Posted January 31, 2025

By Greg Guenthner

Sector Shake-Up! And the New Winners Are…

It’s been a noisy week!

The market swamped us with a Fed meeting and a slew of big earnings announcements.

And it also treated us to an artificial intelligence disaster, complete with wall-to-wall coverage of the most important stock to ever exist — Nvidia (NVDA).

If you tune into CNBC, you’ll hear all about the single-stock leveraged ETFs some traders are using to bet on NVDA and other hot plays.

This is what happens when a huge group of investors is convinced a stock can only go up; they take on leverage without fully understanding the potential consequences and inevitably get burned in the end.

But there are plenty of opportunities in this market not named NVDA. In fact, we think this AI shakeup will come and go without much lasting effect on the broad market.

Here’s why…

Rotation, Rotation, Rotation

Plenty of positive action is taking place under the surface of this mini tech disaster.

While Nvidia dragged down the major averages at breakneck speed, cyclical market sectors behaved as if they didn’t get the DeepSeek memo. Following Monday’s initial shock, it seems more like a lack of concern than a failed transmission…

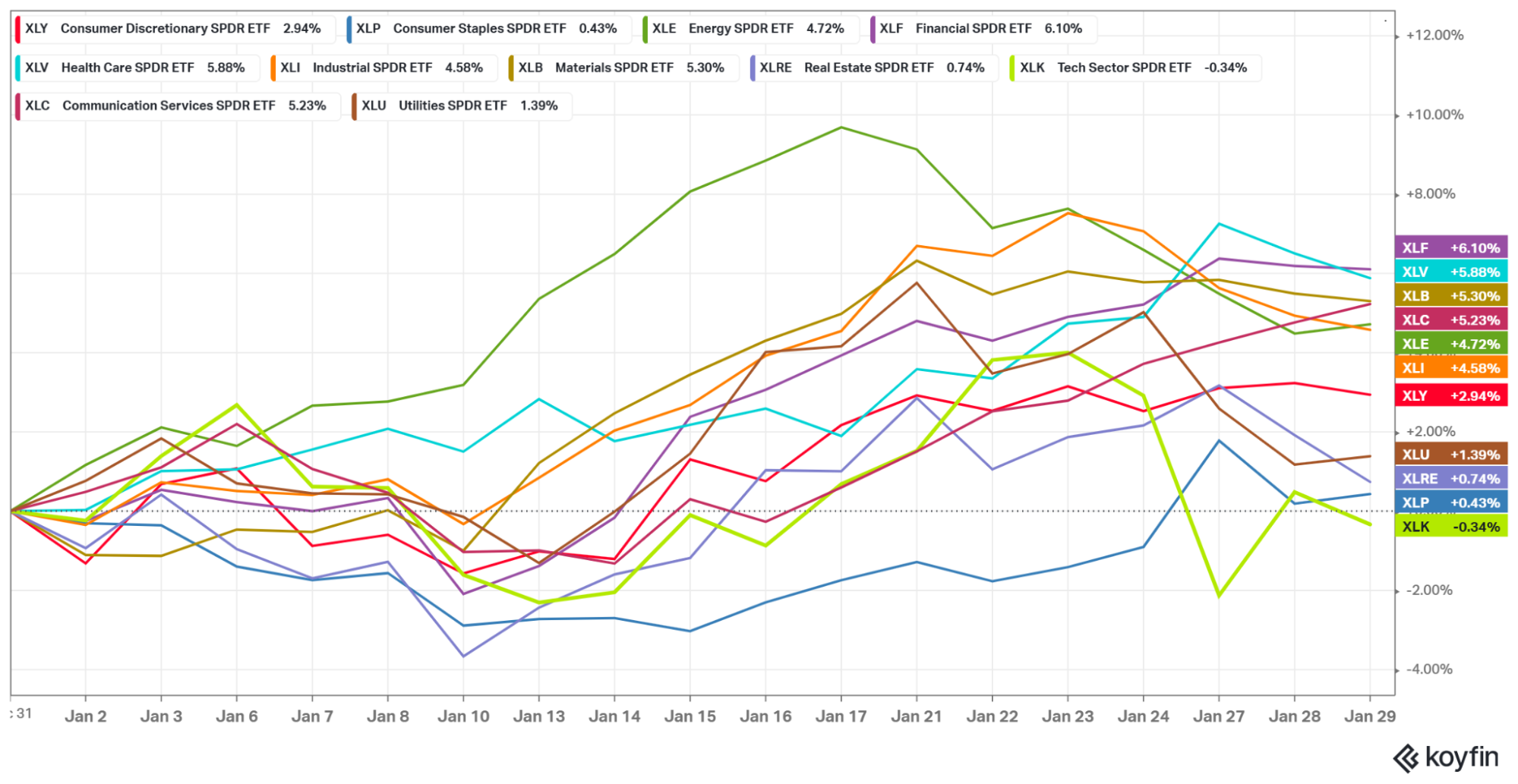

Check out the year-to-date performance of the large-cap sector ETFs.

I know we have one more trading day left in January. But so far, the only S&P 500 sector printing negative returns is technology (XLK). Every other sector is seeing green, even staples.

Notice what sectors are leading: financials, materials, energy, industrials. It’s no wonder Papa Dow finished Monday afternoon in the green. (In fact, all 30 Dow Jones Industrial Average components posted positive returns to start the week.)

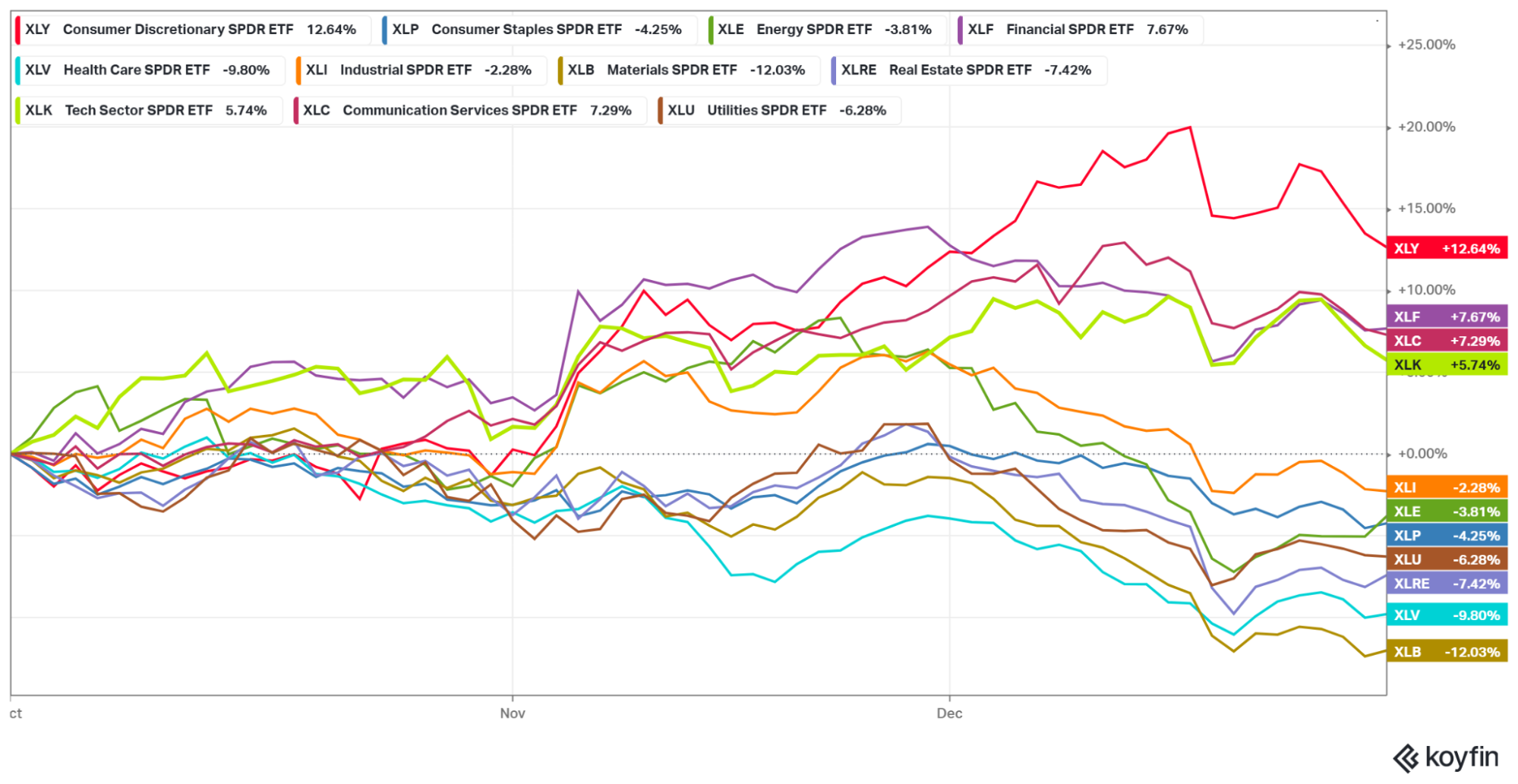

Finally, cyclical areas are joining the bull market party after their Q4 no-show. Here’s a look at last quarter’s performance of the same S&P 500 sector ETFs.

It looks nothing like the start of 2025!

Consumer discretionary, financials, communication services, and technology held the top spots. But here’s the kicker…

They were the only sectors to post gains. The rest of the pack were in the red by at least 2%. (Materials were the biggest loser dropping 12%!)

Remember, participation beneath the surface was unraveling back then. More stocks were printing fresh lows than new highs. And investors were eagerly awaiting a Santa Claus Rally.

Fast forward to today, and the market is undergoing a textbook bullish rotation as the one-month new highs list expands and last quarter’s losers take the lead.

From the looks of it, the broader market doesn’t care whether investors want to own NVDA or not. As long as that’s the case, neither should you.

But just because the tables have turned in favor of materials, industrials, and financials doesn’t mean you should ditch technology.

Sellers Are in Short Supply

Sunday’s open provided us with the first clue the Nvidia shakeout was an isolated event. From the outset the selling pressure was narrow.

Nasdaq futures gapped lower at the open and by early Monday morning had dropped almost 1,000 points. However, the majority of overnight markets remained quiet. Sure, the other major averages took a hit along with the Nasdaq but nowhere near as severe.

Plus, areas of the market that tend to receive a defensive bid – T-bonds, gold, crude oil — were mute. Traders were not bothered one bit by the DeepSeek shenanigans.

Instead of running from the fire, investors rushed toward it. Speculative software names like Atlassian (TEAM) and Service Now (NOW) avoided the bloodbath. And Salesforce (CRM) ripped almost 4% Monday.

But that’s just it: Monday wasn’t a bloodbath. NVDA and a handful of extended AI stocks took a haircut after leading the market for the past nine months. A little lowering of the ears for the names was long overdue much like the 10% correction that keeps eluding the stock market.

Meanwhile, even the tickers that took a sympathy beating bounced back the following day. After shedding roughly a quarter of a percentage point to start the week, Shopify (SHOP) turned it around with a 9% rally Tuesday.

And the sexy six?

They appear unfazed by Nvidida’s woes. Meta Platforms (META) gapped to new all-time highs yesterday, while Alphabet Inc. (GOOG) and Amazon (AMZN) danced around record levels.

The rest of the Mags should benefit from cheap chips. Regardless, the storm clouds are parting with blue skies ahead for stock market bulls.

If you still need convincing, I’ve got one last chart to share with you.

So Goes January…

So goes the year!

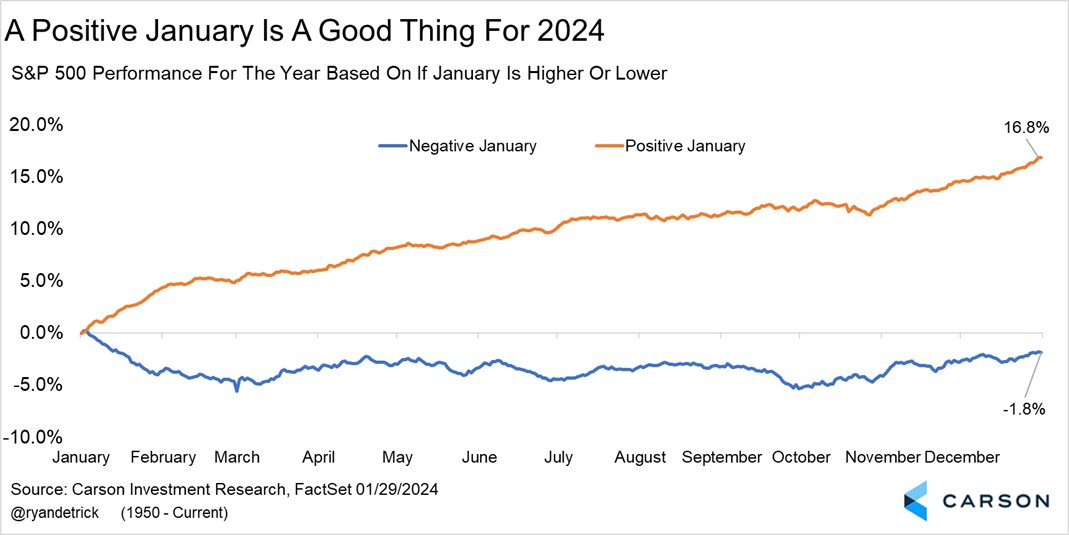

Perhaps it sounds superstitious, but January returns set the tone for the rest of the year.

Ryan Detrick of Carson Investment Research highlights the significance of the January Barometer below.

The S&P 500 averages a 16.8% gain when the first month of the year ends on a high note.

On the flip side, a negative January portends more weakness to come, averaging a 1.8% loss for the following calendar year. We’ll have a definitive read on this year’s gauge by today’s close.

It’s pretty clear that we should avoid Nvidia and a handful of AI stocks right now. But Monday’s selloff was no tech disaster — no matter what the permabears would like to think.

The S&P 500 is on course to finish January up roughly 3%. Wednesday’s FOMC announcement was a nothing burger (as expected). And earnings reports remain positive.

Meanwhile, gold is hitting new all-time highs after going nowhere since late October, and we have GDX calls over at The Trading Desk that are printing money.

Despite a volatile news week and some choppy action, there’s absolutely no reason to get too bearish right now.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Fade the End of the World

Posted March 06, 2026

By Greg Guenthner

The Dark Side of the Tape

Posted March 04, 2026

By Nick Riso

The Iran War: What’s Next for Stocks, Oil and More

Posted March 02, 2026

By Enrique Abeyta

It’s Not Just You, This Market Is Mind-Melting

Posted February 27, 2026

By Greg Guenthner

Israel, India and Iran: The Calm Before the Strike

Posted February 26, 2026

By Enrique Abeyta