Posted March 21, 2025

By Greg Guenthner

How to Trade the “Bad News Bounce”

A “bad news bounce” is lifting the stock market right now – and it might just be setting us up for a strong move off last week’s lows.

You might not have noticed if you were following the S&P 500’s closing price, so I’ll explain how the situation is developing in real time…

First, the setup: Stocks stopped going down!

I know that one’s a bit obvious. But we need to see selling pressure abate to entice buyers to dip their toes in the water. This started to happen last Friday into Monday as the first brave bulls took a swipe at some of their favorite stocks.

Next, we needed the market to either extend higher or cling to those early gains at the very least. While action has been choppy most of the week, we’ve yet to see any ugly moves severely undercutting the young rally.

Finally, we needed to see how stocks would perform under the increasing pressure of a negative news cycle.

Thankfully, the Fed delivered the goods!

Jerome Powell took the mic on Wednesday afternoon and declared he’s in no hurry to cut rates. The Federal Reserve also updated its growth and inflation projections. On the surface, neither are bullish. Growth will slow, the Fed warned, and inflation will increase during these uncertain times. Stagflation? Yikes…

But the bulls didn’t blink.

The averages rallied into the close as the S&P posted an upside move of more than 1%, while the tech-heavy Nasdaq shot to a 1.4% gain as traders hit the “buy” button.

The second test came after the market closed. First, Trump publicly pressured the Fed to cut rates to help the economy transition to the new tariff policies. And by the wee hours of the morning, European officials were warning US tariffs could squash growth.

Futures posted a modest retreat early Thursday. But we started to sense that the reaction from investors and the financial media was overbaked. The headlines made it seem as if the market was in free-fall following the strong post-Fed rally. Yet stocks were barely red heading into Thursday’s session.

Here’s where the road diverges…

The S&P 500 and Nasdaq 100 lurched lower (albeit less than half a percentage point, respectively). While, on the other hand, individual stocks rose on healthy gains.

Today, I’ll share one of those names taking the high road – a stock that could ride this “bad news bounce” to record highs.

But first, I’ll explain what you should expect in the coming weeks…

Hold Tight!

Don’t let the recent chop fool you.

We’ve seen some strength off the bottom. Most notably, 90% of the S&P 500 posted positive returns on two back-to-back days (last Friday and Monday of this week).

Rarely do we witness broadening participation such as this. As you might expect, back-to-back 90% up days often leads to continued strength, but not immediately.

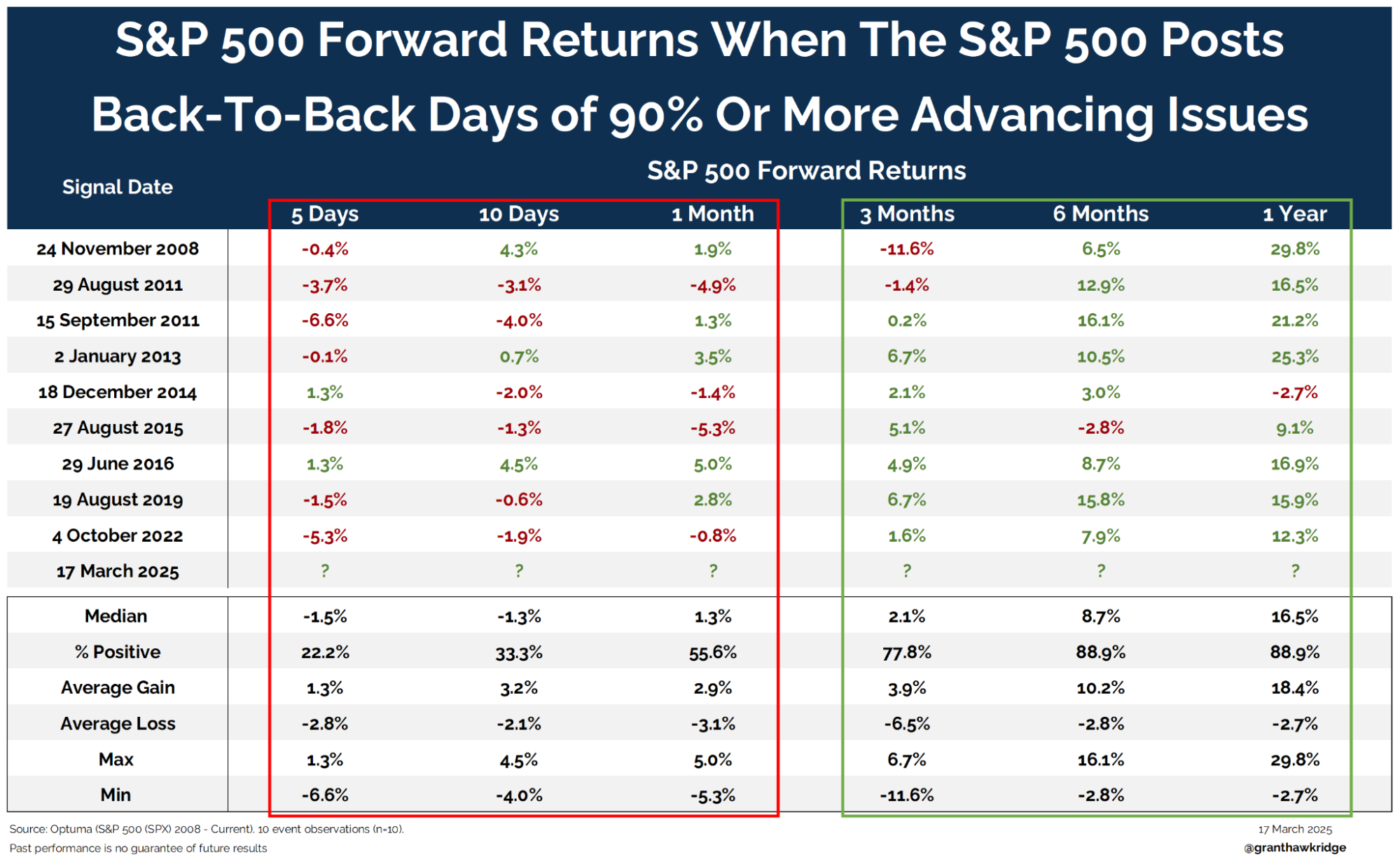

Grant Hawkridge (one of my favorite analysts) ran through the data over at The Daily Number.

Here’s what he found…

Source: @GrantHawkridge

Six months out, the market sees green 88.9% of the time. That’s a solid stat for the bulls and another reason to bet on a bounce.

But here’s the catch: Five days after back-to-back 90% advancing days, the S&P 500 prints red 77.8%. Today marks day four.

So while it might be messy out there, that’s to be expected at this point.

Remember, the S&P 500 dropped 10% in sixteen days. Steep selloffs, like the one we just experienced, need time to repair the damage inflicted by the bears.

The data suggests the market's upward path smooths the further out we go, fully backing the bulls three months removed from the breadth expansion.

In the meantime, we like buying stocks that are outperforming.

Hitchin’ A Ride To All-Time Highs

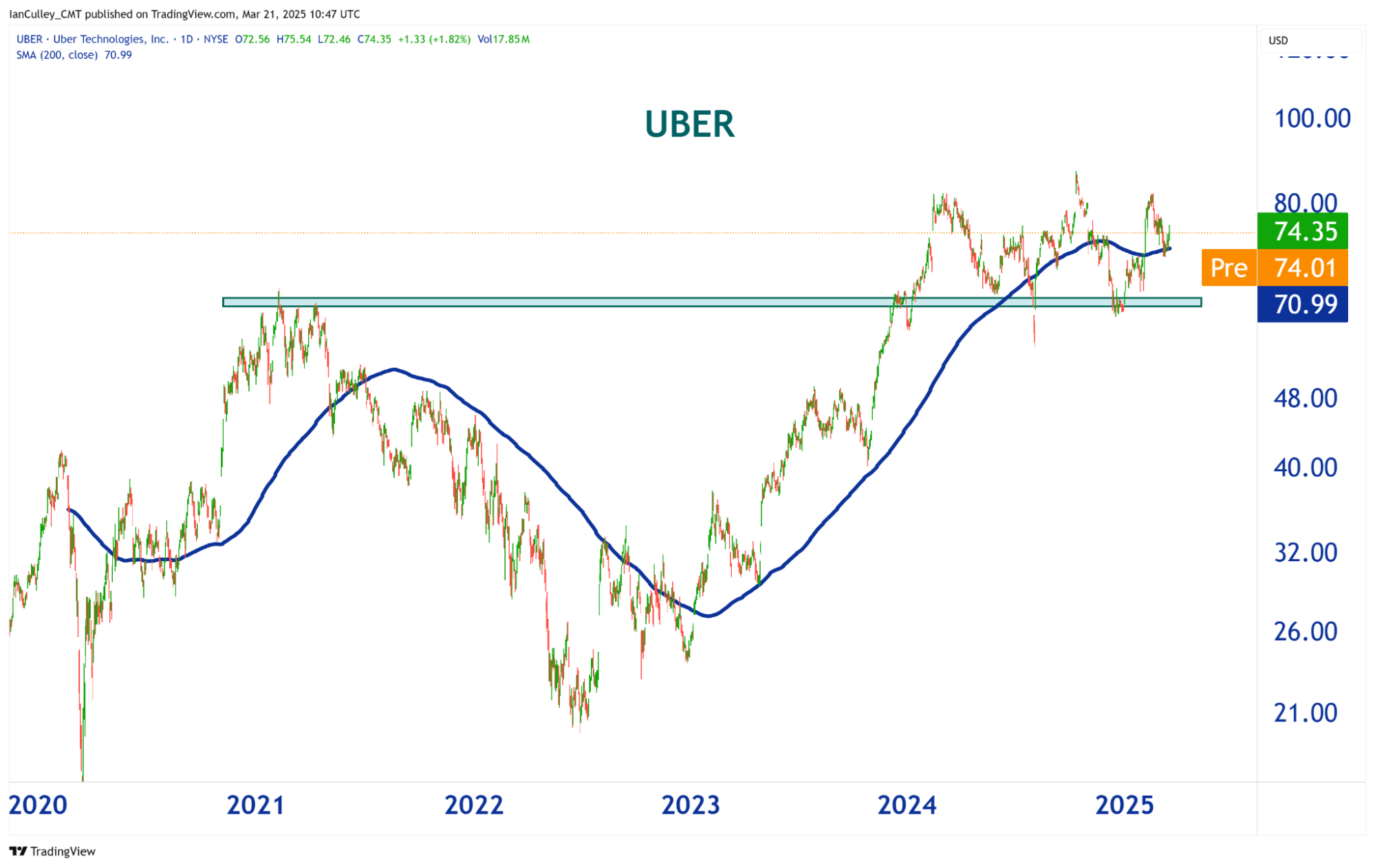

UBER was one of the first big stocks to flash green yesterday morning. By the end of the day, it jumped 1.86% versus NVDA’s 0.86% gain and the S&P 500’s -0.22% loss.

Plus, UBER is up almost 7% since stock indexes bottomed last week – leaps and bounds above the broader market.

It’s also a quality name that’s firming up at a key area…

UBER put in a nice higher low last week and is bouncing at its 200-day moving average (dark blue line).

We also like its consolidation above its 2021 peak (where the post-Covid melt-up began to cool). Those 2021 highs are now acting as a floor, supporting the next upside move.

Yesterday, we added UBER over at TheTrading Desk with the Feb. highs just above 82 bucks as our near-term target. That’s a double-digit move that could lift any portfolio.

The averages are still in the dumps. History tells us the S&P 500 needs a little more time to gain back its confidence and start hitting the ball again.

Once it does, today’s “bad news bounce” will become tomorrow’s broad snapback rally… and UBER will be knocking on the door to new all-time highs.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

The Next Trillion-Dollar Whale

Posted March 28, 2025

By Greg Guenthner

Free Investment Tip: Fewer Stocks = Better Returns

Posted March 27, 2025

By Enrique Abeyta

TSLA Leaves Hate Sellers in the Dust

Posted March 25, 2025

By Greg Guenthner

Ready…Aim…FIRE!

Posted March 20, 2025

By Enrique Abeyta

Breakout Alert: Energy Is Heating Up Fast

Posted March 18, 2025

By Greg Guenthner