Posted November 21, 2024

By Enrique Abeyta

The “Maverick” Approach to Investing

I’ve always been a free-thinker.

It’s a quality that I value both in my personal and professional life.

I don’t care how things have been done in the past, and I certainly don’t care about sounding smart.

All I care about is doing things the right way.

When it comes to the markets, that means one thing: making money.

That’s why everyone calls me “The Maverick.” I picked up the moniker at Wharton, and it’s stuck with me ever since!

My independent approach to the markets is the key to my trading strategy…

One I’ve developed over my three-decade career and has proved successful in every type of stock market environment.

Today I want to tell you more about it.

The Signal

I wrote to you earlier this week about my strategy for identifying winning stocks.

My system is based on looking at the single most powerful metric for predicting future stock price performance – earnings revisions.

The key is to find a stock with three consecutive positive earnings revisions.

Most large companies have dozens of analysts at banks and brokerages that cover the stock, basically writing research and analysis about it.

They also make predictions (or estimates) about the financial metrics the company will report in the future. This is true for every financial metric, but there are only a few that really matter.

The most important ones are a company’s sales, cash flow, and earnings, which is measured by earnings per share (or EPS).

Most of the time, EPS is the only one you really need to focus on when analyzing a stock.

As time goes on, these analysts update their predictions. If a company is doing well then, they raise their estimates.

Rising estimates (or earnings revisions) as they are called are the single most powerful predictor of near-term (and long-term) stock prices.

If you find a company that sees consistently rising numbers, then the stock will follow.

There’s only one problem: earnings revision data is very hard to get. Only a couple of high-priced data services have it.

This is the way that Wall Street likes it!

They know this data is the best predictor and want to keep it for themselves so they can continue to print money.

The good news is that I have access to this data and have been using it successfully for decades. And I will share this hidden key to profits with my readers.

It’s not just about having the data, though. You need to know how to use it.

Over the years, I’ve refined a unique approach that relies on the “1-2-3” stock pattern, which can help you identify BIG profit potential.

Here is how it works…

1…2…3…Blast Off

I use Bloomberg to look at earnings revision data. If a company goes from negative or flat revisions to three consecutive positive ones, then I’m interested.

Three revisions provide us with a trend in a company’s operations. It’s rare for a company to see rising estimates for that long and not see follow-through in operations.

And the follow-through can be massive.

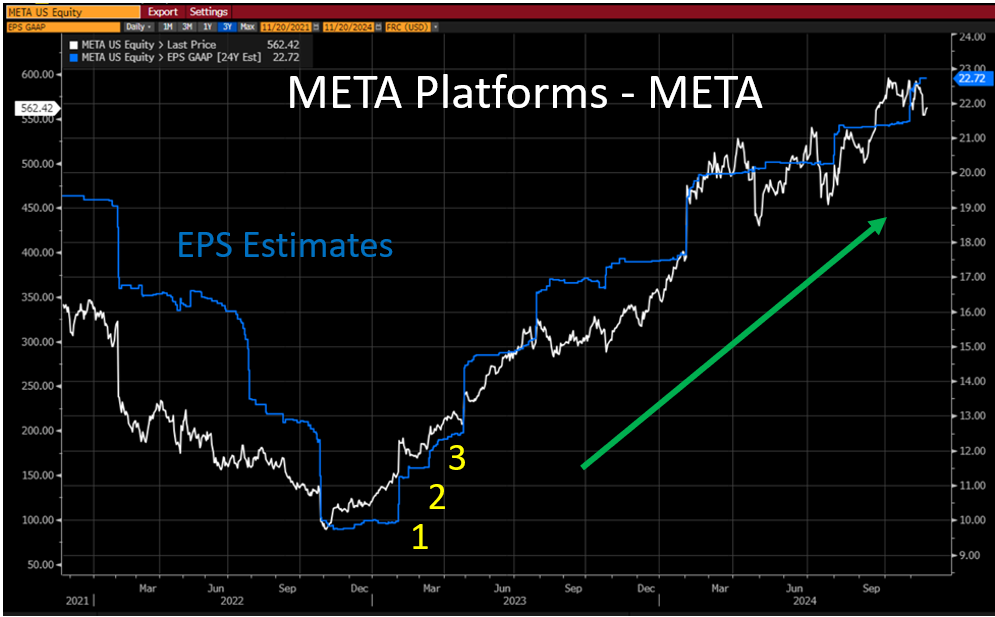

One of the best examples of the success of the “1-2-3” stock pattern I’ve seen in recent years is Meta Platforms Inc. (META), parent of Facebook.

Here’s a chart showing the stock price and the analysts' estimate for 2024 EPS going back a few years.

In the chart, you can see that the estimates for 2024 EPS were consistently going down back in 2022.

This was as META worked off the post-COIVD digital hangover. Meanwhile, it was making massive investments in infrastructure.

Estimates went down and the stock followed them.

Now, look at the chart where negative revisions stopped. That was the bottom of the stock price.

From December 2022 to February 2023, we saw multiple positive earnings revisions, triggering the “1-2-3” pattern.

And as you can see in the chart above, it took off immediately after.

Even if you waited for the confirmation of the signal and bought after the stock doubled, you still had the opportunity to make almost three times your money in two years.

META is one of the best examples of stock price following earnings revisions that I have ever seen.

This same thing happens to almost all of the best stocks after the “1-2-3” pattern is in.

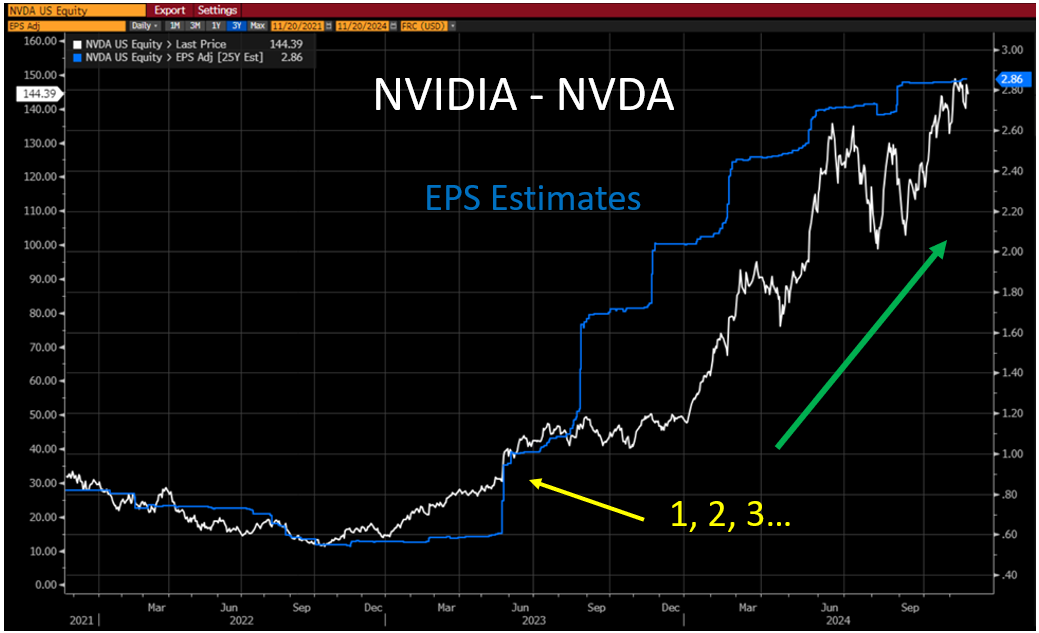

Let’s talk about the most popular stock in the last few years, Nvidia Corp. (NVDA).

Here’s that same chart with the stock price and the analyst estimates for 2024 EPS.

The pattern is very similar to that of META.

Numbers moved down through 2022 as NVDA faced a slowdown in consumption of their chips from their technology customers.

The post-COVID digital hangover impacted META, and that flowed all the way through to NVDA.

NVDA’s estimates bottom a little bit after META, and we see the first positive revision in February 2023.

From there, the stock triggered our “1-2-3” signal by May of that year.

If you had waited for that signal, you could have bought the stock at around $25 per share. This was up +100% from the stock’s 2022 bottom six months earlier.

Did you miss it? Not at all. Today, NVDA is trading SIX TIMES higher!

That’s the power of the “1-2-3” stock pattern that can propel you toward life-changing returns. And I’m here to help you find these opportunities.

You’ll hear more from me about this soon. So stay tuned!

In Case You Missed It: Ignore the Post-Election Noise

Top Trades Live is a completely FREE resource that helps you become a better trader.

Each week, Enrique and Greg give you a broad look at what’s happening in the markets and share a single stock with true breakout potential.

On the latest Top Trades Live, they break down the post-election noise, highlight what really matters (spoiler alert: it’s price), and outline a couple of their favorite trades.

You’ll find all that and more in the recap below.

We hope you’ll join us on next week’s Top Trades Live!

In the meantime, send us an email if you have any questions or a topic you want Enrique and Greg to cover next week.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

I Dumped HALF My HOOD Shares

Posted July 04, 2025

By Greg Guenthner

STOCK WARS: Independence Day Edition

Posted July 03, 2025

By Enrique Abeyta

![[Breakout Confirmed] This 10x Trade Is Taking Off](http://images.ctfassets.net/vha3zb1lo47k/5SZCYl7OZbRTZpXv6ItiqQ/fcc3fb7ac31039e02a1e4ef1ff161ca5/ttr-issue-07-01-25-img-post-2.jpg)

[Breakout Confirmed] This 10x Trade Is Taking Off

Posted July 01, 2025

By Ian Culley

Elon Musk Changed My Life Forever

Posted June 30, 2025

By Enrique Abeyta

How I Build MONSTER Positions

Posted June 27, 2025

By Greg Guenthner