Posted March 24, 2025

By Enrique Abeyta

One Company’s Secret to 47,535% Returns

I chuckle every time I hear investors or analysts argue over buybacks.

It never ceases to amaze me when obscure financial concepts become part of mainstream discourse.

I’ve seen it all during my three-decade career in capital markets. And in recent years, share buybacks have taken the cake!

But for being one of the most contested topics on the street, most pundits and talking heads have no idea what they’re talking about. Shocker!

So today, I’ll pick apart some common buyback rebukes and share with you one of the most successful stock repurchase campaigns in history.

Before we go any further, though, let's clarify what a share buyback actually is and how it works…

The Power of Stock Buybacks

Companies have a defined number of shares outstanding (for our example, let's say 100), and for publicly traded companies those are usually free to trade.

If a company has cash, it wants to spend — no matter where that cash comes from — it could go into the open market and buy some of those shares.

Let's say the stock is $10 per share and the company wants to buy 10 of its own shares.

That means it would spend $100 on "buying back" those shares. The company can then "retire" these shares, leaving it with 90 shares outstanding.

The big question is, does this create any economic value?

Like most of these questions, there are several factors to consider...

In theory (and mostly in practice), if there's constant demand for the shares, then the share price should go higher.

Per our example, let's say 100 investors are willing to pay $10 per share and now there are only 90 shares available.

Do the 10 investors who now can't get a share (because of the retired shares) go out and offer a higher price?

This reduction of the share count is called "shrinking the float," and historically companies that have aggressively shrunk their share floats have been particularly good stocks.

Shrink the Float, Lift the Boat

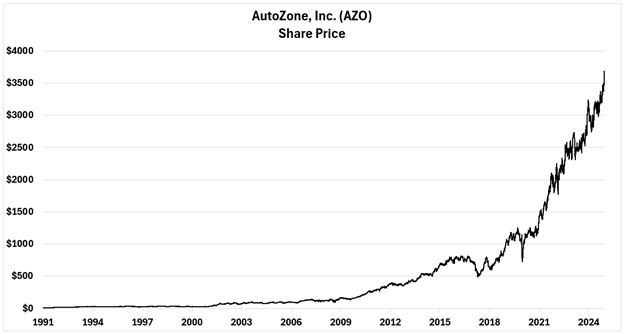

A notable example is the stock of auto repair retailer AutoZone (AZO). Look at the stock price since 1991…

Since June 1991, the company’s stock price has compounded at a rate of +20.5%. This is significantly better than the S&P 500 and is a total return of 47,535%!

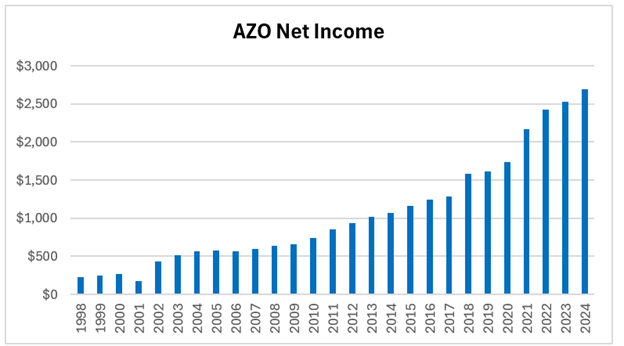

Next, look at AutoZone's net income since 1998…

The company has an impressive track record, growing net income more than tenfold from $228 million to almost $2.7 billion.

Still, that's far short of the stock's growth over the same time.

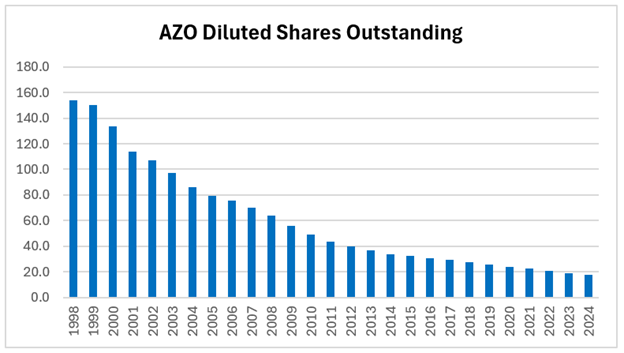

However, if we look at its share count, we can see how aggressively AutoZone has been buying back the stock...

Across the period where it grew earnings by ten-fold, AutoZone also reduced its share count by almost 90%!

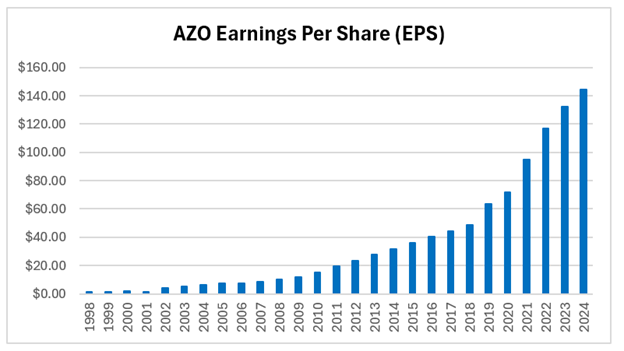

The net result is that its earnings per share (EPS) soared.

As you can see, EPS has gone from $1.48 to almost $144 per share, or almost 10,000%!

AZO has taken a decent growth business and harnessed their cash flow to buy back a crazy amount of stock and amplify EPS growth. This has been well rewarded in the stock market.

This is obviously an example of a buyback that has been great for shareholders. In fact, it's one of the most successful in financial history.

But is this the norm? Therein lies the problem…

Judge Not Lest Ye Be Judged

The first question is whether the company would have been better off investing in its business instead. Would the stock have gone even higher with even higher earnings power?

This is hard to argue, because AutoZone did grow its earnings by ten-fold in a mature U.S. market for automobiles.

The argument that companies are better off investing in the business is the most common criticism of buybacks, but it suffers from one of the greatest fallacies we see in financial analysis: that outsiders can make better judgments than management teams in terms of running the business.

Management teams aren't perfect, but most of them did not get there by accident. They are skilled professionals who also have much more information than any outsider.

What is most galling, honestly, is that financial analysts and politicians who criticize them are completely unqualified to make these kinds of determinations. Most of them have never run anything, much less a large publicly traded company.

One of the best aspects of our financial system is that these companies also have a board of directors, with several of them being independent of management. Significant laws and regulations also govern these boards.

The system isn't perfect, as there are still mistakes made and even sometimes frauds... but overall, it works very well.

There are "checks and balances" in place to make sure the interests of shareholders — and increasingly, employees — are properly served.

Almost always, a company that's buying back stock would rather invest more in the business if it had the opportunity. The share buyback, however, is an accurate view of its investment opportunities.

Financial Engineering at Its Best

Another criticism is that share buybacks are simply "financial engineering" and don't create any "real" value.

Frankly, this doesn't make sense.

Most aspects of running a company's balance sheet — issuing shares, issuing debt, paying debt down, etc. — is "financial engineering." And the argument about "real" value runs into our discussion above about the demand for shares.

Also, remember something that I've said repeatedly — stocks are just pieces of paper.

Sure, shareholders technically own the cash flows of the business. But those cash flows are very seldom paid out to shareholders.

Shareholders look at companies that successfully buy back their stock as shrinking the supply, feeding into a relatively constant demand. This should (and most often does) create buyers who are willing to pay more for the stock, and as a result, the shares go higher.

This has certainly been the case with AutoZone's stock...

When properly executed, share buybacks are great for shareholders and are a strong net positive for the stock market and economy overall.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Revealed: The New Momentum Trades for 2026

Posted January 09, 2026

By Greg Guenthner

5 Healthy Investing Habits to Start Today

Posted January 08, 2026

By Enrique Abeyta

2026: The Leaders, the Laggards, and a Wild Card

Posted January 05, 2026

By Enrique Abeyta

Optimism Wins: A Fresh Mindset for 2026

Posted January 01, 2026

By Enrique Abeyta

War, Media Game of Thrones, and a Shocking Assassination

Posted December 29, 2025

By Enrique Abeyta