Posted September 25, 2025

By Enrique Abeyta

Melt Up Like It’s 1999

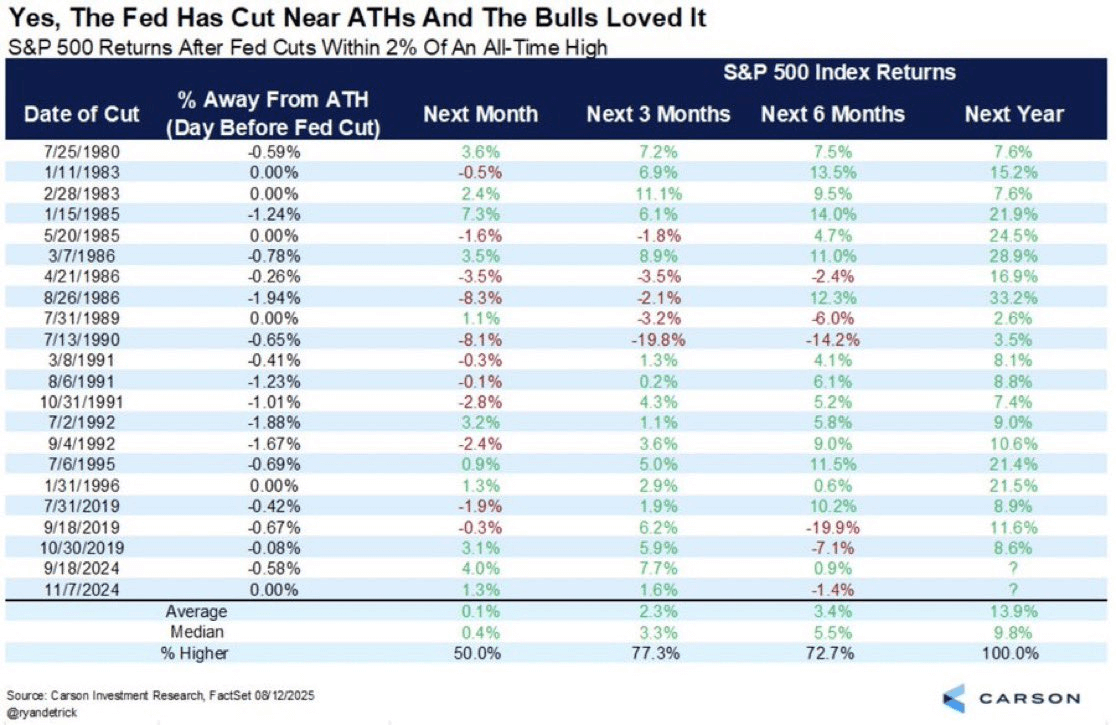

The Fed cut rates last week while stocks were trading around all-time highs.

While that may not be the norm, it has happened before — 16 times to be exact.

Each time, the result was the same: The stock market continued to rise over the following year.

On average, the S&P 500 has gone on to post a return of nearly +15% one year later. And this time doesn’t appear to be any different.

So you need to prepare for what may be the next great melt-up.

Let me explain…

The Fed Just Lit a Match

I recently saw a story from one of my favorite analysts, Ryan Detrick, Chief Market Strategist at Carson Group.

He shared this table showing what has happened to the S&P 500 after the Fed cuts near all-time highs.

Source: Carson Group

Look at the table, and you can see that every single time so far, the S&P 500 was higher a year later. The average 12-month forward return is 13.9%, which is significantly better than the long-term average performance of the stock market.

Do I think history is likely to repeat itself this time? I absolutely do.

Additional Rate Cuts Will Follow

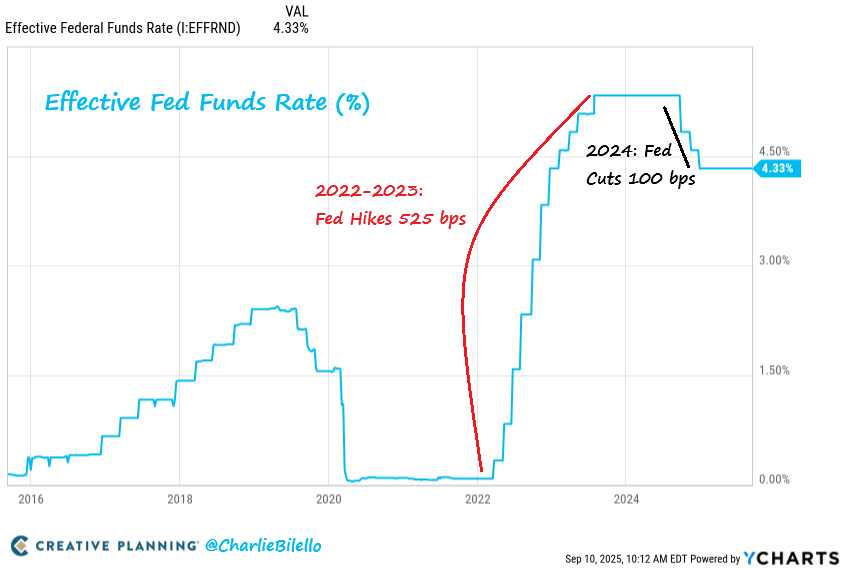

Here’s another chart I recently came across, showing the Fed Funds rate over the last decade.

On the chart, you can see that so far, the Fed has reversed less than one-quarter of the hikes it implemented over the last few years. This means the Fed has a lot more firepower to use if it deems it necessary.

Do I think they will need it? Well, here is another chart that may clarify things.

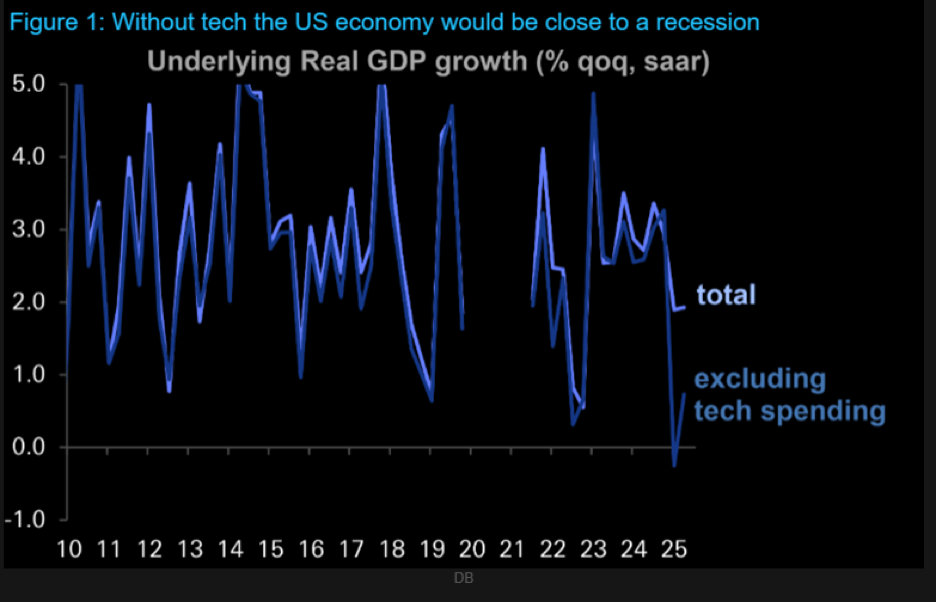

This chart illustrates real GDP growth quarter-over-quarter over the past 15 years. It also shows what it would have been without technology spending.

As shown in the chart, technology spending has been a significant contributor to GDP growth over the past year. Without it, we would already be in a recession.

This is why the Federal Reserve is likely to unwind the previous rate hikes.

I am a long-term bull on artificial intelligence, but any market participant with experience knows that the recent capital expenditure cycle is of great concern.

It is so good, in fact, that it’s bad.

Spending has ramped up to such an extent that it is virtually certain to decelerate at some point in the coming quarters. At that point, the Fed will likely need to step in and cut rates to prevent the economy from slipping into a severe recession.

Stocks Will Melt Up Like It’s 1999

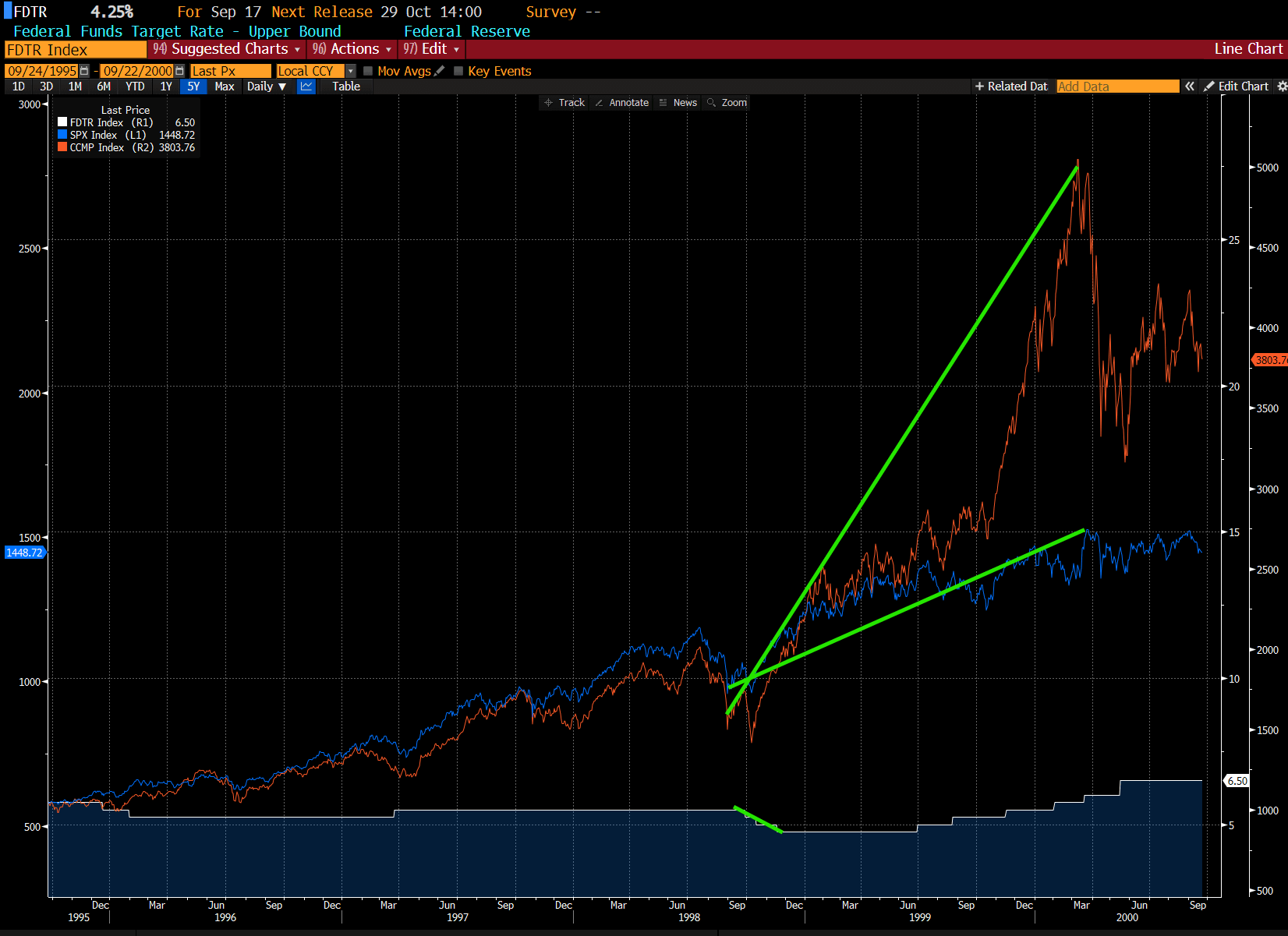

Today’s market reminds me of another time that the Fed was cutting interest rates relatively close to all-time stock market highs — late 1998.

Here is a chart showing the price of the S&P 500, the NASDAQ Composite, and the Fed Funds Target Rate (Upper Bound) from 1995 to 2000.

At the bottom of the chart, you can see that the Fed cut rates from 5.50% to 4.75% in late 1998 in response to the collapse of hedge fund Long-Term Capital Management.

This was right as we were in the middle of a massive capital expenditure ramp-up to build the technology infrastructure for the initial rollout of the internet and broadband.

Sound familiar?

As a result of this combination (accelerating technology capital expenditures and easing Fed policy), we saw one of the most explosive stock market environments in history.

When people ask me what the craziest market environment I have ever seen is, I tell them it’s not the Global Financial Crisis, COVID, or even September 11…

It is the 1999 melt-up in the Nasdaq.

The combination of falling rates and soaring tech spending created one of the most explosive bull markets in history.

The same forces are building again today. Whether you call it a “melt up” or simply a runaway rally, the lesson is the same: fight the Fed at your own peril.

The smarter move is to recognize the setup and prepare your portfolio before it fully ignites.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

“Luck Is Not Real”

Posted February 19, 2026

By Enrique Abeyta

The S&P 500 Lies

Posted February 18, 2026

By Nick Riso

The Kill Switch: How a Hidden Algorithm Is Blowing Up Boring Stocks

Posted February 16, 2026

By Enrique Abeyta

Snapback Trade Watchlist: HOOD, SHOP, TOST

Posted February 13, 2026

By Greg Guenthner

Play Ball! 3 Investing Rules From the Baseball Diamond

Posted February 12, 2026

By Enrique Abeyta