Posted January 13, 2025

By Enrique Abeyta

The Case for a 2025 Market Melt-Up

Prediction season is upon us!

Over the past week, I shared 10 scenarios that could shock investors and the market in 2025. To be clear, I view the list as a set of likely surprises, not predictions.

They’re events that I strongly believe could happen — but will catch most investors completely off guard.

Today, I wanted to dive deeper into one of those surprises.

In my view, the stock market will be up again in 2025 — either by a lot or by a little — but NOT down, like many anticipate.

Allow me to explain.

Stocks Will See Green

The outlook is simple. Stable(ish) interest rates and stable(ish) inflation, along with positive economic growth and corporate earnings growth, will push the stock market higher.

If I’m wrong about any of those four variables in a big way, then the outcome will be different. For now, though, I think this is a reasonable view.

The idea that the market might be up by a little is probably most folks' base case, and I agree.

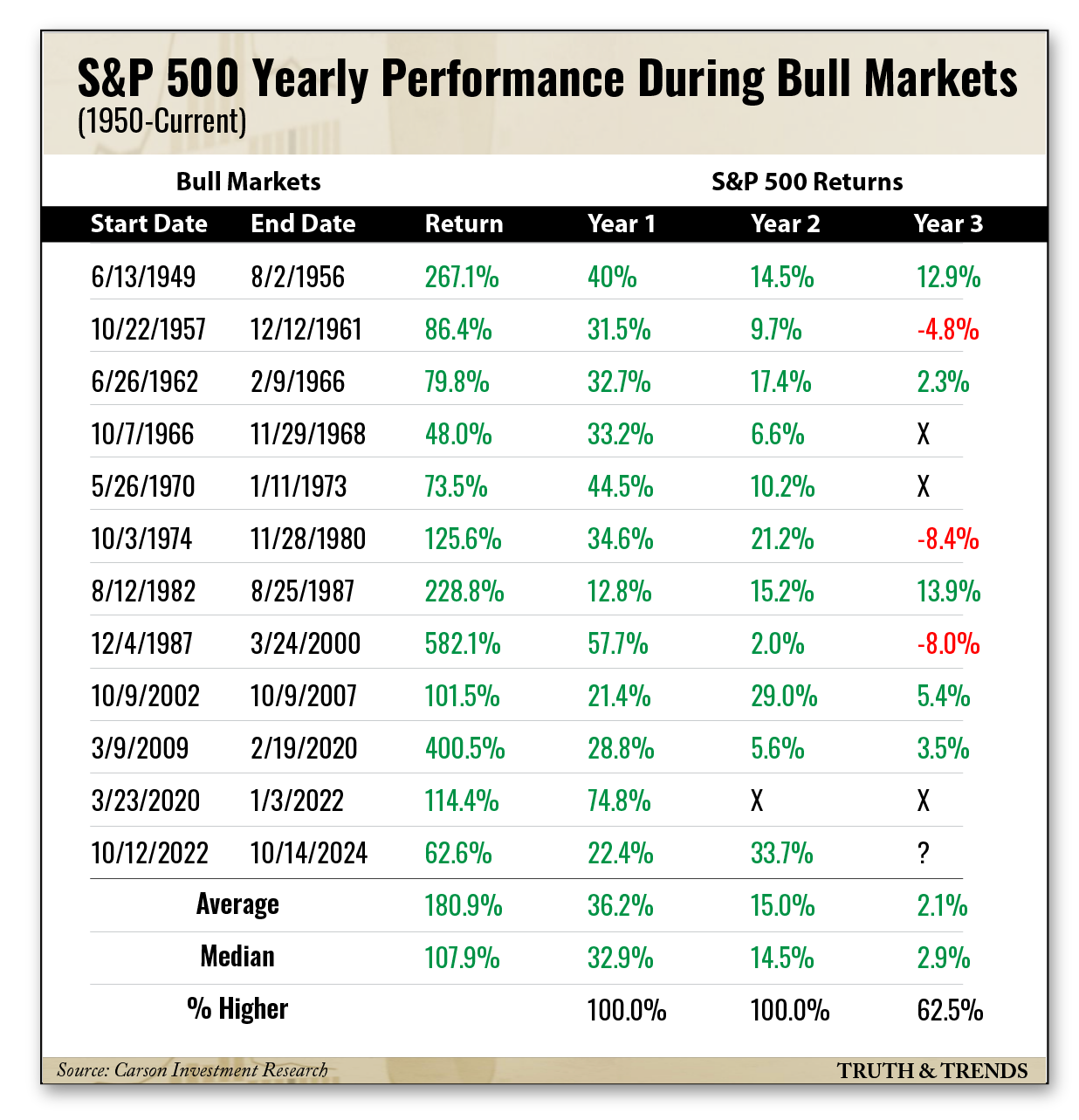

Here’s a chart from our friend Ryan Detrick at Carson Group showing the history of bull market performance by year.

You can see the third year of a bull market is usually the most difficult.

A choppy stock market in 2025 makes a lot of sense. After two strong years (and quite a few political and economic crosscurrents), it would seem to be the consensus.

But what if this is wrong?

This gets back to our conversation about a potential “melt-up” in the stock market.

The Trend Is Your Friend

Most investors see the stock market up by a lot and expect that trend not to continue.

That’s not how the stock market works in the intermediate term, though, as the biggest rallies in history have happened in succession.

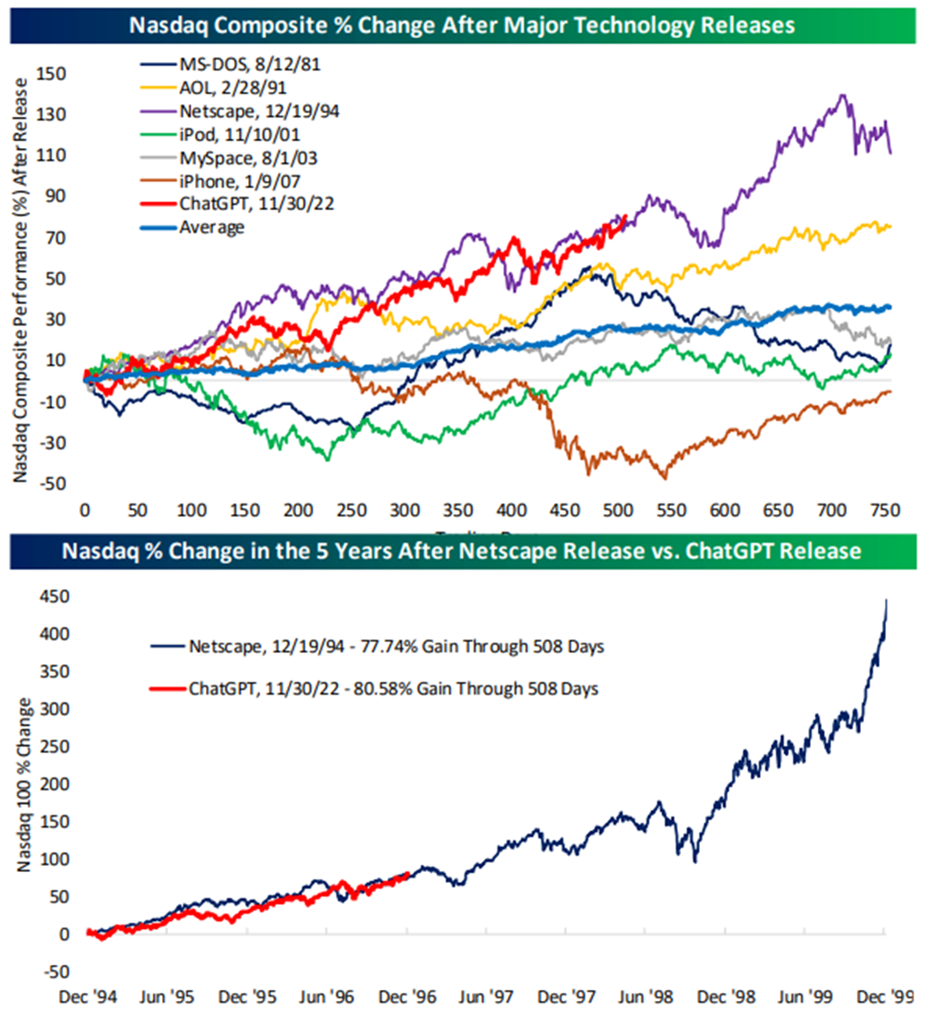

Below is a pair of great charts from Bespoke Investment Research. The first is a little busy, but it shows the performance of the Nasdaq Composite after the introduction of major new technologies.

Think of the introduction of Microsoft DOS back in 1981, the launch of the first major internet service provider, America Online, in 1991 and the iPhone in 2007. Significant technological advances that changed the world.

Here’s the chart, along with one specific example highlighted underneath.

Source: Bespoke Investment Research

This shows how artificial intelligence and ChatGPT compare to some of the big, game-changing trends of the past.

So far, ChatGPT looks most similar to the introduction of Netscape back in 1994.

While the internet first burst onto the scene in the late 1980s and early 1990s, it wasn’t until the consumer-facing and user-friendly Netscape browser was introduced that it became widely known among consumers.

This is similar to what has happened with AI and ChatGPT. Developments in AI have been happening for years, but ChatGPT brought it to the mass market.

Based on the above charts, you can imagine the potential upside in the stock market.

The S&P 500 was 24% in 2023 and 23% in 2024. Can buyers sustain a double-digit rally in 2025?

While the third year of a bull market is usually difficult, there’s something special about having two solid 20%+ years in a row…

Strength Begets Strength

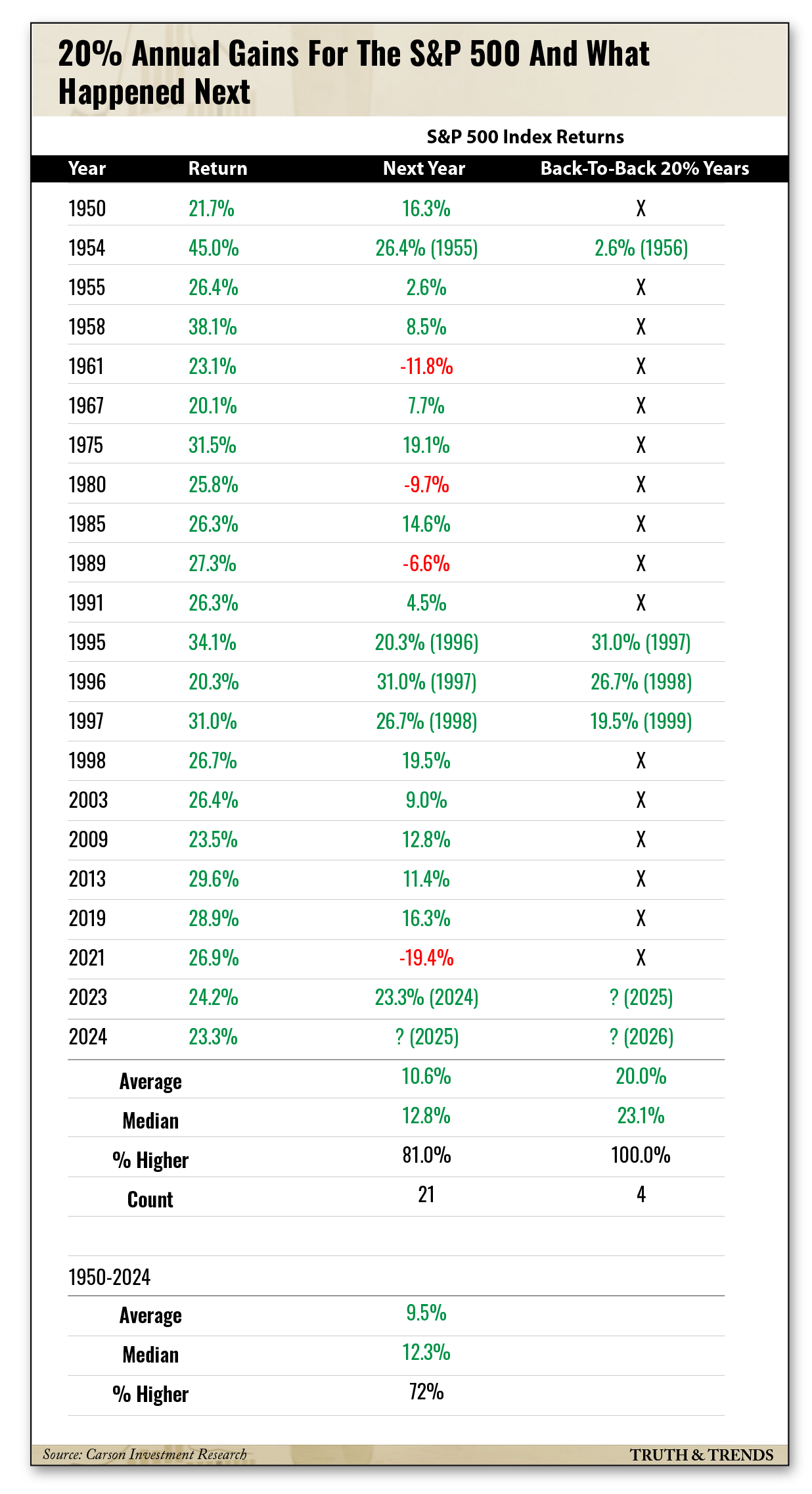

Here’s another table from Detrick showing how the stock market has performed after two back-to-back 20% years…

Getting two strong years like that is pretty rare and has only occurred four times since 1950.

All four times, the market has been higher the next year. This adds to my conviction that the stock market will not finish the year lower.

The average gain has also been strong, with only 1954 coming in with the “up a little” scenario. The other years in the late 1990s averaged over a 25% return.

I am confident THAT outcome is not in the consensus!

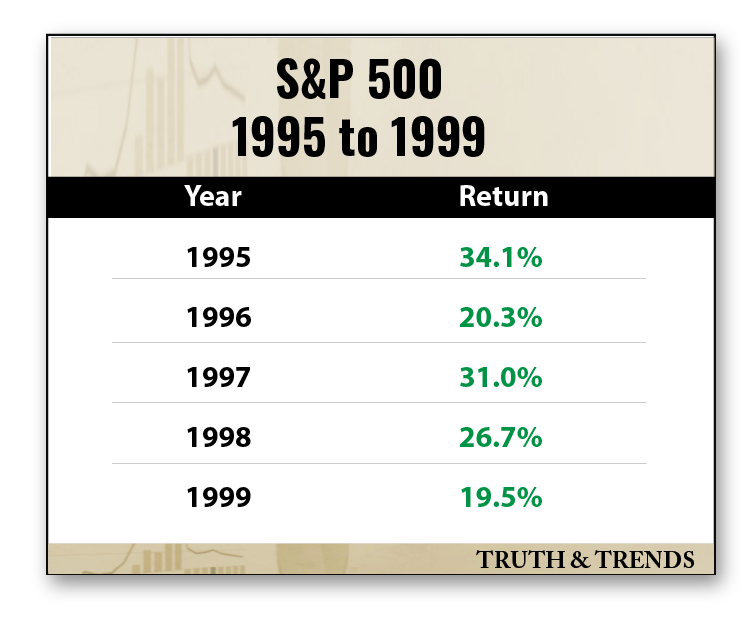

Here’s a quick table showing that period from the late 1990s that I referenced above…

Will this happen again? I can’t say for sure, but being open to the idea is a good strategy.

I challenge myself every day to be prepared for the downside. However, being prepared for unexpected upside also makes a lot of sense.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

It’s Not Just You, This Market Is Mind-Melting

Posted February 27, 2026

By Greg Guenthner

Israel, India and Iran: The Calm Before the Strike

Posted February 26, 2026

By Enrique Abeyta

Tariff Tantrum Redux

Posted February 23, 2026

By Enrique Abeyta

The Weight of Nothing

Posted February 20, 2026

By Nick Riso

“Luck Is Not Real”

Posted February 19, 2026

By Enrique Abeyta