Posted June 12, 2025

By Enrique Abeyta

Stock Wars: Palantir vs. CoreWeave

Speculative trades are back on the menu after the stock market’s roaring rebound.

The word “speculation” may have a bad reputation. But look it up in the dictionary and you’ll see…

“Investment in stocks, property or other ventures in the hope of gain but with the risk of loss.”

That doesn’t sound like a bad thing to me, but rather a description of reality.

In my opinion, there’s nothing inherently wrong with speculation when it comes to building your wealth. You need to take on risk to see good returns.

But not all speculation is the same. And even with the potential for return, the risks don’t always make sense. Think of it this way...

It’s one thing to invest a small bit of your money in a promising new biotech company after you've done some homework on their trials.

Throwing your entire nest egg at a meme stock that's only soaring because of internet buzz, on the other hand, is a completely different animal.

Both are speculative, sure. But one's a calculated gamble based on real potential, while the other is more like a lottery ticket.

Today, I’ll show you how to think about speculative trades using two of the market's hottest stocks as examples.

The Newcomer: CoreWeave

First, let’s look at CoreWeave Inc. (CRWV). This company provides software solutions and cloud services to major technology companies.

They essentially build out large data centers that they can rent out to bigger companies like Google and Microsoft.

There has been some controversy about the company’s balance sheet and the fact that Nvidia, one of the biggest suppliers, has also been one of their biggest sources of funding.

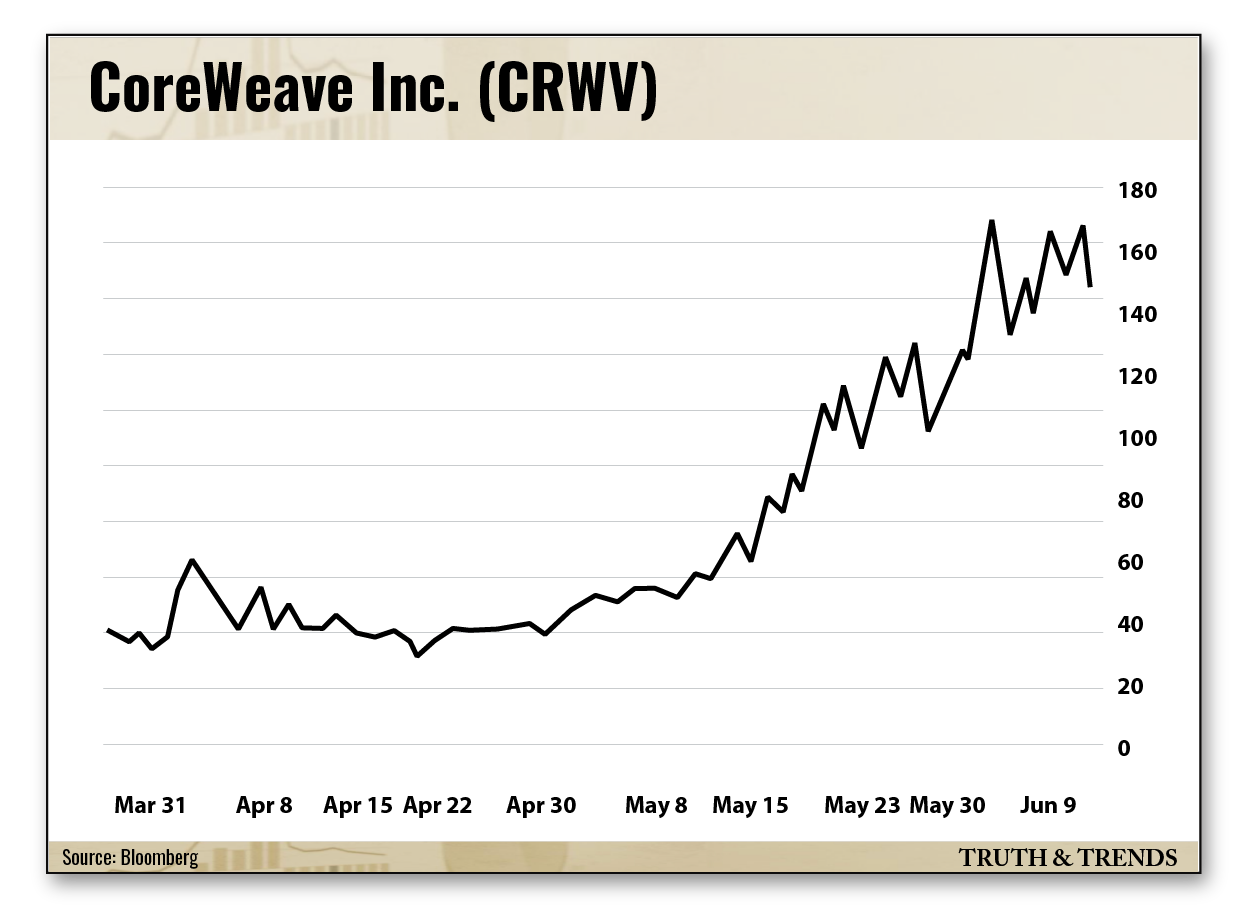

The area in which they operate, though, is super hot. The company went public via IPO back in March. Here is a chart of the stock price since then.

After its debut, the stock actually broke through the IPO price of $40 before it began trading higher.

It churned sideways during the subsequent market volatility. But as the overall stock market recovered, the stock soared.

From $50 a share at the start of May, the stock recently traded as high as $166 per share at the start of June. That’s a 230% return in just one month.

No doubt, these are some great returns. But is it worth speculating on this rally continuing?

I think CRWV has a very interesting business model and certainly operates in a sector with tremendous growth.

What I don’t like, however, is that we have very little information on the company. The stock hasn’t even been around long enough to have a 100-day moving average.

The company also hasn’t reported earnings yet, so we don’t know whether they are likely to beat or miss earnings.

To use a blackjack analogy, buying this stock is like walking up to the table and knowing you have one face card or a “10.”

Not a bad place to start. But you don’t know what your other card is or what card will be dealt.

So while you may have the start of a good hand, you simply have too little information.

Given how many options you have in the stock market, why would you make a bet where you don’t know?

The Returning Champ: Palantir

Compare that to another stock market favorite, the security software company Palantir Technologies Inc. (PLTR).

They are a next-generation supplier of security systems to major governments and corporations and one of the leaders in artificial intelligence.

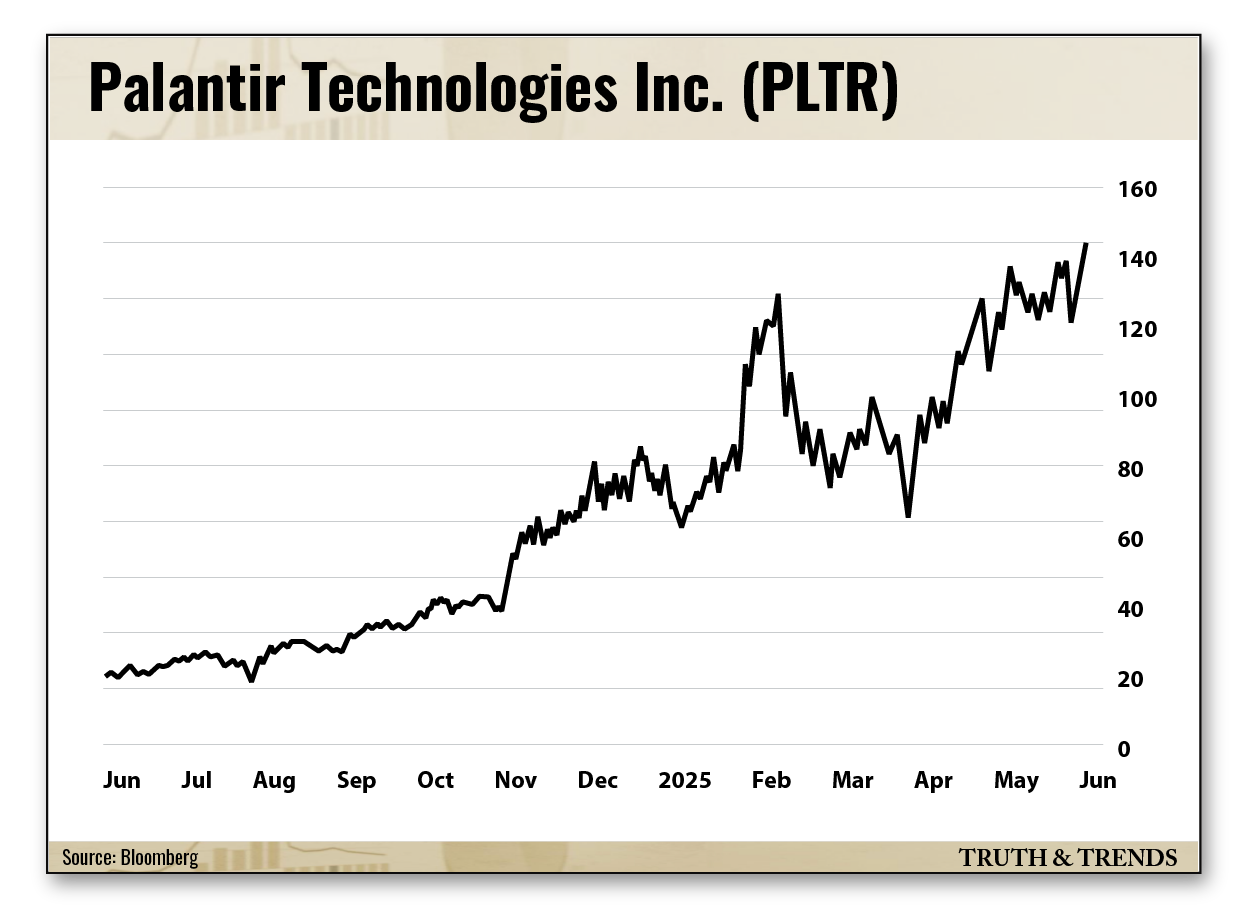

This has been another outstanding stock. Check out the chart below.

The share price has gone from less than $20 to an intraday high of $140 just yesterday. And the stock has doubled since the market bottomed back in April.

This company came public via a direct listing back in September 2020. As a result, we have a lot more data on PLTR.

First, you can see on the chart that we have a well-established uptrend in addition to well-defined 50-day, 100-day and 200-day moving averages.

In the context of this uptrend, it has been an outstanding strategy to buy this stock as it tested its moving averages.

If you bought a third of a position at the 50-day moving average and another third position at the 100-day moving average, you would be sitting on triple-digit returns over the last year.

We also have lots of fundamental data regarding the company’s operations.

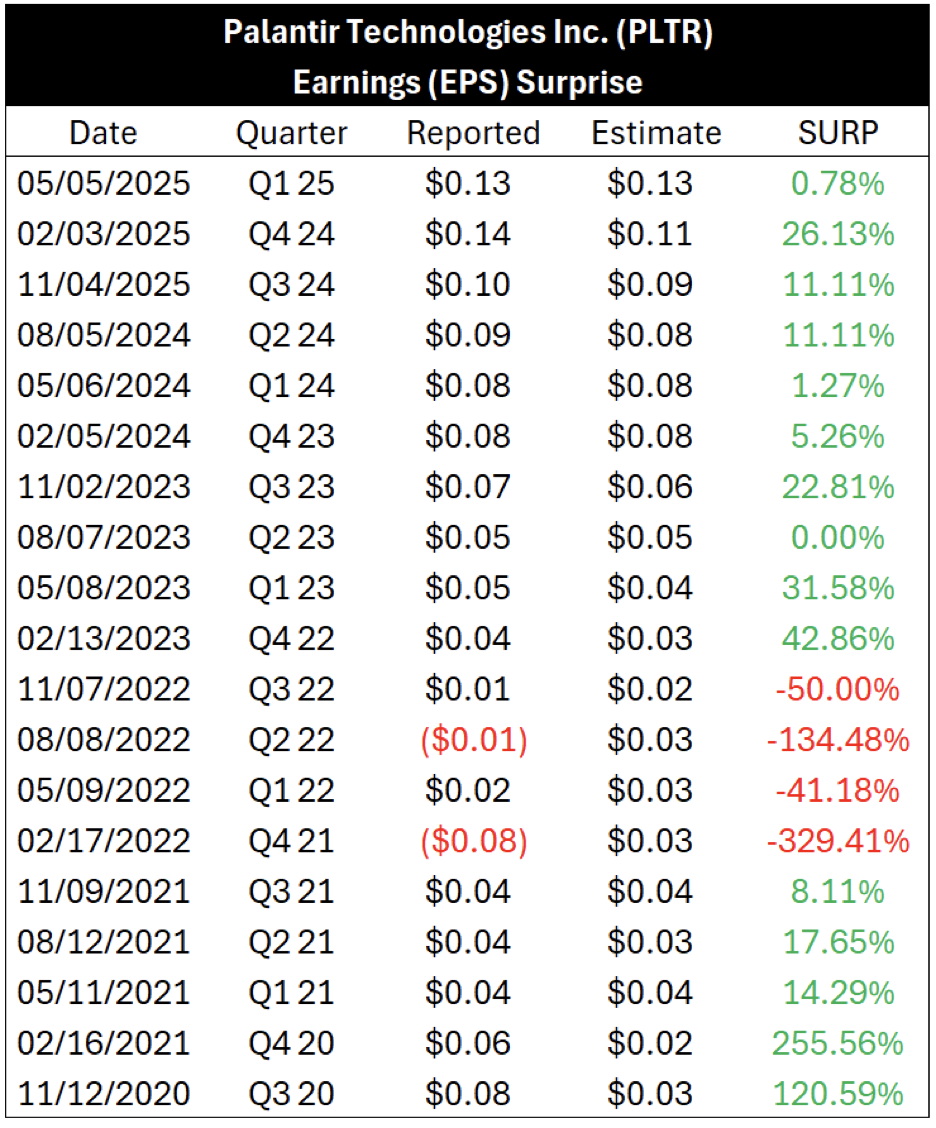

They have reported almost five years of quarterly results and have beaten the numbers for the last few years. Here is a table showing those results.

After struggling during the technology pullback in 2022, they have beaten numbers every quarter since the start of 2023, resulting in analysts raising their EPS estimates.

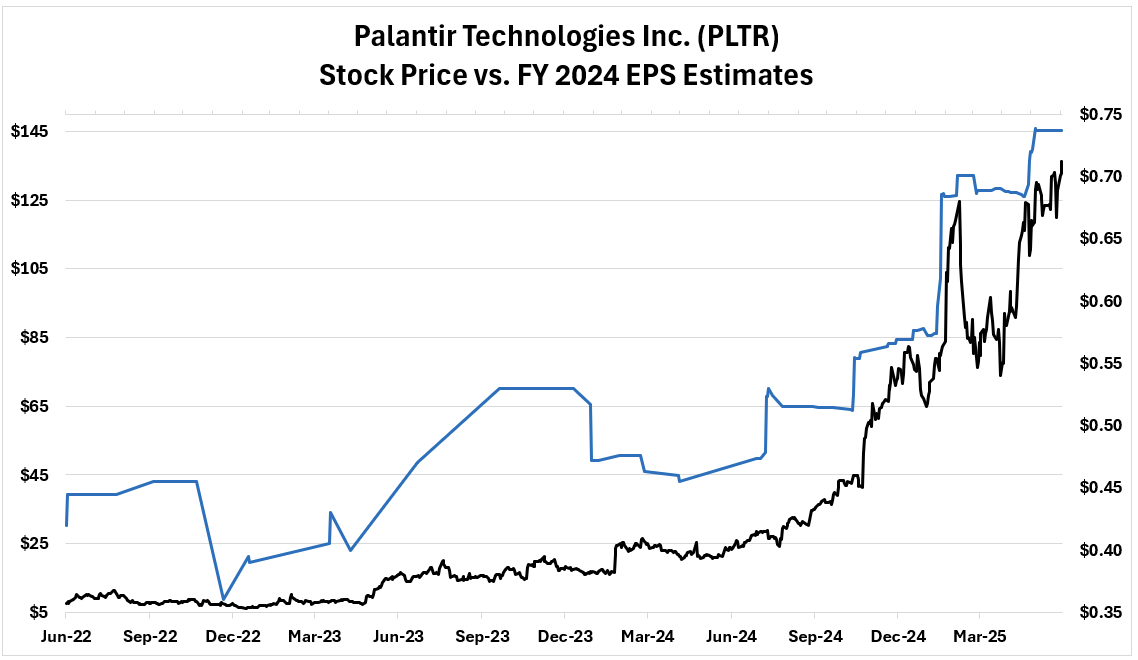

Here is a chart showing the stock price (black line) and the analyst’s consensus estimates for fiscal year 2026 EPS (blue line).

Numbers have been going straight up, and estimates have more than doubled in the last year. These two pieces of analysis are why the stock is in such a well-established uptrend.

So, is PLTR a better “speculation” than CRWV?

As a trader, I believe it is. But a word of caution before you go out and buy shares right now…

The stock is overextended after its massive rally. It recently traded above 80 on the relative strength index (RSI), indicating that it’s overbought.

You would much rather buy the stock on the moving averages rather than chasing the price.

Bottom line, speculation can provide you with huge returns. But not all speculation is the same.

The difference between a winning and losing bet often comes down to how much you know about the stock before you buy it.

We advise you to go for stocks with the most data. And remember, timing is everything.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Elon Musk Changed My Life Forever

Posted June 30, 2025

By Enrique Abeyta

How I Build MONSTER Positions

Posted June 27, 2025

By Greg Guenthner

Ken Griffin Is Full of Sh*t

Posted June 26, 2025

By Enrique Abeyta

The “Wall of Worry” Climb Is Over

Posted June 24, 2025

By Ian Culley

GME: A Warren Buffett Kind of Stock

Posted June 23, 2025

By Enrique Abeyta