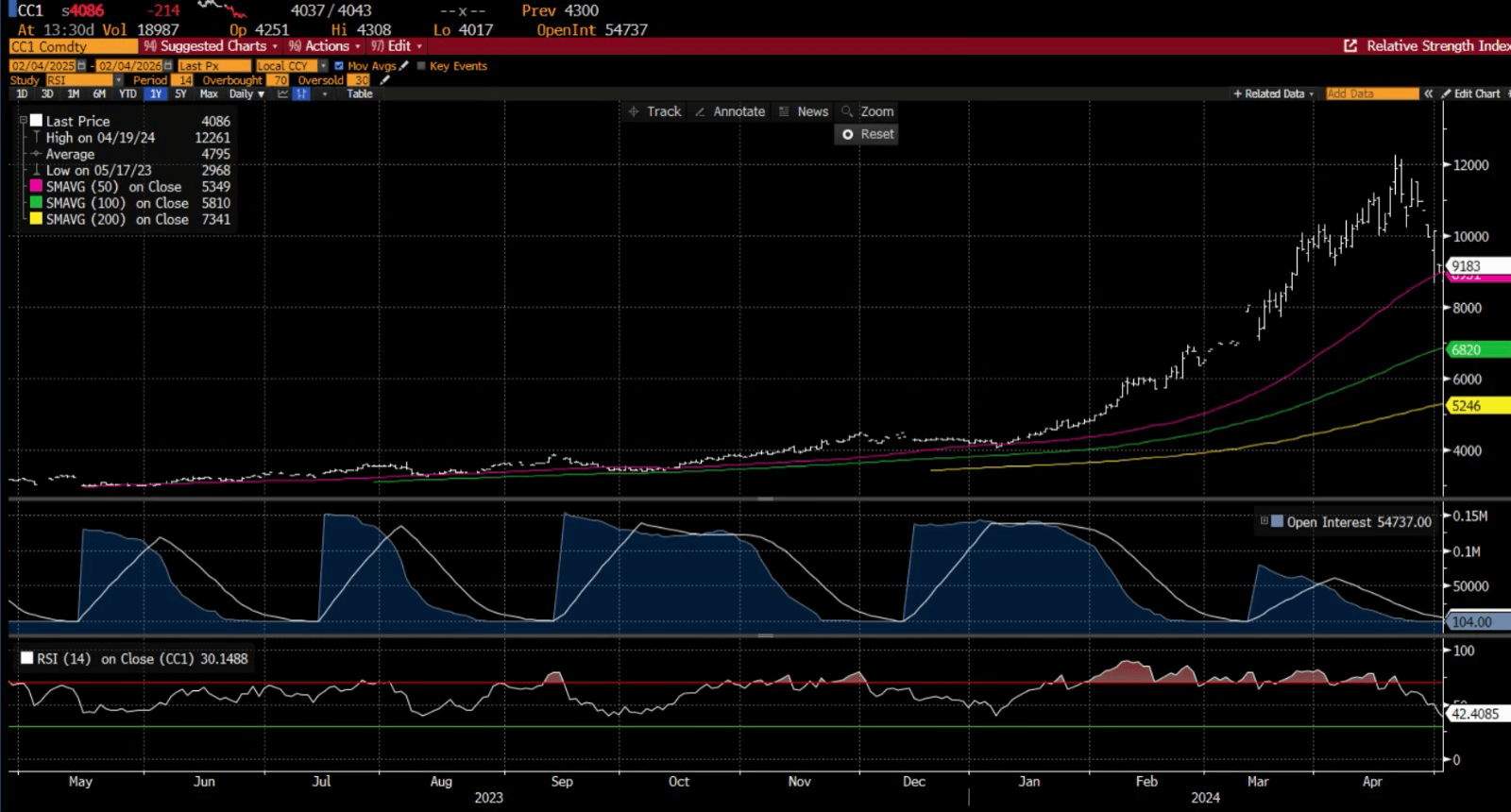

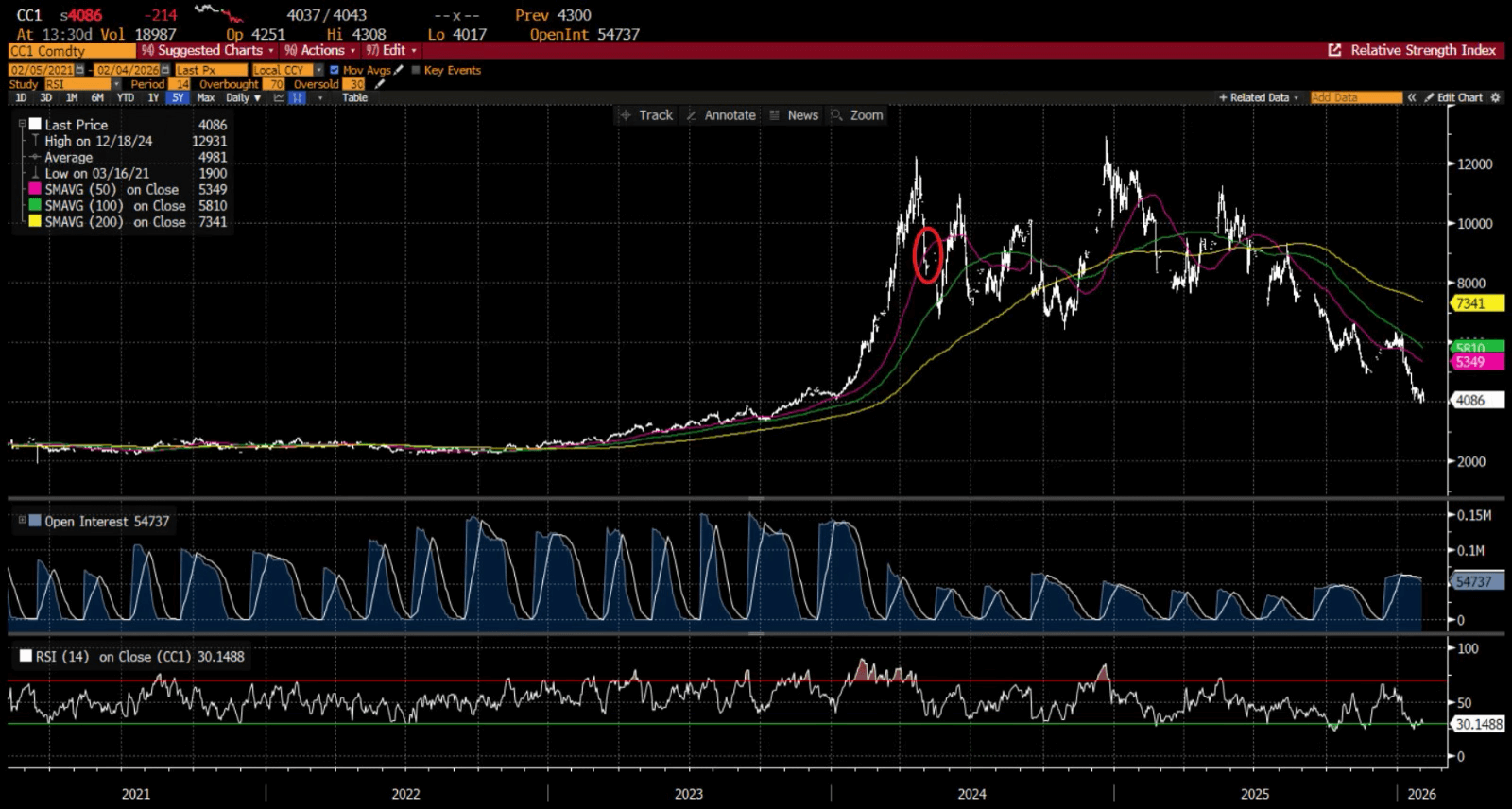

Cocoa prices exploded higher throughout 2024, driven by severe supply shortages in West Africa.

The narrative was airtight. Prices went parabolic, peaking near $12,900 per metric ton.

Then the unwind came. Demand destruction set in, weather conditions improved, and speculative capital rushed for the exits.

Fast forward to today and cocoa prices have collapsed more than 60%, settling near $4,000 per ton.

The fundamentals didn’t just change overnight. The momentum did.

You may think that this kind of collapse couldn’t happen to silver. After all, cocoa is an agricultural commodity, and silver is money.

But markets don’t care.

No asset class is immune to momentum dynamics. Not stocks, not crypto, not commodities, and not even precious metals.

This doesn’t mean silver is doomed or that the recent selloff marks the end of the move.

Momentum could return. If silver stabilizes and begins to push higher again, we could absolutely see another leg up.

But it does mean investors should be alert.

When your Uber driver or barista are suddenly talking about silver, we’re no longer in normal market conditions…

We’re in the middle of an asset-focused momentum event.

The Final Word on Silver and Momentum

At the end of the day, my goal here has always been to help you make money — and keep it.

I’m not here to tell you not to invest in silver. I’m here to make sure you understand the environment you’re operating in.

Momentum can be a powerful ally, but it demands respect. It rewards discipline on the way up and punishes complacency on the way down.

Remember this above all else…

Momentum doesn’t care about your thesis, your patience, or how long you’ve waited for silver to shine.

It only cares about price.

And as any trader can tell you, momentum gives, and momentum takes away.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

The Silver Implosion in Slow Motion

Posted February 04, 2026

By Nick Riso

Silver's Swan Dive Is Just the Beginning

Posted February 02, 2026

By Enrique Abeyta

Lightning Round: Trump’s Fed Pick, the Silver Crash, and More

Posted January 30, 2026

By Greg Guenthner

Forget the Noise, You're Not Bullish Enough

Posted January 29, 2026

By Enrique Abeyta

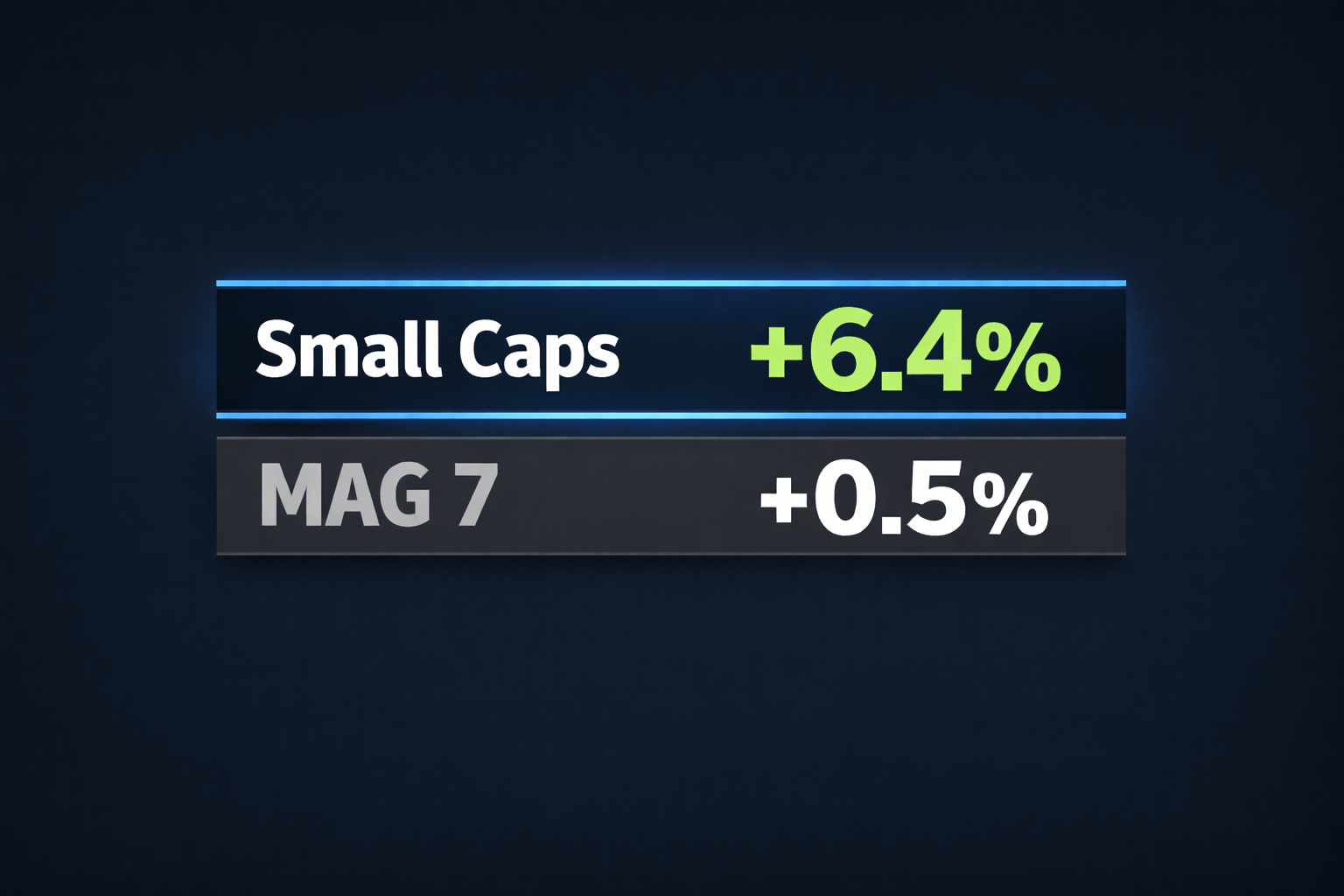

Small Caps Are Back, Baby!

Posted January 23, 2026

By Greg Guenthner