Posted March 14, 2025

By Greg Guenthner

Gold Breaks $3,000!

Nobody wants to buy.

Not Wall Street pros. Not retail traders. Not even your cousin who mysteriously stopped texting you back when Bitcoin slipped below $90K.

Investors are scared. And I don’t blame them!

The S&P 500 is entering correction territory. Plus, the Mag 7 names went from greeting traders with open arms and healthy profits to turning a cold shoulder.

This market is convincing some traders to sit tight until their go-to stocks kick back into rally mode.

But you don’t have to stand around with your hands in your pockets.

Instead, all you need to do is set aside big tech’s disappointment and lean into the stocks and sectors coasting to new highs…

Record-Setting Rocks

Gold is jumping to one new all-time high after another. Yet most investors would rather own the greatest companies in the world than a shiny rock you bury in your backyard.

It makes sense on the surface: Gold and U.S. stocks have marched higher together since last March.

That relationship changed last month. The S&P 500 has dropped more than 10% since mid-February on its way to a new 6-month low. Meanwhile, Gold is up a cool 1.50% over the same timeframe.

Dig a little deeper, and rocks have bested stocks since last spring. Over the twelve months preceding the U.S. benchmark’s February peak, Gold rose almost 50% versus the S&P’s 22% gain.

Gold has been the clear choice despite being unloved and under-owned…

Perhaps most investors will consider Gold a missed opportunity now that it’s trading above $3K. I don’t.

History teaches us not to underestimate Gold’s upside potential. The yellow rock climbed roughly 650% during the last commodity boom. A comparable rally this time around would see the shiny rock dancing to the tune of $8K.

In the meantime, I have my eyes set on $3,300 and a handful of mining plays that will also rally. (More on those mining stocks in just a minute.)

Regardless of the asset – stocks, bonds, commodities – it doesn’t get more bullish than new all-time highs.

But when it comes to metals and mining stocks, a strong bid beneath Silver takes a close second…

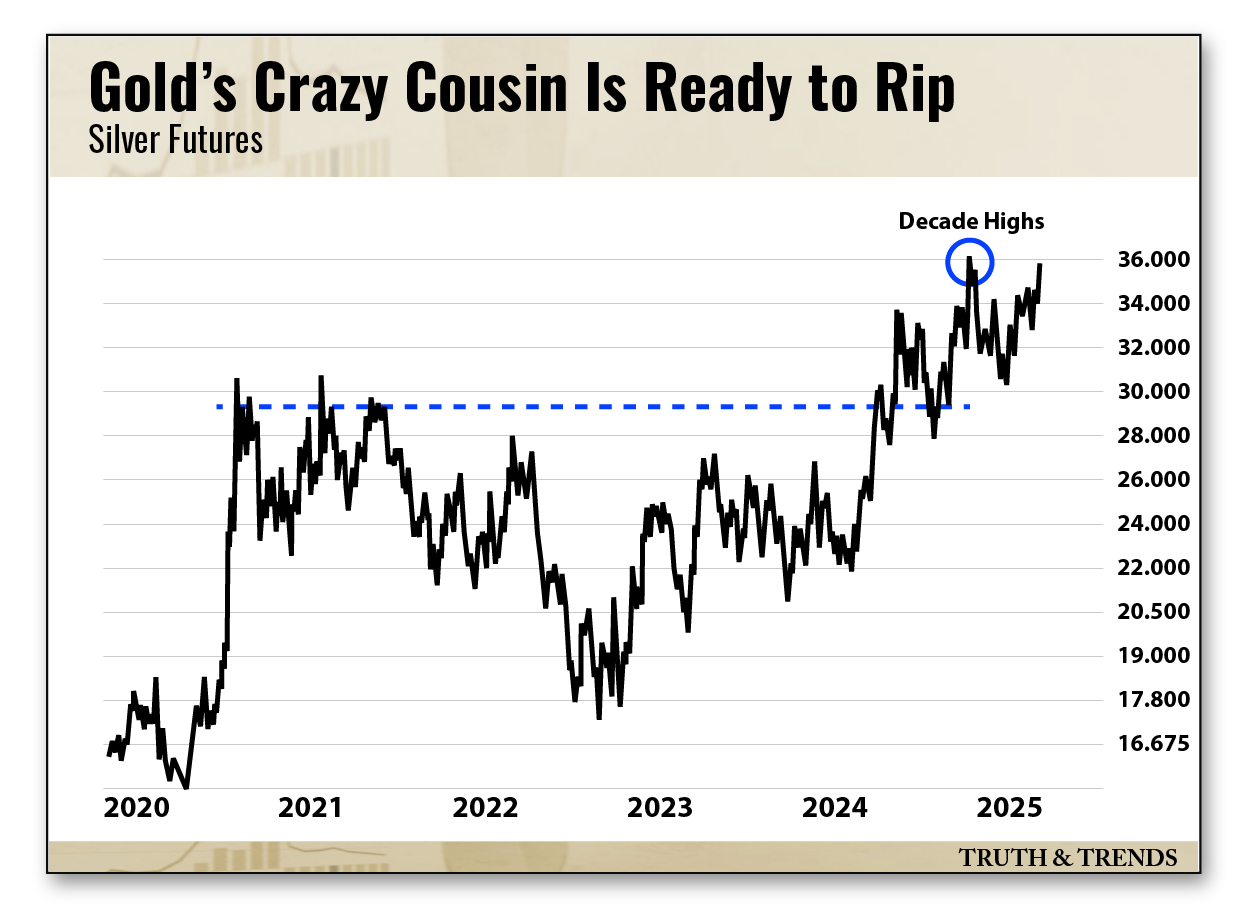

Gold’s Crazy Cousin Is Ready to Rip

Metals across the board benefit when silver futures blast off on a rip-roaring rally.

When the market environment flips bullish for metals, silver gets explosive. That’s why many traders fondly refer to the shiny rock as gold’s crazy cousin.

It’s been a while since we’ve experienced an extended period of silver outperformance. In fact, silver remains light years away from its all-time high set way back in 2011…

Earlier this week, we got a jump on a potential silver breakout by adding the Amplify Junior Silver Miners ETF (SILJ) to our portfolio over at The Trading Desk. So far, it's working out beautifully as silver rips toward its November peak. A break above last year's high will likely send silver screaming to $40

In that environment, you gotta imagine gold futures are cruising while the broader metals and mining space catches a bid.

In fact, it’s already starting to happen…

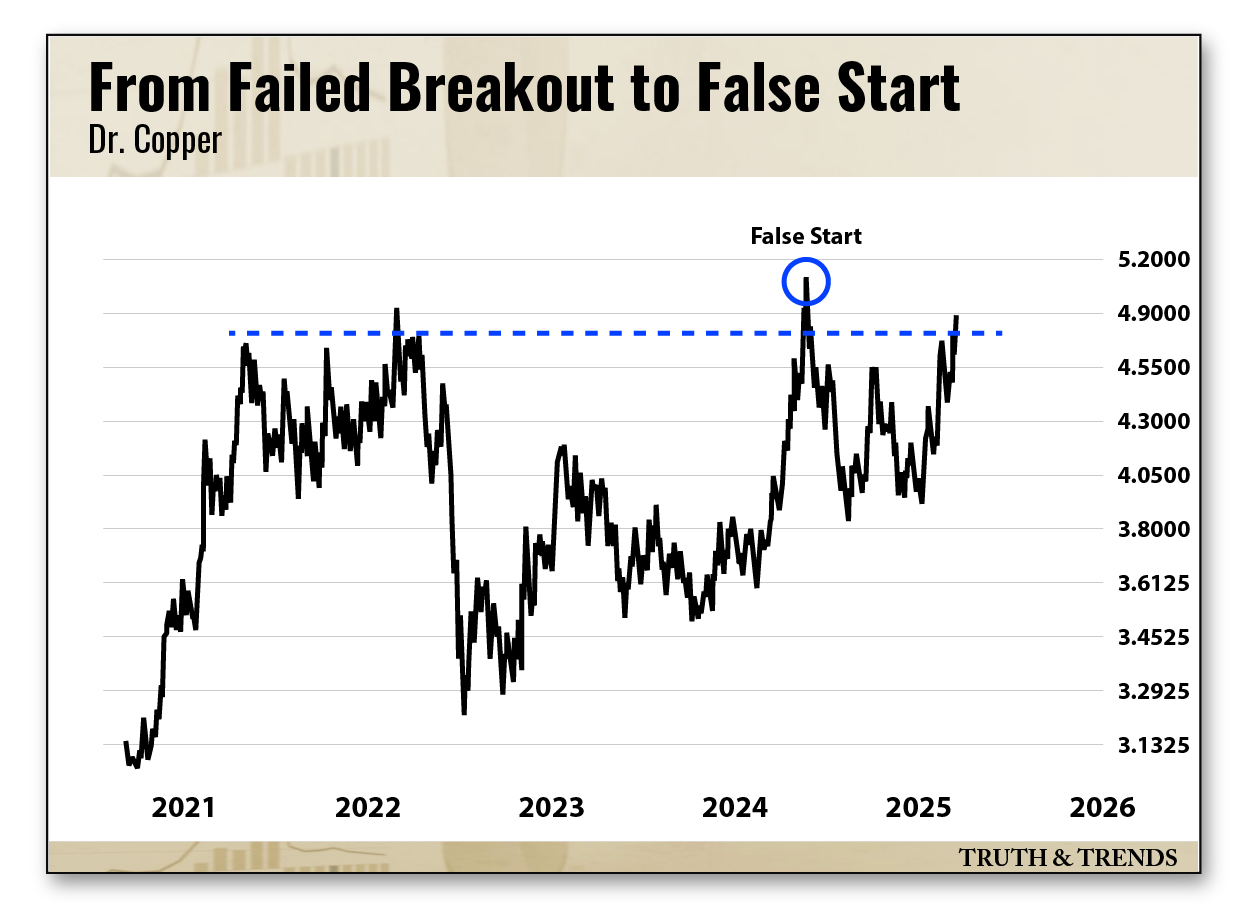

From Failed Breakout to False Start

Before we dive deeper into the base metals, let’s address the elephant in the room: tariffs.

Aluminum is nearing 3-year highs. Tin is edging closer to its 2024 peak. And steel is ramping to its highest level in over twelve months.

Are these rallies just a reaction to Trump’s tariffs? Perhaps, but I don’t want to overthink it. I’d rather focus on the charts and trade what’s in front of me.

Commodities continue to rally – even lumber futures are posting fresh 100-day highs – and while few areas look as inviting as precious metals… Dr. Copper is breaking out!

After retracing the majority of last month’s rally, copper futures are hitting their highest level since May 2024. Remember, it was last May when the economic bellwether ripped to all-time highs.

A new record could be in the cards later this spring if copper futures hold above the Feb. 13 close, and you better believe copper mining stocks will join in the fun.

Freeport McMoRan Inc. (FCX) is the first to come to mind. It’s a mining bellwether and an excellent place to start.

Of course, Southern Copper Corp. (SCCO) is another stock to consider, with its $74B market cap. And for the risk-prone investor, the small-cap Hudbay Minerals Inc. (HBM) should also track copper’s rally.

Stocks have enjoyed a heck of a run since the lows of the 2022 bear market.

But the S&P 500 is now officially in correction territory – 10% off its all-time highs set just a few weeks ago.

The environment is becoming far more challenging as investors ditch stocks and crypto.

Don’t let the crowd's choice to step aside cloud your judgment. Plenty of buying opportunities are out there. You just need to know where to look.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

It’s Not Just You, This Market Is Mind-Melting

Posted February 27, 2026

By Greg Guenthner

Israel, India and Iran: The Calm Before the Strike

Posted February 26, 2026

By Enrique Abeyta

Tariff Tantrum Redux

Posted February 23, 2026

By Enrique Abeyta

The Weight of Nothing

Posted February 20, 2026

By Nick Riso

“Luck Is Not Real”

Posted February 19, 2026

By Enrique Abeyta