Posted December 11, 2025

By Enrique Abeyta

Meet Mr. Bubbleology, the Next Fed Chair

There’s a growing consensus that Trump’s top economic advisor, Kevin Hassett, is in line to be the next Fed chair.

Normally, this news doesn’t mean much for the markets.

Over 30 years of active investing, my experience is that it doesn’t really matter who the Fed chair is.

For that matter, it doesn’t even matter who the president is when it comes to our financial system.

Our economy is much bigger than any one of these individuals. While they have influence, they very seldom change the course of events — at least not on purpose.

But like so many other aspects of Trump’s administration, these rules are changing.

The reality is that political norms have been under attack for decades by both sides. Trump is simply taking it to the next step.

That doesn’t make it right or good for the country, but it’s the truth.

And 2026 could be the year when the president and the Fed exert more influence on the stock market than any other time in American history.

It all starts with Kevin Hassett.

A History of Bold Calls

To be completely honest with you, I didn’t know a lot about Hassett until recently.

In the same vein, I don’t know much about Powell or any of the former Fed chairs. Again, they are influential but not all that important in the grand scheme.

Hassett may be different.

I recently read an article on one of my favorite news sites, Bari Weiss’ The Free Press, which went through his background.

Did you know that he authored a book called “Dow 36,000” back in 1999?

In the book, he and his co-author predicted that the Dow Jones (then at around 10,000) was about to see a “rapid rise” to 36,000.

Investors would sell bonds to buy high-growth stocks and send stocks quickly to record highs.

This book was published in October 1999.

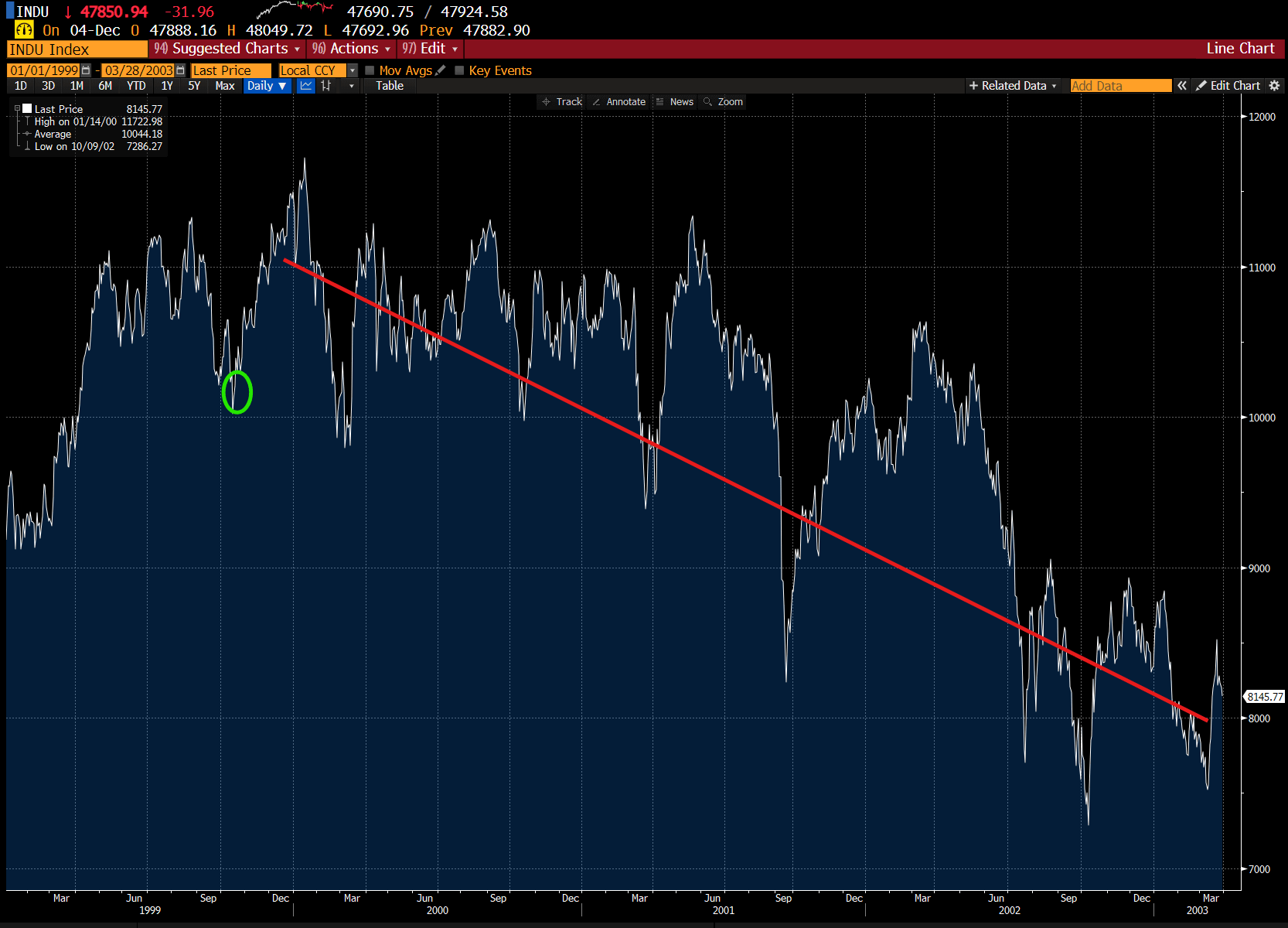

Here is a chart of the Dow Jones going back to that period. The green circle is when he published his prediction.

It looked pretty good for about four months, but not so great after that.

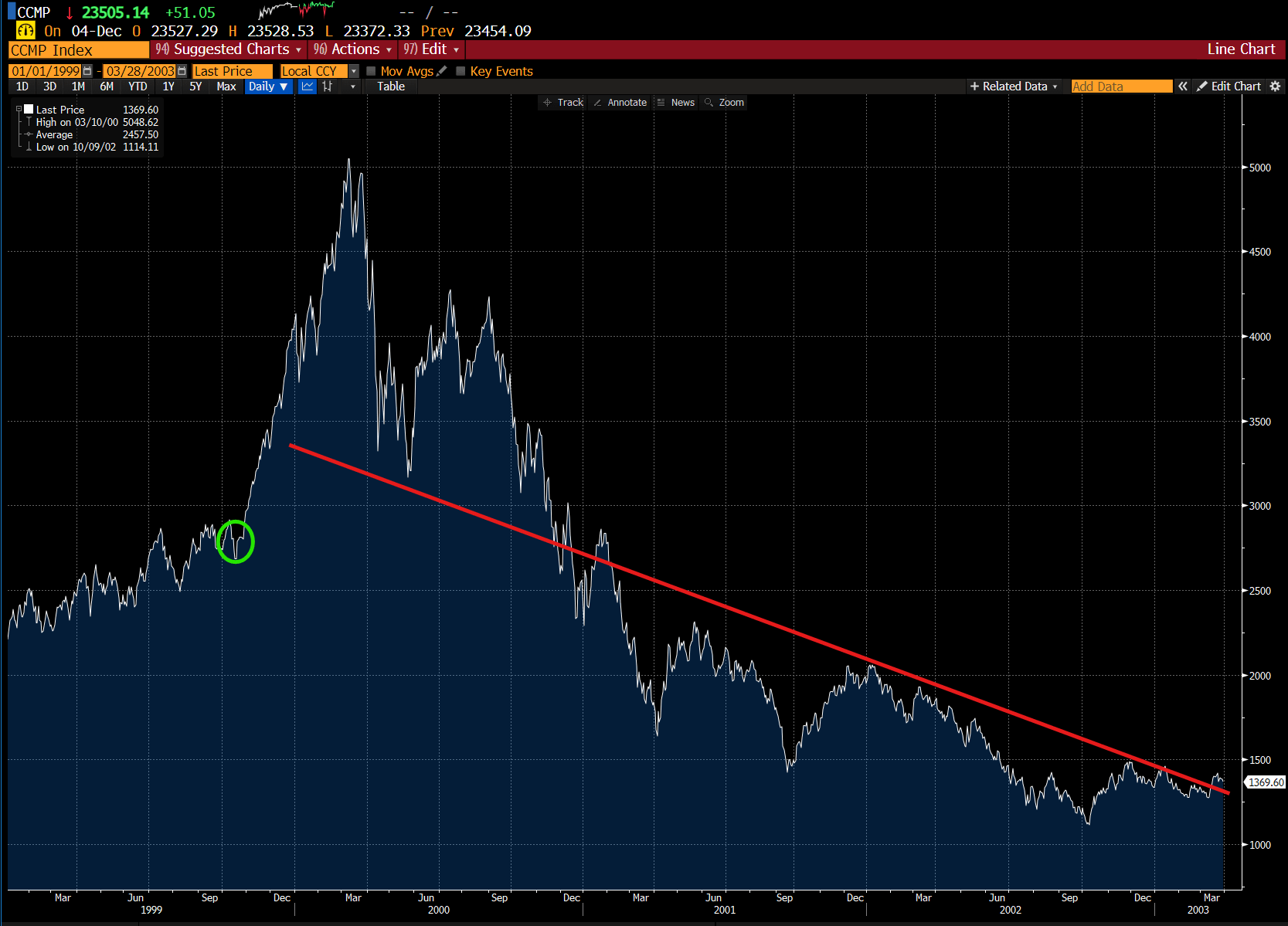

The Dow fell 20% over this period. But to really understand that time, take a look at the same chart for the Nasdaq Composite.

Again, his call looked great at first. But after?

From the time of his prediction, the Nasdaq was cut in half. Anyone who chased the market would have done much worse, as it would fall 72% from the peak.

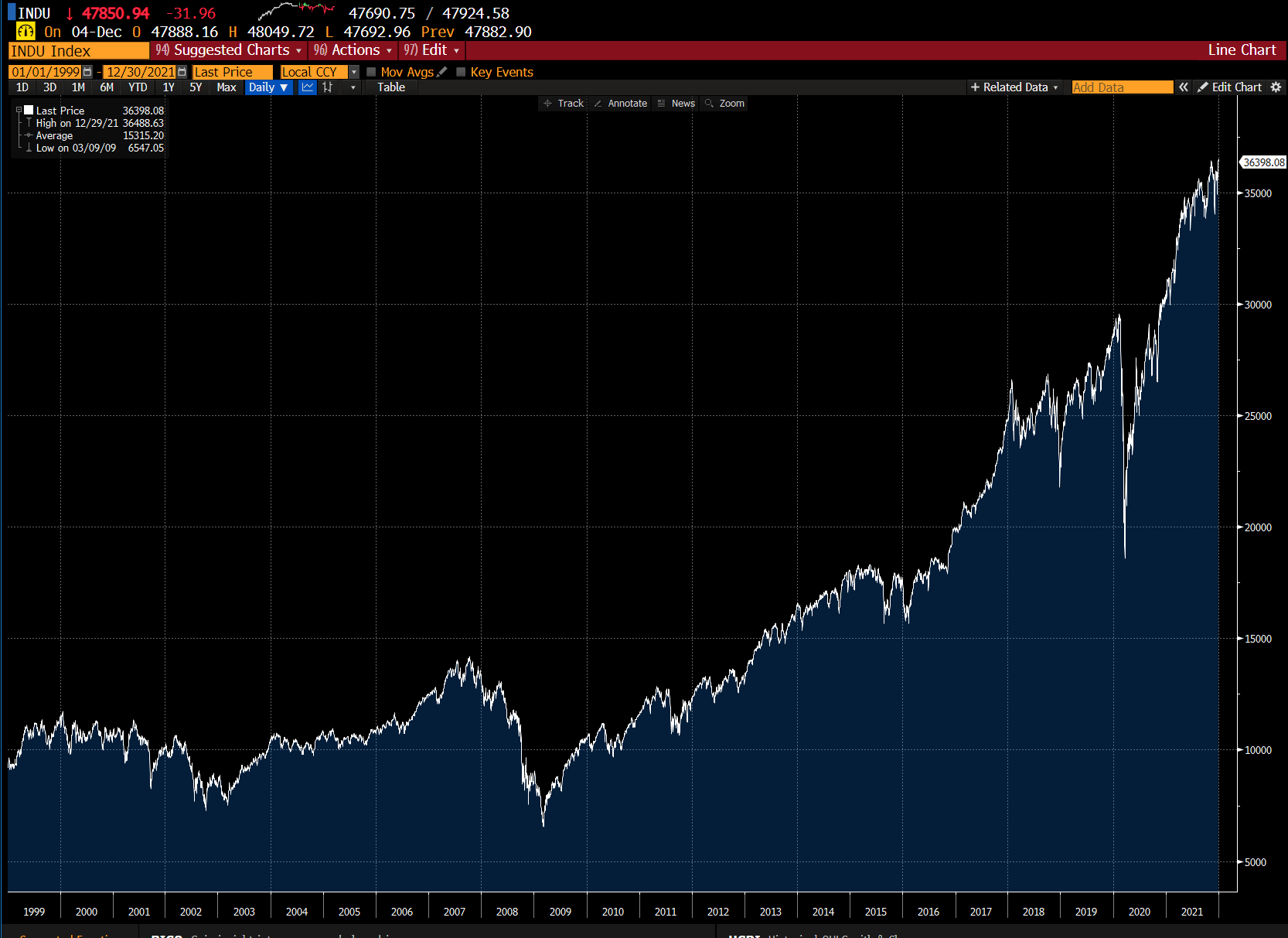

In all fairness, the Dow Jones did eventually breach the 36,000 level. Here is the long-term chart.

It breached that level at the end of 2021 — or over two decades later.

I’m pretty sure that when he published that sensationally titled book in 1999, that was not what he had in mind.

The “Bubbleology” Framework

Now, I’m not here to criticize Hassett for making a bad call. We have all made them before.

What’s most interesting is that two years later, Hassett published another book. This one was titled “Bubbleology.”

In the midst of the technology stock crash, Hassett did admit that bubbles could happen in the short term.

His larger point — and it’s a superb one — is that stocks win over the long run. They massively outperform bonds and can change the lives of ordinary investors.

I strongly agree with this premise.

In that follow-up book, Hassett pointed out that investors who pulled out of the stock market during the mid-1990s missed out on massive returns.

Even considering the ensuing stock market crash, you still would have been better buying stocks over the next five years in each year EXCEPT late 1999.

Why does all this matter for the stock market in 2026?

Hassett is clearly someone who has spent a lot of time thinking about stock market bubbles.

He is also someone with a longer-term view who would argue that while the bubbles are painful, they are normal.

In the context of fealty to Trump and Trump’s focus on winning the November midterm elections, Hassett will not be afraid to feed the beast.

Again, the Fed chairman or president rarely matters to the stock market. But 2026 could be the exception to that rule.

So maybe it’s time to party like it’s 1999 once again!

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

A Crude Awakening: History Says Buy Stocks

Posted March 09, 2026

By Enrique Abeyta

Fade the End of the World

Posted March 06, 2026

By Greg Guenthner

The Dark Side of the Tape

Posted March 04, 2026

By Nick Riso

The Iran War: What’s Next for Stocks, Oil and More

Posted March 02, 2026

By Enrique Abeyta

It’s Not Just You, This Market Is Mind-Melting

Posted February 27, 2026

By Greg Guenthner