Posted March 11, 2025

By Greg Guenthner

Good Morning, Vietnam!

Investors can’t sell U.S. stocks fast enough.

The herd is growing impatient over Trump’s tariff games as the averages fall out of bed to kick off the new trading week.

Tech is tanking.

Crypto is spiraling lower.

It’s a bloodbath for the bulls.

But you'll find far more favorable conditions outside U.S. markets. Germany, the UK, and Emerging Markets are holding up better than their U.S. counterparts.

In fact, there’s one group of stocks poised to rip in the weeks and months ahead.

These stocks are flashing a setup that looks incredibly similar to what we saw in Chinese equities this time last year – just before Alibaba Group Holdings Ltd. (BABA) doubled…

China Leads by Example

Not too long ago, Chinese stocks were off-limits. They were toxic, stumbling below their 2020 lows with no floor in sight.

But the winds began to change last spring.

Following a bullish momentum reading, Chinese equities found their feet. And buyers slowly re-entered the market.

A funny thing happened. The market rewarded those brave souls who took a chance on what many viewed as the trash trade.

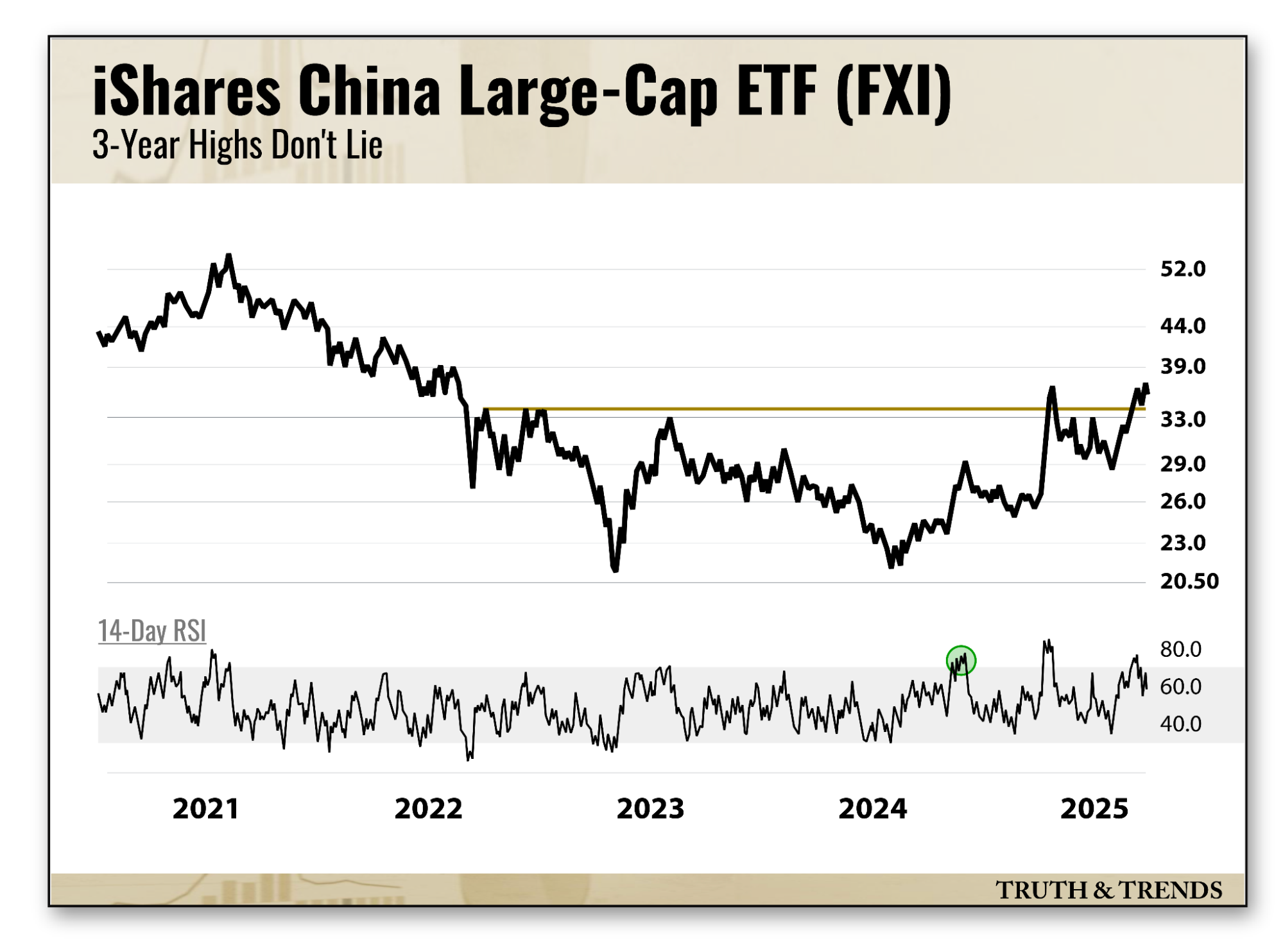

Check out the iShares China Large-Cap ETF (FXI) with the 14-day RSI in the lower pane…

Three-year highs don’t lie: Chinese stocks are ripping.

FXI is hitting its highest level since the FOMC began hiking interest rates in 2022 and almost doubling since the beginning of last year. BABA has fared even better – up 55% year-to-date.

You’ve likely heard the buzz circulating BABA and other Chinese stocks in recent months. But no one was talking about buying these stocks last April when FXI hit overbought (green circle in the lower pane) for the first time in fifteen months. Nobody.

In the weeks following the bullish momentum print, FXI rallied to a nine-month high. The upside follow-through suggested a bearish-to-bullish trend reversal was afoot. Chinese equities soon emerged from a bearish stupor.

But China isn’t the only Asian market waking up to fresh highs.

Technically speaking, the next group of stocks is in the same boat as FXI last spring – right before it sailed 50%.

Good Morning, Vietnam!

Remember Vietnam?

You’ve likely heard of U.S. tech’s “anything but China” game plan.

Over the last three years, Silicon Valley rerouted supply chains away from China to anywhere but — like Singapore, Thailand, and Vietnam, with the latter enjoying plenty of attention in recent years.

In fact, Nvidia CEO Jensen Huang announced Vietnam as the latest site for a new R&D center last December.

But Vietnam’s increased economic productivity runs far deeper than Big Tech…

As of 2023, the WSJ estimates the Southeast Asian country “supplies a third of the sports shoes, half of the wooden beds and dining tables, and a quarter of the solar cells imported by the U.S.”

That’s a lot of shoes (checks the tongue of Nike)!

No wonder Vietnam carried a $123 billion trade surplus with the United States last year, ranking third behind China and Mexico.

Bullish as it all sounds, you don’t need to follow the headlines or hang on to the latest sound bite to realize the trend is swinging in favor of Vietnam.

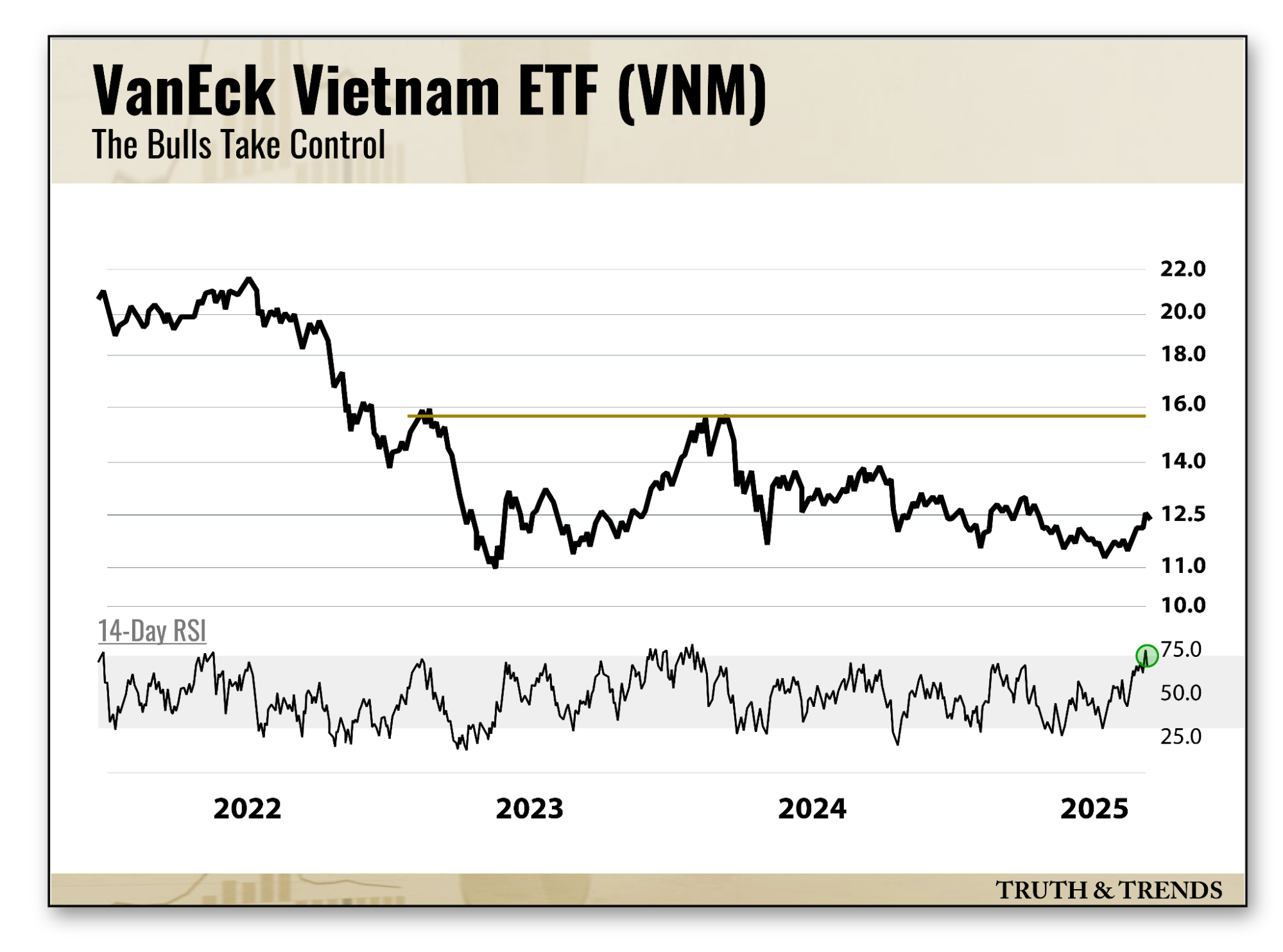

Check out the VanEck Vietnam ETF (VNM)...

VNM is registering multi-month highs and its first overbought momentum reading in over a year, just like Chinese equities last spring.

I like taking a chance on Vietnam at these levels. The reward outweighs the risk 3:1, with a three-to-six-month target at last year’s high.

Plus, you can leave VNM for the birds if it undercuts eleven bucks. So, we’ll know if we’re wrong in the coming weeks.

If that isn’t good enough for you, look at it this way…

The S&P 500 (SPY) dropped 2.66% yesterday, while VNM slipped 1.29%.

Which would you rather own in the coming weeks?

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

It’s Not Just You, This Market Is Mind-Melting

Posted February 27, 2026

By Greg Guenthner

Israel, India and Iran: The Calm Before the Strike

Posted February 26, 2026

By Enrique Abeyta

Tariff Tantrum Redux

Posted February 23, 2026

By Enrique Abeyta

The Weight of Nothing

Posted February 20, 2026

By Nick Riso

“Luck Is Not Real”

Posted February 19, 2026

By Enrique Abeyta