Posted January 15, 2026

By Enrique Abeyta

Insider Trading From Hamilton to Pelosi

In 1790, while the United States was finding its footing after the Revolutionary War, a quiet financial scramble was underway.

Debt certificates issued to soldiers and states during the war were trading for pennies on the dollar.

They were widely dismissed as nearly worthless promises from a fragile new government.

Then word began to circulate inside Congress.

Alexander Hamilton, the newly appointed Treasury Secretary, was preparing a sweeping proposal to consolidate the nation's debts and fund them at full face value.

If the plan passed, bonds that had been nearly worthless overnight would suddenly be worth 100 cents on the dollar.

The problem wasn’t the plan itself. It was who heard about it first.

Before the news reached the broader public, members of Congress and politically connected insiders acted quickly.

Information only traveled as fast as a horse or sailboat. So some hired stagecoaches and boats to rush south, where distressed debt was plentiful and cheap.

Their goal was to buy as much paper as possible before the rest of the country found out.

When Hamilton’s plan became public, prices surged. Those who had moved early made enormous profits.

By modern standards, this looks exactly like insider trading. Politically connected individuals used nonpublic information to profit in financial markets.

But at the time, there were no securities laws, disclosure requirements, or regulatory bodies overseeing financial behavior.

The American financial system was being built in real time. And speculation was not a side effect of that process — it was part of it.

Before Wall Street... Before the SEC… Before Rules

In the aftermath of the Revolution, the young nation was drowning in debt.

The federal government owed money. The states owed money. Soldiers had been paid in IOUs instead of cash.

These debt certificates traded at steep discounts because confidence in the government’s ability to repay them was low.

Alexander Hamilton believed that national credit was essential to the survival of the republic.

In early 1790, he proposed assuming state debts at the federal level and funding both state and federal obligations at par. The proposal was bold and controversial.

It also created one of the first major information edges in American financial history.

There were no real-time headlines. No regulatory filings. No equal access to information.

Members of Congress learned of Hamilton’s proposal first, and some acted on that knowledge before it became widely known.

When the plan passed, bond prices exploded higher. The profits were real, immediate, and highly concentrated among those closest to power.

At the time, critics like James Madison objected loudly.

He argued that speculators were unfairly rewarded while soldiers and farmers, many of whom had sold their bonds out of necessity, were left behind.

Others accepted the outcome as inevitable.

Hamilton himself did not personally speculate, but he understood that markets respond to policy and that information advantages are rarely neutralized.

In hindsight, this episode marks what could reasonably be described as the birth of insider trading in America, even if the term itself would not exist for another century.

The More Things Change, the More They Stay the Same

Fast-forward more than 200 years, and the dynamics remain strikingly familiar.

Today, modern investors hear about insider trading so often that it barely registers.

A headline breaks about a senator’s perfectly timed stock purchase. Or a filing reveals a major options trade made just days before a regulatory announcement.

Social media erupts, pundits argue, and then the market moves on.

The cycle repeats itself so frequently that it can start to feel like corruption is not a flaw in the system, but a feature of it.

This is frustrating for many investors.

Why should a small group of politicians and business leaders profit from information that the public doesn’t have?

Why do the same names keep appearing in trading disclosures that seem impossibly well-timed?

The uncomfortable truth is that those closest to power have always had an informational edge, and history shows that they rarely resist using it.

What has changed is visibility.

For most of American history, this behavior was hidden behind closed doors.

Trading records were private. Information moved slowly. Deals were whispered in hallways and acted on long before the public ever learned what had happened.

Today, that veil has been pulled back.

Technology, digital filings, and market transparency have given investors unprecedented clarity into how political and financial power actually operates.

Entire businesses now exist to make sense of that data.

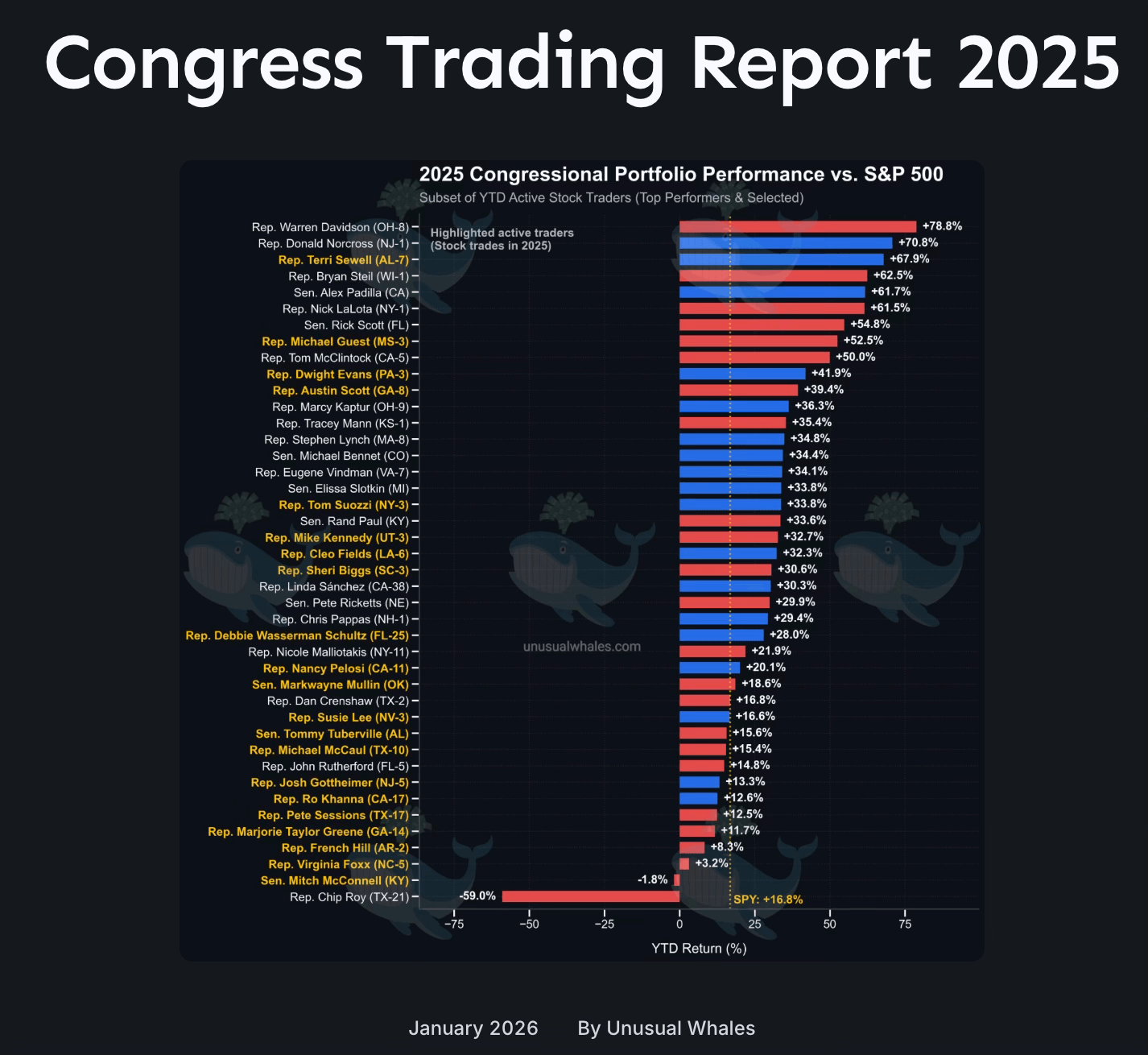

Unusual Whales has built a following by tracking unusual options activity, institutional positioning, and the public trading disclosures of members of Congress.

Their widely discussed “Nancy Pelosi tracker” aggregates political trading filings to show what insiders are buying and selling, often revealing trades that appear uncannily prescient.

In many cases, simply mirroring these trades has produced eye-opening results for regular investors.

Whether you see this information as troubling, fascinating, or profitable, one thing is clear: the market no longer operates in the dark.

The information gap has narrowed, even if it hasn’t disappeared.

Public filings, real-time data, and analytical platforms now allow regular investors to observe patterns that once would have been invisible.

What used to happen quietly in the halls of Congress now leaves a digital footprint.

While political insiders may still act on privileged information, their behavior is increasingly observable, measurable, and, in many cases, tradable.

We Trade the World We Live In

This doesn't mean the system is perfect, or even fair.

Reasonable people can disagree about whether the often-discussed legislation to rein in insider trading in Washington could provide a meaningful impact.

But as investors, we don’t trade the world we wish existed. We trade the world as it is.

The lesson from 1790 is that markets have always rewarded those who understand how power, information, and incentives interact.

Today, unlike in Hamilton’s time, that understanding is no longer limited to a privileged few.

At Truth and Trends, our job is to help you navigate that reality.

We study the data, the flows, and the behavior of those closest to power so you don't have to operate at a disadvantage in information.

Markets will always be imperfect. But knowledge, when shared, has a way of leveling the field.

The insiders never stopped trading. Now, at least, you can see them.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Small Caps Are Back, Baby!

Posted January 23, 2026

By Greg Guenthner

Greenland, Carry Trades, and Lazy CNBC Takes

Posted January 22, 2026

By Enrique Abeyta

“TACO” Out… “Big MAC” In

Posted January 19, 2026

By Enrique Abeyta

“BTSD” — The Powell Probe Trade

Posted January 12, 2026

By Enrique Abeyta

Revealed: The New Momentum Trades for 2026

Posted January 09, 2026

By Greg Guenthner