Posted February 11, 2025

By Greg Guenthner

Love It or Hate It…These Stocks Are Breaking Out

Last year’s winners are failing to deliver.

You wouldn’t know it by tuning into the mainstream media and their constant drumbeat of tariffs, the Department of Government Efficiency (DOGE), and the technology stock du jour. But I’m sure your portfolio is well aware.

The Roundhill Magnificent Seven ETF (MAGS) finished the first six weeks of 2025 in the red.

Meanwhile, nooks and crannies of the market – areas most investors overlook – are breaking out to new highs. Today, I’ll share with you a group of stocks the average investor not only ignores but loves to hate.

Don’t worry, if you like trading Amazon (AMZN), Spotify (SPOT), and Tesla (TSLA), a few of these names will be right up your alley.

Let’s dive in…

Leave Your Biases Behind

China…

When I hear “China”, tariff is the first word that comes to mind. After that, it abruptly turns to the People’s Republic’s dumpster fire of a stock market. (Last year, the Shanghai Composite retested its 2020 pandemic lows.)

What I don’t think about are explosive breakouts, record highs, and rip-roaring rallies à la Chinese equities.

However, that’s what you’ll see as you flip through the charts.

Check out the S&P 500 (SPY) year-to-date performance compared to the China ETF (FXI).

FXI is up double digits so far this year compared to the U.S. benchmark. Yes, Chinese equities are outperforming! When was the last time you heard that?

If you’re wondering how tariffs will affect the China rally, let me assure you… I have no idea and neither does anyone else. Turn the other way if someone tries to tell you tariffs will sink Chinese stocks. It’s all conjecture.

On the other hand, the bid beneath the market is there for all to see.

Instead of speculating on future events that will likely never come to fruition, I prefer to expend my energy on something real: supply and demand in the form of price.

One way to catch these rising prices, of course, would be to buy FXI and call it a day. But the potential for more explosive gains is waiting if you know where to look…

Buy Strength

Let’s start with a few of FXI’s top holdings.

First, Alibaba Group Holdings Ltd. (BABA) is an easy way to juice your returns. Alibaba is the Amazon of China, and the e-commerce giant sits just below fresh multi-year highs following yesterday’s 7.55% rally. Keep this one on your radar!

Next is Tencent Music Entertainment Group (TME), the online music company. TME is the second-largest FXI component, coming in just behind BABA at 9%. The stock has gained roughly 250% since the October 2022 low and is now coiling below last year’s high.

BYD Co. Ltd. (BYDDY), the battery manufacturer and top Tesla competitor, might be my favorite Chinese name. Last week, it broke out of a five-year base, gaining 20% and posting a new all-time high. If speculative fervor continues to spill into China’s market, I want to own the strongest Chinese stocks. BYD fits the bill.

Other areas also deserve our attention, most notably education stocks. I have TAL Education Group (TAL) in my sights as it hits fresh six-month highs.

On the flip side, there are always companies and sectors you want to avoid. China is no different in that regard, and NIO Inc. (NIO), the electric car manufacturer, is toxic. I’m talking nuclear! NIO is closer to printing a five-year low than a new high across any notable time frame.

Bottom line: You don’t want to be caught holding weakness, even in the form of a revered basket of stocks or the most loved shares on the exchange.

Speculative U.S. growth stocks have caught a bid, and now we can add Chinese equities to the buy list.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

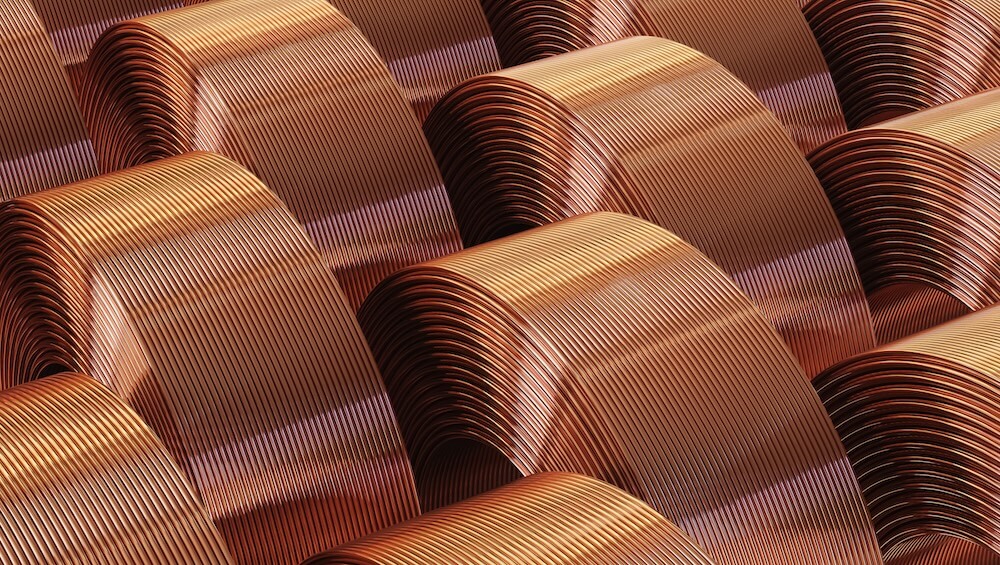

Breakout Alert: Copper Coils for a Monster Move

Posted December 02, 2025

By Ian Culley

Time for a Reality Check

Posted December 01, 2025

By Enrique Abeyta

Thankful for the Greatest Game on Earth

Posted November 27, 2025

By Enrique Abeyta

The Art of the Stop Loss

Posted November 25, 2025

By Ian Culley

A “Blue Owl” in the Coal Mine

Posted November 24, 2025

By Enrique Abeyta

![[VIDEO] How to Spot a Bounce Worth Buying](http://images.ctfassets.net/vha3zb1lo47k/52knC5jBCw9jj5rBVAQMRs/9213f9d92a2262a0ec1b42df9a62678d/ttr-issue-11-21-25-img-post-2.jpg)