Posted January 23, 2025

By Enrique Abeyta

Is Nvidia’s Reign Over?

One single chart is telling me that Nvidia's AI chip dominance is coming to an end...

That its undisputed reign as the AI king over the past two years might soon follow the path of IBM or Cisco — companies that once ruled their domains but have since become relics of their former glory.

To be clear, AI is not "over." In many ways, its story has yet to begin.

But we might be treading down a dark path right now — one that the media, analysts, Wall Street, and Main Street can't see.

A path that, ultimately, will lead Nvidia to a $1T loss in market cap.

In fact, I think it will happen sometime this year… probably in a single day.

It might sound crazy. But bold calls, backed by irrefutable evidence, are where the real money is made.

Now, this doesn’t mean that I think NVDA is a bad company, nor do I think it’s a short.

I simply think NVDA is in a difficult position with the tremendous growth it has seen in the demand for its product.

Let me explain…

A Blast from the Past

Nvidia has benefitted from one of the biggest capital expenditure cycles in the history of technology.

I was thinking about what’s going on with NVDA and what similar situations I had seen in my career.

As I was doing so, I saw a great note from my old friend Dan Ferris over at Stansberry Research. He mentioned a similar situation that neither of us was around for but was as impactful as artificial intelligence — the introduction of radio.

As he says it, every bubble has that ONE company that’s the “it” company for that moment. For radio it was Radio Corporation of America (RCA). This was the “picks and shovels” company of the rollout selling radios and parts to enthusiasts.

As Dan retells it, the first radio station started broadcasting in November 1920, and by 1929 there were nearly 700 stations across the country. Sales of radio equipment went from $60 million a year in 1922 to $842 million in 1929.

Just about any stock with the word “radio” in the name went soaring. Think of what happened with anything with the word “crypto” in it a couple of years ago.

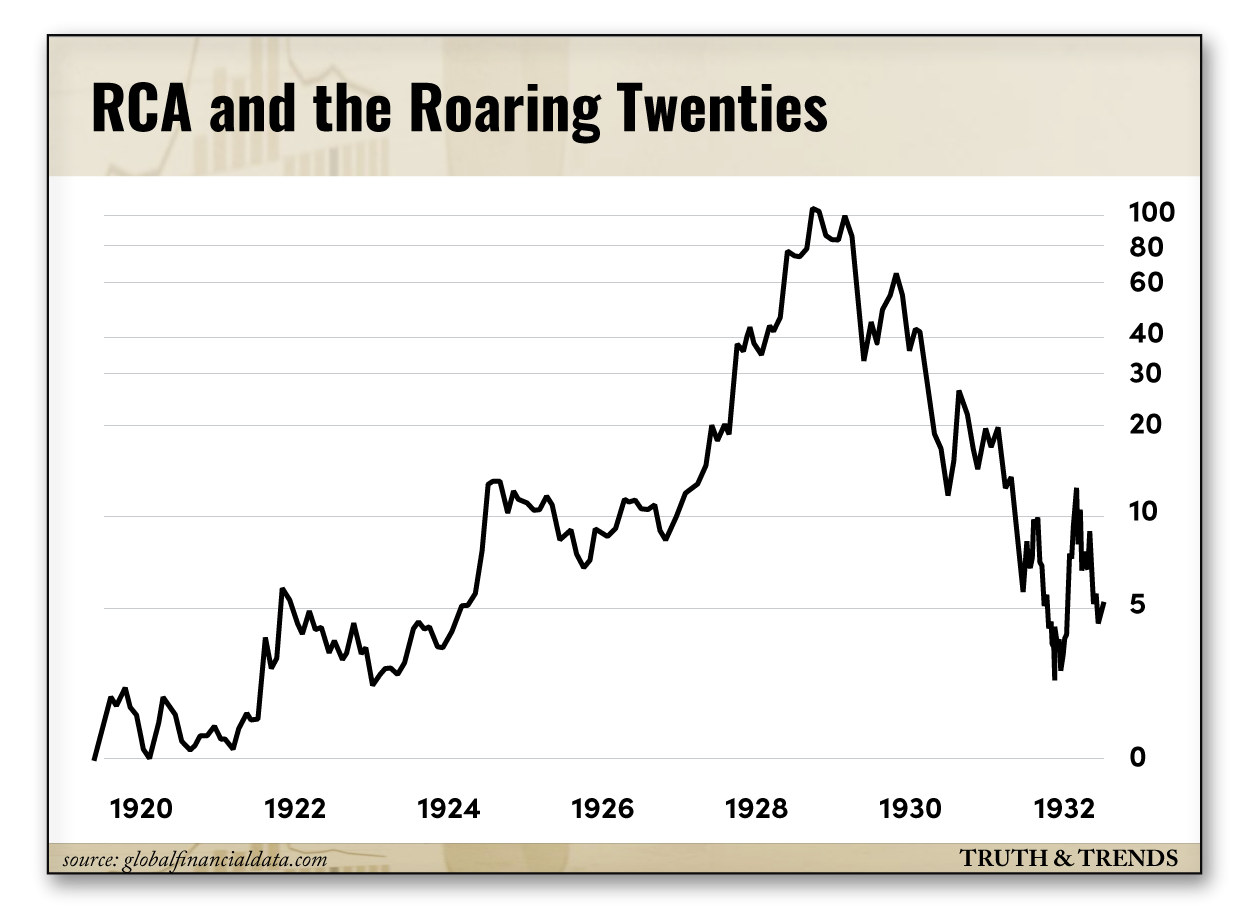

RCA was the leader of the pack. It went from a split-adjusted share price of $1.17 in 1921 to $114.75 by 1929. That’s a 9,700% return!

Here’s the chart…

After the run up, it crashed back down to $2.62 by 1932. It didn’t reach that old high again until the 1960s.

This isn’t to say that NVDA is going to do what RCA did, but rather to point out that there are always big trends that will change the world and a company that is leading the way. When they go to the moon, though, you need to be careful.

While I wasn’t around for the advent of radio and RCA, I was around for what happened during the dot-com era. Folks forget that the primary catalyst for the boom was the literal physical build out of the internet.

Much like the radio era before, the demand for equipment to build the backbone of the internet was absolutely booming!

Telecommunications companies (whose stocks were soaring) were out there buying tons of equipment.

Many folks recently have been referencing what happened to the stock of Cisco Systems Inc. (CSCO) back then.

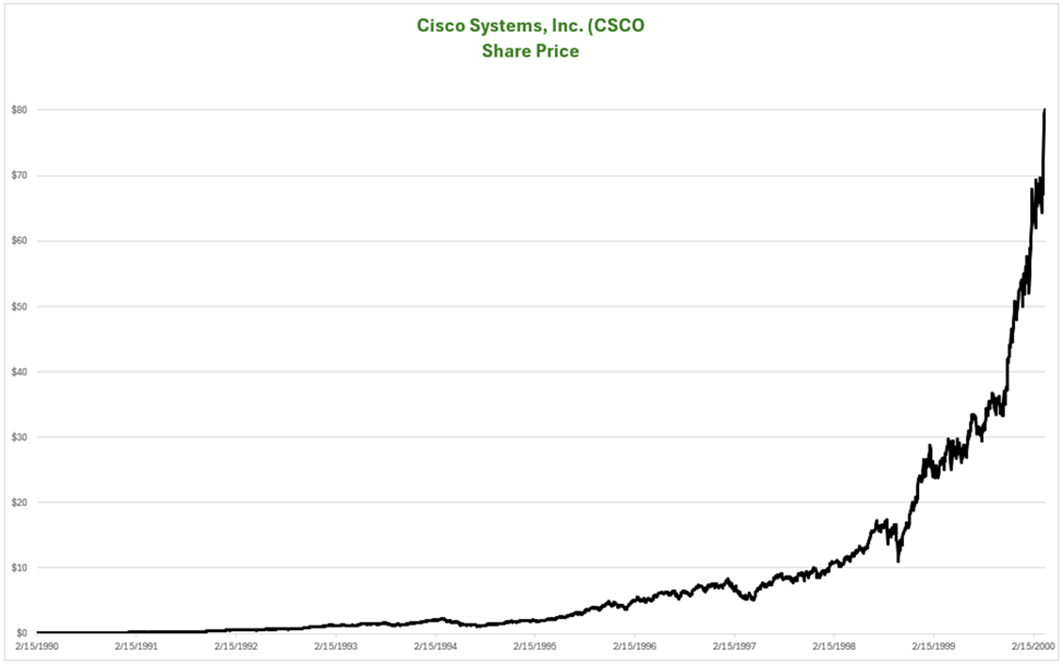

Dan points out that sales grew from $5 million in 1988 to more than $22 billion by 2001 — an incredible 4,000% increase! That was REAL demand.

When you grow revenue like that, you are likely to see a strong stock price. Here’s the stock chart from back then…

The stock peaked on March 27, 2000, at more than $80 per share.

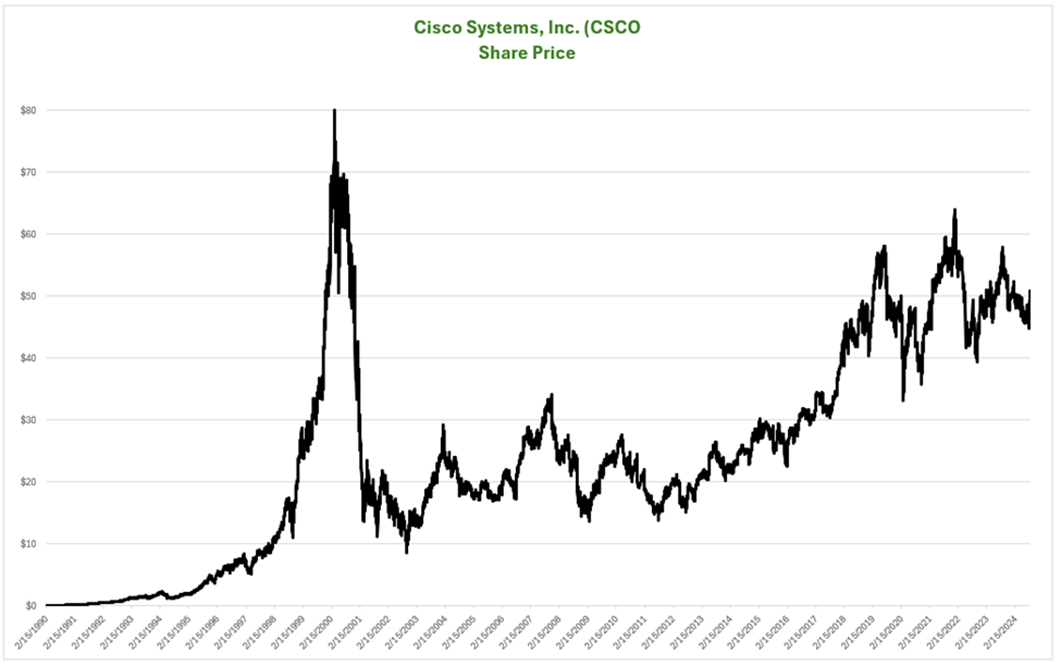

I’m guessing you know what happened next, but here’s that chart anyway…

Almost 24 years later, and the stock has yet to reach those old highs.

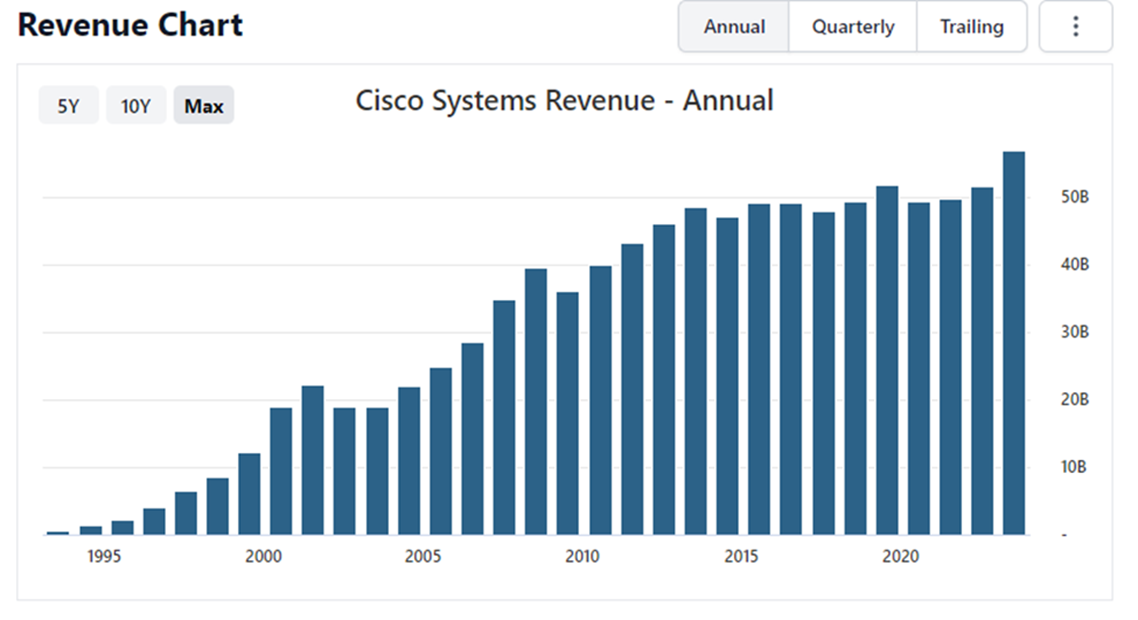

Here’s an important chart that I want to share regarding CSCO, showing revenue growth from 1993 through the present day.

I spoke about the huge growth across the 1990s. But look at what happened at the end of this period — CSCO revenue went down.

It would continue to move higher and more than double. But for a three-year period it was going in the other direction.

Could this happen to NVDA?

It certainly doesn’t feel like it right now as the company is crushing numbers and growing like crazy. But I remember those CSCO reports back in 1999, and they felt the same.

Back then, CSCO was making the “must have” networking equipment as every telecommunications company on Earth scrambled to build out the internet.

These competitive companies would pay virtually anything at the time to get the equipment. In their mind, they couldn’t afford to be left out!

Eventually, they got enough equipment to build out what they initially needed. In fact, they built out much more than was initially needed and didn’t need to buy very much equipment for a while.

CSCO also built more capacity and was able to satisfy these customers. Unfortunately, they did so right as the customers realized that, in their excitement, they had built more than they needed in the near term.

In the meantime, competitors to CSCO who were way behind either caught up with better products or with attractive pricing. The product wasn’t as good, but it was a lot cheaper, more available, and “good enough.”

(Stop and read that again. This is what I think eventually happens to NVDA.)

It will still be a leader and likely see revenue grow multi-fold from these levels. It’s still an awesome company in an awesome area.

The market, though, catches up. Especially in an equipment area like semiconductors.

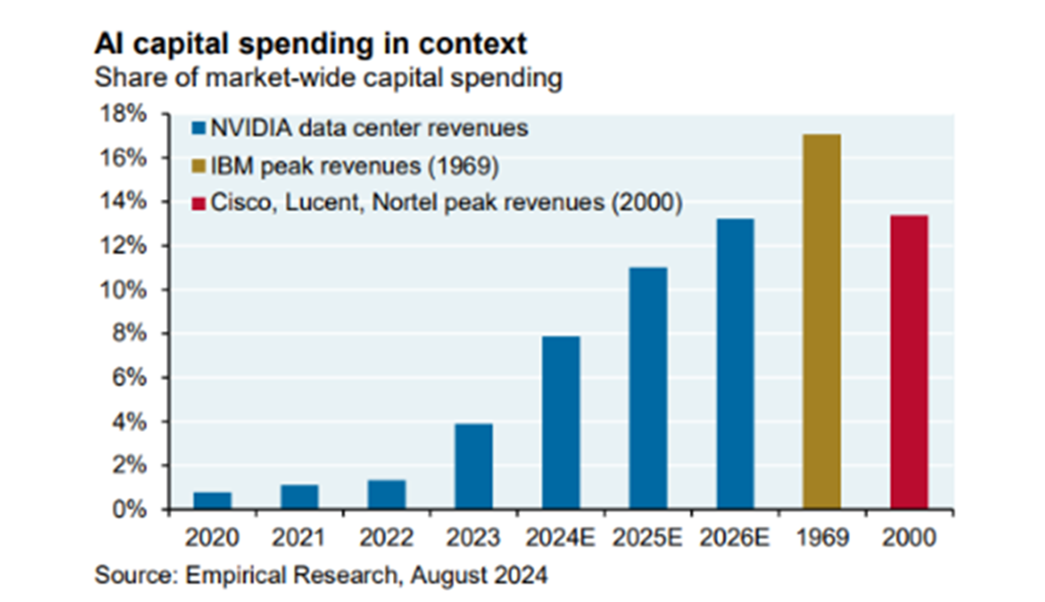

I recently saw an exhibit that puts the risk to NVDA in context.

The One Single Chart…

This table shows NVDA data center revenues as a percentage of the total technology capital spending in the United States. This is calculated from publicly available data.

On the table you can see how the NVDA spend compared to similar technology build outs. This table included the first wave of the computing build out with IBM in the late 1960s. It also includes the internet infrastructure build out we referenced above.

Both the IBM and CSCO situations ended very badly. The NVDA numbers are similar at this point.

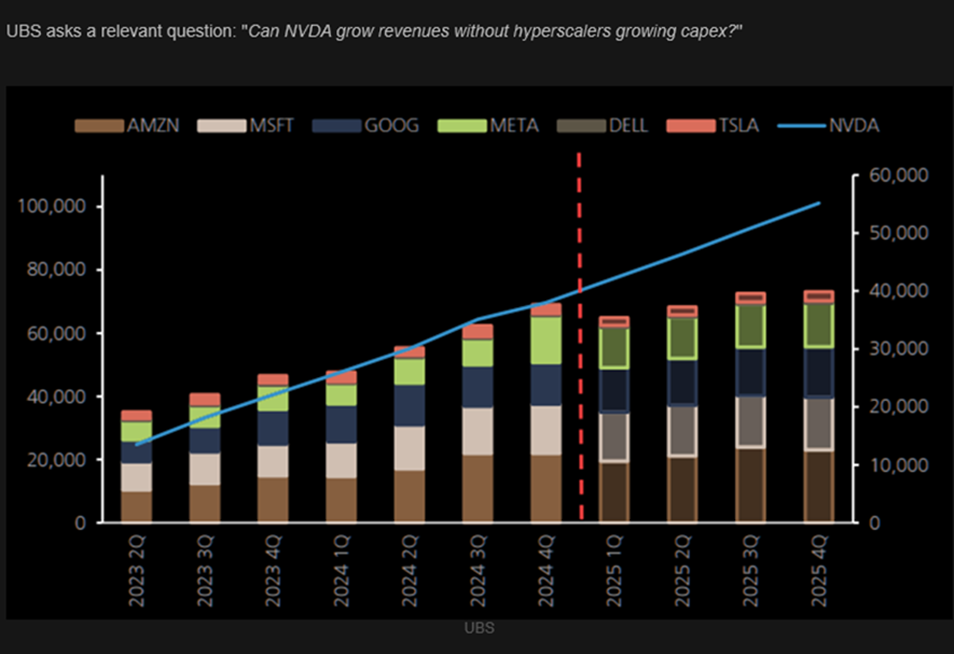

Another exhibit I saw recently also gives me concern.

This table shows the capital expenditure spending by the big hyperscalers — Amazon, Microsoft, Meta, Dell, and Tesla. These are the companies spending the money on the NVDA chips to build out this next generation infrastructure.

On the table you can see how it grew in the last couple of years. This is what has driven the tremendous growth at NVDA.

The challenge is that looking at the public guidance of these companies for the next few quarters, it would imply that there would be a sequential decline in their spend.

This may not happen. These companies have consistently been spending more than their original guidance. At some point, however, they will spend less. It’s simply math.

If that happens in 2025, I think that NVDA stock is vulnerable. Even if the company simply beats the number by a smaller than expected amount, the stock could tumble. Investor enthusiasm is THAT high.

I think NVDA is a great company in a great position. But eventually, the stock is going to face some real challenges.

Be prepared.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Fade the End of the World

Posted March 06, 2026

By Greg Guenthner

The Dark Side of the Tape

Posted March 04, 2026

By Nick Riso

The Iran War: What’s Next for Stocks, Oil and More

Posted March 02, 2026

By Enrique Abeyta

It’s Not Just You, This Market Is Mind-Melting

Posted February 27, 2026

By Greg Guenthner

Israel, India and Iran: The Calm Before the Strike

Posted February 26, 2026

By Enrique Abeyta