Posted June 27, 2025

By Greg Guenthner

How I Build MONSTER Positions

Swing trading is my bread and butter.

I make strategic, short-term bets on the strongest stocks on the market as they’re breaking out, squeezing everything I can out of these extreme momentum moves. Then, I sell and move on to my next target.

This strategy has obliterated the market since the averages began slipping during the springtime tariff tantrum.

Since the S&P 500 broke below its 50-day moving average on February 24, my readers at The Trading Desk have had a chance to book 13 winning trades.

Seven of these gains were 100% or more (two additional trades clocked in above 95% that I’m not counting in this total). And just five were losers.

More impressively, we’ve done it all over a short period where the S&P dropped nearly 20%, then rallied back to the scene of the crime.

But short-term gains aren’t the only benefit of operating with a trader’s mindset.

I’ve seen it time and again: Traders think trading is the end-all be-all.

That’s a major mistake. Real wealth encompasses thinking for the short and long term…

I utilize the same swing trading principles to plan my long-term portfolio. I’ll show you how to do that today.

Plus, I will reveal my latest long-term buy — a stock that I believe will eventually become the next important mega-cap winner.

Let’s dive in!

Quit Thinking Like an Investor

Over the years, I’ve implored my readers to stop thinking like an investor…. and start thinking like a trader.

I recently told you that thinking like a trader will not only dramatically improve your returns, but it will also free you from the never-ending spin cycle of the financial media, bogus Wall Street analysis, and foggy economic prognostications that never seem to come true.

This is the philosophy I used to build my long-term position in Robinhood Markets Inc. (HOOD) over the last several years. It’s now the largest position in my portfolio — and I don’t think it’s anywhere near its peak!

Successful traders must recognize that the market moves in distinct, almost predictable patterns. Even if you love a stock's fundamentals and business prospects, you must optimize your buys to alleviate stress and achieve maximum gains.

That’s why I lean on my trading philosophy when I find a company I believe is ready to cross the threshold into world-beating status.

This company in question is Uber Technologies Inc. (UBER).

I don’t have to tell you what Uber does. But I’ve been chirping about the stock for a while and have had it on the back burner as a potential addition to my concentrated portfolio of longer-term bets.

As I’ve discussed with Enrique on Top Trades Live, it’s the ultimate TAM (total addressable market) play. The market for Uber is huge and will only become more important as the idea of self-driving technology reaches fever pitch.

Buying Your Next Big Winner

I’ve recently started to build my Uber position (a little later than I expected!). I achieved this by purchasing half of the total amount of shares I ultimately want to own, which is the first key to this longer-term strategy.

Some investors frown on this behavior. If you want to buy a stock, get in now! This works for most. But when I start a position, I often aim to optimize emotional stability. I don’t want to get shaken out on an unexpected drop. By starting off small with plans to add later, I can set a wider stop loss and avoid getting stuck in an emotional decision.

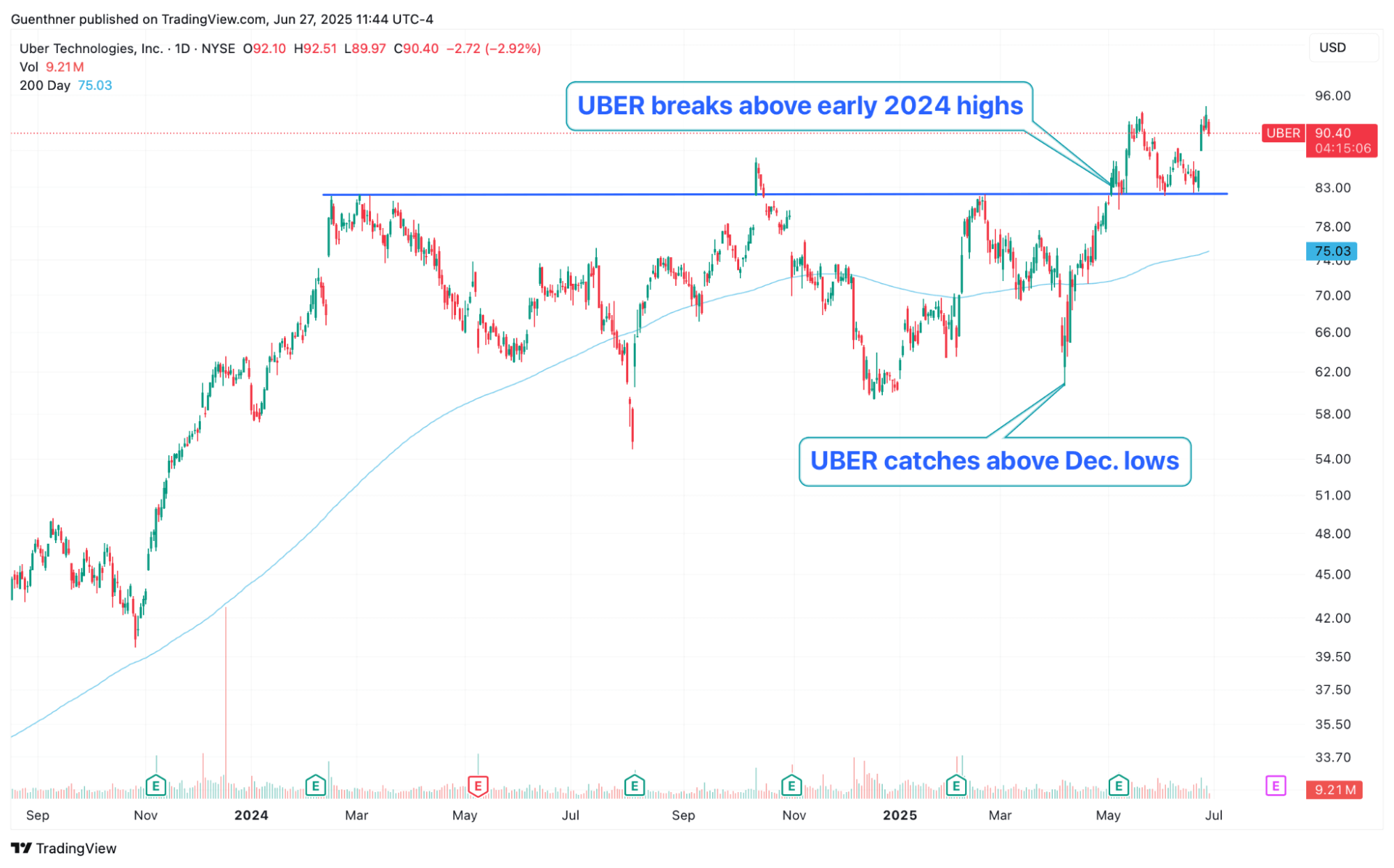

UBER took a break from its 2023 rally last year and traded in a wide range. This is when I was spending a lot of time watching and waiting. I was looking for signs that the stock was regaining the strength it had displayed during the early days of the bull market.

After dancing above and below its flat 200-day moving average multiple times, I finally saw something interesting:

During the tariff panic, UBER shares never fell below their December 2024 lows. Not even close!

Then, when the stock started to rally with the broad market, it began to outperform the averages.

This relative strength continued through the 200-day moving average to the February pivot highs. This level also coincides with the early 2024 highs, marking an important psychological area for the stock.

This is where I bought: right near $83.

Remember: I started with a partial position. I didn’t need UBER to hold $83 and run in order to feel secure with my holding. Instead, I could withstand a drop back into its consolidation area, even if that meant a date with its 200-day moving average all the way back in the low $70 range.

With an established partial holding, I’m already in a position for success. UBER broke out, then retraced this level a couple times, a relatively common occurrence on longer timeframes. For the second leg of my position, I will look to add on a bounce following any major pullbacks this summer as long as the breakout remains intact.

I suspect Uber will reach (or exceed) $100 at some point in the months ahead. By this point, I will have a large enough cushion to withstand any minor drops. That puts me in a position of strength — free from the worry of dealing with a difficult decision due to my holdings being stuck in the red.

I recommend implementing a similar strategy on all your longer-term market bets. By scaling in and following the charts, you can safely and strategically build positions like my new UBER holding that will hopefully turn into long-term winners like HOOD.

Your portfolio will thank you!

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

![[Breakout Confirmed] This 10x Trade Is Taking Off](http://images.ctfassets.net/vha3zb1lo47k/5SZCYl7OZbRTZpXv6ItiqQ/fcc3fb7ac31039e02a1e4ef1ff161ca5/ttr-issue-07-01-25-img-post-2.jpg)

[Breakout Confirmed] This 10x Trade Is Taking Off

Posted July 01, 2025

By Ian Culley

Ken Griffin Is Full of Sh*t

Posted June 26, 2025

By Enrique Abeyta

The “Wall of Worry” Climb Is Over

Posted June 24, 2025

By Ian Culley

GME: A Warren Buffett Kind of Stock

Posted June 23, 2025

By Enrique Abeyta

Juneteenth: A Commitment to American Optimism

Posted June 19, 2025

By Enrique Abeyta