Posted January 21, 2025

By Greg Guenthner

How To Use My Favorite Indicator

I’m not a big indicator guy.

I’m sure you’ve seen those charts on X (formerly known as Twitter) or StockTwits – multiple lines hovering over price with rows of nondescript squiggles below. They’re obnoxious, noisy, and make it near impossible to track what matters most: Price!

Instead, I like to keep it simple by applying one versatile tool that I find useful in almost every situation: the Relative Strength Index or RSI.

Today, I’ll share with you the one reason why I prefer the RSI over other technical indicators.

But first, you need to know what the Relative Strength Index is and what it is not…

What It Is and How It Works

Newbie traders often confuse the Relative Strength Index with relative strength analysis (a ratio line comparing two assets). I don’t blame them. The name can be misleading.

But J. Welles Wilder, Jr. created the RSI in the late 70s well before the popularity of relative strength analysis. Instead of identifying the assets outperforming their peers, he wanted to capture the strength of price movements…

The RSI is a momentum indicator that measures the velocity of price swings, up or down, with readings oscillating between 100 and 0. An RSI print greater than 70 is considered overbought, while oversold conditions trigger when it falls below 30. Extreme readings such as these often pinpoint key turning points in the trend.

Most analysts and traders use the Relative Strength Index for signs of exhaustion in buying or selling pressure. Remember, price doesn’t move in a straight line. Uptrends consist of rallies followed by consolidations, and downtrends unfold in a series of selloffs interrupted by brief yet forceful relief rallies.

Unless you’re a value investor or prefer to buy and hold, two components comprise every successful trade: direction and timing. That’s where the RSI comes to your aid…

By applying the momentum oscillator to your trend analysis you can better time your entries and exits. For instance, you’re likely entering at the highs when the RSI reaches overbought or exiting at a critical low when it slips into oversold territory.

That’s why so many traders use the RSI during choppy markets, buying low and selling high as prices mean revert.

But most traders are oblivious to the ways they can use this oscillator to ride the underlying trend…

Bullish or Bearish

I find extreme RSI readings valuable. However, I learned early on that the strongest markets hit overbought and stay overbought.

Plus, the Relative Strength Index oscillates at higher levels during uptrends and lower levels during downtrends, indicating who has control.

(Few traders pay attention to this small detail, but it’s crucial.)

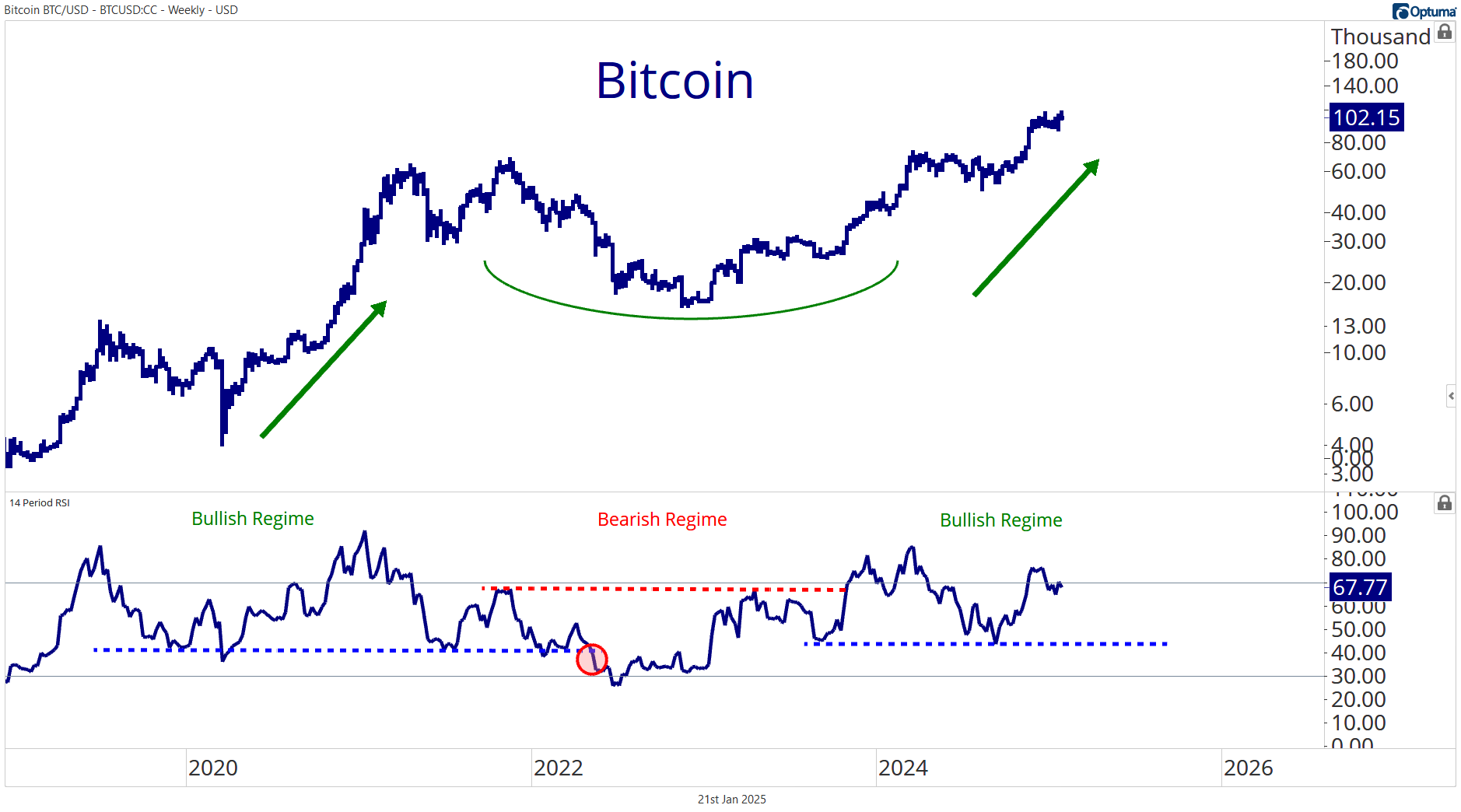

Check out the weekly Bitcoin chart with the 14-week RSI in the lower pane …

Notice how the index churns at higher levels while Bitcoin’s uptrends and at lower levels as the crypto currency corrects. Technical analyst and legendary trader Connie Brown refers to these RSI ranges as momentum regimes.

Despite dropping below 40 for roughly two weeks during the Covid selloff, the 14-week RSI bounced within a bullish momentum regime (between 42 and 85) during the 2020-2021 bull run. For the better part of two years, traders were rewarded for leaning into the uptrend and buying the dip whenever RSI reached 40.

Bitcoin bulls held court.

But that changed after the indicator accompanied Bitcoin to new multi-year lows in spring 2022. The breakdown out of the bullish momentum regime (highlighted in red) confirmed a significant trend reversal was underway and risks were to the downside.

Lo and behold, Bitcoin went on to drop approximately 50% into the fall before posting a cycle low of roughly 15K. Meanwhile, the RSI slipped below 30.

The bears finally had the upper hand.

Buying the dip came with elevated risks until RSI hit 70 and exited the bearish regime in October 2023.

The bulls were now back in the driver seat.

Fast forward to today, and the uptrend remains intact. Bitcoin flirts with new all-time highs. And momentum has yet to dip below 43 since.

Paying close attention to bullish and bearish regimes like these can help you keep your head on straight when planning trades or managing existing positions.

But this is just the tip of the RSI iceberg.

We’ll talk more about other helpful RSI strategies soon!

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Tariff Tantrum Redux

Posted February 23, 2026

By Enrique Abeyta

The Weight of Nothing

Posted February 20, 2026

By Nick Riso

“Luck Is Not Real”

Posted February 19, 2026

By Enrique Abeyta

The S&P 500 Lies

Posted February 18, 2026

By Nick Riso

The Kill Switch: How a Hidden Algorithm Is Blowing Up Boring Stocks

Posted February 16, 2026

By Enrique Abeyta