Posted October 28, 2025

By Ian Culley

The “Dash for Trash” Is On

The dash for trash has begun.

Forget about value stocks and sound business models. Right now, it’s all about fast money.

69% in 38 days… 82% in 21 days… 191% in 25 days…

These are the recent rallies for Rocket Lab Corp. (RKLB), Unusual Machines Inc. (UMAC) and D-Wave Quantum Inc. (QBTS), respectively.

It’s no secret. Markets are heating up. Even former meme stock Beyond Meat Inc. (BYND) is capturing speculators' attention.

It doesn’t surprise me that BYND and other meme stocks are gaining traction.

The market’s back in melt-up conditions, and stocks are popping off right and left. Traders are looking for gargantuan gains in a matter of days.

If these highly volatile conditions make you feel a little queasy, don’t worry. You don’t have to chase speculative stocks that have already rallied 300% this year.

Plenty of outstanding opportunities exist across the market, and many of them are worn-torn veterans from the past melt-up.

Today, I’ll show you three of them.

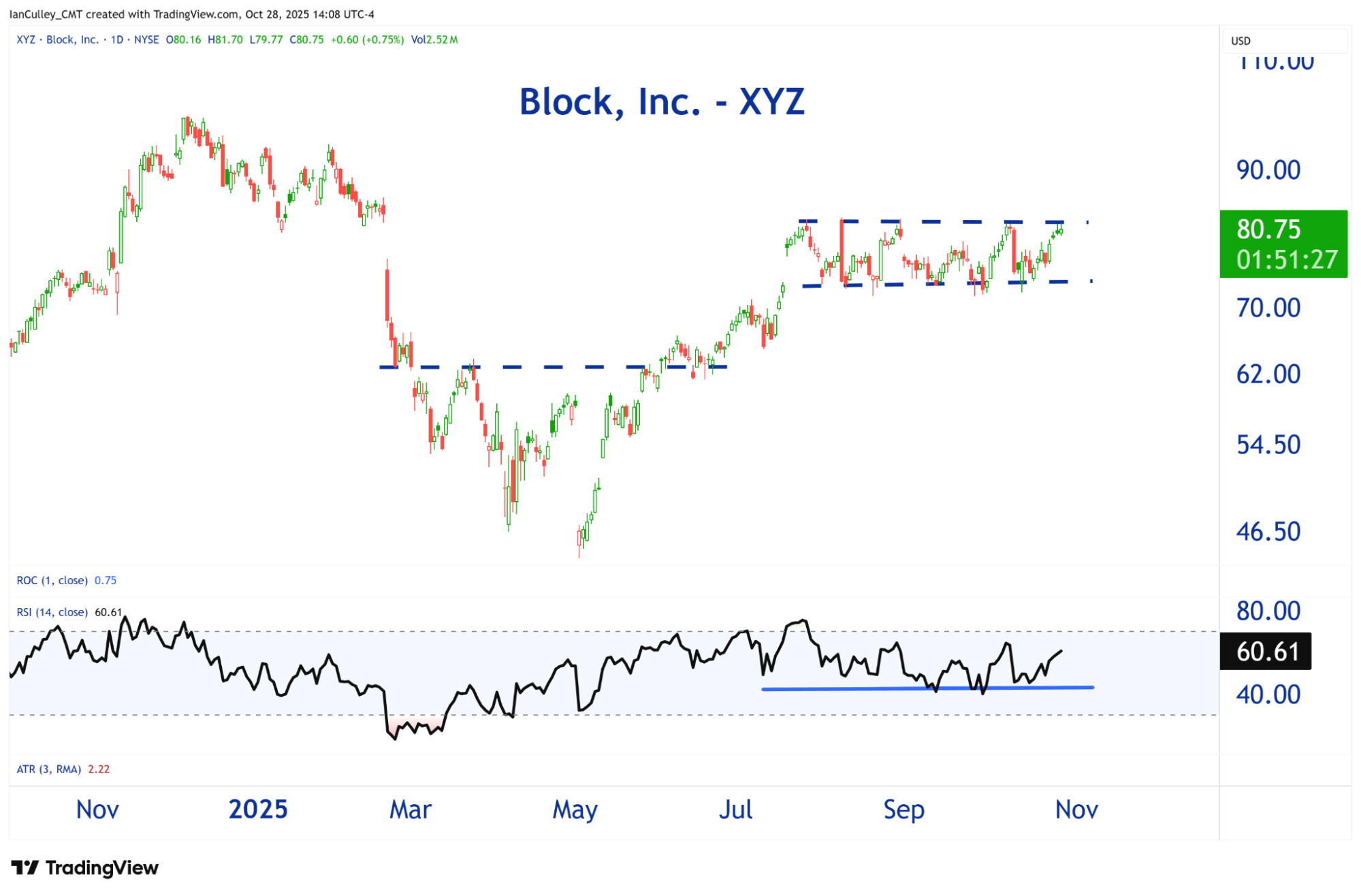

1. Block Inc. (XYZ)

You may recall the company Square. It rallied off the March 2020 lows from approximately $33 to $283 in under a year.

Like most melt-up names at the time, it ultimately cratered more than 80% from its peak.

I ignored this stock for years until it came into focus earlier this spring. Only Square appeared under a different name with a new ticker: Block Inc. (XYZ). (I guess you change the company name if share prices go nowhere for years.)

Right before Memorial Day, XYZ flashed a clear buy signal. The chart carved out a tradable low. Seasonal patterns supported a border tech rally. And the tech-growth risk barometer, ARK Innovation ETF (ARKK), entered rally mode.

Well, the trade worked out handsomely, climbing more than 40% into late July and well beyond my initial profit target.

Three months later, XYZ is preparing for the next leg higher.

The technical setup is as good as it gets for a breakout trader. Price is challenging the upper bounds of a tight 15% range, and momentum is improving (lower pane).

But what I like most about Block in this environment is that I remember when those little white squares first burst on the scene.

I was amazing. I no longer needed cash at the farmers' market.

On the other hand, I have no idea what a quantum computing chip actually does or how it will eventually change my life.

The fervor for Quantum computing, flying cars, and drone stocks will eventually spill over to the old-school pandemic names that were imprinted in traders' minds during the “stocks only go up” rally.

Once it does, stocks like the next two names and XYZ will bring traders back to 2021 and give them a chance to right their mistakes from the last melt-up. That’s an offer I imagine few will be able to resist.

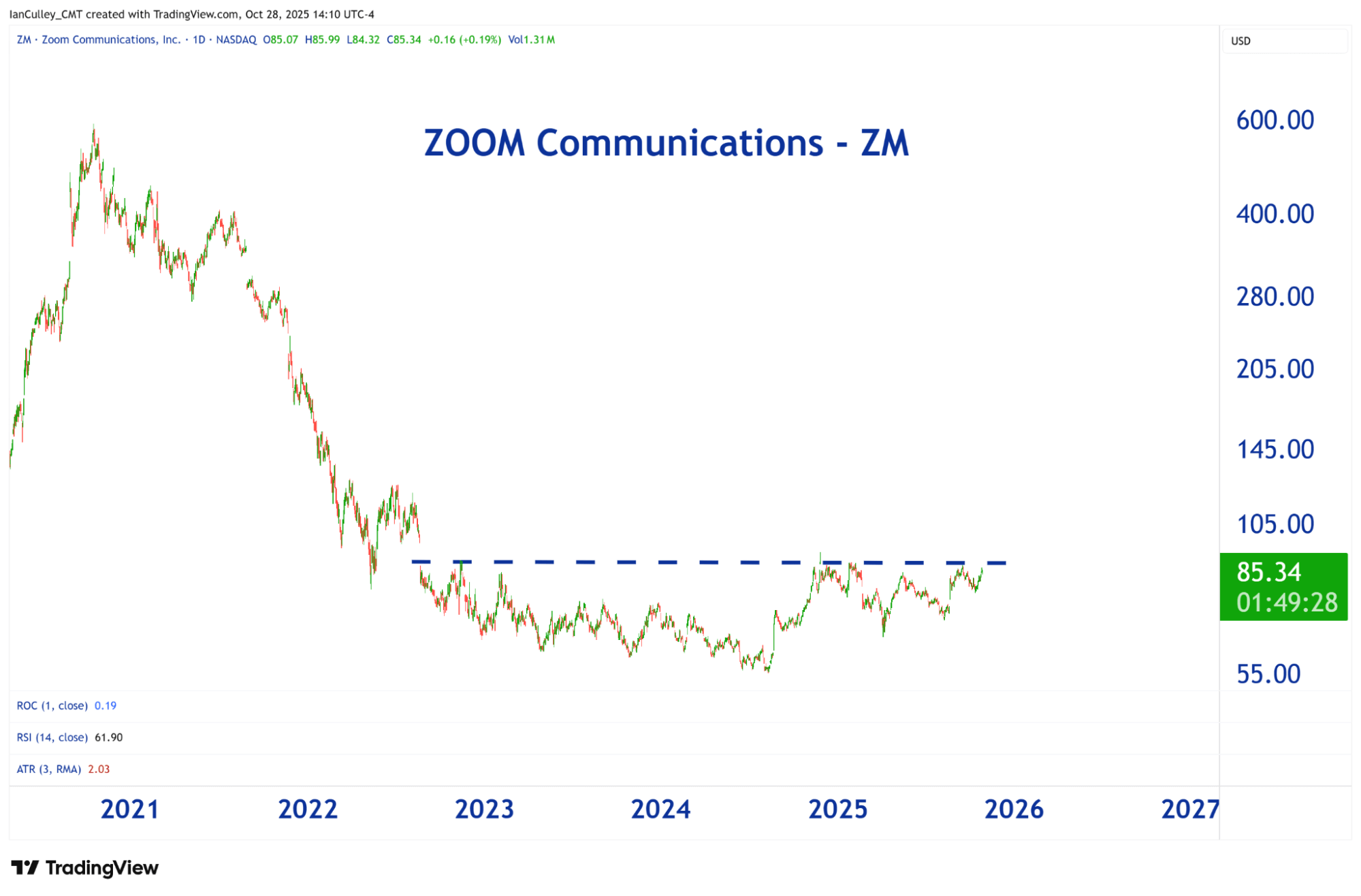

2. Zoom Communications Inc. (ZM)

Next, you have the video conferencing Zoom Communications (ZM).

Zoom checks many of the same boxes as Block. It’s a real company with legitimate revenue. It survived the previous bubble. And most traders can recall its explosive rally.

Plus, remote work is here to stay. Surveys estimate approximately 36.2 million Americans will work from home this year. Working from home is only possible with video conferencing software such as Zoom.

And then there's the burgeoning telehealth industry. I actually had a virtual appointment with my doctor last week, and he practices 15 minutes down the road from my house.

So like XYZ, Zoom isn’t going anywhere — and neither has its share price. I suspect that will change any day now.

ZM has been in the bottoming process for going on three years. However, a decisive break above its year-to-date high would register a fresh multi-year breakout and the beginning of a new uptrend.

Zoom could run it back to $120 to $140 in a heartbeat. And sest of all, you don’t need to chase it at these levels.

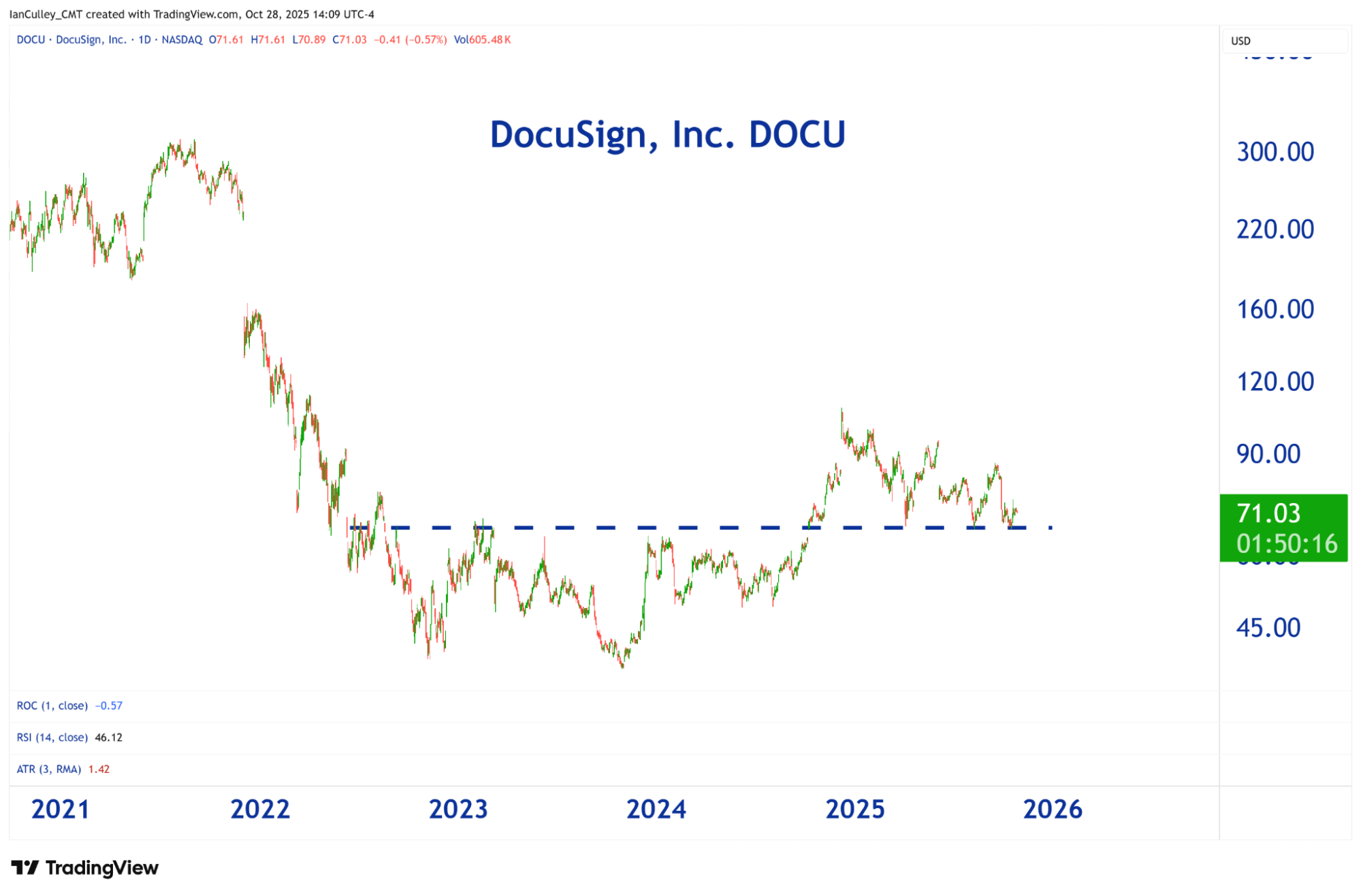

3. DocuSign Inc. (DOCU)

Finally, we have DocuSign Inc. (DOCU).

Like the previous companies, DocuSign endured the ultimate test of a full-blown melt-up and emerged a mainstay. (I can’t remember the last time I signed a legal document on physical paper.)

That’s what I like so much about these names. They’re survivors. They know how to go parabolic, and most traders know it.

The only thing DOCU is missing is a fresh rip-roaring rally. If DOCU is joining the melt-up, this is the spot.

Price is retesting a critical shelf of former highs that are now acting as support, which provides you with an excellent level to define your risk. In this environment, a solid bounce could turn DOCU into a quick double.

On the other hand, you’ll know you’re wrong if DOCU is slipping below its August low. And if it does, you can move on and buy a drone stock.

Don’t get me wrong, I have no qualms with buying a tactical dip in a flying car name or any other uber speculative ticker. Those trades simply demand a different set of rules and a watchful eye.

No one is forcing you to trade the most volatile runners.

In fact, the market is offering you plenty of options to play the melt-up. Many of those stocks, like the three mentioned above, have been through a cycle or two and are legitimate companies.

It’s not a bad idea to have a few tried and true tickers in your portfolio, especially when traders are chasing the newest idea, the hottest story, and the fastest money.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

![[VIDEO] The Year-End Rally Is Back On!](http://images.ctfassets.net/vha3zb1lo47k/4mfoBVvX4hSw8BLbDAjPP7/c13db091bfeef2a493bcfd0f1e73df14/ttr-issue-12-05-25-img-post.jpg)

[VIDEO] The Year-End Rally Is Back On!

Posted December 05, 2025

By Greg Guenthner

The Truth About Stock Market “Voodoo”

Posted December 04, 2025

By Enrique Abeyta

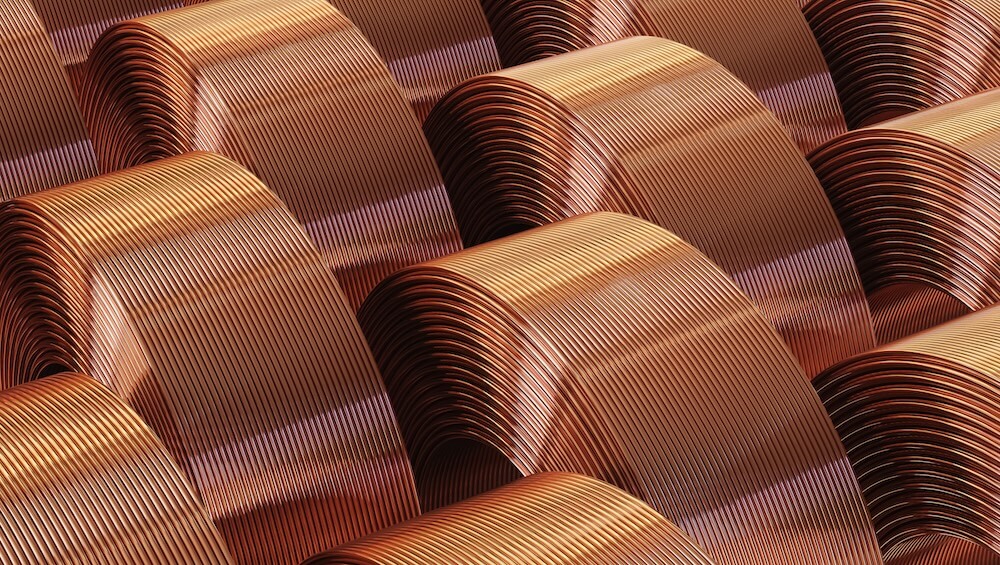

Breakout Alert: Copper Coils for a Monster Move

Posted December 02, 2025

By Ian Culley

Time for a Reality Check

Posted December 01, 2025

By Enrique Abeyta

Thankful for the Greatest Game on Earth

Posted November 27, 2025

By Enrique Abeyta