Posted January 20, 2025

By Enrique Abeyta

The Market Doesn’t Care About the Dollar…

Everyone’s losing their minds over interest rates, CPI, PPI, PCE… The list is exhaustive!

Sure, these macro factors can move stocks. But getting caught up in this overhyped, overused wagon the media keeps pushing will cost you.

And let’s be real: The media’s latest shiny object is setting the average investor up for an even rougher ride.

They’re laser-focused on one factor — brought back into the spotlight thanks to Trump's return — that’s supposedly yanking the market around like a rag doll. This could spell doom for your money.

What am I talking about?

The U.S. dollar.

Breaking Down the Dollar

First, let’s talk about what we mean when we talk about the “price” of the U.S. dollar.

The dollar trades against different currencies at different prices. It moves up and down not only based on what is happening in America but what is happening in those countries.

To understand the value of the dollar relative to a basket of currencies. Here are the currencies and weightings…

- Euro (EUR), 57.6% weight

- Japanese yen (JPY), 13.6% weight

- Pound sterling (GBP), 11.9% weight

- Canadian dollar (CAD), 9.1% weight

- Swedish Krona (SEK), 4.2% weight

- Swiss Franc (CHF), 3.6% weight

The index doesn’t include two of our three largest individual country trading partners — China and Mexico — but still is a good proxy for what is happening to our currency.

Seldom is this question asked, but why do we as stock investors care about the price of the U.S. dollars?

Sharp movements in the value can impact the value of trade (exports and imports) and create volatility in the economy.

The U.S. also has consistently been a net importer. We import (buy) from the rest of the world more than we export (sell) to the rest of the world.

This means that when the value of the dollar goes higher, the price of our goods is higher when we sell abroad. In theory, this makes those products less attractive.

Conversely, the prices of the goods of other countries are cheaper with our higher-priced currency. In theory, this is a benefit for the American consumer.

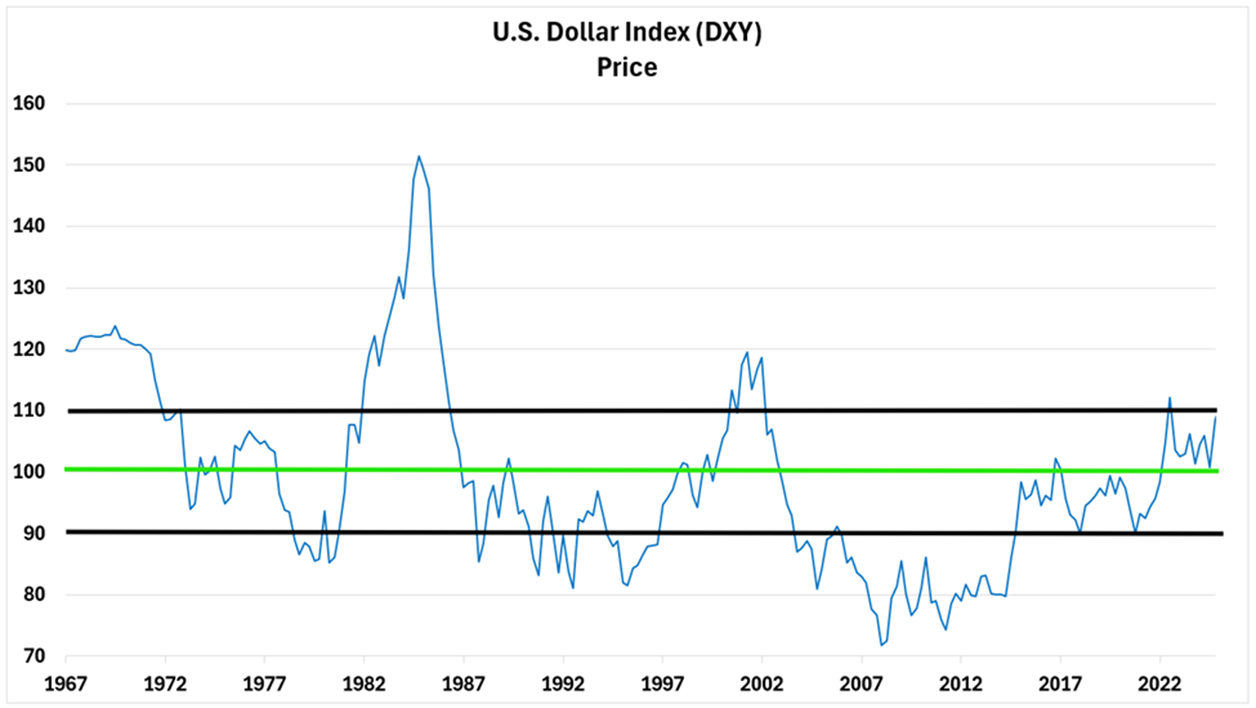

Here is a chart showing the DXY over the last 58 years…

On the chart, you can see that there has been some volatility with a long-term average price (green) of 100.

Over the period it has traded between 90 and 100 more than half the time. Over the last four decades, it has traded in that range closer to 70% of the time.

The first thing to note about the chart is that periods of dollar strength or weakness have not been correlated much to the stock market.

The dollar was strong in the early 2000s as the stock market collapsed during the Internet Bubble crash, but it was even higher in the mid-1980s when the stock market soared.

It was also weak going into the global financial crisis, but then the stock market soared and it remained low for several years.

Given that the U.S. is a net importer (we buy more than we sell) to the tune of about $800 billion or roughly 3% of GDP — a strong dollar should be GOOD for consumers. Good for consumers should be good for the economy.

Recently, though, there has been a great deal of angst about the higher dollar.

Don’t Let the Buck Get You Down

The fear surrounding the dollar rally doesn’t hold up to the almost 60-year data set. I guess “this time could be different,” but the data is overwhelming that movements in the dollar have not had any impact on stocks.

Even when we went to our highest highs, the stock market soared.

My view is similar to our view on interest rates. The movement in the dollar is not large enough or fast enough to make a difference.

Unlike interest rates, though, I can’t recall a time in my 30-year career when movements in the dollar have EVER really had an impact. Three decades and not once!

Maybe, however, the drivers behind the move in the dollar are factors that could negatively impact the stock market and economy. Is the dollar telling us something?

This happens sometimes (like the global financial crisis), but right now the dollar is simply trading with interest rates.

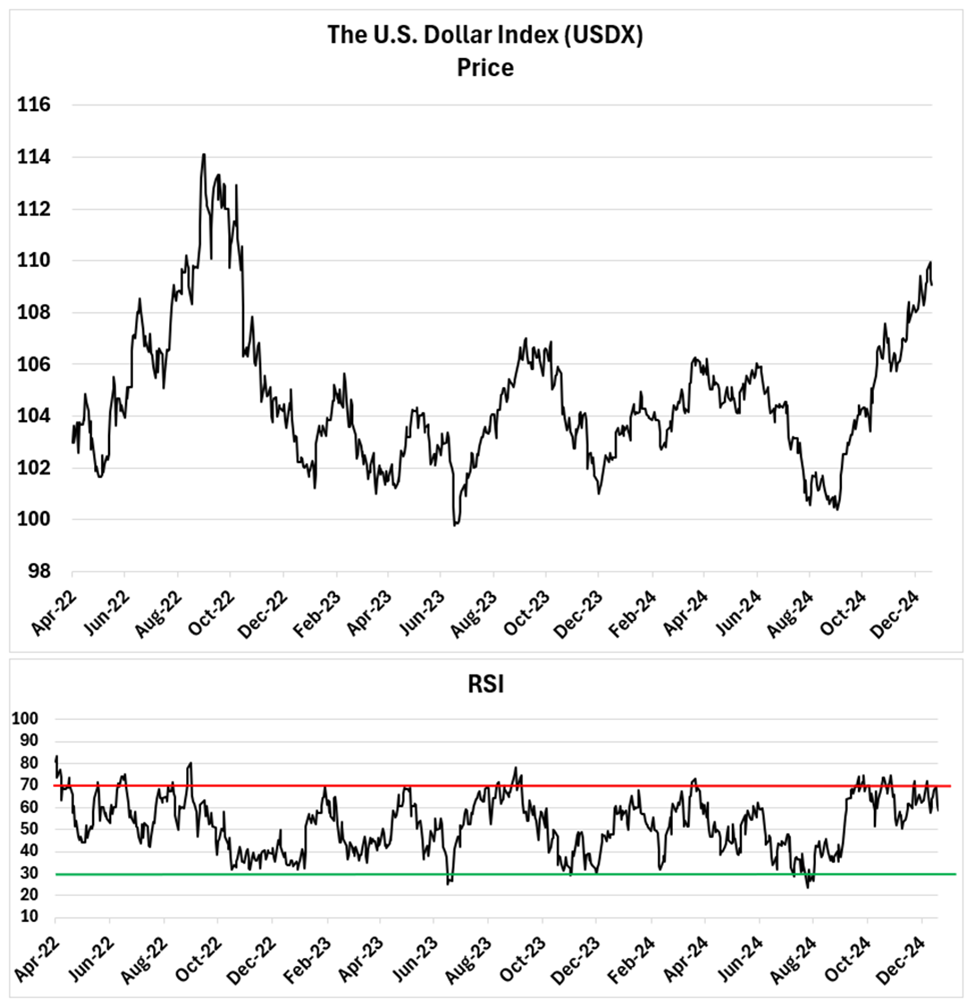

Below are the price charts for the yield on the 10-year U.S. Government Bond and the DXY Index.

We have also included the chart of my favorite short-term technical indicator, the relative strength index (or RSI). This is a good indicator of investor emotions.

Here are the charts…

While they are not identical, they track very closely. Especially in recent months.

Our argument for why the dollar has moved higher is the same as it was for interest rates in last week’s note. It is not inflation. It is not government debt.

It is too many investors on one side of the boat. Look at the RSI of the DXY trading above the overbought 70 level.

As I said in my previous note, these are trading assets that are subject to human emotion just like any stock.

What I find particularly egregious about the discussion of the dollar and its impact on the stock market is that it almost NEVER has an impact.

In our lifetimes we might see it happen, but it hasn’t yet. It also is certainly not now.

One point is to remember: the media is not your friend. They are not here to make you money. (We, however, are!)

So tune out the “smart” money narrative noise and focus on your process. Come up with a great plan and stick to it.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Fade the End of the World

Posted March 06, 2026

By Greg Guenthner

The Dark Side of the Tape

Posted March 04, 2026

By Nick Riso

The Iran War: What’s Next for Stocks, Oil and More

Posted March 02, 2026

By Enrique Abeyta

It’s Not Just You, This Market Is Mind-Melting

Posted February 27, 2026

By Greg Guenthner

Israel, India and Iran: The Calm Before the Strike

Posted February 26, 2026

By Enrique Abeyta