Posted December 22, 2025

By Enrique Abeyta

My 2025 Prediction Report Card

Earlier this year, I shared a few of my top predictions for 2025.

Now that the year is drawing to a close, I thought it would be a good time to revisit them and see how I did.

My first set of predictions was about stocks and crypto. Right off the bat, I have to say that I did pretty darn good!

Well, except for one…

Read on below for my 2025 stock market predictions and an update on just how right (or wrong) I was.

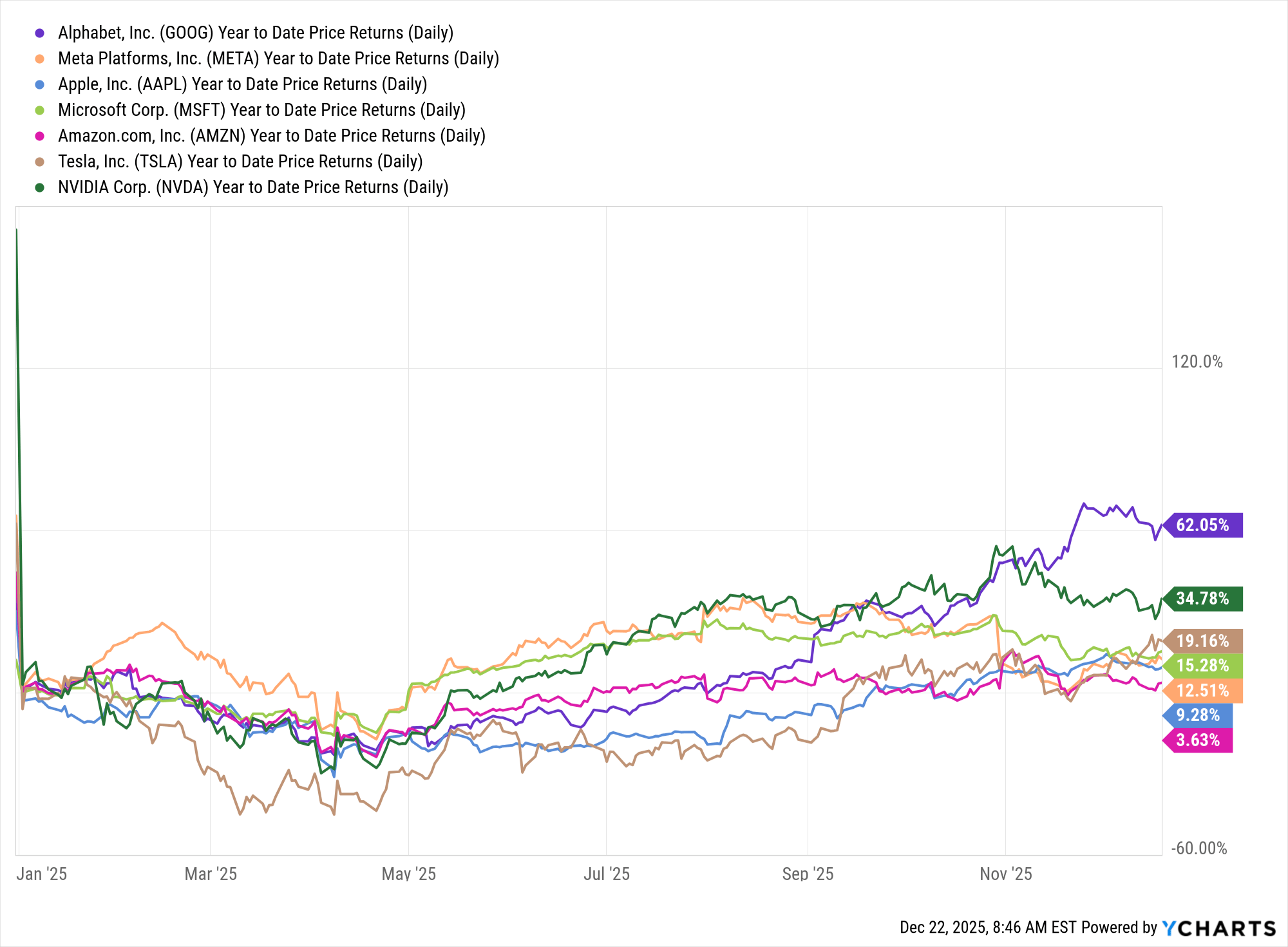

#1: The Mag 7 Will Outperform Again (Except Nvidia)

With the Mag 7 stocks leading the market for two straight years, many people anticipated they would underperform in 2025.

But I predicted that most of them would continue dominating this year and outperform the broad market.

I also predicted that Nvidia, one of Wall Street’s most beloved stocks at the time, would be the exception and underperform.

So, how did they do?

Well, the year isn’t over yet. But here’s a snapshot of how the Mag 7 are doing right now.

As a group, the Mag 7 are up a little over 20% on the year. That’s better than the S&P 500, which is up about 15%.

Clearly, it’s been another strong year for this group of stocks.

The biggest difference between 2025 and the two years before is the spread between the winners and losers.

In previous years, there had been one huge winner — Nvidia. The rest were all up solid double digits.

This year, the leader is Alphabet with a solid 60% return. But many of the others aren’t up by much at all.

In fact, four of the seven have underperformed the S&P 500.

Without a late run by Tesla at year-end, only two of them would have outperformed the broad market.

So my prediction was technically correct, even if Mag 7 outperformance looked different from years past.

I’m okay with that; right is still right. I give myself an “A-” on this one.

#2: Small-Caps Will Continue to Struggle

This is another one where I went against the consensus.

Given the long stretch of underperformance by small caps for the last few years, many investors expected them to begin outperforming.

I disagreed and said that the Russell 2000 small-cap index would underperform once again.

This one is coming down to the wire. But as of this morning, the Russell 2000 is up roughly 13%. That’s marginally less than the S&P 500 and quite a bit behind the Nasdaq.

But again, right is right.

I’ll give myself a good passing grade, but with a few reservations. Let’s call it a “B+.”

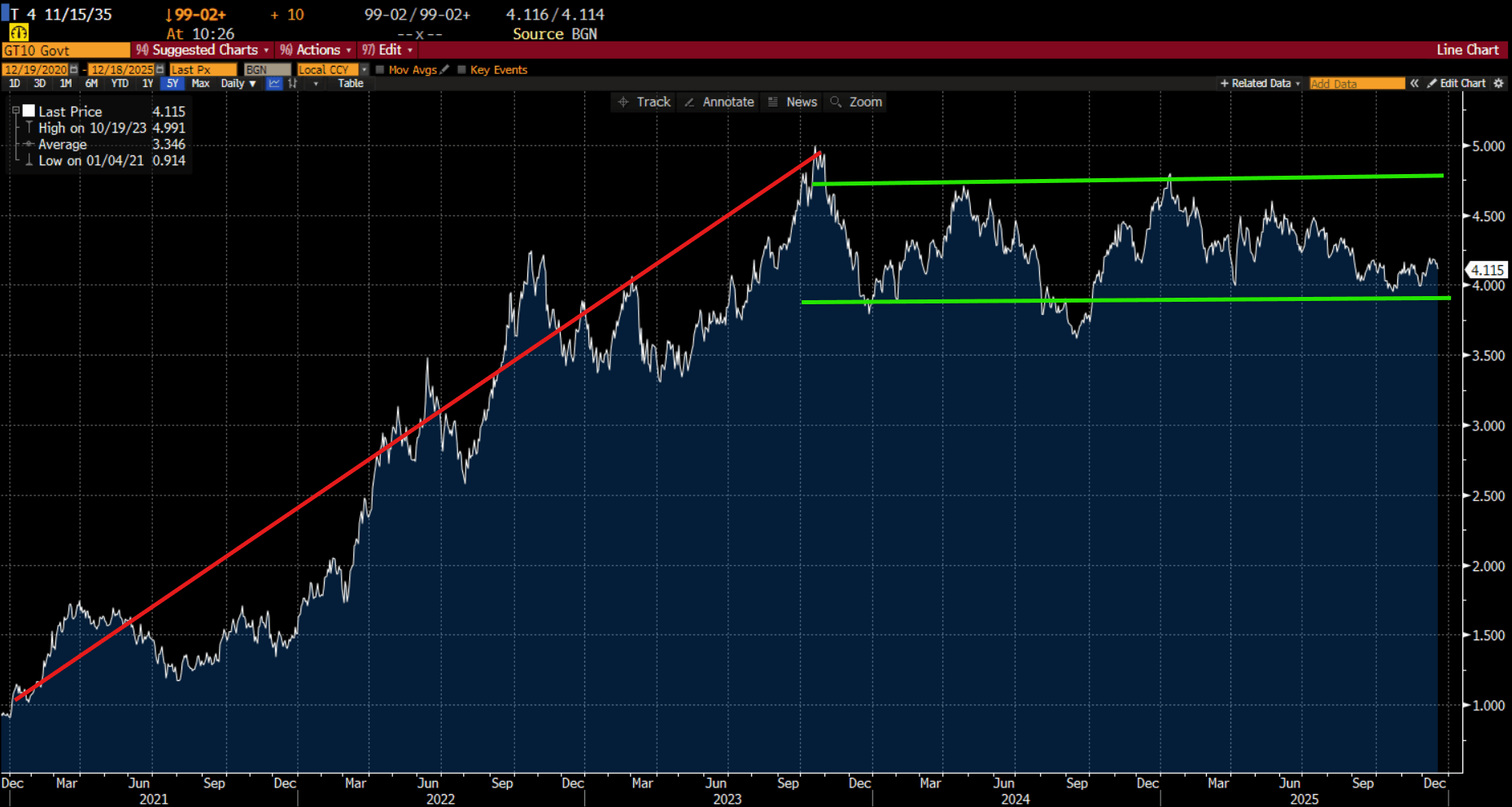

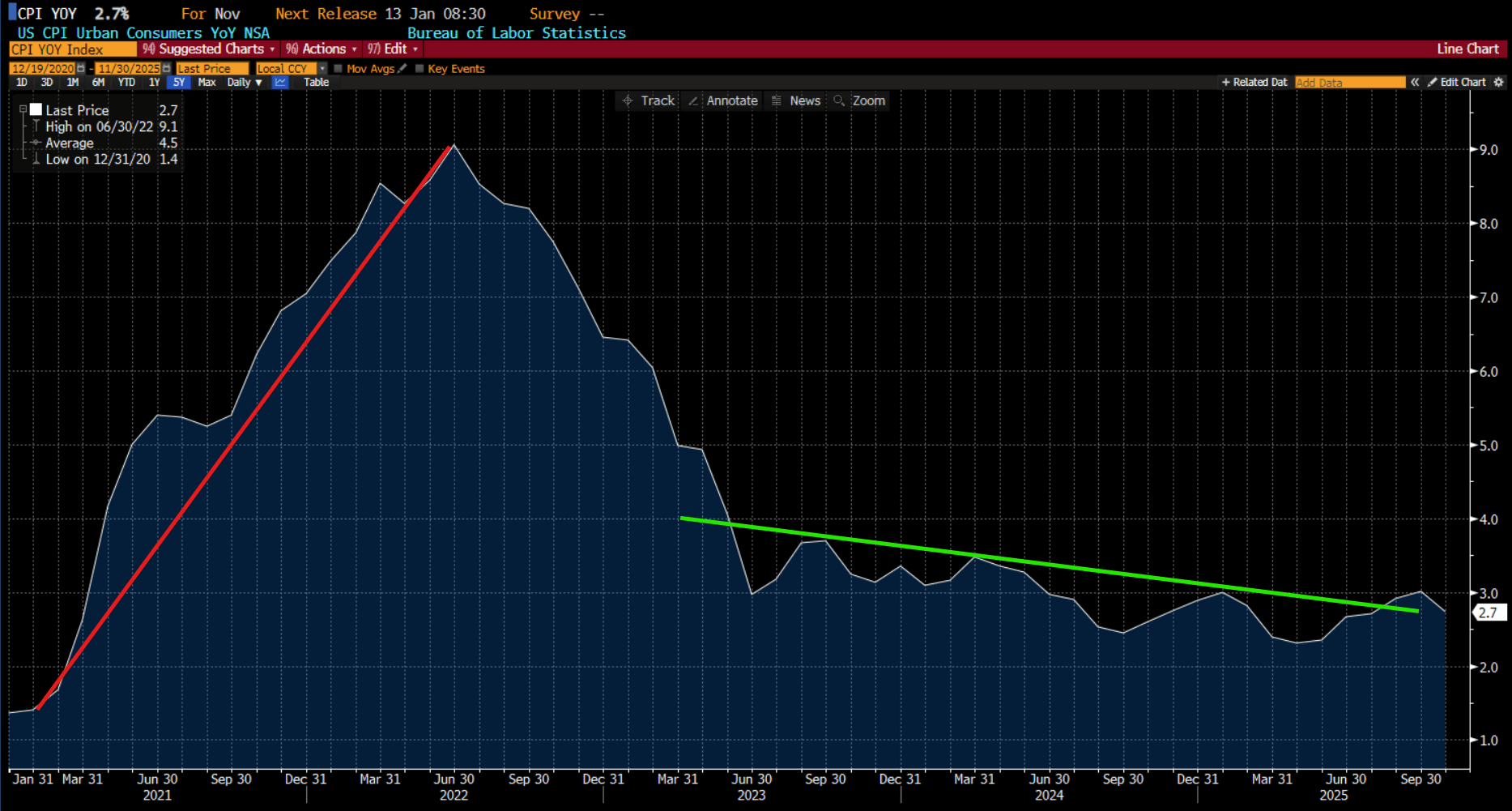

#3: Interest Rates and Inflation Won’t Matter

There’s a lot of talk about interest rates almost every year. And in recent years, there’s also been a huge focus on inflation.

I thought both of those concerns were very valid in 2022 when the Fed was actively working to fight the inflation that soared post-COVID.

But it’s been my view that after the period of rapid rate increases, neither of these would matter very much.

The reason is simply that I didn’t think either of them would do very much.

Here are the charts of the yield on the benchmark U.S. Government 10-year bond and the CPI.

Interest Rates: U.S. Government 10-Year Bond Yield

Inflation: Year-Over-Year Change in Consumer Price Index

These charts look very similar to how they did last year. The only difference is that the green lines are longer.

I would also note that both rates and inflation appear to be trending lower now.

With the economy posting fine growth and the stock market higher, this prediction gets a solid “A.”

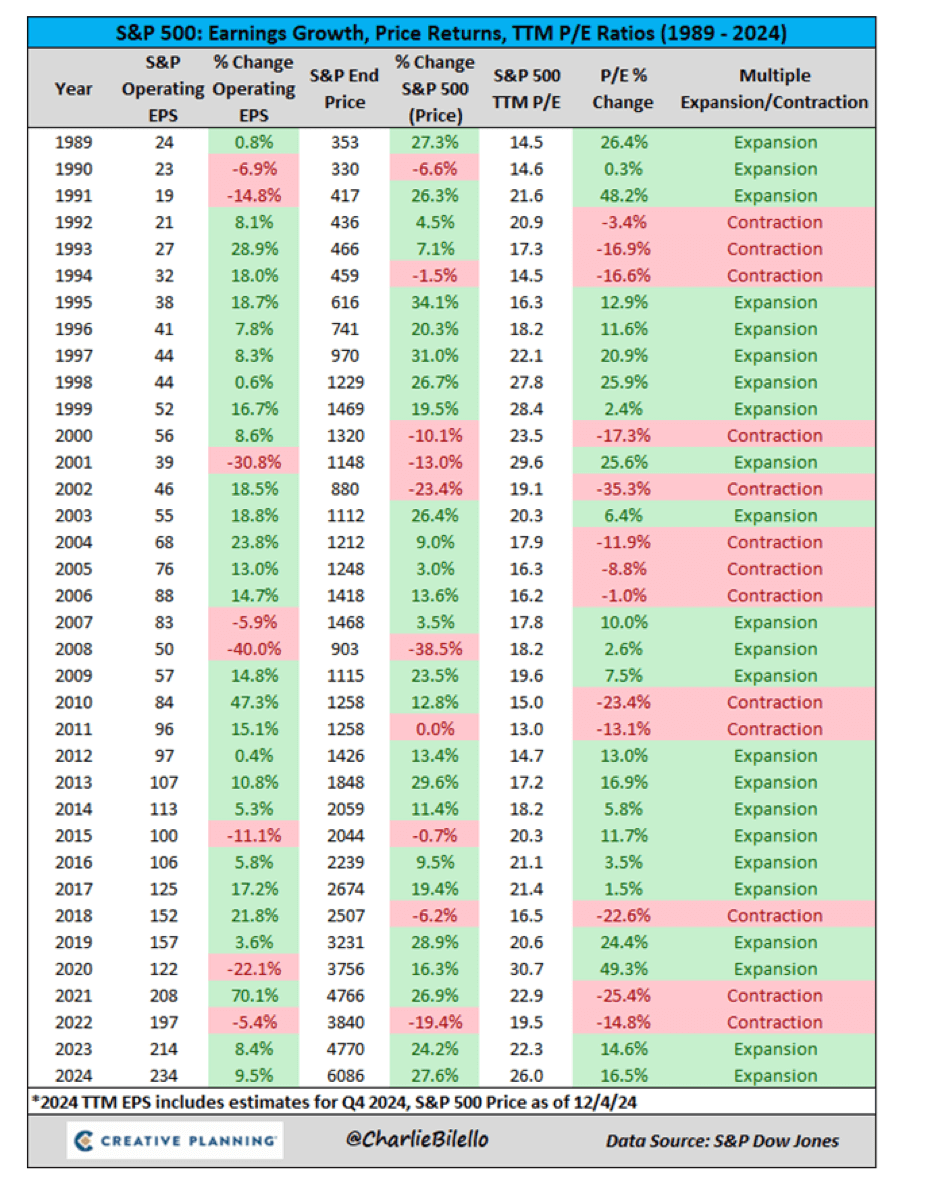

#4: The Stock Market Goes Up a Lot (or a Little)… But NOT Down

This was another one where folks were predicting a reversion to the mean.

The stock market was up more than 20% in both 2023 and 2024. How could it be up again in 2025?

Well, trends in markets tend to persist, and this one did as well.

Here is a table from Charlie Bilello that I shared last year.

And here’s what I wrote:

“On the chart, you can see that there’s a high correlation between growth in earnings at the S&P 500 and price performance. Valuation didn’t matter.

Steady interest rates, inflation, and commodity prices combined with an accommodative monetary and fiscal policy indicate earnings will likely grow over the next year.

Maybe they grow more or less than current expectations, but I expect them to grow. If they grow, then stocks go up.

The surprise may be that they only go up slightly (say, less than 10%) as we have a choppy stock market.

Or maybe they go up a lot (greater than 30%) as we revisit the melt-up environment of the late 1990s.

Either way, I don’t think the stock market will drop in 2025.”

Well, earnings grew nicely in 2025. And we had plenty of mid-year chop, so this was pretty spot on.

The stock market wasn’t necessarily up “a lot” or “a little.” Instead, it was just right. I think this one is an “A-.”

#5: Bitcoin Hits $250K

Hey, four out of five ain’t bad, right? With Bitcoin trading below $90,000, this one was far off.

I’ll have more to say on where I think Bitcoin is headed in 2026 soon. But for now…

This gets an almost failing grade. Not quite an “F” since Bitcoin didn’t completely crash, but a solid “D-.”

I said this when I originally shared these predictions in January, but it bears repeating…

I may be right, or I may be very wrong. This year, I was both. But never let it be said that I’m afraid to take a stance on the market!

I look forward to sharing my predictions for 2026 soon. So stay tuned.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

“BTSD” — The Powell Probe Trade

Posted January 12, 2026

By Enrique Abeyta

Revealed: The New Momentum Trades for 2026

Posted January 09, 2026

By Greg Guenthner

5 Healthy Investing Habits to Start Today

Posted January 08, 2026

By Enrique Abeyta

2026: The Leaders, the Laggards, and a Wild Card

Posted January 05, 2026

By Enrique Abeyta

Optimism Wins: A Fresh Mindset for 2026

Posted January 01, 2026

By Enrique Abeyta