Posted August 28, 2025

By Enrique Abeyta

Julian Roberston and the Discipline That Built Billions

Julian Robertson wasn’t just any hedge fund manager. He was the man behind one of the most famous and successful funds ever.

Robertson founded Tiger Management in 1980 with $8 million from family and friends.

The firm eventually peaked with $22 billion in assets and held one of the best track records in modern investing history.

Beyond the success of Tiger, Robertson is also famous for the success of those who worked at the fund (dubbed "Tiger cubs") or others who were trained at their funds ("Tiger grand cubs").

Combined, these funds now manage hundreds of billions — and have probably created more value for investors than any other group in history.

Earlier this week, I shared the famed Tiger Management Investment Framework for long-term investments with you.

Today, I want to follow up with some thoughts on the legacy of its founder, Julian Robertson, and what it mean for you as a regular investor.

The Legacy of Julian Roberston

I have a personal history with Julian and Tiger. My first buyside job was at a firm called Atalanta Sosnoff Capital, which was in the same building as Tiger, 42 floors below.

A few years later, I interviewed for a job with Viking Global — one of the “Tiger Cub” funds — but unfortunately did not get the job.

Many years later, I eventually worked for one of the Tiger grand cubs when I joined my old friend Rick Gerson at the founding of his firm Falcon Edge Capital.

Rick had worked for the legendary John Griffin, one of the more famous and successful Tiger cubs, of Blue Ridge Capital since its founding. Not to mention, he was also one hell of a human being!

At Falcon Edge, I had the opportunity to see the Tiger research process firsthand. As I discussed earlier this week, that process revolved around the concept of value-added research ("VAR").

The idea was that investors shouldn't just rely on Wall Street's research or even what the company says…

They should also find outside sources that create the clearest picture of the company's fundamentals and competitive positioning.

This could involve speaking with customers, competitors, consultants — you name it.

It would not be unusual for us to speak with literally hundreds of non-Wall Street sources when developing a thesis on a major position.

This research was coupled with trying to understand what was not widely understood by Wall Street. This was referred to as "variant perception" and was always key to an investment.

It was great to use outside sources to develop a clear picture of a company's positioning. But did we really have an insight that was any different from what everyone else was thinking?

Another aspect of this process was that it was exhaustive and relentless. This was no "checking the box" exercise...

It was more like training as a professional athlete. As I mentioned before, we would sometimes do hundreds of interviews, and our internal reports could also run hundreds of pages.

Julian and his protégés have many other legacies I could discuss, but this exhaustive research process is the most powerful — and the one that I got to experience firsthand.

So, what does this mean for the regular investor?

The Tiger Approach in Your Portfolio

The first thing to consider is to remember that this is your competition.

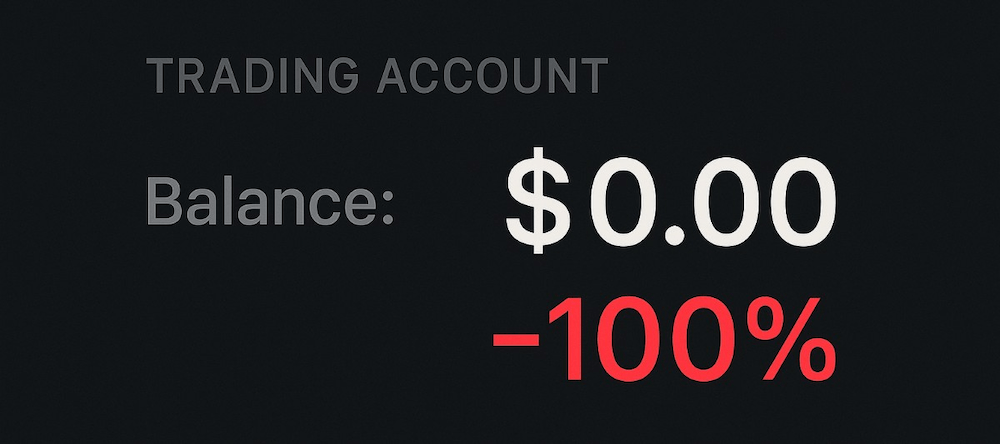

These are very incentivized investment firms with lots of capital and the ability to do research at a level that an average investor would never come close to being able to accomplish.

This is why a focus on the big picture and long-term investing makes the most sense for individuals.

If you get the big picture right with a big thesis, you don't need to have this degree of due diligence to support your thesis.

A long-term emphasis also allows you to look through some of the smaller details.

This is not to say that the Tiger firms don't also look at the big picture and the long term, but they have a much greater ability to optimize in the near term.

Individuals should be looking years out to maximize returns.

All that being said, I do think that understanding your investments is key to not only investment selection, but also having the conviction to stay invested during the most difficult times.

Do some work on what you own and make sure you understand your positions, as that ultimately leads to the best investment success.

If you can pair that understanding with a long-term focus, you’ll be ahead of the pack.

That’s Julian Robertson’s real gift to us as investors: a reminder that clarity and conviction matter more than complexity.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

$MEME - Animal Spirits Run Wild

Posted October 24, 2025

By Greg Guenthner

Gold: The New Meme Stock

Posted October 23, 2025

By Enrique Abeyta

Beware the “Backdoor Correction”

Posted October 21, 2025

By Ian Culley

The Leverage Trap: A Painful Lesson in Risk

Posted October 17, 2025

By Greg Guenthner

4 Hard Truths for a Parabolic Market

Posted October 16, 2025

By Enrique Abeyta