Posted June 13, 2025

By Greg Guenthner

How Cathie Got Her Groove Back

They mocked her when she had the audacity to go on CNBC and declare Tesla shares were headed to $1,000.

Then, it actually happened.

Every speculator in the world hailed her as a hero. ARK Invest CEO Cathie Wood became the queen of the bull market. And her legend would only grow as the 2020 growth stock bubble minted trading fortunes.

But Cathie’s fall from grace was even faster than her meteoric rise. She went from basking in stockpicker glory to the punchline of every joke as her innovation empire collapsed under the weight of the grinding 2022 bear market.

Everyone forgot about those crazy growth stocks, as many lost 80% of their value or more. But don’t look now…

Many of these bruised and battered tech has-beens are quickly rising from the ashes. ARK Innovation ETF (ARKK) has exploded more than 60% off its April lows, easily besting the major averages.

Cathie is back! And if you don’t have some of these names in your trading portfolio, you’re getting left behind.

The Ultimate Market Barometer

I admit it, I was never a fan of all the Cathie worship. Her catch-all “innovation” tag for her favorite mishmash of tech-growth names always felt like a cop out. And the fact that she ignored countless market warnings and rode these stocks into the ground is concerning, at the very least.

But you don’t have to be an ARK evangelist to pull value out of the fund's performance. You don’t even have to buy a single share.

You see, ARKK has been my trusty market hype-o-meter since the early days of the COVID pandemic. It’s not an investment. It’s a barometer. Its performance measures how strong the retail trade is at any given moment, and how likely it is that an early market rally has plenty of fuel left in the tank.

Consider the brief history of ARKK’s time in the spotlight.

Rabid lockdown traders helped propel Cathie’s favorite innovation to new heights. Many of these tech-growth wonders doubled, tripled, and quadrupled (or more!) as the COVID Bubble inflated.

But by late 2021, a storm was brewing. As the Nasdaq Composite stubbornly caught a bid and marched higher leading up to Christmas, ARKK completed a massive top.

ARKK lost nearly 13% in Nov. 2021, followed by a December drop of nearly 10%. But the selling was still “quiet” as most investors and the financial media were content that the major averages were doing just fine.

You know what happened next…

The sellers locked in, and all those growth stocks that couldn’t possibly go any lower did just that. After rallying more than 325% off its COVID crash lows, ARKK embarked on a round trip for the ages.

To recap: these highly tradable, emotionally charged innovation stocks exploded higher when the market was hot. Then, they were the first to fall apart as a brutal bear market set in.

Quit the Hype and Buy the Breakouts

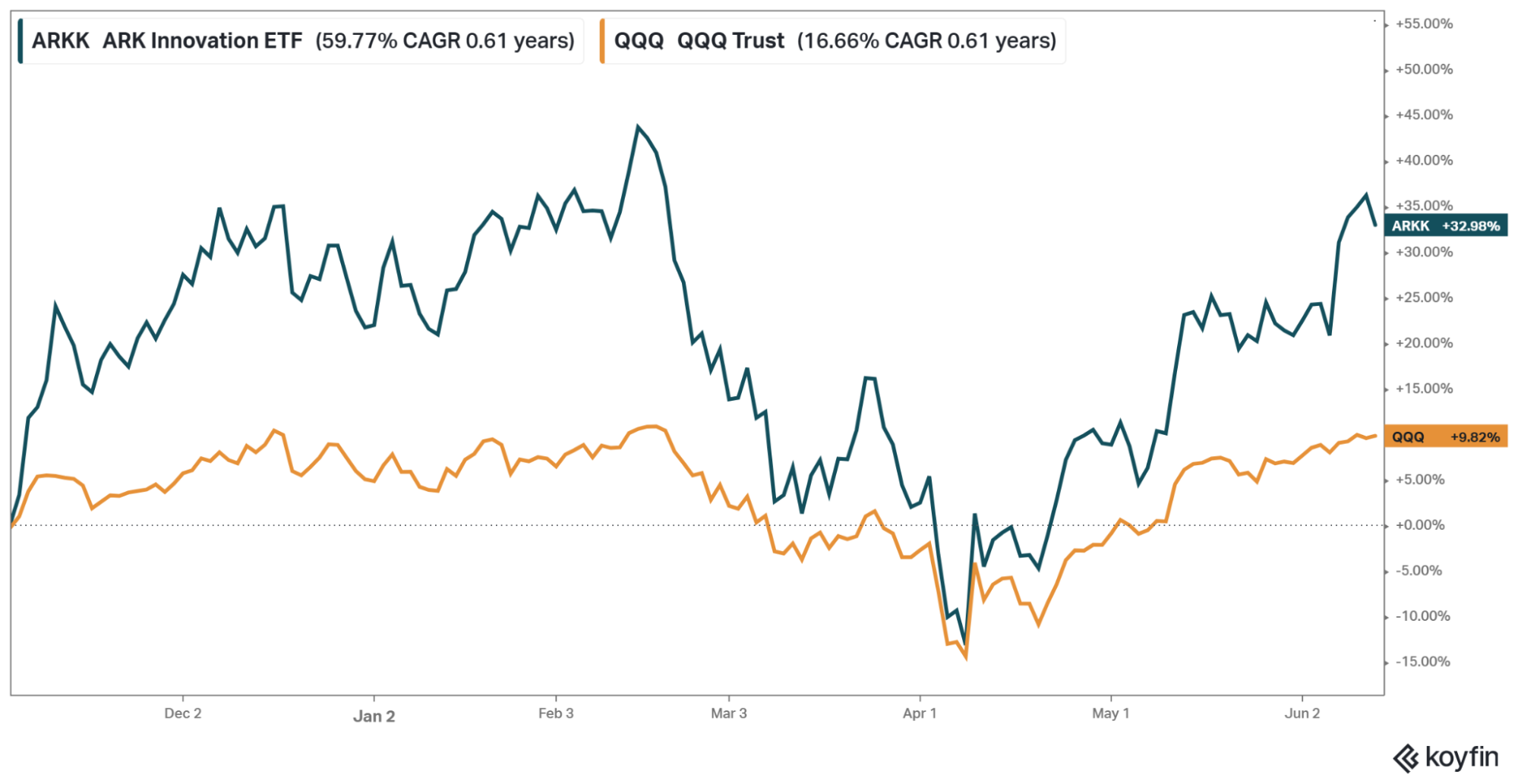

So, where does ARKK stand now? Take a look for yourself.

The tech-growth trade has been on a wild ride since the election rally in November. ARKK sprinted ahead, gaining more than 45% in just about four months, completing a massive base breakout.

But the celebration was short-lived. Liberation Day slammed the more speculative areas of the market, and ARKK was sucked down the tubes, pulling even with the Nasdaq by early April.

That turned out to be the ultimate fake-out. ARKK (dark blue line) immediately caught a bid following its sharp drop, and is now up more than 32% since the election rally began, compared to QQQ’s (orange line) gain of less than 10%.

Select top ARKK holdings have posted even more impressive gains off the April lows:

- TEM: +91%

- RBLX: +85%

- ACHR: +83%

- HOOD: +75%

- PLTR: +75%

I’m not asking you to buy into the narratives of these story stocks.

I honestly don’t care about most of them as companies. But I do care about the charts. And right now, these ARKK holdings are flashing risk on.

Don’t worry if you aren’t involved in any of these red-hot names. These are the stocks you should be tracking for consolidations and solid entry points for swing trades and longer-term holds.

Despite everything happening in this crazy world, the snapback moves in these stocks prove speculators are in control and willing to take on risk. That’s important information!

These names (and other volatile growth stocks) will remain in play throughout the summer and beyond.

Barring a major market reversal, they will be the best way to generate outsized returns as the major averages creep back toward their all-time highs.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Elon Musk Changed My Life Forever

Posted June 30, 2025

By Enrique Abeyta

How I Build MONSTER Positions

Posted June 27, 2025

By Greg Guenthner

Ken Griffin Is Full of Sh*t

Posted June 26, 2025

By Enrique Abeyta

The “Wall of Worry” Climb Is Over

Posted June 24, 2025

By Ian Culley

GME: A Warren Buffett Kind of Stock

Posted June 23, 2025

By Enrique Abeyta