Posted October 31, 2025

By Greg Guenthner

Is the Melt-Up on the Ropes?!

The major averages are dancing near all-time highs.

The Fed just cut rates.

And some of the biggest names in the market, such as Palantir Technologies Inc. (PLTR), Amazon.com Inc. (AMZN), and Alphabet Inc. (GOOG), are posting strong breakouts.

Plus, stocks are powering through one of the weakest seasonal periods and are well on their way to a third year of strong gains. We’re enjoying a six-month rally that has barely taken any time to consolidate – and there’s still plenty of punch left at the party.

It doesn’t get much better than that…

But not everyone is enjoying the action we’ve experienced over the past couple weeks. In fact, some traders are feeling downright frustrated as November quickly approaches.

So, is the market about to roll over and ruin the holidays? Not so fast…

Over at The Trading Desk, we’re preparing for an impending Q4 market melt-up, a situation that would feature extremely favorable conditions for many of the speculative stocks that have outperformed this year.

Today, I’ll show you why the bulls are getting nervous – and why you shouldn’t let a few weeks of choppy action warp your judgement.

That’s right – melt-up season is still a go! And I have the charts to prove it.

Let’s dive in…

Calm Your Nerves – It’s Only Chop

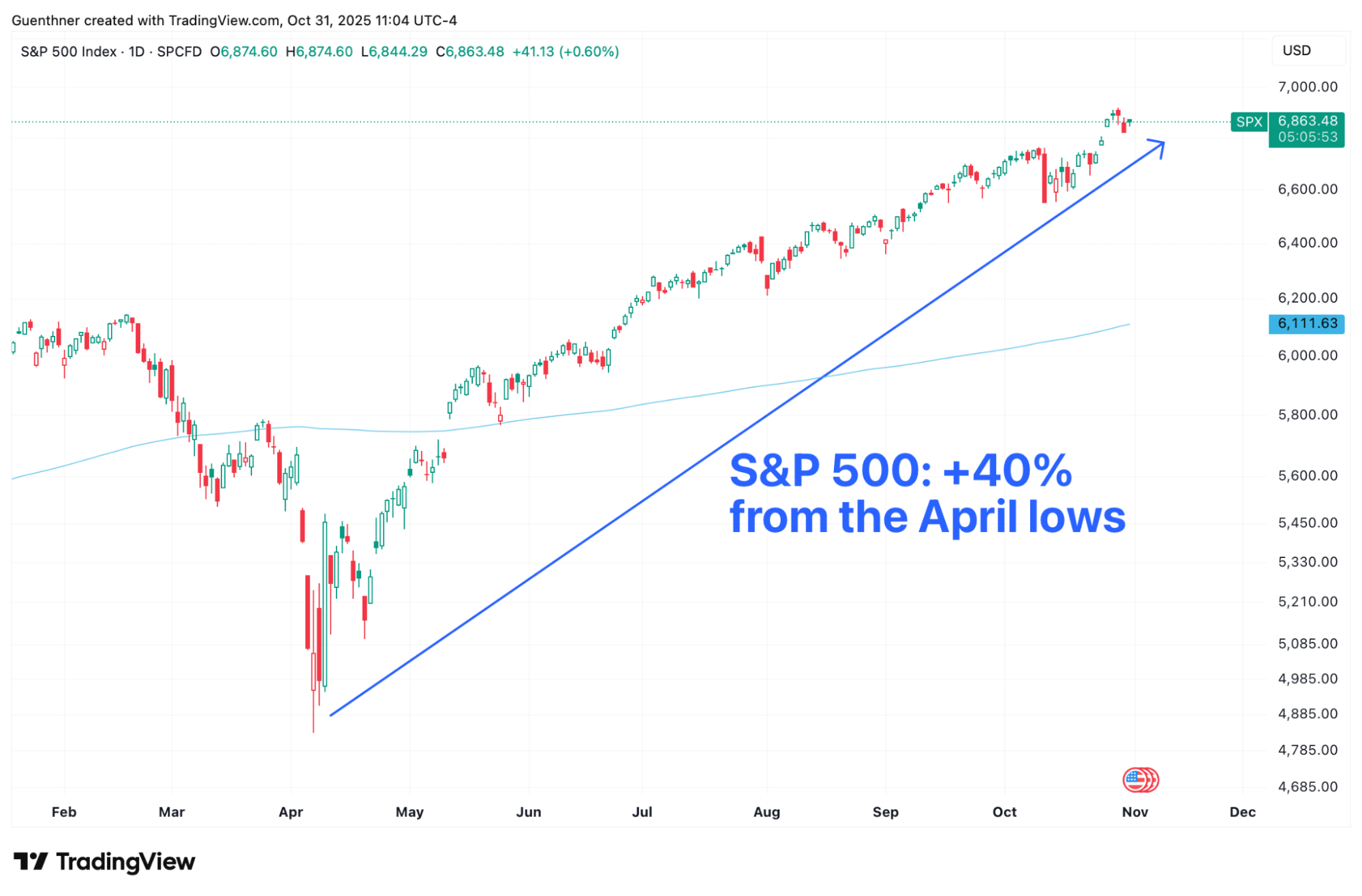

The market has enjoyed a smooth ride higher since the April tariff tantrum lows. Every time it looked like a corrective move might take hold, buyers swooped in and pushed stocks higher.

Summer chop?

Nowhere to be found…

A September volatility event?

Nope. Instead, we were treated to a picture-perfect uptrend…

An ugly October surprise?

Not even close. A historic government shutdown barely moved the needle…

Instead of a gut-wrenching selling event this month, we’ve simply experienced a momentum reset in some of the strongest speculative trades.

The quantum and artificial intelligence trades that traders feasted on since April finally started to slow down and backfill.

The hot stocks that were breaking out in September aren’t exactly setting the world on fire right now. Crypto has also failed to extend higher. Bitcoin is pinned in a wide range for months. In fact, it’s resting right where it was trading at the beginning of July.

While no ominous breakdowns have emerged, the popular trading vehicles have run out of juice during the back half of October. The red-hot metals trades have sharply reversed. Everything that was working is starting to trickle lower.

No, this isn’t the end of the world. But you have to remember that speculators’ minds are warped by recency bias. For months, these stocks did nothing but go up – a lot! Now that they are consolidating or posting healthy corrective moves, no one knows what to think.

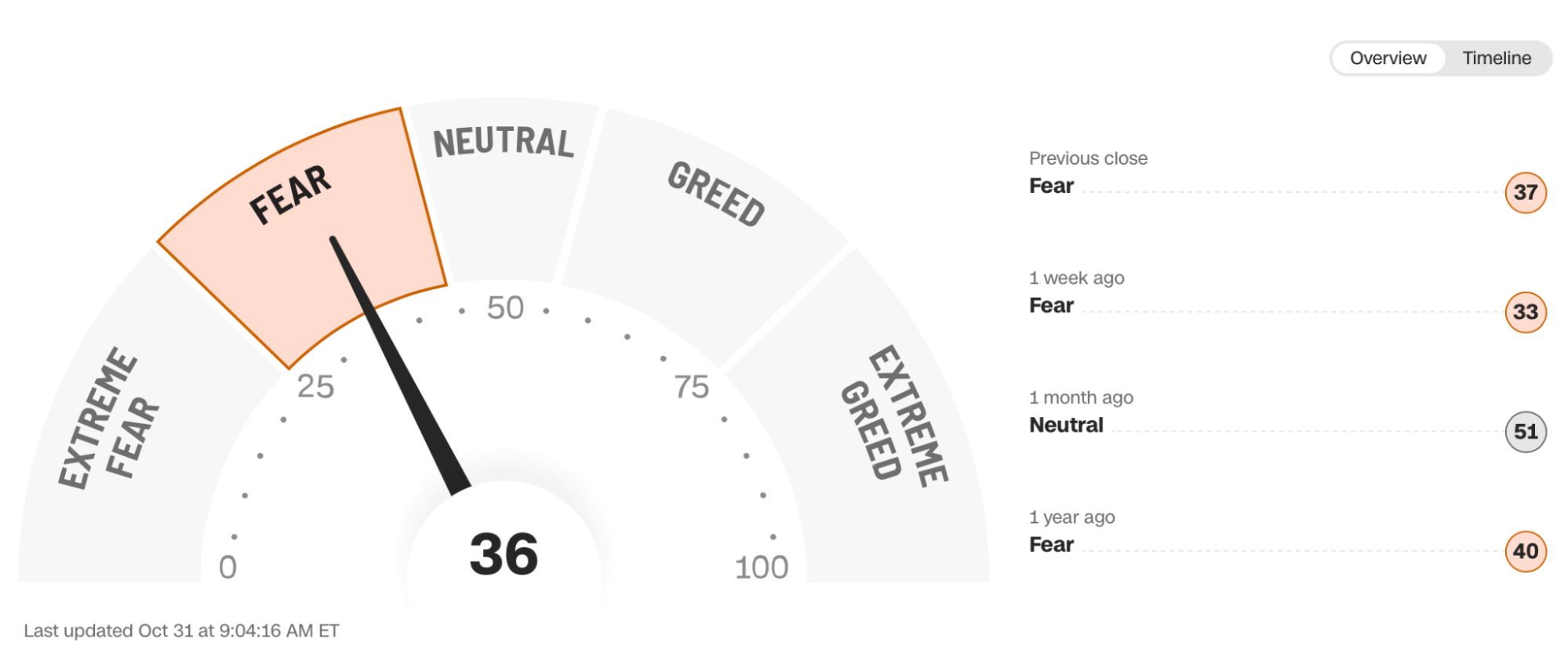

That’s probably why the CNN Fear&Greed Index has been stuck on “FEAR” for the past several weeks, even as the averages have leaped to new highs:

We’ll see if this momentum reset in the speculative tech baskets amounts to anything. But as of today, I don’t think enough damage has been done to cancel our melt-up plans just yet…

Zoom Out – The Charts Are Just Fine

While the hotter trades have cooled off, the broad market hasn’t missed a beat in October, thanks in part to a rotation back into the Mag-7 stocks, many of which had been lagging for months.

Yes, your favorite quantum stock has likely retreated 30-40% from its highs. But the Mags are reinvigorated, as evidenced by a fresh breakout in the Roundhill Magnificent Seven ETF (MAGS) one week ago (it has since extended higher by more than 6% thanks to bang-up earnings courtesy of AMZN, GOOG, and AAPL).

This quick rotation has helped sustain the uptrend in the major averages, even as market breadth has deteriorated in late October.

The result: New all-time highs, and a clean, unbroken uptrend in the S&P 500:

This chart doesn’t exactly look like the world is coming to an end – despite the red in your trading portfolio courtesy of the momentum reset.

Watch Out for a November Sentiment Shift

The calendar is about to flip to November, ushering in a powerful seasonal effect: a time that is traditionally the strongest 3-month period for stocks (November - January).

While sentiment has clearly backed off extreme bullish levels, there’s no reason to expect stocks to crater into the holiday season.

In fact, I’d argue that bleeding off some of the bullish sentiment and the resets in the more speculative stocks is a positive right now. It’s simply setting us up for better buying opportunities when the market turns sharply higher – without the need to chase extended breakouts into the stratosphere to get involved in these themes.

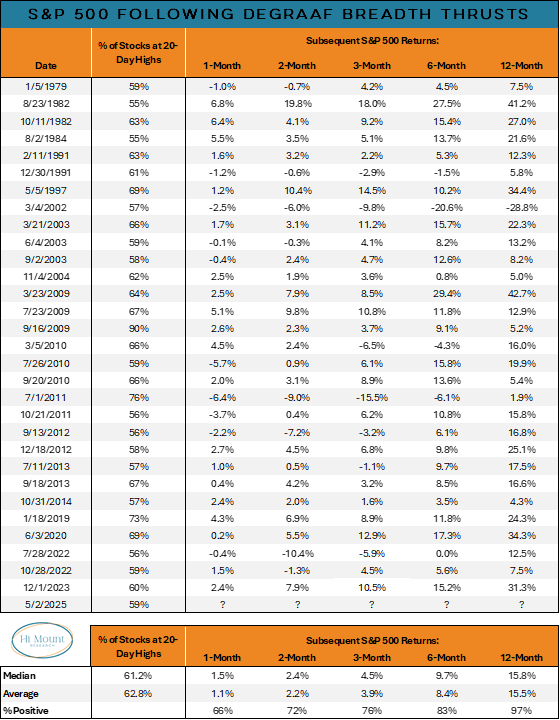

Once again, if we take a look at the bigger picture, the breadth thrust registered back in May following the bounce off the April lows is still very much in the “green zone” for stocks heading into the end of the year.

Take a look at this table from Willie Delwiche at Hi Mount Research:

Stocks flashed a powerful breadth thrust during the May recovery – a phenomenon that happens when more than 55% of S&P 500 stocks hit a 20-day high.

Past occurrences have yielded outstanding bullish results over the next 12 months (the only negative S&P returns during the ensuing 12-month period following a thrust occurred in March 2002, during the middle of the dot-com unwind).

Keep in mind, we’re less than six months removed from the latest signal. Using history as our guide, markets should be higher well into the first quarter.

Bottom line: Don’t let this choppy tape rattle you heading into November!

The sentiment unwind and backfilling of the hotter trades in late October should set us up for additional gains heading into the final two trading months of the year.

I expect the return of bubbly conditions very soon. You should have ample opportunity to buy fresh breakouts into November and ride them into the end of the year.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

![[VIDEO] The Year-End Rally Is Back On!](http://images.ctfassets.net/vha3zb1lo47k/4mfoBVvX4hSw8BLbDAjPP7/c13db091bfeef2a493bcfd0f1e73df14/ttr-issue-12-05-25-img-post.jpg)

[VIDEO] The Year-End Rally Is Back On!

Posted December 05, 2025

By Greg Guenthner

The Truth About Stock Market “Voodoo”

Posted December 04, 2025

By Enrique Abeyta

Breakout Alert: Copper Coils for a Monster Move

Posted December 02, 2025

By Ian Culley

Time for a Reality Check

Posted December 01, 2025

By Enrique Abeyta

Thankful for the Greatest Game on Earth

Posted November 27, 2025

By Enrique Abeyta