Posted June 15, 2025

By Ian Culley

The MJ of Money Just Dunked on the Dollar

The Michael Jordan of trading just dunked on the dollar.

Billionaire hedge fund manager Paul Tudor Jones joined Bloomberg TV’s Open Interest and made a bold prediction a couple of days ago: The U.S. dollar will drop 10% over the next year.

If you’re not familiar with PTJ, his claim to fame was making a reported $100 million in a single day on Black Monday in 1987 — and then went on to amass an $8.1 billion net worth since.

For obvious reasons, Jones’ words tend to carry some gravity. And when he calls for a 10% drop in the dollar? It’s time to listen.

A 10% drop is big for a stock. But for a currency? Monumental.

And I’m in full agreement here. The dollar is headed lower mainly because of interest rate cuts.

But as wild as his prediction sounds, I believe PTJ’s big call falls short in two key respects: severity and length.

I see the USD sliding much faster than he thinks, and the decline will last far longer than just a year.

The Sell America trade is changing fast…

It’s quickly evolving into Sell The Dollar.

Before I outline the USD’s path, what it means for you and your portfolio, and where PTJ misses the mark, we must discuss one of the key drivers behind the dollar’s inescapable decline.

Let me explain…

More Cuts = Weaker Dollar

Interest rate cuts will lead to the dollar’s slump, or more precisely, the interest differentials between the U.S. and other developed nations.

(I’ll have more on interest rate differentials in just a minute. But first, a primer on why the dollar’s decline is a near certainty.)

Trump has made his stance on U.S. yields loud and clear. He wants lower rates. And he wants them now.

Earlier this year, Fed Chair Jerome Powell faced Trump’s fury after refusing to do his bidding.

Trump called him “Mr. Too Late,” going so far as to threaten Powell’s position before quickly backtracking.

I thought Powell was out, laws and the Constitution be damned. Trump does what he wants. And when you get to the point that he’s spending time and energy on coming up with a disparaging nickname for you, you’re done.

Months later, Powell is still running the show and Trump continues to hurl insults. After the Fed Chair failed to cut rates at last month’s FOMC meeting, Trump simply remarked, “He’s a fool that doesn’t have a clue.”

Whether you agree with the president or not, we’re all stuck with him until May 2026. Whoever Trump puts in his place will cut baby, cut!

Falling yields at the short end of the curve will put downside pressure on the dollar. But that’s only half of the equation.

(Interest Rate Differentials: Enter stage left.)

Remember the dollar’s parabolic rally in 2022? The Fed’s aggressive rate hikes fueled the rally.

Old “Mr. Too Late” was first to the punch. Plus, Powell was able to hike at an accelerated pace due to historically low interest rates and a relatively robust U.S. economy.

Europe tried to catch up. But it couldn’t. Germany and the U.K. narrowly escaped financial calamity as the pound retested its all-time low versus the dollar and the euro slipped below parity for the first time in 20 years.

Today, it’s the other way around. The U.S. is destined for lower rates, while Europe has made it clear they’re done — no more cuts!

Once the difference in yields swings in favor of the euro, you can kiss the buck goodbye. Interestingly, dollar bears aren't waiting around for Powell’s successor.

Dollar Disaster Incoming

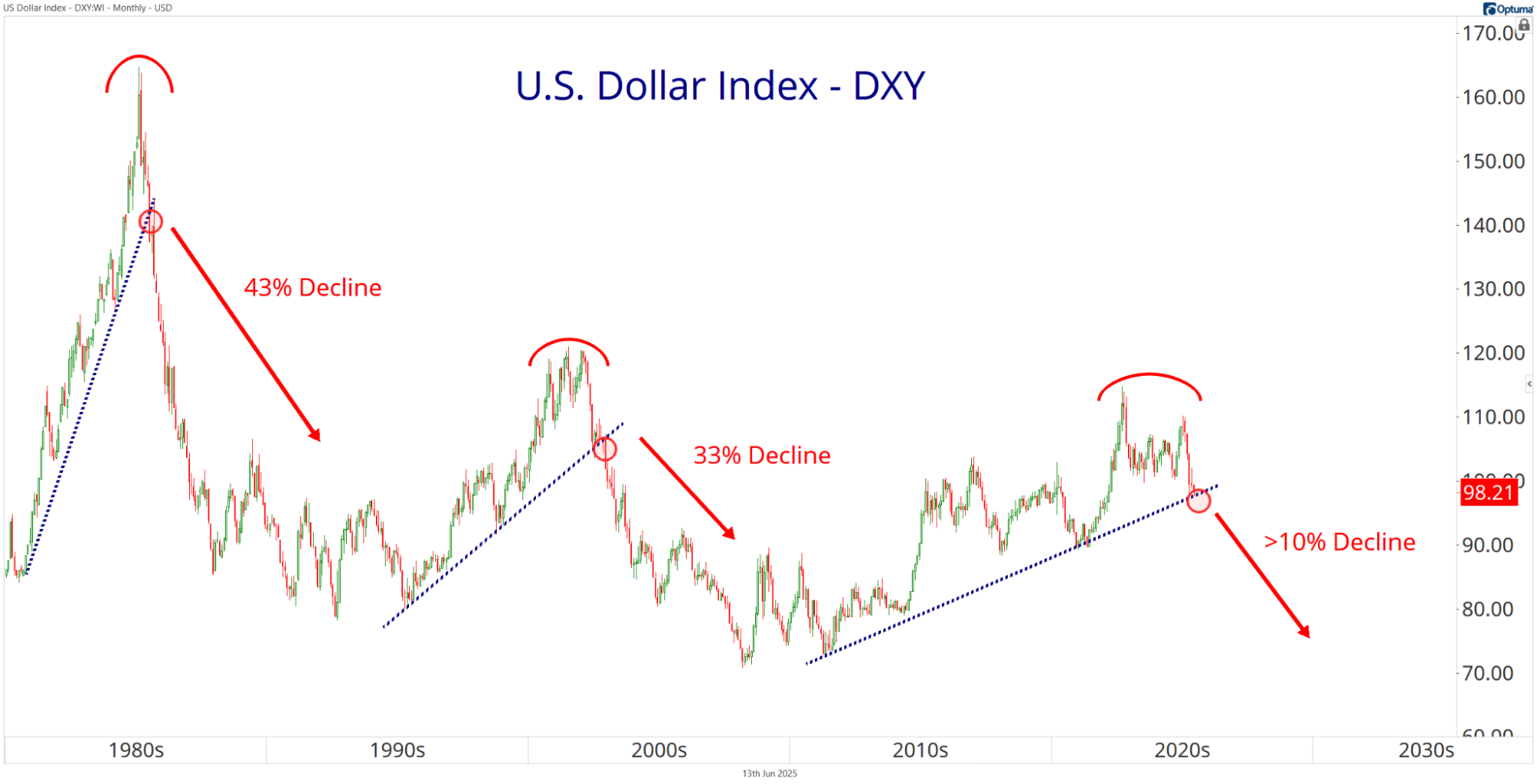

The U.S. Dollar Index (DXY) has been here before.

Major trend reversals in 1985 and 2002 began with a simple trendline break…

From the summer of 1985 to the summer of 1992, the dollar shed 43%. DXY also posted a double-digit loss (33%) following its 2002 breakdown. Both far exceeded a 10% decline and lasted years, not months.

Fast forward to today, the U.S. Dollar Index is on the verge of a similar break…

I think PTJ’s 12-month forecast fails to account for the past six months. The dollar index is down more than 10% year-to-date.

Whoever you want to peg as the culprit — traders, investors, European pension funds — it doesn’t matter. Capital is already flowing out of the USD, and these flows will only intensify over the next twelve months.

DXY could easily print an 89-handle by year-end. Once the Fed begins cutting rates, I bet King Dollar will be slumming down in the low 70s much faster than anyone expects.

To be clear: a tumbling dollar doesn’t mean you won’t have opportunities to make money in this market. There are several ways to play the trend:

Commodity stocks, emerging markets, developed Europe…

These will be themes producing the best returns as the dollar dive bombs over the next 3-5 years (maybe longer).

I’m not saying ditch U.S. equities, or to shy away from speculative growth themes such as quantum computing, flying cars, or space travel.

Instead, think of your pool of speculative growth names expanding beyond small-cap tech.

The past couple of weeks have showcased what you can expect: Flying car stocks soaring side by side with South African mining stocks.

If you find it a bit overwhelming, don’t worry. I’ll be here to share with you those obscure names you don't have on your radar.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Elon Musk Changed My Life Forever

Posted June 30, 2025

By Enrique Abeyta

How I Build MONSTER Positions

Posted June 27, 2025

By Greg Guenthner

Ken Griffin Is Full of Sh*t

Posted June 26, 2025

By Enrique Abeyta

The “Wall of Worry” Climb Is Over

Posted June 24, 2025

By Ian Culley

GME: A Warren Buffett Kind of Stock

Posted June 23, 2025

By Enrique Abeyta