Posted January 10, 2025

By Greg Guenthner

How to Outwit The Earnings Season Crowd

I don’t trade earnings announcements.

More specifically, I don’t jump in front of earnings announcements with a fresh trade in the hopes that I somehow get lucky and guess the market reaction ahead of time.

But just because earnings season kicks off next week doesn’t mean you have to sit on your hands…

Earnings announcements can lead to some amazing buying opportunities.

You just have to know what to look for — and how to spot these buy points when the numbers start rolling in over the next few weeks.

Today, I’m going to reveal my earnings season secrets.

I’ll explain how I make trading decisions when potentially trend-busting earnings announcements get in the way.

I’ll also show you a technique I use to drastically improve my odds of success during these uncertain trading periods.

It all starts with the timing…

Taking the Guesswork Out of Earnings Season

My favorite earnings trades don’t require you to make any guesses about revenues, profit margins, or estimates.

If you’ve been around these parts awhile, you’ve probably read or watched a few of my rants about how you can’t trade the news or time your short-term buys and sells by the headlines.

This is true whether you're tracking a planned earnings announcement or a surprise event, because it’s impossible to know if the buying or selling force from the initial reaction will continue.

This is also one of the main reasons I never attempt to get in front of earnings. You never know how a stock will react, even to solid numbers. The CFO could hiccup during the conference call and crash the stock 10%.

Any stock you buy just before earnings are announced is a pure gamble, hence my first earnings trading rule: Only buy after the numbers are released and the conference call is complete.

This strategy might sound absurd. Why wait until after the numbers come out and investors are lining up to buy or sell the stock?

It all comes down to the fact that the crowd’s initial earnings reactions are sometimes wrong, catching traders offside and leading to some of the most powerful trading setups in the market.

How to Trade an Earnings Reversal

Post-earnings reversals are rare. But when they occur, you have an excellent shot at getting a “perfect” entry price for a new trade that will launch much higher in the weeks and months ahead.

Here’s what to look for…

First, you want to track stocks that have just reported earnings and are gapping down on the news. The reasons don’t matter. It could be obvious — lowered guidance or whiffing on top-line or bottom-line estimates. (One quick note: Financial reporters will attempt to explain the why, and everyone will simply take this information as fact. You can ignore their conclusions. They don't factor into our decision-making process.)

Next, wait to see how the stock behaves after it gaps lower. If it catches a bid and starts to recover, watch closely. If it can close the earnings gap in just one or two trading days, you have your signal: It’s a buy!

These trades work due to the herd’s extreme post-earnings emotions. For whatever reason, a wave of sellers ditch the stock immediately after earnings are announced. Then, cooler heads prevail and the more patient buyers swoop in to pick up shares at a discount. Once the rest of the crowd realizes the stock isn’t broken, they pile back in. And the trend usually extends higher.

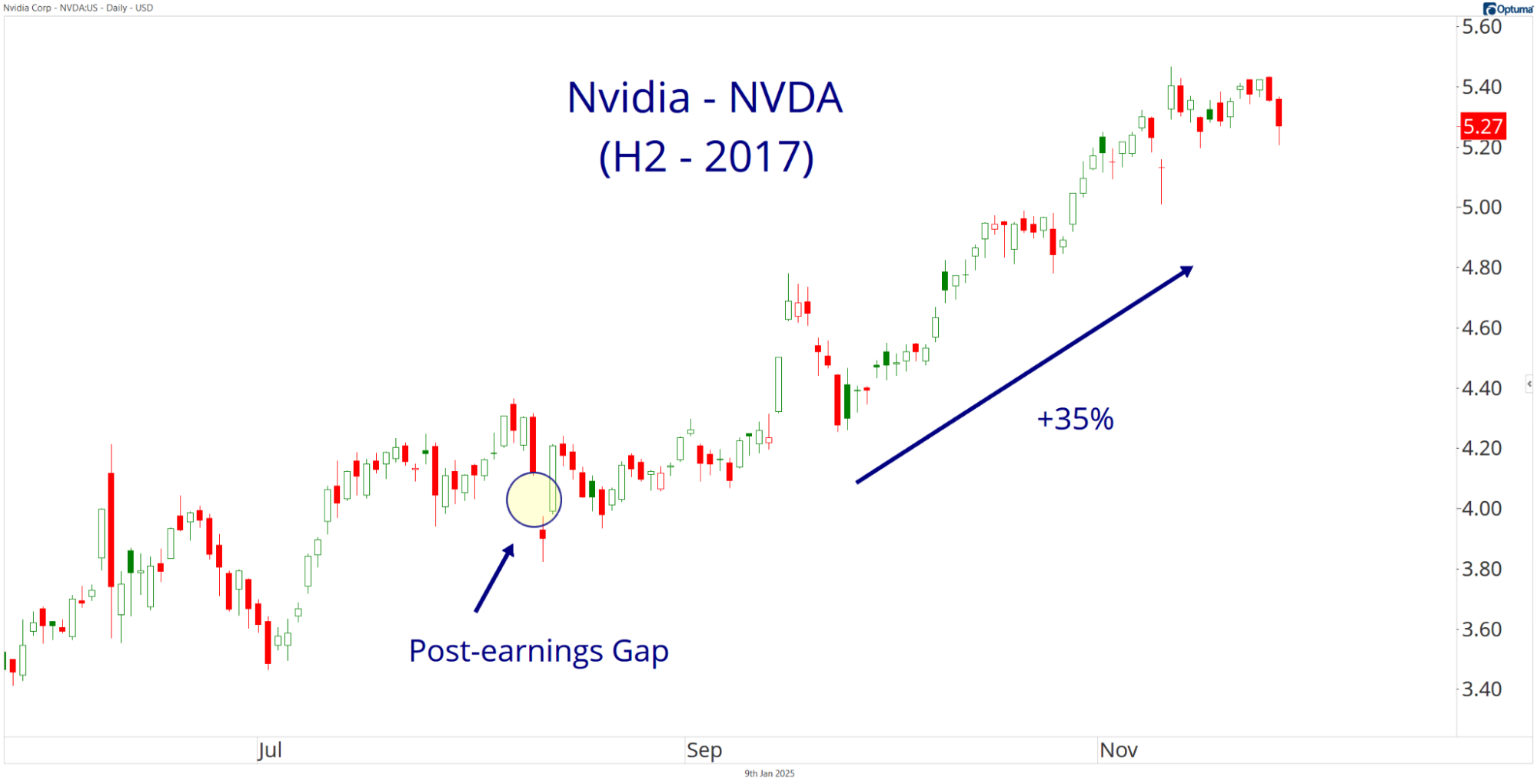

Check out this picture-perfect earnings reversal in NVIDIA (NVDA) from 2017.

On Aug. 11, NVDA gapped down more than 5% after reporting quarterly earnings the night before.

But the stock exploded higher the next day, closing the gap to post a gain of nearly 8%. The recovery stabilized the stock, helping to trigger a fresh rally that led to gains of nearly 40% from those earnings lows over the next three months.

A couple of quick notes about these earnings reversal trades:

- This NVDA chart is an ideal situation for a position trade. It took a little less than two days to close the gap. Sometimes, it can happen much faster, creating a violent move for day traders and swing traders to exploit.

- These trades also work in reverse! A stock that gaps higher on earnings, then fizzles out, would make an ideal short if it fails to rally back to the scene of the crime.

Keep an eye out for these earnings reversal setups over the next few weeks. It’s the perfect strategy to deploy in these uncertain times.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

The Weight of Nothing

Posted February 20, 2026

By Nick Riso

“Luck Is Not Real”

Posted February 19, 2026

By Enrique Abeyta

The S&P 500 Lies

Posted February 18, 2026

By Nick Riso

The Kill Switch: How a Hidden Algorithm Is Blowing Up Boring Stocks

Posted February 16, 2026

By Enrique Abeyta

Snapback Trade Watchlist: HOOD, SHOP, TOST

Posted February 13, 2026

By Greg Guenthner